verified trust: reciprocity, altruism, and - HEC Lausanne

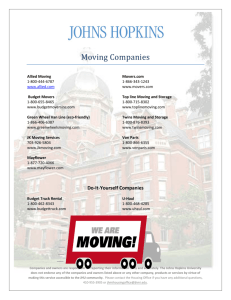

advertisement