kenya airways 2015-16 financial results release

advertisement

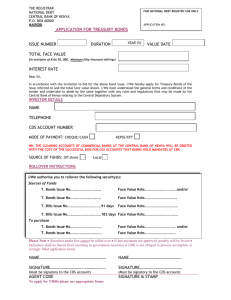

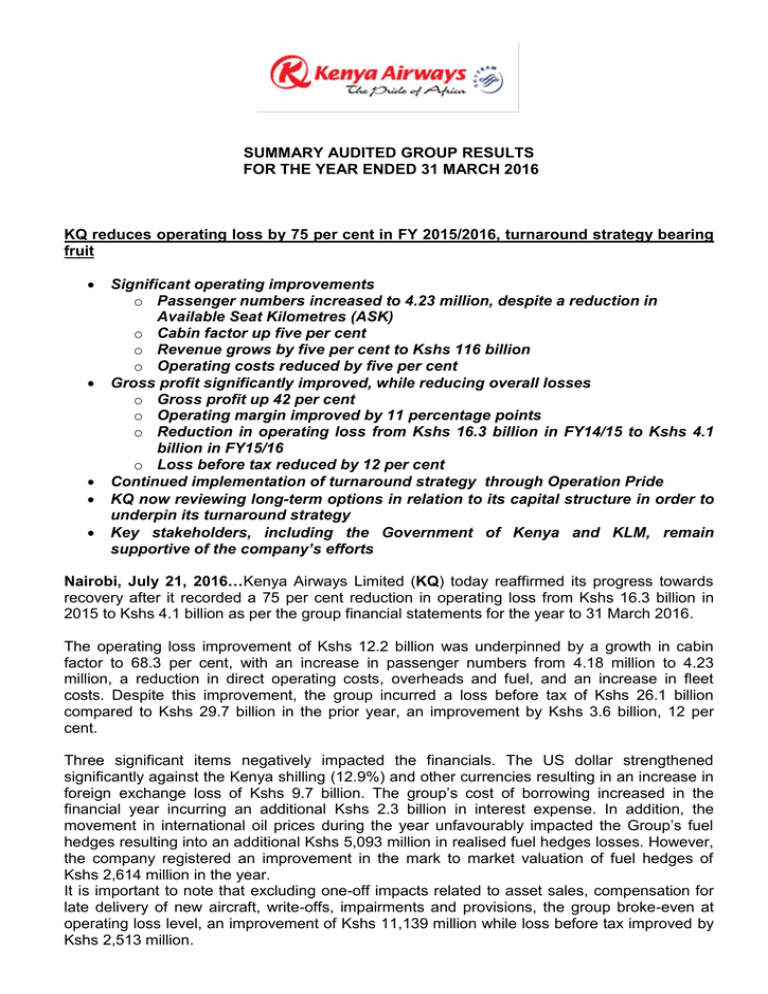

SUMMARY AUDITED GROUP RESULTS FOR THE YEAR ENDED 31 MARCH 2016 KQ reduces operating loss by 75 per cent in FY 2015/2016, turnaround strategy bearing fruit Significant operating improvements o Passenger numbers increased to 4.23 million, despite a reduction in Available Seat Kilometres (ASK) o Cabin factor up five per cent o Revenue grows by five per cent to Kshs 116 billion o Operating costs reduced by five per cent Gross profit significantly improved, while reducing overall losses o Gross profit up 42 per cent o Operating margin improved by 11 percentage points o Reduction in operating loss from Kshs 16.3 billion in FY14/15 to Kshs 4.1 billion in FY15/16 o Loss before tax reduced by 12 per cent Continued implementation of turnaround strategy through Operation Pride KQ now reviewing long-term options in relation to its capital structure in order to underpin its turnaround strategy Key stakeholders, including the Government of Kenya and KLM, remain supportive of the company’s efforts Nairobi, July 21, 2016…Kenya Airways Limited (KQ) today reaffirmed its progress towards recovery after it recorded a 75 per cent reduction in operating loss from Kshs 16.3 billion in 2015 to Kshs 4.1 billion as per the group financial statements for the year to 31 March 2016. The operating loss improvement of Kshs 12.2 billion was underpinned by a growth in cabin factor to 68.3 per cent, with an increase in passenger numbers from 4.18 million to 4.23 million, a reduction in direct operating costs, overheads and fuel, and an increase in fleet costs. Despite this improvement, the group incurred a loss before tax of Kshs 26.1 billion compared to Kshs 29.7 billion in the prior year, an improvement by Kshs 3.6 billion, 12 per cent. Three significant items negatively impacted the financials. The US dollar strengthened significantly against the Kenya shilling (12.9%) and other currencies resulting in an increase in foreign exchange loss of Kshs 9.7 billion. The group’s cost of borrowing increased in the financial year incurring an additional Kshs 2.3 billion in interest expense. In addition, the movement in international oil prices during the year unfavourably impacted the Group’s fuel hedges resulting into an additional Kshs 5,093 million in realised fuel hedges losses. However, the company registered an improvement in the mark to market valuation of fuel hedges of Kshs 2,614 million in the year. It is important to note that excluding one-off impacts related to asset sales, compensation for late delivery of new aircraft, write-offs, impairments and provisions, the group broke-even at operating loss level, an improvement of Kshs 11,139 million while loss before tax improved by Kshs 2,513 million. Mbuvi Ngunze, Kenya Airways CEO said: “The results were achieved in a tough aviation context, in which airlines continue to be weighed down by wild currency fluctuations, volatility in fuel prices, and a changing commodity price environment. An industry forecast by IATA indicates that African airlines will continue to be in negative profit territory in 2016, despite overall improvement in performance. In conjunction with the overall trajectory of the results, a number of other key performance indicators for Kenya Airways also showed marked improvements.” Operation Pride As part of the airline’s turnaround strategy Operation Pride – whose main planks are closing the profitability gap, refocusing the business model as well as optimising the capital of the company – KQ has rationalised its fleet through selling off and leasing some of its surplus aircraft, and monetised certain assets. A staff right-sizing exercise is ongoing. The plan aims at both revenue and cost-side improvements. These actions have already reduced fleet costs by about $7 million from July 2016, thus improving the airline’s liquidity. Mr Ngunze commented: “One of the key goals of Operation Pride is a reduction of the gap in profitability, which is on track. We have also revised our network to improve connectivity and ability to sell flights to more destinations within the network, while densifying our Africa presence through increased frequencies. We are turning the corner and are in a better place, strategically. Most significantly, and in a difficult global business environment, we are improving our business and keeping a tight lid on our costs. I thank all our employees, shareholders, partners and associates whose cooperation and input made these improved results possible.” Consideration of long-term options in relation to the Company’s capital structure After extensive internal review of alternatives, KQ has reviewed the options in relation to its capital structure in order to ensure the financial flexibility, stability, and sustainability that is commensurate with the turnaround strategy. The aim is to place Kenya Airways on a stronger footing and provide a stable base for longterm growth. The company will also continue its focus on improving service quality. 2 Stakeholder Support and Interim Financing “The Government of Kenya and KLM, in their capacity as major investors in Kenya Airways, have indicated their continued strong support of the company’s operational turnaround and the capital structure optimisation process; are closely involved throughout the process and intend to remain major stakeholders in the company over the long term,” said Mr Ngunze. Further, as announced in the last financial year, the company secured bridge financing to the tune of USD 200 million. The first tranche of USD 100 million was received in September 2015 and the second tranche was received in July 2016. This borrowing is supported through an onlending agreement from the Government of Kenya as a key stakeholder. 3 SUMMARY CONSOLIDATED INCOME STATEMENT 31 Mar 2016 KShs M 31 Mar 2015 KShs M 116,158 110,161 Direct costs (67,861) (76,059) Fleet ownership costs (29,578) (25,932) (22,812) (120,251) (24,503) (126,494) Operating loss (4,093) (16,333) Operating margin (%) (3.5%) (14.8%) Finance costs (7,047) (4,734) 8 153 (4,155) (7,452) Other costs (10,812) (1,346) Loss before income tax (26,099) (29,712) (126) 3,969 Loss after tax (26,225) (25,743) Net profit margin (%) Loss per share (KShs) (22.6%) (17.53) (23.4%) (17.21) Revenue Overheads Finance income Losses on fuel derivatives Income tax (charge)/credit 4 SUMMARY CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Loss for the year Other comprehensive income Loss on hedged exchange differences Gain/(loss) on hedged fuel contracts Revaluation of leasehold land, property and equipment Deferred taxation on hedges Total other comprehensive income Total comprehensive income for the year 5 31 Mar 2016 KShs M 31 Mar 2015 KShs M (26,225) (25,743) (7,180) 1,761 1,940 (3,479) (5,192) (2,830) (427) (8,449) (29,704) (34,192) SUMMARY CONSOLIDATED STATEMENT OF FINANCIAL POSITION 31 Mar 2016 KShs M ASSETS Non-current assets Property and equipment Intangible assets Prepaid operating lease rentals Aircraft deposits Others Current assets Inventories Trade and other receivables Current income tax recoverable Assets held for sale Bank and cash balances TOTAL ASSETS EQUITY AND LIABILITIES Equity attributable to owners Non-controlling interest Total equity Non - current liabilities Loans and borrowings Deferred tax liability Others 120,871 802 2,015 2,177 2,840 128,705 125,422 1,163 1,237 10,391 2,798 141,011 1,922 15,084 1,218 6,659 4,827 29,710 158,415 1,897 14,819 1,222 19,847 3,267 41,052 182,063 (35,718) 51 (35,667) Current liabilities Sales in advance of carriage Fuel derivatives Trade and other payables Loans and borrowings Others TOTAL EQUITY AND LIABILITIES 6 31 Mar 2015 KShs M (6,009) 46 (5,963) 113,216 2,264 5,126 120,606 104,175 1,487 1,724 107,386 13,004 3,163 24,040 29,316 3,953 73,476 158,415 11,270 6,928 17,131 43,609 1,702 80,640 182,063 SUMMARY CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Share capital Share premium Reserves KShs M KShs M KShs M Non controlling Total Equity Interest KShs M KShs M Year ended 31 March 2016 At 1 April 2015 Comprehensive income Loss for the year Other comprehensive income Total comprehensive income 7,482 8,670 (22,161) - - 46 (5,963) 5 5 (26,225) (3,479) (29,704) - - (26,230) (3,479) (29,709) 7,482 8,670 (51,870) 51 (35,667) As at 1 April 2014 Comprehensive income Loss for the year Other comprehensive income Total comprehensive income 7,482 8,670 12,034 43 28,229 - - (25,746) (8,449) (34,195) 3 3 (25,743) (8,449) (34,192) At 31 March 2015 7,482 8,670 (22,161) 46 (5,963) At 31 March 2016 - Year ended 31 March 2015 7 - SUMMARY CONSOLIDATED STATEMENT OF CASH FLOWS 31-Mar-16 KShs M 31-Mar-15 KShs M 13,404 8 (6,893) (157) 6,362 5,904 153 (4,734) (109) 1,214 (561) 7,215 (525) (414) 5,715 (75,551) 4 88 (1,307) (76,766) Cash flows from financing activities Borrowings received Repayment of borrowings / lease obligations Net cash (used in) /generated from financing activities 24,213 (34,730) (10,517) 101,533 (33,932) 67,601 Net increase / (decrease) in cash and cash equivalents 1,560 (7,951) Cash and cash equiv at beginning of year 3,267 11,218 Cash and cash equivalents at end of year 4,827 3,267 Cashflows from operating activities Cash generated from operations Interest received Interest paid Income tax paid Net cash generated from operating activities Cash flows from investing activities Purchase of property and equipment Proceeds from disposal of property and equipment Deposits paid / refunds received Other Net cash from /(used in) investing activities Media Contact: Wanjiku Mugo. wanjiku.mugo@kenya-airways.com tel: +254714619221 About Kenya Airways Kenya Airways, a member of the Sky Team Alliance, is a leading African airline flying to 54 destinations worldwide, 44 of which are in Africa and carries over four million passengers annually. The airline was recently voted the Leading Airline in Africa by passengers in the World Travel Awards. It has also been voted the Leading Airline in Africa – Business Class four years in a row. Kenya Airways has a fleet of 36 aircraft that are some of the youngest in Africa; this includes its flagship B787 Dreamliner aircraft. The on-board service is renowned and the lie-flat business class seat on the wide-body aircraft is consistently voted among the world’s top 10. Kenya Airways takes pride in being at the forefront of connecting Africa to the World and the World to Africa through its hub at the new ultra-modern Terminal 1A at the Jomo Kenyatta International Airport in Nairobi. For more information, please visit www.kenya-airways.com. 8