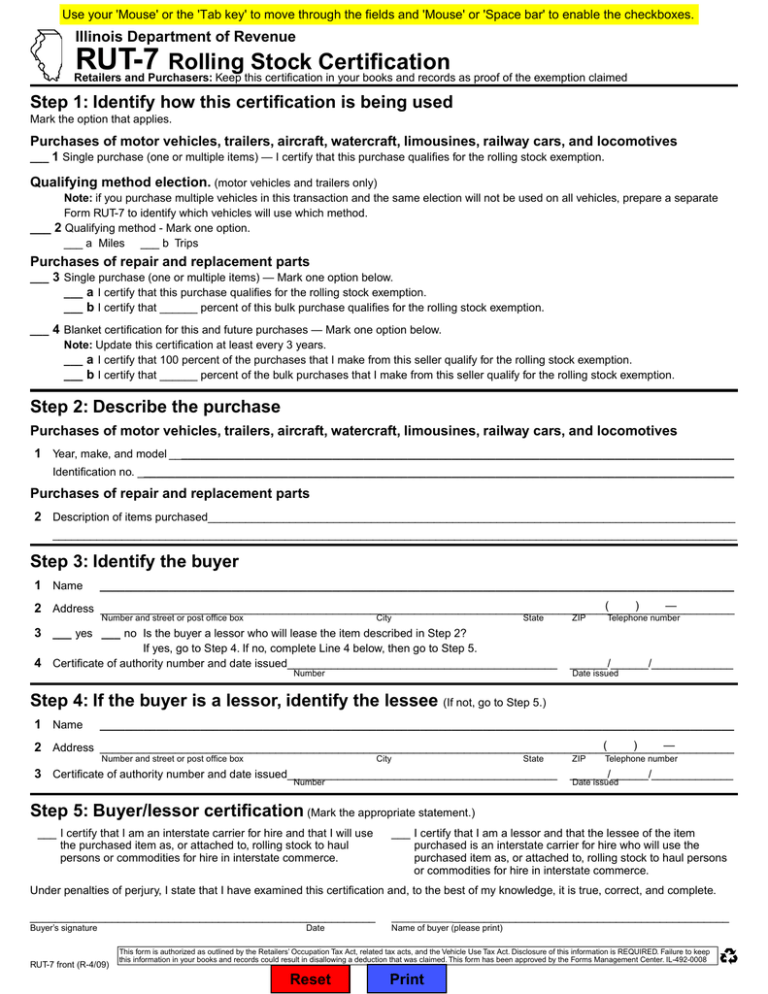

RUT-7 Rolling Stock Certification

advertisement

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes. Illinois Department of Revenue RUT-7 Rolling Stock Certification Retailers and Purchasers: Keep this certification in your books and records as proof of the exemption claimed Step 1: Identify how this certification is being used Mark the option that applies. Purchases of motor vehicles, trailers, aircraft, watercraft, limousines, railway cars, and locomotives ___ 1 Single purchase (one or multiple items) — I certify that this purchase qualifies for the rolling stock exemption. Qualifying method election. (motor vehicles and trailers only) Note: if you purchase multiple vehicles in this transaction and the same election will not be used on all vehicles, prepare a separate Form RUT-7 to identify which vehicles will use which method. ___ 2 Qualifying method - Mark one option. ___ a Miles ___ b Trips Purchases of repair and replacement parts ___ 3 Single purchase (one or multiple items) — Mark one option below. ___ a I certify that this purchase qualifies for the rolling stock exemption. ___ b I certify that ______ percent of this bulk purchase qualifies for the rolling stock exemption. ___ 4 Blanket certification for this and future purchases — Mark one option below. Note: Update this certification at least every 3 years. ___ a I certify that 100 percent of the purchases that I make from this seller qualify for the rolling stock exemption. ___ b I certify that ______ percent of the bulk purchases that I make from this seller qualify for the rolling stock exemption. Step 2: Describe the purchase Purchases of motor vehicles, trailers, aircraft, watercraft, limousines, railway cars, and locomotives 1 Year, make, and model __________________________________________________________________________________________ Identification no. _______________________________________________________________________________________________ Purchases of repair and replacement parts 2 Description of items purchased____________________________________________________________________________________ _____________________________________________________________________________________________________________ Step 3: Identify the buyer 1 Name _____________________________________________________________________________________________________ ( ) — 2 Address _____________________________________________________________________________________________________ Number and street or post office box City State ZIP Telephone number 3 ___ yes ___ no Is the buyer a lessor who will lease the item described in Step 2? If yes, go to Step 4. If no, complete Line 4 below, then go to Step 5. 4 Certificate of authority number and date issued___________________________________________ Number ______/______/_____________ Date issued Step 4: If the buyer is a lessor, identify the lessee (If not, go to Step 5.) 1 Name _____________________________________________________________________________________________________ ( ) — 2 Address _____________________________________________________________________________________________________ Number and street or post office box City State 3 Certificate of authority number and date issued___________________________________________ Number ZIP Telephone number ______/______/_____________ Date issued Step 5: Buyer/lessor certification (Mark the appropriate statement.) ___ I certify that I am an interstate carrier for hire and that I will use the purchased item as, or attached to, rolling stock to haul persons or commodities for hire in interstate commerce. ___ I certify that I am a lessor and that the lessee of the item purchased is an interstate carrier for hire who will use the purchased item as, or attached to, rolling stock to haul persons or commodities for hire in interstate commerce. Under penalties of perjury, I state that I have examined this certification and, to the best of my knowledge, it is true, correct, and complete. _______________________________________________________ _______________________________________________________ Buyer’s signature Name of buyer (please print) RUT-7 front (R-4/09) Date This form is authorized as outlined by the Retailers’ Occupation Tax Act, related tax acts, and the Vehicle Use Tax Act. Disclosure of this information is REQUIRED. Failure to keep this information in your books and records could result in disallowing a deduction that was claimed. This form has been approved by the Forms Management Center. IL-492-0008 Reset Print General Instructions What is the purpose of Form RUT-7? To claim the rolling stock exemption, you must complete Form RUT-7, Rolling Stock Certification. Who may claim the exemption? You must be recognized by a specific federal or state regulatory agency as an interstate carrier for hire and have received a certificate of authority to engage in interstate commerce. This does not apply to limousine operators. When may a lessor claim the exemption? If you are a purchaser who will be leasing the item you may claim the exemption if the • lessee is recognized by a specific federal or state regulatory agency as an interstate carrier for hire and has received a certificate of authority to engage in interstate commerce; and • lessee will use the item in a qualifying manner as described in these instructions; and • lease is in effect or executed at the time of the purchase for use as rolling stock. The tax exemption will last only as long as the lease remains in effect and the item is being used in a qualifying manner. When the item reverts to your use, you must pay Use Tax on the fair market value (not to exceed the purchase price) of the item directly to the Illinois Department of Revenue on or before the last day of the calendar month following the month in which the item reverts to the use of the lessor. To pay Use Tax, contact us at 217 782-3336 or 800 732-8866 and we will send you the proper form. What qualifies for the exemption? Certain items purchased or used by interstate carriers for hire to be used as rolling stock in interstate commerce qualify for the exemption. Items include: • motor vehicles • trailers • watercraft • railway cars • aircraft • limousines • repair and replacement parts Aircraft, watercraft, or rail carrier items (and repair and replacement parts): You must use these items for hire to carry persons or commodities in interstate commerce on a regular and frequent basis. Second division motor vehicles, limousines, and trailers (and repair and replacement parts): If the CDF sales tax exemption is claimed, the items purchased are exempt only if the motor vehicle or trailer qualifies for the rolling stock exemption as shown below. • A motor vehicle (other than a limousine) must have a gross vehicle weight rating of more than 16,000 pounds. • A motor vehicle, limousine, or trailer must carry persons or property for hire in interstate commerce for either — more than 50 percent of its total trips in a 12-month period; or, — more than 50 percent of its total miles in a 12-month period. The total trips or miles for which persons or property are carried for hire between points in Illinois may be used to qualify for the exemption if the journey or shipment originates or terminates outside Illinois. You must identify which method will be used — trips or miles — at the time of purchase and document your choice on Form RUT-7. If you do not choose an option, you will be deemed to have chosen the miles method. You must use the motor vehicle or trailer in a qualifying manner under the chosen method for each consecutive 12-month period from the initial title or registration date, whichever is later. If you do not, the exemption will be revoked and applicable tax, penalties, and interest will be due. If you make fleet purchases and will not use the same qualifying method, a separate Form RUT-7 must be completed for each vehicle or trailer since the election is on a per item basis. Keep a copy in your books and records to verify your election. Note: To document each trailer’s qualifying use, you may use documentation showing what qualifying motor vehicle or qualifying group of motor vehicles to which the trailer is dedicated. For more information, see Informational Bulletins FY 2005-01 and 2008-03, Rolling Stock Exemption Changes. RUT-7 back (R-4/09) What does not qualify for the exemption? It is not the type of item that determines if it qualifies for use as rolling stock, but how the item is used by an interstate carrier for hire. Only those items specifically used as rolling stock qualify for the exemption. For example, items do not qualify for use as rolling stock when they are used only • to transport company officers, employees, customers or others not for hire (even if the persons cross state lines); or • to transport property a business owns or is selling and delivering to customers (even if the items cross state lines); or • as support vehicles when the vehicles do not haul persons or commodities for hire in interstate commerce. When is the Form RUT-7 due? Form RUT-7 is due at the time of the transaction. Keep a copy in your books and records to document the exemption. Are there other returns that must be filed? When the item qualifying as rolling stock • is sold by an Illinois dealer, use Form ST-556, Sales Tax Transaction Return. • is purchased from an out-of-state dealer, use Form RUT-25, Vehicle Use Tax Transaction Return. • is purchased (or acquired by gift or transfer) from an individual or other private party, — and is a motor vehicle as defined by 625 ILCS 5/1-146 or limousine as defined by 625 ILCS 5/1-139.1 of the Illinois Vehicle Code, use Form RUT-50, Private Party Vehicle Tax Transaction. — and is an aircraft or watercraft, use Form RUT-75, Aircraft/ Watercraft Use Tax Transaction Return. • such as railway cars, locomotives, or repair and replacement parts is sold by a retailer, use Form ST-1, Sales and Use Tax Return. Step-by-Step Instructions Step 1— Lines 1- 4: Mark the option that applies. Lines 3b and 4b may be used for bulk purchases only. Note: Update blanket certificates executed for repair and replacement parts at least every three years. Step 2— Line 1: If the purchase is a motor vehicle, trailer, aircraft, watercraft, limousine, railway car, or locomotive provide the year, make, and model. Provide the appropriate identification number for the item sold, such as a vehicle identification number (VIN) for motor vehicles, limousines, and trailers, a hull identification number (HIN) for watercraft, (N) number for aircraft, or other identification number for railway car and locomotive. Line 2: If the purchase is a repair and replacement part, provide a description of the item. Step 3 — Lines 1 and 2: Provide the requested information. Line 3: If you are a lessor who will lease the item to an interstate carrier for hire who will use the item under lease as “qualifying” rolling stock in interstate commerce, check “yes,” and go to Step 5. If not, complete Line 4, before going to Step 5. Line 4: If you are an interstate carrier for hire, write your certificate of authority number and date issued. Note: Limousines do not receive a certificate of authority number. Write “limousine” instead of the certificate of authority number. Step 4 — Lines 1- 3: Complete this information if you are a lessor who will lease an item to an interstate carrier for hire who will then use the item under lease as “qualifying” rolling stock in interstate commerce. The lease must have been in effect at the time of purchase. Step 5 — If you are an interstate carrier for hire, check the statement on the left side. You must sign and date the certification and print the signed name. If you are a lessor who will lease the item to a lessee who is an interstate carrier for hire and who then will use the item as “qualifying” rolling stock in interstate commerce, check the statement on the right side. You must sign and date the certification and print the signed name.