Kathy C. Hopkins, CFM SRL-Lead

Kathy C. Hopkins, CFM

SRL-Lead

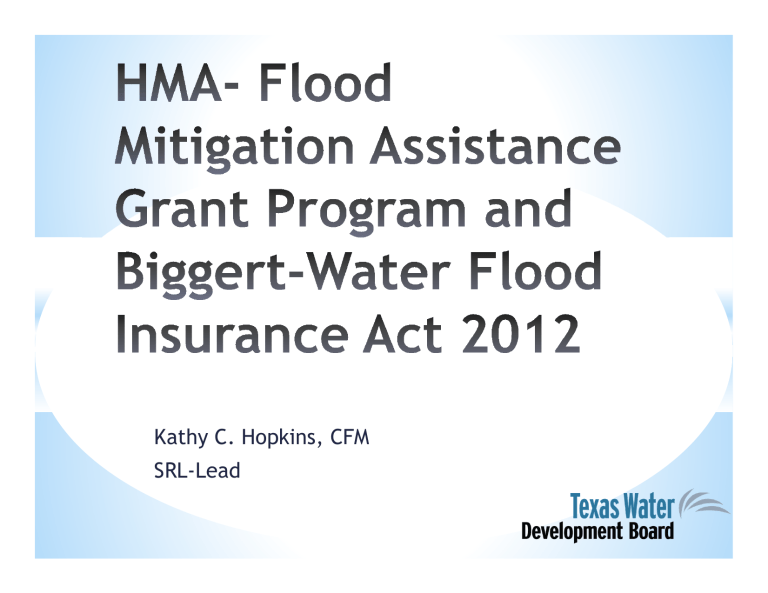

Hazard Mitigation Grant Program

Prior to BW-12

Grants

Severe

Repetitive

Loss

Flood

Mitigation

Assistance

Flood

Protection

Planning

Hazard

Mitigation

Grant

Program

Repetitive

Flood

Claim

Pre-

Disaster

Mitigation

Texas

Agency

Texas Water

Development

Board

HMA

Grant-Federal

Grant Program

Key

State Grant

Program

Texas Division of Emergency

Management

Flood Mitigation Assistance

Grant Programs Post BW-12

Severe

Repetitive

Loss

Assistance

Repetitive

Flood

Claim

Hazard Mitigation Grant Program

FY 2014

Grants

Flood

Mitigation

Assistance

Flood

Protection

Planning

Hazard

Mitigation

Grant

Program

Pre-

Disaster

Mitigation

Texas

Agency

Texas Water

Development

Board

HMA

Grant-Federal

Grant Program

Key

State Grant

Program

Texas Division of Emergency

Management

* Federal and State cost shares;

* FMA funding limits;

* FEMA review process;

* Defines which Federal Funds can be used for the local match;

* And more mitigation projects.

FMA- Cost Share

* Severe Repetitive Loss Properties

100 % Federal Funds

* Repetitive Loss Properties

90% Federal and 10% local Match

* All Others

75% Federal and 25% local Match

FMA- Funding Restrictions

Prior to BW-12

* The total amount of FMA funds provided during any 5-year period shall not exceed $10 million to any State agency or $3.3 million to any community.

* The total amount of FMA funding provided to any State including all communities located in the State shall not exceed $20 million during any 5 year period.

* Individual planning grants using FMA funds shall not exceed $150,000 to any applicant or $50,000 to any subapplicant FMA funds only can be used for the flood hazard component of a hazard mitigation plan that meets the planning criteria outlined in 44 CFR Part 201.

* The total planning grant using FMA funding made in any fiscal year to any state and the communities located within the State shall not exceed $300,000.

* No more then 7.5 percent of FMA funds shall be used for planning in any fiscal year.

* A planning grant shall not be awarded to a State or community more than once every 5 years.

FMA- Funding Restrictions

Post BW-12

Individual planning grants using FMA funds shall not exceed $50,000 to any applicant or

$25,000 to any subapplicant. FMA funds can only be used for the flood hazard component of a hazard mitigation plan that meets the planning criteria outlined in 44 CFR Part 201.

FMA-FEMA and State

Review

* No more “National Review”. It will be reviewed by the FEMA Region and final approval by FEMA HQ; and

* States will have to rank all projects when submitting to FEMA.

Federal Funds Allowed to be Used as Local Match

The two Federal funds that could be used in

FMA:

* U.S. Department of Housing and Urban

Development (HUD) Community Development Block

Grant (CDBG) funds; and

* Federal loan payments, such as U.S. Department of

Agriculture (USDA) Farm Service Agency loans and

U.S. Small Business Administration (SBA) loans.

Mitigation Projects (added)

* Mitigation Reconstruction;

* Non-structural Retrofitting of

Existing Buildings and Facilities;

* Infrastructure Retrofit; and

* Soil Stabilization.

* Protect human life and property;

* Remove property from the

SFHA;

* To avoid high NFIP insurance rates; and

* Etc…

NFIP Rate Increase

Associated with BW-12

* Now- Changes underway:

Full-risk rates will apply to pre-FIRM property not previously insured, newly purchased, or repurchased after a lapse, occurring on or after July 6, 2012.

Premiums for older (pre-FIRM) non-primary residences in a Special Flood Hazard

Area will increase by 25% each year until they reflect the full-risk rate- January 1,

2013.

* Later in 2013

Premium for pre-FIRM business properties, SRL, and properties where claims payment exceed fair market value will increase by 25% each year until they reflect the full-risk rate

Normal rate revision which occurs annually, and a 5% assessment to build a catastrophic reserve fund as required in the legislation.

* Later 2014 (Section 207)

Premiums for existing properties in areas affected by updated maps will see a phase-out of discounts –grandfathering rates- over five years at a rate of 20% percent per year to reach full-risk rates

Information courtesy of FEMA Region 6.

Subject to change.

BW-12 and Rebuilding/Mitigation

Decisions

Elevation lowers premiums.

“ZONE A” EXAMPLE

Homes built below

BFE could be hit hard by an increase to full-risk rates

Elevating 3 feet above the BFE could lower premiums significantly!

Slide courtesy of FEMA Region 6.

Subject to change.

Future insurance savings can offset higher construction costs.

“ZONE V” EXAMPLE ( NEW BFE SHOWS 4’ HIGHER RISK)

ELEVATION /COSTS 4 ft

Foundation

Flood Insurance/yr

Mortgage increase + flood/yr

$18,000

$17,500

$17,500

Peace of Mind

Slide courtesy of FEMA Region 6.

Subject to change.

8 ft

$29,000

$ 7,000

$ 7,588

10 ft

$30,000

$ 3,500

$ 4148

Homeowner pockets more than

$13,000/year compared to the current BFE