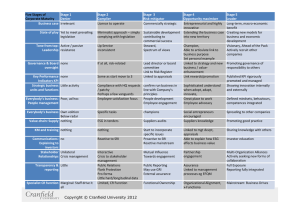

consultation conclusions

advertisement