Market Watch December 2010 Market Direction: At a Glance

advertisement

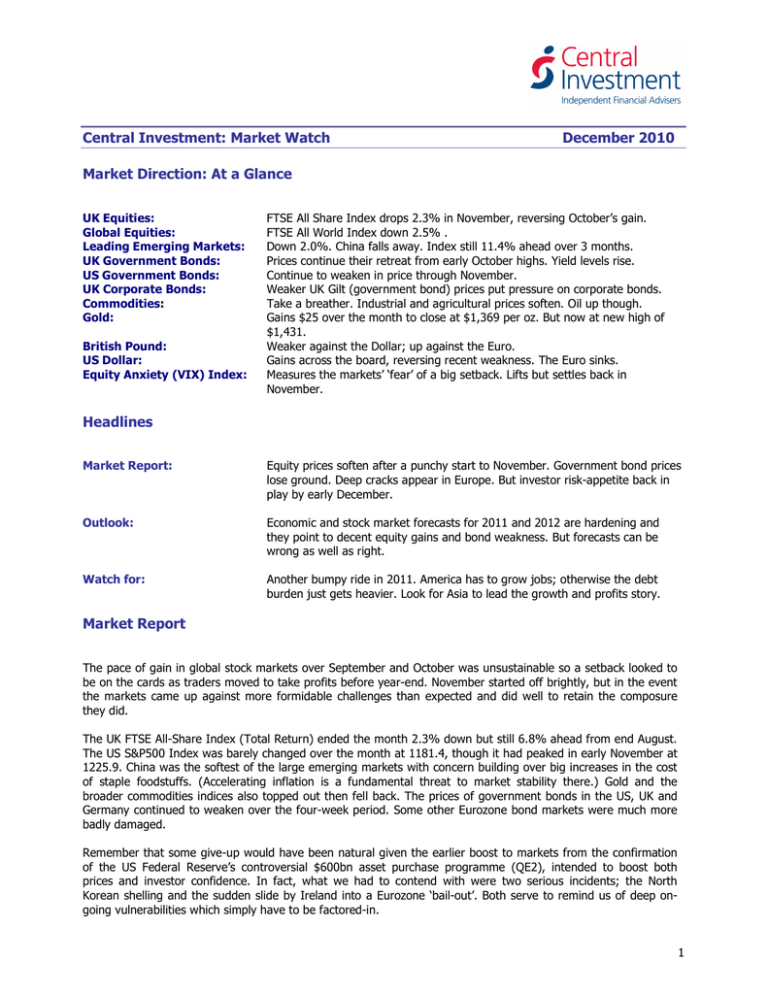

Central Investment: Market Watch December 2010 Market Direction: At a Glance UK Equities: Global Equities: Leading Emerging Markets: UK Government Bonds: US Government Bonds: UK Corporate Bonds: Commodities: Gold: British Pound: US Dollar: Equity Anxiety (VIX) Index: FTSE All Share Index drops 2.3% in November, reversing October’s gain. FTSE All World Index down 2.5% . Down 2.0%. China falls away. Index still 11.4% ahead over 3 months. Prices continue their retreat from early October highs. Yield levels rise. Continue to weaken in price through November. Weaker UK Gilt (government bond) prices put pressure on corporate bonds. Take a breather. Industrial and agricultural prices soften. Oil up though. Gains $25 over the month to close at $1,369 per oz. But now at new high of $1,431. Weaker against the Dollar; up against the Euro. Gains across the board, reversing recent weakness. The Euro sinks. Measures the markets’ ‘fear’ of a big setback. Lifts but settles back in November. Headlines Market Report: Equity prices soften after a punchy start to November. Government bond prices lose ground. Deep cracks appear in Europe. But investor risk-appetite back in play by early December. Outlook: Economic and stock market forecasts for 2011 and 2012 are hardening and they point to decent equity gains and bond weakness. But forecasts can be wrong as well as right. Watch for: Another bumpy ride in 2011. America has to grow jobs; otherwise the debt burden just gets heavier. Look for Asia to lead the growth and profits story. Market Report The pace of gain in global stock markets over September and October was unsustainable so a setback looked to be on the cards as traders moved to take profits before year-end. November started off brightly, but in the event the markets came up against more formidable challenges than expected and did well to retain the composure they did. The UK FTSE All-Share Index (Total Return) ended the month 2.3% down but still 6.8% ahead from end August. The US S&P500 Index was barely changed over the month at 1181.4, though it had peaked in early November at 1225.9. China was the softest of the large emerging markets with concern building over big increases in the cost of staple foodstuffs. (Accelerating inflation is a fundamental threat to market stability there.) Gold and the broader commodities indices also topped out then fell back. The prices of government bonds in the US, UK and Germany continued to weaken over the four-week period. Some other Eurozone bond markets were much more badly damaged. Remember that some give-up would have been natural given the earlier boost to markets from the confirmation of the US Federal Reserve’s controversial $600bn asset purchase programme (QE2), intended to boost both prices and investor confidence. In fact, what we had to contend with were two serious incidents; the North Korean shelling and the sudden slide by Ireland into a Eurozone ‘bail-out’. Both serve to remind us of deep ongoing vulnerabilities which simply have to be factored-in. 1 Ireland is symptomatic of serious structural flaws that now afflict the Eurozone single-currency area. Banks are too big, too heavily-borrowed and overloaded with poor quality loans that need written down in value. Implicitly, national governments are seen as the saviours of last resort for any of their banks that threaten to stumble. That notion explicitly places the bank bad debt burden on Eurozone governments, many over-borrowed themselves. When financial markets refuse to advance additional loans to the afflicted banks or the afflicted governments or both, then insolvency threatens. It is that simple and that serious. These are not cracks that can be papered over. Germany is not prepared to be the single-currency area’s ultimate cash machine. This is not a problem that will go away. And yet as we move into mid-December, equities, gold and commodities are on the march again. What’s in store for 2011? The US S&P 500 equity index: Gold: …Back to a two-year high. Touches $1.431, a record high Outlook for 2011 We wrote last month of the US Fed’s QE2 programme which essentially revolves around printing money until some of it sticks at the point where jobs are created. An even bigger boost to the American economy emerged on December 7 when the Obama administration agreed a $900bn extension of tax cuts and unemployment benefits for up to two years. This will give a lift at all income levels and is absolutely designed to encourage spending and investment and to energise the economic recovery. An early response by analysts has been to lift their growth and profits forecasts for 2011 and 2012. When upgrades meet up with positive market ‘sentiment’ equities go up. The prospect of a stronger US economy gives much more substance to the anticipation of a global economic upturn so stock markets in Europe and Asia have very quickly picked up on the story. Commodities sit at the leading edge of global economic momentum. Suddenly the broad index of raw material prices is back at a twoyear high. Copper has surged at an all-time high and oil is back on track for $100 a barrel. That of course has implications for inflation pressures down the line, giving fresh impetus to the gold price, already buoyed by Chinese buying and by what we will term a ‘distrust’ of paper currencies. This sounds promising for equities, for commodities, for precious metals and for real assets like quality property. It is not so helpful for government bonds which tend to sell off as inflation expectations lift, and it threatens to end the strong run-up in the prices of corporate bonds. Their valuation benchmarks are government bonds. 2 The big opinion-formers – the market analysts and strategists at the international investment banks and respected research houses – deliver a range of views that shape into a consensus. As an investor, you either play with the consensus or go against the herd. Across the expert views that we look to follow, the emerging mainstream opinion is as follows. Equities are decent to good value because their valuations are not expensive, there is the prospect of double-figure profits growth in 2011 and 2012, they are an effective inflation-hedge (as long as inflation expectations don’t soar) and they are cheap to bonds. Government bond prices are more likely to fall back than rise next year, and the best has been seen of the rally in corporate bond prices. One of the key supports for equities is the wide range of international dividend-paying companies that can deliver income just not available from cash, as well as gains in capital value as markets go higher. Another is that big institutional holders are (perhaps seriously) under-weight equities. They don’t own enough of them. Universal optimism would of course be seriously misguided, so it is not going to serve to be in denial about the risks out there. Chief among these are the fallibility of economists’ forecasts, the real structural challenges faced by the US economy (debt, housing, a moribund labour market) and the mighty strains now threatening to render apart Eurozone members. The Euro must survive. There is no alternative, isn’t that right? To cap this month’s report, just to paint the big picture, we finish with a very long-run chart of US equity prices (S&P 500), going back to the 1920s. If you like to identify trends, the chart highlights five: • The steep secular bear market into the early 1930s. • The long secular bull market between the mid-30s and the mid-60s. • The sideways stretch across the 70s. • The secular bull market from the early 80s to the turn of the century. • The volatile and twice-capped stretch over the past decade. If the picture for next year plays out as above, the up-leg at the extreme right hand side (beginning in March 2009) will continue to keep us in a cyclical bull market. The ceiling for the S&P 500 under that interpretation is 1500. At that point, who knows? The US S&P 500 Index 1920 to 2010. • • • A continued bumpy ride. Market sentiment can be fickle. Aggressive bond investors could seriously damage European banks and the weaker peripheral Eurozone members. The full effort of US economic policy is directed at getting America back to work. Watch for better jobs numbers. Without them, the debt burdens just get heavier. Look for continued ‘good news’ from ‘Factory Asia’. The regional Asian economy is adding a visible new dimension; that of brand-aware shoppers and sophisticated shopkeepers. China is playing its part to the full, in gold, art and wine for a start. 3 PERFORMANCE BENCHMARKS % change over period 1m 3m 6m 12m AFI Aggressive Index FTSE APCIMS Growth IMA Active Managed 0.6 -0.9 0.2 8.8 8.1 5.9 7.0 15.4 10.7 11.3 AFI Balanced Index FTSE APCIMS Balanced IMA Balanced Managed -0.3 -0.9 -0.2 7.0 6.3 5.6 6.6 11.6 9.9 10.7 AFI Cautious Index FTSE APCIMS Income IMA Cautious Managed -1.0 -1.1 -0.7 3.4 5.1 5.6 4.7 8.7 8.8 7.4 IMA Absolute Return UK 0.0 2.6 2.5 2.9 FTSE All Share Total Return FT Gilt 5-15 Year -2.3 -0.8 6.8 -1.8 8.6 4.3 11.5 7.4 50:50 FTSE All Share & Gilt 5-15 Year -1.6 2.5 6.5 9.5 Source: Financial Times. Trustnet, IMA 4