- BLG.com

advertisement

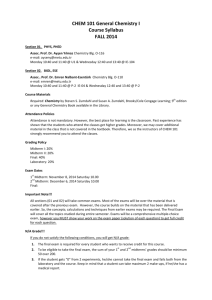

MERGERS & AQUISITIONS BULLETIN MARCH 2013 DRAFTING GO-SHOP CLAUSES IN CANADIAN M&A TRANSACTIONS While still used sparingly, there has been a slight increase in the use of “go-shop” clauses by Canadian targets in friendly acquisitions over the past few years. The few issuers that used go-shops were able to sign an acquisition agreement and conduct a market check after signing, thereby enabling them to secure an offer for the company while still preserving their ability to actively seek higher bids. In most friendly acquisitions of Canadian companies, however, the target will conduct a market check before entering into an acquisition agreement. Since the target has already conducted a market check, the buyer will insist that the acquisition agreement contain a “no shop” provision that, subject to limited exceptions, prohibits the target from soliciting or dealing with competing offers. Two potential risks of conducting a pre-signing market check are: (i) some buyers may not be willing to participate in an auction or market check process which could result in the loss of a potential offer, and (ii) during the time it takes to conduct the market check, equity and/or debt markets could change such that the target’s stock becomes less desirable or valuable, or a potential buyer may no longer be able to secure debt financing or use its own stock as acquisition currency. This could result in not only the loss of a potential offer, but if the market check was, or becomes, public, the target can be considered damaged or unwanted and experience a significant decrease in its stock price. Despite the potential benefits of a go-shop, or the fact that they have become fairly common in the United States, particularly in deals involving private equity buyers, go-shops are used only sparingly in Canada - there have only been 21 announced deals since 2007 which included a go-shop clause. Furthermore, the empirical evidence in Canada, though somewhat limited, shows that it is very rare for a topping bid to emerge as a result of a go-shop. Over the past five years, the only deal with a go-shop that resulted in a topping bid was the October 17, 2011 offer by by Cara Operations Limited to acquire Prime Restaurants Inc. In that transaction, Fairfax Financial Holdings Limited made a topping bid during the go-shop period that Cara did not match. It is not clear why go-shops have not resulted in more topping bids, though a few possibilities include: (i) high initial bids, perhaps as a result of the pressure of the go-shop, (ii) investors, particularly private equity investors, not willing to participate in a process where there is an existing bid, or (iii) investors not participating in the postsigning market check as a result of the short go-shop period together with the fact that they must not only top an existing bid, but do so factoring in the break fee as well as any matching rights. Given the potential benefits and limitations to go-shops, it is critical that targets and their advisors carefully negotiate and draft go-shops to maximize effectiveness. Some of the key points that should be considered include: • Length of the Go-Shop Period – A go-shop should provide sufficient time to conduct a meaningful market check which will depend on factors such as the complexity of the target and the pool of potential bidders. Goshop periods in Canada are typically between 30-45 days though we have seen as short as 14 days and as long as 60 days. • Two Tiered Break Fee – Most go-shops include a two tiered break fee that provides for (i) a reduced break fee during the go-shop period or thereafter with an excluded person (discussed below), and (ii) a full break fee following expiry of the go-shop period. The go-shop break fee is generally about 40-60% of the full break fee. • Excluded Person – The majority of the 21 Canadian deals announced since 2007 permitted the target to continue to negotiate with an “excluded person” during the no-shop period and to pay the lower, go-shop break fee if a transaction was announced with an excluded person. While the precise definition is subject to negotiation, an “excluded person” is a bidder that submitted an acquisition proposal to the target during the go-shop period that the target board determined is, or is reasonably l ikely to lead to, a superior proposal. • Matching Rights – In most public acquisitions, a bidder is given a right to match a superior proposal during the non-solicit (or no-shop) period. However, in approximately one-third of the transactions involving a go-shop, the initial bidder was not given the right to match a superior proposal during the go-shop period even though they were able to do so during the non-solicit period. AUTHOR Jason Saltzman Toronto 416.367.6196 jsaltzman@blg.com MERGERS & AQUISITIONS GROUP Calgary Dan Kolibar | 403.232.9559 | dkolibar@blg.com Brad Pierce | 403.232.9421 | bpierce@blg.com Montréal Fred Enns | 514.954.2536 | fenns@blg.com John Godber | 514.954.3165 | jgodber@blg.com Toronto Paul Mingay | 416.367.6006 | pmingay@blg.com Jeff Barnes | 416.367.6720 | jbarnes@blg.com Vancouver Warren Learmonth | 604.640.4166 | wlearmonth@blg.com Fred Pletcher | 604.640.4245 | fpletcher@blg.com BORDEN LADNER GERVAIS LAWYERS | PATENT & TRADE-MARK AGENTS Calgary Centennial Place, East Tower 1900, 520 – 3rd Ave S W Calgary, AB, Canada T2P 0R3 T 403.232.9500 F 403.266.1395 blg.com Toronto Scotia Plaza, 40 King St W Toronto, ON, Canada M5H 3Y4 T 416.367.6000 F 416.367.6749 blg.com Montréal 1000, rue De La Gauchetière Ouest Suite 900 Montréal, QC, Canada H3B 5H4 Tél. 514.879.1212 Téléc. 514.954.1905 blg.com Vancouver 1200 Waterfront Centre 200 Burrard St, P.O. Box 48600 Vancouver, BC, Canada V7X 1T2 T 604.687.5744 F 604.687.1415 blg.com Ottawa World Exchange Plaza 100 Queen St, Suite 1100 Ottawa, ON, Canada K1P 1J9 T 613.237.5160 F 613.230.8842 (Legal) F 613.787.3558 (IP) ipinfo@blg.com (IP) blg.com Waterloo Region Waterloo City Centre 100 Regina St S, Suite 220 Waterloo, ON, Canada N2J 4P9 T 519.579.5600 F 519.579.2725 F 519.741.9149 (IP) blg.com This bulletin is prepared as a service for our clients and other persons dealing with mergers and acquisition issues. It is not intended to be a complete statement of the law or an opinion on any subject. Although we endeavour to ensure its accuracy, no one should act upon it without a thorough examination of the law after the facts of a specific situation are considered. No part of this publication may be reproduced without prior written permission of Borden Ladner Gervais LLP (BLG). This bulletin has been sent to you courtesy of BLG. We respect your privacy, and wish to point out that our privacy policy relative to bulletins may be found at http://www.blg.com/home/website-electronic-privacy. If you have received this bulletin in error, or if you do not wish to receive further bulletins, you may ask to have your contact information removed from our mailing lists by phoning 1.877.BLG.LAW1 or by emailing unsubscribe@blg.com. © 2013 Borden Ladner Gervais LLP Borden Ladner Gervais LLP is an Ontario Limited Liability Partnership.