V I S I T U S AT W W W. B I G S K Y E C O N O M I C D E V E L O P M E N T. O R G

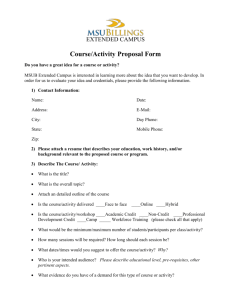

NEW BUSINESS

Startup Kit

Everything your business needs to

get started in Yellowstone County.

SOLVE the PROBLEM

Start Here

CONNECTIVIT Y

Fluctuating computing demand is a problem. Unless you work with CenturyLink. With

our integrated cloud computing services you get the scalable computing platform

your business needs and access to our next-generation network built right in. Our

highly flexible approach means as your business grows your network can keep up.

The solution to this problem is your password at ultimateproblemsolver.com.

Helping Businesses

PROSPER AND GROW

BUSINESS CHECKING | CASH MANAGEMENT | LINES OF CREDIT

BUSINESS LOANS | ONLINE & MOBILE BANKING

SBA Preferred Lender

King Ave

655­2700

Shiloh & Grand

655­3900

Hilltop & Main

896­4800

Downtown

655­2400

WWW.STOCKMANBANK.COM

© 2012 Stockman Bank

© 2012 CenturyLink, Inc. All Rights Reserved.

Member FDIC

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

L E T T E R F R O M E X E C U TI V E

D I R E C TO R S T E V E A RV E S C H O U G

TA B L E O F CO N T E N T S

BILLINGS: OPPORTUNITY

Step 1

E N T R E P R E N E U R S H I P A N D S M A L L B U S I N E S S D E V E LO P M E N T

are vital to the success of economic development in Yellowstone County.

Big Sky Economic Development believes that entrepreneurs are crucial

for a thriving community and economy. The investments they create for

Yellowstone County are immeasurable.

Our economic system is based upon free enterprise and the right of each

person to take the risk, follow a dream, and open his/her own business.

The enclosed information, compiled by Big Sky Economic Development, is

designed to answer many of the questions that arise when someone begins

the process of opening a new business.

Is Entrepreneurship for You?

W H AT I S A N EN T R EP R EN E U R ? . . . . . . . . . . . . . . . . . . . . .

I S EN T R EP R EN E U R S H I P R I G H T FO R YO U ? . . . . . . . . . . . .

T H E N E W B U S I N E S S C H EC K L I S T . . . . . . . . . . . . . . . . . . .

Step 2

STEVE ARVESCHOUG

Executive Director,

Big Sky Economic Development

Planning Your Business

BUSINESS PL AN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F E A S I B I L IT Y S T R AT EGY . . . . . . . . . . . . . . . . . . . . . . . . . .

Owning and operating a business can be challenging. It requires dedication,

patience, a variety of skills, and money. Big Sky Economic Development

has worked to gather this information for small businesses to support the

desire of entrepreneurs to follow their dreams. Please take the time to

read the material and use it to your advantage. Knowing how to handle

the challenges of opening your own business and knowing yourself is

imperative to your businesses success.

D E T ER M I N I N G C A S H N EED ED TO S TA RT A B U S I N E S S . .

FI N A N C I N G I N FO R M AT I O N . . . . . . . . . . . . . . . . . . . . . . . .

D EM O G R A P H I C I N FO R M AT I O N . . . . . . . . . . . . . . . . . . . . .

L EG A L A S P EC TS O F S TA RT I N G A B U S I N E S S . . . . . . . . . .

R EG I S T R AT I O N O F A S S U M ED B U S I N E S S N A M E . . . . . . .

In the event this information leads to additional questions, please don’t

hesitate to contact Big Sky Economic Development. Big Sky Economic

Development offers a variety of services to assist Montana business owners

with getting on the road to success, and we do that through the support of

Yellowstone County taxpayers and our Member Investors.

T H E S EC R E TA RY O F S TAT E . . . . . . . . . . . . . . . . . . . . . . .

S TAT E I S S U ED L I C EN S E S . . . . . . . . . . . . . . . . . . . . . . . . .

L I C EN S I N G A N D P ER M ITS I N FO R M AT I O N . . . . . . . . . . . .

ZO N I N G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

We ask for your help in identifying additional information that should be

added to this guide. Share your suggestions! The more information we can

provide, the better we may assist you and the entrepreneurs who follow.

B U I L D I N G CO N S T R U C T I O N / R EN OVAT I O N S/O CC U PA N C Y

H E A LT H P ER M ITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F ED ER A L L I C EN S I N G . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Best of luck,

EM P LOY ER TA X R E S P O N S I B I L IT I E S . . . . . . . . . . . . . . . . .

U T I L IT I E S . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

L A B O R A N D SA F E T Y R EG U L AT I O N I N FO R M AT I O N . . . . .

A P P L I C AT I O N , H I R I N G & T ER M I N AT I O N P R O C E S S E S . . .

Steve Arveschoug

6

7

8

9

10

12

13

14

15

17

17

18

18

18

19

19

19

20

22

23

24

Executive Director

Big Sky Economic Development

NOTICE: The information contained within this publication is given for informational purposes only and should not be constructed as legal or professional

advice or assistance.

Laws and information contained herein are from multiple sources and are subject to frequent changes. While this publication will be updated annually to

capture those changes, you should consult a licensed professional when dealing with legal and financial matters regarding your specific situation. You

should also verify the other information contained herein to be sure that you have the most current and accurate information.

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

4

Step 3

Additional Resources

R E S O U R C E D I R EC TO RY . . . . . . . . . . . . . . . . . . . . . . . . . .

G LO S SA RY O F T ER M S . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

27

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

5

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

S T E P 1 : I S E N T R E P R E N E U R S H I P FO R YO U ?

STEP 1: IS ENTREPRENEURSHIP

FO R YO U ?

Is

Entrepreneurship

for You?

W H AT I S A N

ENTREPRENEUR?

I e c [ e d [ m ^ e e h] W d _p[ i W d Zc W _ dj W _ d i

a b u s i n e s s ve n t u re

I e c [ e d [ m ^ e j W a[ i e d j^ [ h _ i a W d Z

d o e s w h a t h e /s h e wa n t s i n o rd e r to

m a ke a p rof it

I e c [ e d [ m ^ e Y W d Y e e hZ _ d Wj[ j^ [

re s o u rc e s ava i l a b l e to m e e t a n e e d

H ow c a n yo u b e c o m e a n e n tre p re n e u r ?

H ow c a n yo u s t a r t yo u r ow n b u s i n e s s?

B i g S k y Ec o n o m i c D eve l o p m e nt h a s

c o m p i l e d th i s b o o k a s a re f e re n c e

g u i d e to s i m p l if y tr a n s iti o n i nto th e

ro l e of a n e n tre p re n e u r. T h e A B C ’s

of St a r ti n g a B u s i n e s s i n Ye l l ows to n e

C o u n t y wi l l m a ke e s t a b l i s h i n g yo u r ow n

b u s i n e s s e a s i e r by g i v i n g yo u “o n e - s to p

s h o p p i n g ” fo r th e i n fo r m a ti o n yo u wi l l

n e e d . B i g S k y Ec o n o m i c D eve l o p m e nt

i s d e te r m i n e d to p ro m ote e co n o m i c

g row th a n d d eve l o p m e n t . We b e l i eve

th i s b e g i n s with yo u . B y g i v i n g yo u th e

p ro p e r to o l s , we c a n h e l p b u i l d a s tro n g

e c o n o m i c fo u n d a ti o n . We h o p e th i s

b o o k l e t wi l l b e of a s s i s t a n c e . I n o rd e r

to re c e i ve th e m a x i m u m b e n e f it s of th e

i n fo r m a ti o n c o n t a i n e d i n th i s b o o k l e t ,

we s u g g e s t yo u tre a t th i s a s yo u wo u l d

a wo r k b o o k . St a r t a t th e b e g i n n i n g a n d

wo r k th ro u g h to th e e n d , m a k i n g n ote s

a l o n g th e way.

B e f o r e yo u g o to th e b a n k , b e f o r e yo u

w r ite yo u r b u s i n e s s p l a n , o r b e f o r e

yo u q u it yo u r d ay j o b … S TO P a n d a s k

yo u r s e l f o n e q u e s ti o n .

“Is business

ow n e r s h i p a n d a l l th at it i m p l i e s r ig ht

f o r m e? ”

I n th i s s e c ti o n B ig S k y

E c o n o m i c D eve l o p m e nt wi l l h e l p yo u

a s s e s s th at q u e s ti o n .

IS ENTREPRENEURSHIP

R I G H T F O R YO U ?

T h e re i s n o way to e l i m i n ate a l l th e

r i s k s a s s o ci ate d with s t a r ti n g a s m a l l

business.

Yo u

can

i m p rove

yo u r

c h a n c e s of s u cc e s s with g o o d p l a n n i n g

a n d p re p a r ati o n . A g o o d s t a r ti n g

p l a c e i s to eva l u ate yo u r s tre n g th s a n d

we a k n e s s e s a s th e ow n e r a n d m a n a g e r

of a s m a l l b u s i n e s s . C a re f u l l y co n s i d e r

e a c h of th e fo l l owi n g q u e s ti o n s i n th e

t a b l e o n th e n ex t p a g e .

en·tre·pre·ne

ur

\ˌäⁿn-trә-p(r)ә

noun

-ˈnәr, -ˈn(y)u̇ r\

: one who orga

nizes, manag

es,

and assumes

the risks of a

business or en

terprise

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

6

Question

Explanation

Are you a self-starter?

It will be up to you—not someone else telling you—to develop projects,

eh]Wd_p[oekhj_c["WdZ\ebbemj^hek]^edZ[jW_bi$

How well do you get

along with different

personalities?

Business owners need to develop working relationships with a variety of

people including customers, vendors, staff, bankers, and professionals

such as lawyers, accountants, or consultants. Can you deal with a

demanding client, an unreliable vendor, or an unreliable employee?

Are you bankable?

Have you addressed

the need for your

product or service in

the target market?

Do you know who your

target market is?

Are you prepared,

if necessary, to

temporarily lower your

standard of living until

your business is firmly

established?

Have you ever worked

in a managerial or

supervisory capacity?

How good are you at

making decisions?

Do you have the

physical and emotional

stamina to run a

business?

How well do you plan

and organize?

Is your drive strong

enough to maintain

your motivation?

How will the business

affect your family?

The lender will be expecting you as the business owner to share in the

financial risk of your project. The lender will be looking for good credit

score of 650 or more, 100% collateral, and at least 20% equity.

There has to be an unfilled need in the market that your business will

be able to fill in order for your business to be sustainable. Are there

many other options or substitutes for your offering? If so, you may

need to re-evaluate.

Once the need is determined to exist, you need to identify the primary

customer who will pay money for your offering. You need to be able to

describe this customer(s) down to their income, tastes, and motivators

with decision making.

As a small business owner you may not bring as much money home

as you do currently with a full-time job, if any money at all. Are you

prepared (and is your family prepared) to adjust your lifestyle to

accommodate a decrease in income and less free time?

Your professional background is going to be a factor when running

a business. Do you have the management history and interpersonal

skills to be an effective boss?

Small business owners are required to make decisions constantly, often

quickly, under pressure, and independently.

Business ownership can be challenging, fun and exciting. But it’s also

a lot of work. Can you face 12-hour work days six or seven days a week

if necessary?

Research indicates that many business failures could have been avoided

j^hek]^ X[jj[h fbWdd_d]$ =eeZ eh]Wd_pWj_ed e\ ÓdWdY_Wbi" _dl[djeho"

schedules, and production can help avoid many pitfalls.

Running a business can wear you down. Some business owners feel

burned out by having to carry all the responsibility on their shoulders.

Strong motivation can make the business succeed and will help you

survive slowdowns as well as periods of burnout.

The first few years of business startup can be hard on family life. The

strain of an unsupportive spouse may be hard to balance against the

demands of starting a business. There also may be financial difficulties

until the business becomes profitable, which could take months or

years. You may have to adjust to a lower standard of living or put

family assets at risk.

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

7

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

1 : T H E N E W B U S I N E S S C H EC K L I S T

The New Business

Checklist

S T E P 2 : P L A N N I N G YO U R B U S I N E S S

THE BUSINESS PL AN

N ow th at yo u h ave e xa m i n e d yo u r

q u a lif ic atio n s to b e a b u si n e s s

own e r, it ’s ti m e to s ta r t yo u r

b u si n e s s p la n n i ng p r o c e s s !

Planning Your

Business

Provided by QuickBooks

D E T E R M I N E YO U R B U S I N E S S

Fo c u s yo u r i d e a

Re s e a rc h yo u r i d e a

C h o os e a b u si n e s s n a m e

Wr ite a b u si n e s s p l a n

S T R U C T U R E YO U R B U S I N E S S

9 ^ e ei [W de h] W d _pWj_ e dj of [

C o n su lt p rofe s si o n a ls (C PA , t a x a cco u nt a nt , o r at to r n ey)

S et u p yo u r f i n a n ci a l s ys te m s

P R E PA R E A L L N E C E S S A R Y F O R M S , P E R M I T S , A N D L I C E N S E S

O ve r vi ew of fe d e r a l , s t ate , a n d l o c a l re q u i re m e nt s

Fil e co m p a ny p a p e r s with th e S e c ret a r y of St ate ’s of f i ce

O bt a i n a fe d e r a l t a x i d e ntif i c ati o n n u m b e r

Re g is te r yo u r b u si n e s s n a m e

O bt a i n a ll n e ce s s a r y li ce n s e s a n d p e r m it s

Fu lf ill a ll e m p l oye r re q u i re m e nt s

S e c u re i nte ll e c tu a l p ro p e r t y

JW a[Y W h[e\b e Y W bh[ g k _ h[ c [ dj ipe d _ d ] "X k _b Z _ d ]Ye Z [ i

F U N D YO U R B U S I N E S S

U s e yo u r own a s s et s

B o r row f ro m f r i e n d s a n d f a m ily

B o r row f ro m a b a n k

O th e r s o u rce s of e q u it y f u n d i n g

TA X E S A N D I N S U R A N C E

Fu lf ill a ll t a x re q u i re m e nt s

Ke e p d et a il e d re co rd s of a ll d e d u c ti b l e exp e n d itu re s

The Business Plan

A

business plan precisely defines your

business, identifies your goals, and

serves as your company’s résumé. The

basic components include a current and pro

forma balance sheet, an income statement,

and a cash flow analysis. It helps you allocate

resources properly, handle unforeseen

complications, and make good business

decisions. Because it provides specific and

eh]Wd_p[Z _d\ehcWj_ed WXekj oekh YecfWdo

and how you will repay borrowed money, a

good business plan is a crucial part of any

loan application. Additionally, it informs sales

personnel, suppliers, and others about your

operations and goals.

The following outline of a typical business plan

can serve as a guide. You can adapt it to your

specific business. Breaking down the plan

into several components will make writing it

more manageable. Technical assistance is

provided free of charge at Big Sky Economic

Development through the Small Business

Development Center. Call and set up an

appointment with one of our knowledgeable

business advisors.

INTRODUCTION

= _l[ W Z [j W _b [ Z Z [ i Y h _ fj_ e d e\ j^ [

b u si n e s s a n d it s g o a ls .

: _i Y k i i j^ [ emd [ h i ^ _ f e\ j^ [

b u si n e s s a n d th e l e g a l s tr u c tu re .

B _i j i a _bbi W d Z [nf [ h _ [ d Y[ oe k

b r i n g to th e b u si n e s s .

: _i Y k i i j^ [ W Z lW dj W ] [ i oe k W d Z

yo u r b u si n e s s h ave ove r yo u r

co m p etito r s .

MARKETING

: _i Y k i i

of fe re d .

j^ [

f he Z k Y j i%i [ h l_ Y[ i

? Z [ dj_\ oj^ [Y k i je c [ hZ [ c W d Z\e h

yo u r p ro d u c t /s e r vi ce .

? Z [ dj_\ o oe k h c W h a[j " _j i i_p[ W d Z

l o c ati o n s .

; nf b W _ d^ emoe k hf he Z k Y j %i [ h l_ Y[

will b e a d ve r tis e d a n d m a r kete d .

; nf b W _ dj^ [ f h _ Y_ d ]i jh Wj[ ] o$

FI N A N C I A L M A N AG E M E N T

; nf b W _ d oe k h i e k hY[ W d Z j^ [

a m o u nt of i n iti a l e q u it y.

: [l[ b e f W c e dj^ bo e f [ h Wj_ d ]

b u d g et fo r th e f i r s t ye a r.

: [l[ b e f W d [nf [ Y j[ Z h[jk h d e d

i nve s tm e nt a n d m o nth ly c a sh f l ow

fo r th e f i r s t ye a r.

F hel_ Z [

f he ` [ Y j[ Z

_ d Ye c [

s t ate m e nt s a n d b a l a n ce s h e et s

fo r a t wo –ye a r p e r i o d .

? Z [ dj_\ ooe k hX h[ W a[l[ df e _ dj $

; nf b W _ doe k hf [ h i e d W bX k Z ] [jW d Z

m eth o d fo r co m p e n s ati o n .

: _i Y k i i m^ e m_bb c W _ dj W _ d oe k h

a cco u nti n g re co rd s a n d h ow th ey

will b e ke pt .

F hel_ Z [ Ç m^ Wj _\ È i j Wj[ c [ dj i j^ Wj

a d d re s s a lte r n ative a p p ro a c h e s to

a ny p ro b l e m th at m ay d eve l o p .

O bt a i n i n su r a n ce to m itig ate r is k

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

8

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

9

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

2 : T H E B U S I N E S S P L A N c o nt .

F E A S I B I L IT Y S T R AT EGY

2 : F E A S I B I L IT Y S T R AT EGY

O P E R AT I O N S

; nf b W _ d ^ em j^ [ X k i_ d [ i i

will b e m a n a g e d o n a d ay–

to – d ay b a sis .

: _i Y k i i

^ _ h _ d ]

W d Z

p e r s o n n e l p ro ce d u re s .

: _i Y k i i _ d ik h W d Y[ " b [ W i [

o r re nt a g re e m e nt s , a n d

is su e s p e r ti n e nt to yo u r

b u si n e s s .

7 YYe k dj\e hj^ [[ g k _ f c [ dj

n e ce s s a r y to p ro d u ce yo u r

p ro d u c t s o r s e r vi ce s .

7 YYe k dj \e h f he Z k Y j_ e d

a n d d e live r y of p ro d u c t s

a n d s e r vi ce s .

C O N C L U D I N G S TAT E M E N T

I k c c W h _p[ oe k h X k i_ d [ i i

g o a ls a n d o b j e c tive s a n d

exp re s s yo u r co m m itm e nt

to th e su cce s s of yo u r

b u si n e s s .

E d Y[ oe k ^ Wl[ Ye c f b [j[ Z

yo u r b u si n e s s p l a n , revi ew

it with a b u si n e s s co ll e a g u e

f i r s t a n d th e n with th e S m a ll

B u si n e s s

D eve l o p m e nt

C e nte r

M ^ [ doe k\[ [ bYe c\e h j W X b [

with

th e

co nte nt

and

s tr u c tu re ,

m a ke

an

a p p o i ntm e nt

to

revi ew

a n d d is c u s s it with yo u r

b a n ke r. T h e b u si n e s s p l a n

is a f l exi b l e d o c u m e nt th at

s h o u l d c h a n g e a s yo u r

b u si n e s s g rows .

S o u r c e : w w w. s b a .g o v

Feasibility Strategy

I S YO U R B U S I N E S S I D E A

FEASIBLE?

A n swe r th e fo ll owi n g q u e s ti o n s re g a rd i n g

yo u r i d e a .

G ive co m p l ete , we ll th o u g ht

o ut a n swe r s to th e s e q u e s ti o n s .

I f yo u

a re u n su re a b o ut o r a n swe r n o to a ny of

th e fo ll owi n g q u e s ti o n s , th e n yo u s h o u l d

reth i n k yo u r i d e a .

S m a l l B u s i n e s s D e ve l o p m e n t C e n te r

2 2 2 N 3 2 n d S t . S te . 2 0 0

Billings, MT 59101

4 0 6 -2 5 4 - 6 0 1 4

www.bigskyeda-edc.org/small-businessdevelopment.php

M ^ Wj a _ d Z e\ f he Z k Y j Z e oe k f b W d je

of fe r ?

M _bb oe k h f he Z k Y j i Wj_i \ o W d [ [ Z o[j

u nf ill e d ?

M ^ e W h[ co Y k i je c [ h i5 J ^ _i

d ete r m i n e s yo u r t a rg et m a r ket .)

M _bb oe k h f he Z k Y j ^ Wl[ W Ye c f [j_j_l[

e d g e b a s e d o n p r i ce , l o c ati o n , q u a ntit y,

o r s e l e c ti o n?

M ^ [ h[W h[j^ [o 5

M ^ Wj j of [ e\ X k i_ d [ i i Z e oe k f b W d je

start?

R E S E A R C H I N G YO U R M A R K E T S

I t is re co m m e n d e d th at yo u re s e a rc h yo u r

p ote nti a l m a r ket d e m a n d fo r yo u r p ro d u c t

o r s e r vi ce . Fi r s t , d ete r m i n e wh at q u e s ti o n s

yo u n e e d a n swe re d .

T h e fo ll owi n g a re

i d e a s o n wh e re to f i n d th e i nfo r m ati o n yo u

need.

Primary Data:

Oe k h[nf [ h _ [ d Y[ $

; nf [ h _ [ d Y[ ie\f [ e f b [oe ka d em$

I k h l[o

f ej[ dj_ W b

Y k i je c [ h i

je

d ete r m i n e th e i r wa nt s/n e e d s . O bs e r ve

si m il a r b u si n e s s e s .

> em c W do W h[ j^ [ h[5 J ^ _i

_ d Z _ Y Wj[ ioe k hc W h a[ji_p[ $

M ^ WjW h[j^ [ _ hd [ [ Z i5

M ^ eW h[coYe c f [j_je h i5

> em Z e [ i co Ye c f [j_j_ e d Z e _j 5

(O n e m eth o d of m a r keti n g /d e a li n g

with co m p etiti o n is th e e n d - r u n

s tr ate g y.

I n th is s tr ate g y yo u

a d o pt yo u r co m p etito r s’ s tr ate g y

with th e i nte nti o n of m a k i n g it

b et te r.)

> emY W d?h[ W Y ^coj W h] [jc W h a[j 5

( T h e d is tr i b uti o n of yo u r p ro d u c t

is ve r y i m p o r t a nt .

W h e re yo u r

p ro d u c t is l o c ate d d ete r m i n e s

h ow we ll it s e lls .)

> emc k Y ^m_bbj^ [j W h] [jY k i je c [ h

p ay ? ( T h e p r i ci n g of yo u r p ro d u c t

is a ls o ve r y i m p o r t a nt . Yo u m u s t

t a ke i nto co n si d e r ati o n wh at yo u r

co m p etito r s c h a rg e .)

M ^ Wj W h[ j^ [ c W h a[j jh[ d Z i5

( W h at a re p e o p l e b u yi n g? I t is

i m p o r t a nt to b e awa re of wh at

m a r ket tre n d s a re . T h is re l ate s

b a c k to k n owi n g yo u r c u s to m e r s’

n e e d s . Tr y to d is ti n g u is h b et we e n

tre n d s a n d f a d s .)

M ^ WjW h[j^ [j[ Y^ d e b e ] _Y W bjh[ d Z i5

(O n e o bvi o u s a n swe r to th is

q u e s ti o n is th e I nte r n et . W ill yo u

b e u si n g te c h n o l o g y ? H ow c a n

it b e u s e d to h e l p yo u r b u si n e s s?

D o yo u n e e d to a d ve r tis e o n th e

I nte r n et ? D o yo u n e e d a n et wo r k

of co m p ute r s fo r yo u r b u si n e s s?

I f yo u a re i n a b u si n e s s re l ate d

to te c h n o l o g y, it is i m p e r ative

th at yo u s t ay a b re a s t of a ny

c h a n g e s .)

R e s o u rc e :

S m a l l B u s i n e s s D e ve l o p m e n t C e n te r

2 2 2 N 3 2 n d S t . S te . 2 0 0

Billings, MT 59101

4 0 6 -2 5 4 - 6 0 1 4

www.bigskyeda-edc.org/small-business-development.php

? dj[ h l_ [mj^ [ i [X k i_ d [ i iÊiemd [ h i $

? dj[ h l_ [mik f f b_ [ h i "l[ d Z e h i "X W d a[ h i $

Secondary Data:

9 e dj W Y j jh W Z [ W i i e Y_ Wj_ e d i _ $ [ $ jh W Z [

s h ows a n d tr a d e j o u r n a ls).

9 edjWYjj^[IcWbb8ki_d[ii:[l[befc[dj

C e nte r. S e e th e Re s o u rce D i re c to r y

fo r co nt a c t i nfo r m ati o n .

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

10

M A R K E T I N G YO U R B U S I N E S S

I n o rd e r to p ro p e r ly m a r ket yo u r

p ro d u c t , yo u n e e d to a n swe r th e

fo ll owi n g q u e s ti o n s . T h is i nfo r m ati o n

c a n b e u s e d to h e l p yo u d eve l o p yo u r

m a r keti n g p l a n . C o nt a c t th e S B D C fo r

m o re i nfo r m ati o n o n co n s tr u c ti n g th is

plan.

L _i_joe k hf k X b_ Yb_ X h W h o$

Resource:

K i [lW h _ e k ii [ W hY ^[ d ] _ d [ ie dj^ [

I nte r n et (i . e . Ya h o o , B i n g , G o o g l e ,

M S N etc .).

Fu n d e d i n p a r t t h ro u g h a c o o p e r a t i ve a g r e e m e n t

with the U. S . Small Business Administration.

All opinions , conclusions or recommendations

e x p r e s s e d a r e t h o s e o f t h e a u t h o r (s) a n d d o

not necessarily reflect the views of the SBA .

Reasonable accommodations for persons with

d i s a b i l i t i e s w i l l b e m a d e i f r e q u e s te d a t l e a s t

two weeks in advance.

C o n t a c t B i g S k y E c o n o m i c D e ve l o p m e n t

2 2 2 N . 3 2 n d S t . , S u i te 2 0 0

Billings, MT 59101

4 0 6 -2 5 4 - 6 0 1 4 .

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

11

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

2: DETERMINE CASH NEEDED

2 : FI N A N C I N G I N FO R M ATI O N

Determine Cash Needed to Start Business

A

ll of the costs/

expenses can

be estimated

with accuracy through

research on the

internet and obtaining

quotes from the

appropriate vendors/

government agencies.

Add up all monthly

expenses and multiply

by the amount of

months you will need

cash flow during your

business’s first year

of operation (This

is considered your

working capital and

the bank will most

likely not lend you this

total amount.). Finally,

add the start-up costs

to the cash needed.

This is the total cash

needed to start your

business.

Item(s) Needed

START-UP

COSTS

ONGOING MONTHLY

EXPENSES

Salary of Owner/Exempt Emp.

No

Yes

Non-Exempt Employee Payroll

No

Yes

Rent (Building/Equipment)

No

Yes

Purchase of Building

Yes

No

Loan Payment

No

Yes

Yes

Yes

Advertising

(Website, signage)

Supplies

Maybe

Yes

Inventory

Yes

Yes

Internet/Telephone/Fax/Cable

No

Yes

Deposits for Utilities/Services

Yes

No

Maybe

Yes

Insurance

No

Yes

Taxes (including Social Security)

No

Yes

Maintenance/Repairs

No

Yes

Leasehold Improvements

Yes

No

Legal/Professional Fees

Yes

Yes

Purchase of Equipment

Yes

Maybe

Licenses & Permits

Yes

Yes

Utilities

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

12

Financing Information

M A R K E T I N G YO U R B U S I N E S S

W

hen starting a business, one

important consideration is where

to obtain capital to back your

venture. Most startup businesses require a

capital contribution by the business owner,

usually 20%-30% (start-up businesses are more

likely going to contribute 25% or more). The

remaining financing may be available from

local banks, a Certified Development Company,

or private investors. There are several loan

programs available to businesses, all of which

require bank participation. Examples include

the following SBA loans currently available.

SBA Guaranteed Loan Program 7(A).

This program provides financing to

small businesses through guaranteeing

a percentage of the bank’s loan to the

business. Eligible expenditures are for land

and building, machinery and equipment,

working capital, and some restructure

of existing debt. The maximum SBA will

guarantee is $750,000 and not more than

75% of the total loan. The USDA and BIA

offer Guaranteed Loan programs as well.

SBA 504 Loan Program. This program

provides financing for small businesses

through a low interest, fixed rate, and

a long-term loan. The Small Business

Administration (contributing 40%) takes a

second line position behind the bank (50%)

and the borrower is in third place (at least

10% equity).

Eligible expenditures are

for land and building, long-life machinery

and equipment. The maximum the SBA

will finance is $1.5 million (for eligible

manufacturers this amount may be

greater). Job creation is a requirement of

the program.

Revolving Loan Fund.

Businesses in

Billings may qualify for loan funds through

a Revolving Loan Fund. Big Sky Economic

Development, Beartooth RC & D, and

Montana CDC offer a revolving loan fund.

Big Sky EDC’s Revolving Loan Fund

benefits the borrower in that the funds

are available for fixed assets, inventory

and working capital. The fund offers low

origination fees and a competitive fixed

five-year interest rate.

All loan programs require that certain standards

be met. A loan applicant must be of good

character, show the ability to operate a small

business successfully, and have a reasonable

amount of his/her own resources to invest to

withstand possible losses. In addition, the

following will likely be required:

9h[Z_jH[fehjiYeh[,+&WdZWXel[

9ebbWj[hWb WZ[gkWj[ je i[Ykh[ j^[ Z[Xj

(100%) (including a list of collateral and its

value);

7ffhW_iWbi ed j^[ h[Wb fhef[hjo ki[Z Wi

collateral;

F[hiedWb]kWhWdj[[ie\j^ei[f[hiedieh

companies) with 20% ownership and/or

key employees;

I[YedZWhoYebbWj[hWb1

F[hiedWbÓdWdY_WbijWj[c[djiWdZÓdWdY_Wb

statements of business, if applicable; and

8ki_d[iiFbWd$

R e s o u rc e :

Business Finance Department

2 2 2 N 3 2 n d S t . S te . 2 0 0

Billings, MT 59101

4 0 6 -2 5 6 - 6 8 7 1

www.bigskyeda-edc.org/finance-tax.php

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

13

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

2 : D E M O G R A P H I C I N FO R M ATI O N

2 : L EG A L A S P EC TS O F

S TA RTI N G A B U S I N E S S

Demographic

Information

A

va r i et y of f re e d e m o g r a p h i c i nfo r m ati o n is ava il a b l e vi a th e i nte r n et . A

few a re p rovi d e d b e l ow. T h is i nfo r m ati o n b re a k s d own th e p o p u l ati o n by

d if fe re nt c ate g o r i e s su c h a s a g e , s ex , r a ce , i n co m e , e d u c ati o n , a n d eve n

t a s te s . I t c a n b e u s e d to h e l p i d e ntif y th e n u m b e r of p e o p l e with i n yo u r t a rg et

m a r ket th at wo u l d p ote nti a lly u s e yo u r b u si n e s s o r s e r vi ce s .

MSU - B CENTER FOR APPLIED ECONOMIC RESEARCH

w w w. msubillin gs . e d u /c a e r/ in d ex . htm

C E N S U S & E C O N O M I C I N F O R M AT I O N C E N T E R / M O N TA N A

D E PA R T M E N T O F C O M M E R C E

ce ic . mt .g ov

M O N TA N A D E PA R T M E N T O F L A B O R & I N D U S T R Y

wsd .dli . mt .g ov/se r vice/ra d . asp

CENTR AL INDEX OF ECONOMIC INSTITUTIONS

e dirc . re p e c .o rg

U.S. CENSUS

w w w.ce nsus .g ov

U . S . D E PA R T M E N T O F L A B O R

w w w.d ol .g ov/d ol/to pic /s tatis tic s/ in d ex . htm

Legal Aspects of

Starting a Business

D

eciding the legal structure of your

business is a critically important

decision. This determines the taxes

that you’ll pay, the level of personal liability

you will have for your business’s debts and

various rules and regulations governing your

business.

Before you enter into any of these four forms of

business that you contact a business attorney,

CPA, or other qualified advisor. Don’t risk a

mistake! Also, contact the Small Business

Development Center for more information.

THERE ARE FOUR BASIC FORMS

T H AT A N E W B U S I N E S S C A N

FILE AS:

Ieb[Fhefh_[jehi^_f

FWhjd[hi^_f (general, limited, or limited

liability)

9ehfehWj_ed (C or S)

B_c_j[ZB_WX_b_jo9ecfWdo (LLC)

Crist, Krogh & Nord, LLC

John G. Crist · Harlan B. Krogh

Eric Edward Nord · Tanis M. Holm

Attorneys at Law

2708 First Avenue North, Suite 300

Billings, Montana 59101

406.255.0400

www.cristlaw.net

M O N TA N A T O U R I S M

w w w.trave lm o nta n a .o rg /re se a rch

U SA .G OV

w w w. us a .g ov/ To pic s/ Refe re n ce _ S h e lf/ Data . shtm l

B U R E A U O F E C O N O M I C A N A LY S I S ( B E A )

w w w. b e a .g ov

M O N TA N A M E A N S B U S I N E S S

m o nta n a m e a nsb usin e ss .co m

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

14

Specializing in business law,

employment law, securities

matters, commercial litigation,

contract disputes, construction law,

mediations and arbitrations.

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

15

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

2 : L EG A L A S P EC T c o nt

A sole proprietorship is owned and operated

by one person. Under Federal law, it is not

actually considered a separate legal entity.

It is instead considered an extension of the

person who owns the business. This individual

has sole ownership of assets but is also solely

liable for the debts of the business.

A partnership can be formed in three ways.

A general partnership is comprised of two or

more individuals who join to start a business.

Each person has proportional ownership

of the business assets and proportional

liability for business debts. Each person

also has authority in running this business.

A partnership agreement can be drawn up

to alter each person’s particular liability.

However, despite this document, creditors

may collect from each and every member of

the partnership (this may include personal

assets).

A limited partnership is made up of one or

more general partners as well as one or more

limited partners. Limited partners contribute

capital and share in profits/losses. These

limited partners, however, take no part in the

running of the business and are not held liable

\ehj^[eh]Wd_pWj_edÊiZ[Xji$

A limited liability partnership is very similar

to a limited liability company (LLC) which is

discussed below and is generally used by those

types of businesses prohibited by statute from

X[_d]eh]Wd_p[ZWiWb_c_j[Zb_WX_b_joYecfWdo$

In an LLP, all partners may act essentially as

general partners, but are generally protected

from liability for the partnership’s debts. An

LLP is taxed like a regular partnership, but

must be registered with the Secretary of

State.

Whether taking part in a general, limited, or

limited liability partnership, it is advisable that

you draw up a partnership agreement. This

document will detail each partner’s rights

and their responsibilities. Partnerships are

required to file informational tax forms with

both federal and state governments. While

the partnership is not typically taxed on

income, each partner reports share of income

for the partnership on his/her personal tax

returns.

2 : R EG I S T R ATI O N O F A S S U M E D B U S I N E S S N A M E ,

T H E S EC R E TA RY O F S TAT E

A corporation is an entity which must be

approved by the state of Montana through

the Office of the Secretary of State. A

corporation must file federal, state, and local

tax returns on its operations. One advantage

to a corporation is the protection from liability

afforded to shareholders. However, when an

eh]Wd_pWj_ed _i icWbb" Yh[Z_jehi cWo h[gk_h[

personal guarantees of predominant owners.

A disadvantage of the corporation is that the

eh]Wd_pWj_edÊi _dYec[ YWd X[ jWn[Z jm_Y[

(once on the business’s corporate tax return

and again on the shareholder’s personal

income tax returns for any dividends paid to

the shareholders). To address the issue of

double taxation a business can elect to be

an S Corporation. This status allows income

of the company to flow through to the

shareholder’s personal income tax return.

When filing for S Corporation status, please

consult a professional.

To incorporate your business you must file

paperwork with the Montana Secretary of

State. Once incorporated, you will be required

to register and pay fees annually. Publication

of the intent to incorporate is also required.

A limited liability company (LLC) is a relatively

new form of business entity in Montana that

includes some of the characteristics of the

other business entities. The owners are known

as members, and the LLC has the potential to

shield its members from personal liability like

a corporation. However, the profits generated

by the business pass through the business

entity to the members. The default structures

used for taxation purposes are a Partnership

(for multiple–member LLCs) and Sole

Proprietorship (for single–member LLCs).

An attorney should handle the creation of your

business entity for you. In addition to creating

your business, there are more activities that

must be performed. An attorney will advise

you concerning those other requirements.

R e s o u rc e :

M o n t a n a S e c r e t a r y o f S t a te L i n d a M c C u l l o c h

1 3 0 1 E . 6 t h Ave n u e

Helena, MT 59 601

P h o n e : (4 0 6 ) 4 4 4 -2 0 3 4

Fa x : (4 0 6 ) 4 4 4 - 3 976

sos.mt.gov/index.asp

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

16

Registration

of Assumed

Business Name

I

n the state of Montana, if you are

structured as a sole proprietor you

are not required to register your

business name with the state. It is

recommended that every business

conduct a business entity search on the

Montana Secretary of State’s website to

make sure that a pre-existing business

is not already operating under the

same name.

It is also recommended that a national

search is done as well. IT IS ALSO

ADVISED THAT EVERY BUSINESS

REGISTER THEIR ASSUMED BUSINESS

NAME

WITH

THE

MONTANA

SECRETARY OF STATE. If you have

any questions regarding registration of

assumed business name, contact the

Business Services with the Montana

Secretary of State at the address or

phone number listed below.

R e s o u rc e :

M o n t a n a S e c r e t a r y o f S t a te

Business Services

P. O . B ox 2 0 2 8 0 1

H e l e n a , M T 5 9 6 2 0 -2 8 0 1

P h o n e : (4 0 6 ) 4 4 4 - 3 6 6 5 - B u s i n e s s E n t i t y

sos.mt.gov/Business/index.asp

R e s o u rc e :

U n i te d S t a te s P a te n t & Tr a d e m a r k O f f i c e

M a i l S to p

C o m m i s s i o n e r f o r P a te n t s

P. O . B ox 1 4 5 0

A l e x a n d r i a , VA 2 2 3 1 3 - 1 4 5 0

www.uspto.gov/about/index.jsp

A corporation or limited liability company

will not need to file this registration, as

it will already be registered with the

Montana Secretary of State. The fee for

trade name registration is approximately

$20. The Business Services office will

provide any paperwork that needs to be

completed, or you can do so online at

the above web address.

The Secretary of State

T

he Montana Office of the Secretary of State can

provide you with ample information regarding

many different areas of your business including:

9 e hf e hWj_ e d – establishing your legal structure

with online forms and applications

F he\ [ i i _ e d W b B_ Y[ d i k h[ – information

regarding applying for and renewing professional

licensures

I [ Yk h_j_ [ i 8 k i _ d [ i iH[ ] k b Wj_e d –

including securities, cemeteries, and charities

; b [ Y j_ e d i W d Z C e dj W d WLej[ h

I n f o rm ati o n

I j Wj[ 9 W f _je b _ d\e hc Wj_e d

R e s o u rc e :

M o n t a n a S e c r e t a r y o f S t a te

sos.mt.gov

EXECUTIVE OFFICES

State Capitol Building

1301 E. 6th Avenue

Helena, MT 59601

Phone: 406-444-2034

Fax: 406-444-3976

A D M I N I S T R AT I V E

R U L E S S E RV I C E S

1236 6th Avenue

Helena, MT 59601

Phone: 406-444-2055

406-444-2842

Fax: 406-444-4263

NOTARY SERVICES

1236 6th Ave

Helena, MT 59601

Phone: 406-444-5379

406-444-1877

Fax: 406-444-4263

MEDIA CONTACT

Phone: 406-444-2807

Fax: 404-657-5804

RECORDS AND

INFORMATION

MANAGEMENT

')(&8ep[cWdIjh[[j

Helena, MT 59601

Phone: 406-444-9000

Fax: 406-444-9002

ELECTIONS DIVISION/

GOVERNMENT

SERVICES

State Capitol, Room 260

1301 6th Avenue

Helena, MT 59620

Phone: 406-444-4732

Fax: 406-444-2023

B U S I N E S S S E RV I C E S

State Capitol, Room 260

1301 6th Avenue

Helena, MT 59620

Phone: 406-444-5522

Annual Reports:

406-444-3665

Business Entity:

Phone: 406-444-2468

Fax: 406-444-3976

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

17

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

2 : S TAT E I S S U E D L I C E N S E S , L I C E N S I N G

A N D P E R M IT I N FO, ZO N I N G

State Issued

Licenses

S

ome businesses are required to apply for

licensing through the state of Montana.

For more information on license

verification and renewal, visit the Montana

Department of Labor and Industry Business

Standards Division website at:

bsd.dli.mt.gov/license/license.asp

Licensing and

Permit Information

2 : B U I L D I N G CO N S T R U C TI O N , R E N OVATI O N & O CC U PA N C Y,

H E A LT H P E R M ITS , F E D E R A L L I C E N S I N G

Zoning

Building

Construction,

Renovation &

Occupancy

O

nce you have chosen a tentative

location for your business, contact

j^[ ped_d] Z[fWhjc[dj je Z[j[hc_d[

the permitted uses of that location. There

might be special restrictions on that area. DO

NOT INVEST ANY MONEY IN A LOCATION

UNTIL ZONING HAS BEEN THOROUGHLY

RESEARCHED!!!

9khh[djped_d]YbWii_ÓYWj_edi

8k_bZ_d]i[jXWYai

E\\#ijh[[jfWha_d]WlW_bWX_b_joWdZi[hl_Y[

entrance requirements

R e s o u rc e :

Building Division

City of Billings

5 1 0 N . B ro a d w ay - 4 t h f l o o r

Billings, MT 59101

P h o n e : 4 0 6 - 6 5 7- 8 24 6

Fa x : 4 0 6 - 6 5 7- 8 3 2 7

8k\\[hoWhZiehh[gk_h[ZiYh[[d_d]

BejWh[Wc_d_ckc

(ALSO CALLED AN

O C C U PAT I O N A L TA X )

I_]dh[]kbWj_edi

I

f you plan to operate a business in the

state of Montana, you may have to obtain

a city or county business license. In some

cases such as home-based businesses and

some county areas outside the incorporated

city limits, no license is needed. You should

discuss the details of your situation with the

licensing department. The fee for a license is

Yedj_d][dj ed j^[ beYWj_ed" jof[" WdZ i_p[ e\

your business.

R e s o u rc e :

For conducting business within the City of Billings

City of Billings

210 N . 27th St

Billings, MT 59101

c i . b i l l i n g s . m t . u s / i n d e x . a s px ? N I D = 9 8 1

R e s o u rc e :

For conducting business within the Cit y of Laurel

Cit y of Laurel

215 S 1st St

Laurel, MT

w w w. l a u r e l . m t . g ov

Sign permits are required for erecting and

placing any mounted or free-standing signs.

7ffb_YWj_ediWh[Ób[Zj^hek]^j^[ped_d]e\ÓY[$

For specific information about the signage,

contact your local Zoning Administrator or

Commissioner’s office. If your plans do not/

cannot meet these specifications, you can

Z_iYkiiefj_edim_j^j^[ped_d]e\ÓY[$?\oek

ÓdZ j^[ Ykhh[dj ped_d] YbWii_ÓYWj_ed e\ oekh

potential location does not allow for your

Xki_d[ii"oekcWoÓb[WdWff[Wb\ehh[ped_d]$

In order to file this appeal, contact the Zoning

Administrator’s office. An answer on this

appeal can usually be expected 4-5 weeks

after submission of your application packet.

R e s o u rc e :

City & County Planning Division

City of Billings

5 1 0 N . B ro a d w ay - 4 t h f l o o r

Billings, MT 59101

P h o n e : 4 0 6 - 6 5 7- 8 24 6

Fa x : 4 0 6 - 6 5 7- 8 3 2 7

c i . b i l l i n g s . m t . u s / i n d e x . a s px ? n i d =1 8 4

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

18

R e s o u rc e :

M i s s i o n M o u n t a i n F o o d E n te r p r i s e C e n te r

4 0 5 M a i n S t . , P. O . B ox 7 2 2

Ronan, MT 59864

P h o n e : (8 8 8) 3 5 3 - 5 9 0 0

w w w. m m f e c . c o m

A

building permit must be obtained

for both new construction and

renovations of additions to existing

buildings. Before you may construct a

new facility or renovate an existing one,

you must have this permit. Once you have

obtained a building permit, complied with

the regulations pertaining to the area you

are in, and construction is complete, your

facility will be inspected. You will then apply

for a Certificate of Occupancy. Without this

certificate, it is illegal for your business to

reside in the facility.

The Office of Zoning Administration can help

you determine if your location and type of

business are in compliance with ordinances.

You will be required to submit your business

fbWdijej^[ped_d]e\ÓY[jeZ[j[hc_d[_\j^[

business complies/can be adapted to comply

with the following:

BUSINESS LICENSE

agricultural enterprises to become viable

competitors in diverse global markets. Advisory

services offered are: HACCP Plan development;

market analysis; food product development;

label and packaging development; pricing

structure; and co-packing. Contact information

is listed below.

Health Permits

I

f your business involves food processing,

handling, storage, or distribution, you must

obtain permits from your local County Health

Department, (Riverstone Health for Yellowstone

County), which handles the permits for the

entire county and city. If you are unsure if your

business needs a permit, contact the Health

Department.

R e s o u rc e :

E nv i ro n m e n t a l H e a l t h S e r v i c e s

R i ve r s to n e H e a l t h

123 South 27th Street

Billings, MT 59101

P h o n e : 4 0 6 -247- 3 2 0 0

w w w. r i ve r s to n e h e a l t h . o r g / P u b l i c H e a l t h /

E nv i ro n m e n t a l H e a l t h S e r v i c e s / t a b i d / 1 0 5 / D e f a u l t . a s px

The Mission Mountain Food Enterprise Center

assists individuals, small businesses and

Federal Licensing

M

ost new small businesses will not require

any type of federal licensing to conduct

business, unless you will be engaged in

one of the following activities:

H[dZ[h_d]_dl[ijc[djWZl_Y[

CWa_d]WbYe^eb_YfheZkYji

CWa_d]jeXWYYefheZkYji

Fh[fWh_d]c[WjfheZkYji

CWa_d]ehZ[Wb_d]_dÓh[Whci

You will need a Federal permit to also start large

operations such as a television station, radio

station, common carrier, or producer of drugs

or biological products. The aforementioned

businesses are all heavily governmentally

regulated. For more information on federal

licensing for these types of businesses,

contact:

R e s o u rc e :

T h e U . S . D e p a r t m e n t o f A l c o h o l , To b a c c o , a n d

Firearms

Billings Field Of fice

2 9 2 9 T h i r d Ave n u e N o r t h , R o o m 5 2 8

Billings, Montana 59101 USA

P h o n e : (4 0 6 ) 6 5 7- 970 0

Fa x : (4 0 6 ) 6 5 7- 970 1

R e s o u rc e :

The U. S . Federal Drug Administration

1 0 9 0 3 N e w H a m p s h i r e Ave

S i l ve r S p r i n g , M D 2 0 9 9 3 - 0 0 0 2

1 - 8 8 8 - I N F O - F DA ( 1 - 8 8 8 - 4 6 3 - 6 3 3 2 )

w w w. f d a . g ov/

R e s o u rc e :

The U. S . Federal Communications Commission

4 4 5 1 2 t h S t r e e t S W, Wa s h i n g to n , D C 2 0 5 5 4

P h o n e : 1 - 8 8 8 -2 2 5 - 5 3 2 2

T T Y: 1 - 8 8 8 - 8 3 5 - 5 3 2 2

Fa x : 1 - 8 6 6 - 4 1 8 - 0 2 3 2

w w w. f c c . g ov/

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

19

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

2 : E M P LOY E R TA X

R E S P O N S I B I L ITI E S

2 : OT H E R TA X E S

Employer Tax Responsibilities

I N C O M E TA X E S

Fe d e ra l

Businesses with employees must pay employer

taxes and withhold employee taxes for the

Federal government. The EFTPS is used for

Federal tax deposits. The U.S. Department of

Revenue will determine the time of payment. You

will be required to withhold Social Security and

Medicare taxes on gross wages. In addition to this

withholding, the employer must pay a matching

amount. Withholding amounts are also dependent

on the W-4 form from the employee. You should

consult the current year tax table for present

percentages.

St a te

Businesses with employees must pay employee

taxes and withhold employee taxes for the State

of Montana. The State of Montana will provide a

coupon book to accompany your state deposits.

These deposits may be required monthly,

quarterly, or annually. The Montana Department

of Revenue will determine the time of payment.

As with Federal income taxes, you will be required

to withhold Social Security and Medicare taxes

on gross wages. In addition to this withholding,

the employer must pay a matching amount.

Withholding amounts are also dependent on the

W-4 form from the employee. You should consult

the current year tax table for present percentages

R e s o u rc e :

M o n t a n a S t a te D e p a r t m e n t o f R e ve n u e

To l l - f r e e : (8 6 6 ) 8 5 9 -2 2 5 4

r e ve n u e . m t . g ov/f o r b u s i n e s s e s /d e f a u l t . m c px

U n e m p l oy m e n t I n s u ra n ce Ta xe s

Employers pay unemployment insurance taxes as

a business cost through the State Unemployment

Tax Act (SUTA) and the Federal Unemployment

Tax Act (FUTA.) FUTA is normally remitted on a

quarterly basis via the EFTPS. Tax payments cannot

be deducted or withheld from the employee’s

wages.

The Montana Department of Labor collects the

State Unemployment Insurance Tax (SUTA). Newly

liable employers are assigned a beginning tax rate

that can vary between different industries and

pay the tax on the applicable wage-base. Wages

include all remuneration for personal services,

including commissions and bonuses and the

cash value of all remuneration paid in any other

medium other than cash. SUTA tax is remitted on

a quarterly basis to the Montana Department of

Labor & Industry.

R e s o u rc e :

Billings Job Service

2 1 2 1 - B R o s e b u d D r.

Billings, MT 59102

P h o n e : (4 0 6 ) 6 5 2 - 3 0 8 0

w s d . d l i . m t . g ov/ l o c a l / b i l l i n g s

For further information on unemployment Taxes,

contact the Montana Unemployment Insurance

Division at the website below for a complete

directory of state resources regarding taxes and

other new business needs.

R e s o u rc e :

M o n t a n a U n e m p l oy m e n t I n s u r a n c e D i v i s i o n

P h o n e : (4 0 6 ) 4 4 4 - 3 7 8 3

Fa x : (4 0 6 ) 4 4 4 -2 6 9 9

T T Y: (4 0 6 ) 4 4 4 - 0 5 3 2

u i d . d l i . m t . g ov

Wo r ke r s ’ C o m p e n s a t i o n I n s u ra n ce

Workers’ Compensation insurance is required of

all businesses with employees excluding corporate

owner-employees who have elected the exemption.

The rates vary with the business type and the risk

level. For more information, contact the Montana

State Fund.

R e s o u rc e :

M o n t a n a D e p a r t m e n t o f R e ve n u e

E m p l oye e R e l a t i o n s D i v i s i o n

P. O . B ox 8 0 1 1

H e l e n a , M T 5 9 6 24

r e ve n u e . m t . g ov/d e f a u l t . m c px

R e s o u rc e :

M o n t a n a S t a te Fu n d

P. O . B ox 47 5 9

H e l e n a , M T 5 9 6 0 4 - 47 5 9

P h o n e : (4 0 6 ) 4 9 5 - 5 0 0 0

To l l Fr e e : (8 0 0) 3 3 2 - 6 1 0 2

w w w. m o n t a n a s t a te f u n d . c o m /w p s /p o r t a l

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

20

P ay ro l l Ta xe s

Fe d e ra l E xci s e Ta xe s

There are taxes that as an employer you are responsible

for both withholding from employee wages as well as

paying yourself. For more complete information on

employer taxes, see Labor and Safety Regulations

Information on page 23.

There are some forms of business on which the U.S.

government requires additional taxation. This will be

a tax that you are responsible for collecting. This tax

does not come out of your pocket. Typically, it is added

to the sale price of your product or service. Quarterly

Federal Excise Tax Return is used to file most federal

excise taxes. Federal excise taxes can be broken into

nine general categories of products and services, as

follows:

Fe d e ra l Ta x I d e n t i f i c a t i o n N u m b e r s

Your federal tax identification number is the number

used to file your taxes. A Taxpayer Identification

Number (TIN) is an identification number used by the

Internal Revenue Service (IRS) in the administration

of tax laws. If you are a sole proprietorship, you may

use your Social Security Number. Sole proprietors

with employees must have a TIN. Partnerships and

corporations will need a Federal Tax ID number. To

determine whether you need a Tax ID number, contact

your attorney or accountant.

Other Taxes

S TAT E O F M O N TA N A

Big Sky Economic Development strongly encourages all

business owners to consult a CPA regarding taxation.

The following information is meant to be used as a quick

reference and does not constitute legal advice.

Cejehl[^_Yb[ki[jWnl[^_Yb[i]h[Wj[hj^Wd++"&&&

lbs. gross weight);

H[jW_b[hijWnY[hjW_djof[ie\\k[bi1

H[jW_b [nY_i[ jWn ed j^[ iWb[i e\ j^[ \ebbem_d]0

heavy trucks/trailers, tires and tubes, recreation

equipment (e.g. fishing/hunting supplies), firearms,

and ammunition;

7_hjhWdifehjWj_edjWn_\oekWh[jhWdifehj_d]f[efb[

by air, you have to collect this tax);

9ecckd_YWj_edi jWn[i [$]$ j[b[f^ed[ eh j[b[jof[

services);

MW][h_d]jWn[i1

JWn[iedK$I$c_d[ZYeWb

;dl_hedc[djWbjWn[i_cfei[Z_df[jheb[kcfheZkYji"

lWh_ekiY^[c_YWbi"WdZ^WpWhZekimWij[i1WdZ

7bYe^eb"Óh[Whci"Wcckd_j_edi"WdZjeXWYYejWn[i$

Be sure to contact the IRS for complete information

on federal excise taxes.

R e s o u rc e :

I n te r n a l R e ve n u e S e r v i c e

2 9 0 0 4 t h Ave . N .

Billings, MT 59101

(4 0 6 ) 247-74 4 6

w w w. i r s . g ov

S a l e s a n d U s e Ta xe s

Montana does not have a general sales tax; therefore

the state does not provide a sales tax exemption

number. Manufacturers and distributors often ask for

this number when purchasing products out-of-state.

In place of this number it is suggested that you use

the one number specific to the business (SSN or EIN).

Another suggestion would be your business license

number, if applicable. (Not all businesses are required

to have a license number.)

R e s o u rc e :

M o n t a n a D e p a r t m e n t o f R e ve n u e

P h o n e : To l l - f r e e 1 - 8 6 6 - 8 5 9 -2 2 5 4 ; H e l e n a 4 0 6 - 4 4 4 - 6 9 0 0

T D D : 4 0 6 - 4 4 4 -2 8 3 0

m o n t a n a f r e e f i l e . o r g / R T F 1 . c f m? p a g e n a m e = M o n t a n a % 2 0

D e p a r t m e n t % 2 0 o f % 2 0 R e ve n u e % 2 0 2

St a te E xci s e Ta xe s

In addition to federal excise taxes, you may be

responsible for collecting state excise taxes. The

categories are comparable to the federal categories.

Alcoholic beverages, tobacco products, motor carriers,

and trucks with no more than two axles are included in

the taxed categories. You should contact the Montana

Department of Revenue for complete information.

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

21

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

2 : U TI L ITI E S

2 : L A B O R & SA F E T Y

R EG U L ATI O N I N FO R M ATI O N

Utilities

E S TA B L I S H I N G WAT E R , S E W E R ,

A N D GA R BAG E S E RV I C E

T

o establish water, sewer, and garbage service

in an existing location or new facility within

Yellowstone County, you must contact the

local Utility Department. You may be required to

sign a service contract and pay a deposit.

To establish service in the City of Billings contact:

Public Works

2224 Montana Ave - 2nd Floor

Billings, MT 59101

406-657-8230

To establish service in the Custer area contact:

Custer Area/Yellowstone County, Water and

Sewer District

321 4th Street

Custer, MT 59024

406-856-4160

To establish service in Huntley contact:

Huntley-Yellowstone Water District

1645 Date Street

Huntley, MT 59037-9116

406-348-2517

To establish service in Laurel or Park City contact:

Park City Water & Sewer District

120 1st Avenue Southwest

Park City, MT 59063

406-633-2910

To establish service in Lockwood contact:

Lockwood Water & Sewer District

1644 Old Hardin Road

Billings, MT 59101-6590

406-259-4120

To establish service in Worden or Ballantine contact:

Worden-Ballantine Water Sewer

3rd Street

Worden, MT 59088

406-967-2550

Labor & Safety Regulation Information

E S TA B L I S H I N G G A S S E R V I C E

To establish service in Yellowstone County:

Montana Dakota Utilities

1-800-MDU-FAST (1-800-638-3278)

www.montana-dakota.com/Pages/Overview.aspx

E S TA B L I S H I N G E L E C T R I C A L

SERVICE

There are two different electrical companies that

serve Yellowstone County.

Northwestern Energy

1944 Monad Road

Billings, MT 59102-6353

406-655-2543

www.northwesternenergy.com

Yellowstone Valley Electric Cooperative

P.O. Box 249

150 Cooperative Way

Huntley, MT 59037-0249

406-348-3411

Fax: 406-348-3414

www.yvec.com

E S TA B L I S H I N G T E L E P H O N E

SERVICE

T

here

are

multiple

telephone/

communications providers that serve the

Yellowstone County area. The following is a

list of the main providers to contact for rates and

service information.

T

he Montana Department of Labor

& Industry is available to provide

consultation to new businesses in the

state. The local and state departments offer

educational seminars and presentations

throughout the year. These classes cover a

wide range of labor-related topics such as

labor laws, labor issues, prevailing wages,

unemployment insurance, benefits, and

employment services.

It is advisable to contact the local Montana

Department of Labor office regarding these

classes. These seminars are intended to

provide you with all the information you

need to prepare you for the employment

aspect of running a business. You should

begin these classes up to one year before

your intended start-up. At these seminars

you will be provided with a section of the

instructional workbook.

The Montana

Department of Labor can help you walk

through all of your employment and labor

issues and concerns.

R e s o u rc e :

Montana Department of Labor & Industr y

P. O . B ox 1 7 2 8 H e l e n a M T 5 9 6 24 - 1 7 2 8

P h o n e : 4 0 6 - 4 4 4 -2 8 4 0

Fa x : 4 0 6 - 4 4 4 - 1 3 9 4

T T Y: 4 0 6 - 4 4 4 - 0 5 3 2

d l i . m t . g ov

OSHA

T

he issuing and enforcing of occupational

and safety health regulations is handled

by the United States Department of

Labor. The Occupational Safety and Health

Administration (OSHA) is the federal agency

which administers these policies.

The

requirements put forth by OSHA include posting

notices to employees and maintaining accurate

records of employee injuries. OSHA will provide

you with the information on all requirements as

well as related publications. OSHA policies and

regulations must be posted in the workplace

and visible to all employees.

In addition to OSHA, the U.S. government

also supports the Employment Standards

Administration, Mine Safety and Health

Administration, Veterans Employment and

Training Service, and the Pension and Welfare

Benefits Administration.

Each of these

departments is designed to protect both the

employer and employee. Similar to OSHA,

each entity issues and enforces a unique set of

requirements and regulations.

R e s o u rc e :

Occupational Safety and Health Administration

U. S . Department of Labor

2 9 0 0 4 t h Ave n u e N o r t h , S u i te 3 0 3

Billings, Montana 59101

P h o n e : (4 0 6 ) 247-74 9 4

h t t p : //w w w. o s h a . g ov

AT&T

Customer Service or Sales: 1-888-944-0447

Optimum

Customer Service or Sales: 1-866-718-6097

Qwest/CenturyLink

Customer Service or Sales: 1-877-744-4416

Integra Telecom

Customer Service or Sales 1-888- 342-5987

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

22

E D U C AT I N G YO U R S E L F O N

L ABOR /SAFET Y ISSU ES

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J+ / ' & '* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

23

19

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

2 : A P P L I C ATI O N , H I R I N G &

T E R M I N ATI O N P R O C E S S

S T E P 3 : A D D IT I O N A L R E S O U R C E S

Application, Hiring and Termination Processes

State and Federal Employment Laws

T

here are basic ground rules to hiring and firing

employees, and you should always consult

with an employment attorney before making

these decisions. If handled incorrectly, personnel

issues can result in legal problems large enough to

shut down your business. While this guide cannot

provide legal advice, the following points are some

of the things you should consider when faced with

an employment situation. If in doubt, always make

sure to use legal or other employment resources.

;:K97J;OEKHI;B< The best way to prevent

problems is to be familiar with the law. When

you are in doubt about any issue concerning

labor or safety, contact the Montana Department

of Labor & Industry and or the local Job Service

office. See the Resource Directory for contact

information.

T E R M I N AT I O N

DO:

A P P L I C AT I O N A N D H I R I N G

DON’T:

7ia eXl_eki gk[ij_edi$ Do not ask questions

regarding sex, age, race, etc. or anything related

to these areas. These are sensitive areas and

cannot be used as discriminating factors.

Some applicants may believe that all gathered

information is used. It is for this reason that you

should not ask these questions. It is best to avoid

these topics so as to eliminate all possibility of

legal problems.

Mh_j[ ed j^[ `eX Wffb_YWj_ed \ehc$ Any notes

taken during interviews should be made on

photocopies or other paper. This allows you to

preserve the original application without marring

it for your permanent records.

DO:

B_c_j oekh _dj[hl_[m gk[ij_edi je `eX Zkj_[i$

There is no reason to ask questions that apply to

the responsibilities of the position. You may ask an

applicant is he/she has any barriers to completing

the duties. Do not ask question like “Do you have

children?” or “Are you married?” Small talk is

acceptable if the interviewer is careful. Do not

venture into conversations that might produce

seemingly discriminatory information.

CWa[ ikh[ Wbb YecfWdo fheY[Zkh[i \ebbem

employment statutes. Have your advisors or

attorney review your system for application,

hiring, and termination before you begin hiring

and periodically thereafter.

H[l_[m YecfWdo feb_Y_[i$ If you have not yet

developed company policies regarding the

application, hiring, and termination, call the

Montana Department of Labor & Industry or

your local Job Service. Make a checklist of your

procedures. Make sure that you have followed

the rules in the firing process. If you have not

yet completed your checklist, YOU SHOULD

NOT TERMINATE THE EMPLOYEE YET. Take

care to finish all steps in the process to alleviate

any questions and possible legal repercussions.

>Wl[ W ijWj[Z YeZ[ e\ [nf[Yj[Z [cfbeo[[

behavior. Many employers face problems due

to unclear expectations of conduct. It is easier

to prove reasons for termination if such a code

is in place. This documentation will be helpful

if you are faced with paying restitution because

it will show that you had a sufficient cause to

terminate the employee.

9edZkYj Wd [n_j _dj[hl_[m$ This allows you to

tie up any loose ends. Final paychecks can

be issued, and company property (e.g. keys,

paperwork, and files) can be returned. Ask the

employee what he/she liked or disliked about

your company. Ask for feedback on aspects

of your company of which this person has

knowledge. This person might be a bit more

forthcoming with problems or constructive

criticisms than someone who still works there.

A[[f j[hc_dWj_ed e\ Wd [cfbeo[[ X[jm[[d

you (management) and the employee. The

fired employee will appreciate your decision

on this matter. Termination should not be

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

24

discussed with other employees. Privacy

can help you avoid harsh feelings and legal

repercussions.

>Wl[ [cfbeo[[i i_]d W h[b[Wi[$ If you are

offering the fired employee severance pay

or anything else of values, have him/her sign

a release of liability to the company. This

may protect you in case of legal action.

W H E R E T O F I N D YO U R L A B O R

SOURCE

T

here are many resources through which

one can find employees. The first things

that typically come to mind are the

classified advertisements in local newspapers.

You can place ads in these publications for

week long and even month long periods.

Contact the publication you wish to use for

more specific information. The Montana

Department of Labor & Industry at your local

Job Service is an agency that can assist you in

finding employees.

R e s o u rc e :

Billings Job Service

2 1 2 1 - B R o s e b u d D r.

Billings, MT 59102

Phone 40 6 - 652-30 80

w s d . d l i . m t . g ov/ l o c a l / b i l l i n g s

R e s o u rc e :

A s s o c i a te d E m p l oye r s o f M o n t a n a

2 7 2 7 C e n t r a l Ave n u e , S u i te 2

Billings, Montana 59102

P h o n e : 4 0 6 -24 8 - 6 1 7 8

w w w. a s s o c i a te d e m p l oye r s . o r g

S till h ave q u e s tio n s? R ef e r b e low a n d

c o n su lt o u r R e so u r c e D i r e cto r y to f i n d

th e a n swe r !

Additional Resources

BUSINESS PLANNING RESOURCES

Montana Manufacturing Extension Center

Dale Detrick

222 N. 32nd St. Ste. 200

Billings, MT 59101

406-256-6871

www.mtmanufacturingcenter.com

Small Business Development Center at Big Sky

Economic Development

222 N 32nd St. Ste. 200

Billings, MT 59101

406-254-6014

www.bigskyeda-edc.org/small-businessdevelopment.php

SCORE (Senior Core of Retired Executives)

207 N Broadway

Billings, MT 59101

406-294-4422

www.score.org

BUSINESS DEVELOPMENT RESOURCES

Big Sky Economic Development

222 N. 32nd St. Ste. 200

Billings, MT 59101

406-256-6871

www.bigskyeconomicdevelopment.org

Business Expansion and Retention

at Big Sky Economic Development

222 N 32nd St. Ste. 200

Billings, MT 59101

406-256-6871

www.bigskyeda-edc.org/bear.php

Billings Chamber of Commerce

815 South 27th Street

Billings, Montana 59101

406-245-4111

www.billingschamber.com

Laurel Chamber of Commerce

108 East Main St.

Laurel, MT 59044

406-628-8105

www.laurelmontana.org

( ( (D $) ( D :I J$ "I K ? J ;( & &8 ? B B ? D = I "C J* & , #( + , # , . - '8 ? = I A O ;9 E D E C ? 9 : ; L ; BE F C ; D J$ E H =

25

N E W B U S I N E S S S TA RT U P

N E W B U S I N E S S S TA RT U P

3 : A D D ITI O N A L R E S O U R C E S c o nt .

Montana Chamber of Commerce

P.O. Box 1730

Helena, MT 59624-1730

406-442-2405

Fax: 406-442-2409

www.montanachamber.com

Billings Job Service

2121-B Rosebud Dr.

Billings, MT 59102

406-652-3080

wsd.dli.mt.gov/local/billings

Governor’s Office of Economic Development

P.O. Box 200801

Helena, MT 59620-0801

406-444-5634

business.mt.gov

City of Billings

210 N. 27th St

Billings, MT 59101

ci.billings.mt.us/index.aspx?NID=35

Small Business Administration

Montana District Office

10 West 15th Street Suite 1100

Helena, MT 59626

United States

406-441-1081

Fax: 406-441-1090

www.sba.gov/about-offices-content/3/3126

Downtown Billings Association

2815 2nd Avenue North

Billings, MT 59101

406-294-5060

Fax: 406-294-5061

www.downtownbillings.com

BUSINESS MARKETING RESEARCH

RESOURCES

MSU-B Center for Applied Economic Research

Scott Rickard

406-657-1763

www.msubillings.edu/caer/index.htm

Census & Economic Information Center/Montana

Department of Commerce

301 S Park Ave

PO Box 200505

Helena MT 59620-0505

406-841-2740

Fax: 406-841-2731

TTD: 406-841-2702

ceic.mt.gov

3 : G LO S SA RY O F T E R M S

Montana Department of Labor & Industry/Research

& Analysis Bureau - Workforce Services Division

P.O. Box 1728, Helena, MT 59624

406-444-2430

Fax: 406-444-2638

Toll free: 800-541-3904

TDD: 406-444-0532

www.ourfactsyourfuture.org

U.S. Census

www.census.gov

U.S. Department of Labor

200 Constitution Ave., NW

Washington, DC 20210

1-866-4-USA-DOL (1-866-487-2365)

TTY: 1-877-889-5627

www.dol.gov

Montana Tourism

Montana Office of Tourism

PO Box 200533

Helena MT 59620-0501

406-841-2870

Fax: 406-841-2871

www.travelmontana.org/research

Bureau of Economic Analysis (BEA)

Acquisition Systems, Planning and Policy Branch

U.S. Census Bureau

Washington, D.C. 20233

301-763-1822

Fax: 301-763-4149

E-mail: Dijon.f.ferdinand@census.gov

www.bea.gov/index.htm

OTHER WEB - BASED RESOU RCES FOR

ENTREPRENEURS

All Business

allbusiness.com

Business Finance

businessfinance.com

Business Planning Expert bplans.com

Business Owner’s Toolkit toolkit.com

Duct Tape Marketing

ducttapemarketing.com

Entrepreneur.com

entrepreneur.com

Kauffman Foundation’s Resources for Entrepreneurs

entrepreneurship.org

My Own Business

myownbusiness.org

PriceWaterHouseCooper – Vision to Reality

pwc.com

The Wall Street Journal Center for Entrepreneurs

startupjournal.com

Salary.com

salary.com

Famee Foundation

famee.org

Montana Technology Innovation Partnership (MTIP)

mtip.mt.gov/default.mcpx

8 ? =I A O ; 9 E D E C ? 9 : ; L ; BE F C ; D J 9 H ; 7J ? D = C E D J7 D 7 8 K I ? D ; I I E F F E H J K D ? J ? ; I

26

Glossary of Terms

Assets – Resources, owned or

controlled by a company, that

have future benefits.

These

benefits must be quantifiable in

monetary terms.

Balance Sheet – A list of a

company’s assets, liabilities, and

owner’s equity at a particular

point in time; assets=liabilities +

owner’s equity.

Break Even – The unit of volume

where total revenue equals total

cost; there is neither profit nor

loss.

Capacity – The amount of goods

or work that can be produced

by a company given its level of

equipment, labor, and facilities.

Capital – The money, property,

and other valuables which

collectively represent the wealth

of a business: is used to generate

income for that business.

Cash Flow – the movement of

cash into and out of a company;

actual cash received and actual

payments made.

Cash Flow Statement – A

presentation of the cash inflows

and outflows for a particular

period of time; these flows are

grouped into major categories

of cash from operations, cash

investing from activities, and

cash from financing activities.