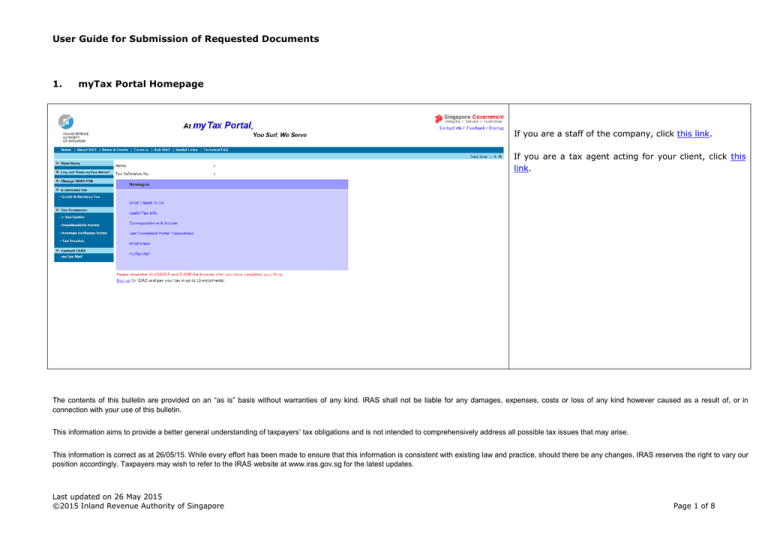

User Guide for Submission of Requested Documents 1. myTax

advertisement

User Guide for Submission of Requested Documents 1. myTax Portal Homepage If you are a staff of the company, click this link. If you are a tax agent acting for your client, click this link. The contents of this bulletin are provided on an “as is” basis without warranties of any kind. IRAS shall not be liable for any damages, expenses, costs or loss of any kind however caused as a result of, or in connection with your use of this bulletin. This information aims to provide a better general understanding of taxpayers’ tax obligations and is not intended to comprehensively address all possible tax issues that may arise. This information is correct as at 26/05/15. While every effort has been made to ensure that this information is consistent with existing law and practice, should there be any changes, IRAS reserves the right to vary our position accordingly. Taxpayers may wish to refer to the IRAS website at www.iras.gov.sg for the latest updates. Last updated on 26 May 2015 ©2015 Inland Revenue Authority of Singapore Page 1 of 8 User Guide for Submission of Requested Documents 2.1 By Staff Step No 1 Last updated on 26 May 2015 ©2015 Inland Revenue Authority of Singapore Action Click on What I Need To Do > Submit Documents > Submit requested document from ‘Messages’ box. Page 2 of 8 User Guide for Submission of Requested Documents 2.2 By Tax Agent Step No Last updated on 26 May 2015 ©2015 Inland Revenue Authority of Singapore Action 1 Enter your client’s Tax Reference Number. 2 Enter the IRAS Pin. 3 Enter the Organisation Tax Reference Number. 4 Click on Login. 5 Click on What I Need To Do > Submit Documents > Submit requested document from ‘Messages’ box. Page 3 of 8 User Guide for Submission of Requested Documents 3. Submission of Documents Step No 1 Last updated on 26 May 2015 ©2015 Inland Revenue Authority of Singapore Action To submit a particular document, click on Attach. Page 4 of 8 User Guide for Submission of Requested Documents 4. Document Upload Step No 1 Action To attach a document, click on Browse List of file formats acceptable: - PDF - XML File size allows per upload is 2 MB. Last updated on 26 May 2015 ©2015 Inland Revenue Authority of Singapore 2 To proceed with the uploading, click on Attach Document. 3 To cancel the uploading, click on Back to Previous Page. Page 5 of 8 User Guide for Submission of Requested Documents 5. Submission of Documents Step No Last updated on 26 May 2015 ©2015 Inland Revenue Authority of Singapore Action 1 To submit another document, Attach at that document. click 2 To delete the attached document, click on Delete. 3 Once all requested document(s) has been attached, to proceed with the submission, click on Submit to IRAS. Page 6 of 8 on User Guide for Submission of Requested Documents 6. Submit Additional Documents Step No Last updated on 26 May 2015 ©2015 Inland Revenue Authority of Singapore Action 1 To submit additional document(s) after all listed documents have been attached, go to the statement ‘Please click here to attach additional documents’. 2 Click on Please click here to attach additional documents. 3 Once all requested document(s) and additional document(s) have been attached, to proceed with submission, click on Submit to IRAS. Page 7 of 8 User Guide for Submission of Requested Documents 7. Submission of Documents Summary Step No Last updated on 26 May 2015 ©2015 Inland Revenue Authority of Singapore Action 1 Click on Go to Main Menu upon ensuring that the document upload is correct. 2 To print Submission of Documents Summary, click on Print this Page. Page 8 of 8