Goldman Sachs ActiveBeta® U.S. Large Cap Equity ETF (GSLC)

Data provided by

Goldman Sachs ActiveBeta® U.S. Large Cap Equity ETF (GSLC)

Stocks Style Box

Large Blend

Morningstar Category

Large Blend

Inception Date

Sep 2015

Total Assets

$1.2 billion

Net Expense Ratio

0.09%

®

Print date: September 30, 2016

Fund Highlights

Fund Strategy

The investment seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Goldman Sachs ActiveBeta® U.S.

Large Cap Equity Index.

The fund seeks to achieve its investment objective by investing at least 80% of its assets (exclusive of collateral held from securities lending) in securities included in its underlying index, in depositary receipts representing securities included in its underlying index and in underlying stocks in respect of depositary receipts included in its underlying index. The index is designed to deliver exposure to equity securities of large capitalization U.S. issuers.

Morningstar Category: Large Blend

Large-blend funds have portfolios that are fairly representative of the overall stock market in size, growth rates, and price. They tend to invest across the spectrum of U.S. industries and owing to their broad exposure, the funds' returns are often similar to those of the S&P 500

Index.

Additional Fund Information & Morningstar Ratings

Inception Date 9/17/2015

Index Fund Yes

Socially Conscious No

Fund Company Goldman Sachs Asset Management LP

Total Net Assets

Total Holdings

1.2B

430

Portfolio Turnover

Fund Availability

Transaction Fee

No Load

--

Open to New Investors

Yes

No

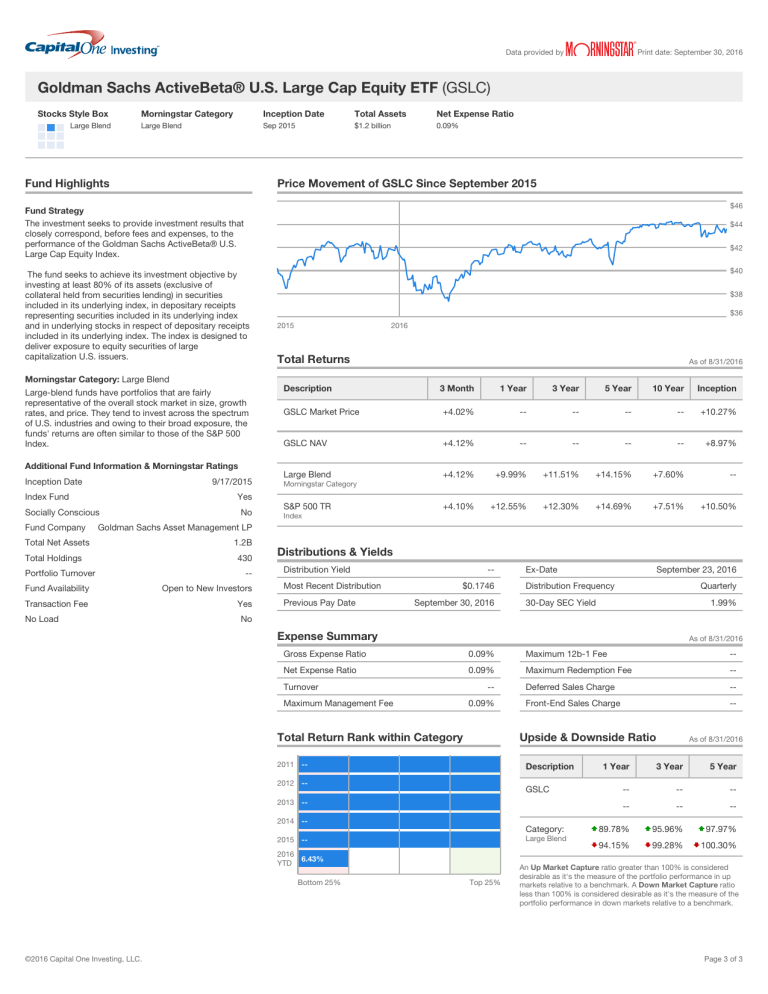

Price Movement of GSLC Since September 2015

2015

Total Returns

Description

GSLC Market Price

GSLC NAV

Large Blend

Morningstar Category

S&P 500 TR

Index

2016

3 Month

+4.02%

+4.12%

+4.12%

1 Year

--

--

3 Year

--

--

+9.99% +11.51%

+4.10% +12.55% +12.30%

5 Year

--

As of 8/31/2016

10 Year Inception

-+10.27%

--

+14.15%

+14.69%

-+8.97%

+7.60% --

+7.51% +10.50%

Distributions & Yields

Distribution Yield

Most Recent Distribution

Previous Pay Date

--

$0.1746

September 30, 2016

Ex-Date

Distribution Frequency

30-Day SEC Yield

September 23, 2016

Quarterly

1.99%

Expense Summary

Gross Expense Ratio

Net Expense Ratio

Turnover

Maximum Management Fee

0.09%

0.09%

--

0.09%

Maximum 12b-1 Fee

Maximum Redemption Fee

Deferred Sales Charge

Front-End Sales Charge

As of 8/31/2016

--

--

--

--

Total Return Rank within Category

2011 --

2012 --

2013 --

2014 --

2015

2016

YTD

--

6.43%

Bottom 25% Top 25%

Upside & Downside Ratio

As of 8/31/2016

Description

GSLC

1 Year

--

--

3 Year

--

--

5 Year

--

--

Category:

Large Blend

89.78%

94.15%

95.96%

99.28%

97.97%

100.30%

An Up Market Capture ratio greater than 100% is considered desirable as it's the measure of the portfolio performance in up markets relative to a benchmark. A Down Market Capture ratio less than 100% is considered desirable as it's the measure of the portfolio performance in down markets relative to a benchmark.

$46

$44

$42

$40

$38

$36

©2016 Capital One Investing, LLC.

Page 3 of 3

Data provided by

Goldman Sachs ActiveBeta® U.S. Large Cap Equity ETF (GSLC)

Stocks Style Box

Large Blend

Morningstar Category

Large Blend

Inception Date

Sep 2015

Total Assets

$1.2 billion

Net Expense Ratio

0.09%

®

Print date: September 30, 2016

Sector Holdings

Technology

Healthcare

Consumer Cyclical

Consumer Defensive

Industrials

Financial Services

Utilities

Real Estate

Communication Services

Other

Global Exposure

United States

Switzerland

Singapore

United Kingdom

As of 8/31/2016

18.05%

15.28%

14.59%

13.83%

10.70%

10.23%

4.13%

4.01%

3.68%

5.50%

Total: 100.00%

As of 8/31/2016

99.54%

0.22%

0.14%

0.10%

Total: 100.00%

Top Holdings

Asset Allocation

100%

50%

0%

-50%

-100%

Type

U.S. Equities

Non U.S. Equities

U.S. Fixed Income

Non U.S. Income

Cash

Other

% Net

99.54

0.46

0.00

0.00

0.00

0.00

% Short

--

--

--

--

--

--

As of 8/31/2016

% Long

99.54

0.46

0.00

0.00

0.00

0.00

Cat. Avg.

93.46

3.59

--

--

2.12

0.85

Risk vs. Reward

Symbol

AAPL

MSFT

JNJ

XOM

AMZN

JPM

HD

FB

PFE

T

Company

Apple Inc

Microsoft Corp

Johnson & Johnson

Exxon Mobil Corp

Amazon.com Inc

JPMorgan Chase & Co

The Home Depot Inc

Facebook Inc A

Pfizer Inc

AT&T Inc

$837

$66.59

$129

$128

$33.86

$40.67

Last

$113

$57.58

$118

$87.29

As of 8/31/2016

18.0K

181K

87.0K

92.4K

333K

273K

# of

Shares

279K

393K

140K

174K

% of Net

Holdings

2.57

1.96

1.45

1.32

1.20

1.06

1.01

1.01

1.01

0.97

No Chart Available

©2016 Capital One Investing, LLC.

Page 4 of 3

Data provided by

Goldman Sachs ActiveBeta® U.S. Large Cap Equity ETF (GSLC)

Stocks Style Box

Large Blend

Morningstar Category

Large Blend

Inception Date

Sep 2015

Total Assets

$1.2 billion

Net Expense Ratio

0.09%

®

Print date: September 30, 2016

Performance data quoted represents past performance and does not guarantee future results. An investment's return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Investors cannot invest directly in an index. These unmanaged indexes do not reflect management fees and transaction costs that are associated with some investments. Past performance is not a guarantee of future results.

ETF research presented by Capital One Investing, LLC incorporates other types of exchange-traded products such as exchange-traded notes (ETNs).

ETF Investors: You should carefully consider an exchange-traded fund's investment objectives, risks, charges and expenses before investing. For a prospectus containing this and other important information, please visit the fund's detailed quote page, or contact a Capital One Investing Customer Service Associate. Please read the prospectus carefully before investing.

Holdings: Any holdings, asset allocation, diversification breakdowns or other composition data shown are as of the date indicated and are subject to change at any time. As a result, they may not be representative of the fund's current or future investments.

ETFs must be bought and sold through a broker-dealer such as Capital One Investing, LLC, which will involve commission expenses. ETFs are not directly redeemable and are subject to market volatility. When buying or selling an ETF, an investor will receive the prevailing market price. Diversification does not guarantee a profit or protect against market losses. Dividends are not guaranteed, and not all ETFs include a dividend investment objective or strategy.

©2016 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on how a fund ranks on a Morningstar Risk-Adjusted Return measure against other funds in the same category. This measure takes into account variations in a fund’s monthly performance after adjusting for sales loads (except for load-waived A shares) redemption fees, and the risk-free rate, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted average of the ratings for the three-, five- and ten-year (if applicable) time periods. Load-waived A share star ratings do not include any front-end sales load and are intended for those investors who have access to such purchase terms (e.g., plan participants of a defined contribution plan). Not all A share mutual funds for which Morningstar calculates a load-waived A share star rating may actually waive their front-end sales load.

Therefore, Morningstar strongly encourages investors to contact their investment professional to determine whether they are eligible to purchase the A share without paying the front load. Goldman

Sachs ActiveBeta® U.S. Large Cap Equity ETF was rated against the following numbers of U.S.-domiciled Large Blend funds over the following time periods: 46 funds in the last three years, 39 funds in the last five years, and 18 funds in the last ten years. With respect to these Large Blend funds, Goldman Sachs ActiveBeta® U.S. Large Cap Equity ETF received a Morningstar Rating of

-32768 stars, -32768 stars and -32768 stars for the three-, five- and ten-year periods, respectively. Past performance is no guarantee of future results. The Morningstar Rating may differ among share classes of a mutual fund as a result of different sales loads and/or expense structure.

The Morningstar Ownership Zone™ provides detail about a portfolio’s equity investment style by showing the range of stock sizes and styles. A portfolio's Ownership Zone™ is derived by plotting each stock in the fund's portfolio within the proprietary Morningstar Style Box™. The shaded area represents the center 75% of the fund’s assets, and it provides an intuitive visual representation of the area of the market in which the fund invests. A “centroid” plot in the middle of the Ownership Zone represents the weighted average of all the fund's holdings. A fund that is concentrated will have a small ownership zone relative to the area of the style box, and broadly diversified fund will have an ownership zone that stretches across many sizes and style. Over a period of time, the shape and location of a fund's ownership zone may vary.

The Morningstar Rating™ is provided for those exchange-traded funds (“ETFs”) with at least a three-year history. Ratings are based on the ETF’s Morningstar Risk-Adjusted Return measure which accounts for variation in monthly performance, placing more emphasis on downward variations and rewarding consistent performance. An ETF’s risk-adjusted return includes a brokerage commission estimate. This estimate is intended to reflect what an average investor would pay when buying or selling an ETF. PLEASE NOTE, this estimate is subject to change and the actual brokerage commission an investor pays may be higher or lower than this estimate. Morningstar compares each ETF’s risk-adjusted return to the open-end mutual fund rating breakpoints for that category. Consistent with the open-end mutual fund ratings, the top 10% of ETFs in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The overall rating for an ETF is based on a weighted average of the time-period ratings (e.g., the ETF’s 3,5, and 10 year rating).. The determination of an ETF’s rating does not affect the retail open end mutual fund data published by Morningstar. Past performance is no guarantee of future results.

Please note, some of the Morningstar proprietary calculations, including the Morningstar Rating™, are not customarily calculated based on adjusted historical returns. The evaluation of this investment does not affect the retail mutual fund data published by Morningstar. For each retail mutual fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Overall Morningstar Rating for a retail mutual fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. This investment’s independent Morningstar Rating metric is then compared against the retail mutual fund universe breakpoints to determine its hypothetical rating. Goldman Sachs ActiveBeta® U.S. Large Cap Equity ETF was rated against the following numbers of U.S.-domiciled Large Blend funds over the following time periods: 46 funds in the last three years, 39 funds in the last five years, and 18 funds in the last ten years. With respect to these Large Blend funds, Goldman Sachs ActiveBeta® U.S. Large Cap Equity ETF received a

Morningstar Rating of -32768 stars, -32768 stars and -32768 stars for the three-, five- and ten-year periods, respectively. Past performance is no guarantee of future results.

The Morningstar Style Box™ reveals a fund’s investment strategy.

For equity funds the vertical axis shows the market capitalization of the long stocks owned and the horizontal axis shows investment style (value, blend, or growth).

For fixed-income funds, the vertical axis shows the credit quality of the long bonds owned and the horizontal axis shows interest rate sensitivity as measured by a bond's effective duration.

©2016 Capital One Investing, LLC.

Page 1 of 3

Data provided by

Goldman Sachs ActiveBeta® U.S. Large Cap Equity ETF (GSLC)

Stocks Style Box

Large Blend

Morningstar Category

Large Blend

Inception Date

Sep 2015

Total Assets

$1.2 billion

Net Expense Ratio

0.09%

®

Print date: September 30, 2016

Morningstar seeks credit rating information from fund companies on a periodic basis (e.g., quarterly). In compiling credit rating information Morningstar accepts credit ratings reported by fund companies that have been issued by all Nationally Recognized Statistical Rating Organizations (NRSROs). For a list of all NRSROs, please visit http://www.sec.gov/divisions/marketreg/ratingagency.htm. Additionally, Morningstar accepts foreign credit ratings from widely recognized or registered rating agencies. If two rating organizations/agencies have rated a security, fund companies are to report the lower rating; if three or more organizations/agencies have rated a security, fund companies are to report the median rating, and in cases where there are more than two organization/agency ratings and a median rating does not exist, fund companies are to use the lower of the two middle ratings. PLEASE NOTE:

Morningstar, Inc. is not itself an NRSRO nor does it issue a credit rating on the fund. An NRSRO or rating agency ratings can change from time-to-time.

For credit quality, Morningstar combines the credit rating information provided by the fund companies with an average default rate calculation to come up with a weighted-average credit quality. The weighted-average credit quality is currently a letter that roughly corresponds to the scale used by a leading NRSRO. Bond funds are assigned a style box placement of "low", "medium", or "high" based on their average credit quality. Funds with a low credit quality are those whose weighted-average credit quality is determined to be less than "BBB-"; medium are those less than "AA-", but greater or equal to "BBB-"; and high are those with a weighted-average credit quality of "AA-" or higher. When classifying a bond portfolio, Morningstar first maps the NRSRO credit ratings of the underlying holdings to their respective default rates (as determined by Morningstar's analysis of actual historical default rates). Morningstar then averages these default rates to determine the average default rate for the entire bond fund. Finally, Morningstar maps this average default rate to its corresponding credit rating along a convex curve.

For interest-rate sensitivity, Morningstar obtains from fund companies the average effective duration. Generally, Morningstar classifies a fixed-income fund's interest-rate sensitivity based on the effective duration of the Morningstar Core Bond Index (MCBI), which is currently three years. The classification of Limited will be assigned to those funds whose average effective duration is between

25% to 75% of MCBI's average effective duration; funds whose average effective duration is between 75% to 125% of the MCBI will be classified as Moderate; and those that are at 125% or greater of the average effective duration of the MCBI will be classified as Extensive. For municipal bond funds, Morningstar also obtains from fund companies the average effective duration. In these cases static breakpoints are utilized. These breakpoints are as follows: (i) Limited: 4.5 years or less; (ii) Moderate: more than 4.5 years but less than 7 years; and (iii) Extensive: more than 7 years. In addition, for non-US taxable and non-US domiciled fixed income funds static duration breakpoints are used: (i) Limited: less than or equal to 3.5 years; (ii) Moderate: greater than 3.5 and less than equal to 6 years; (iii) Extensive: greater than 6 years.

Securities are offered by Capital One Investing, LLC, a registered broker-dealer and Member FINRA/SIPC. Advisory services are provided by Capital One Advisors, LLC, an SEC registered investment advisor. Insurance products are offered through Capital One Agency LLC. All are subsidiaries of Capital One Financial Corporation.

Securities products are: Not FDIC insured • Not bank guaranteed • May lose value • Not a deposit

• Not Insured by any Federal Government Agency

©2016 Capital One Investing, LLC.

Page 2 of 3