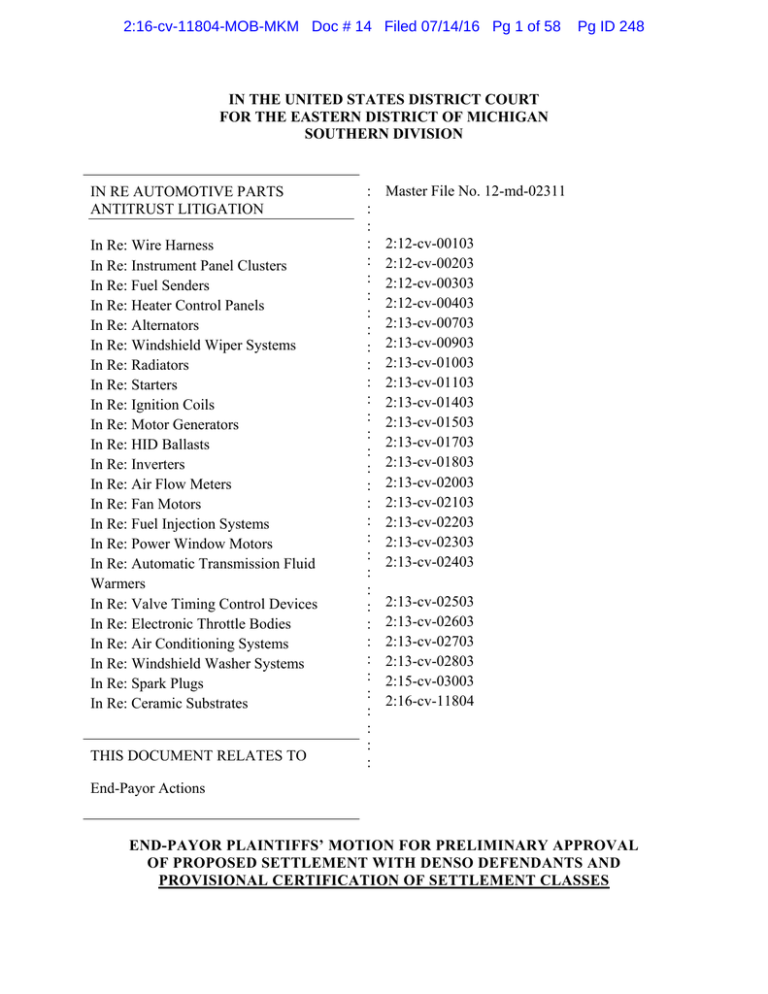

IN THE UNITED STATES DISTRICT COURT

advertisement