Module 10 Objectives Upon completion of this module, you will be

advertisement

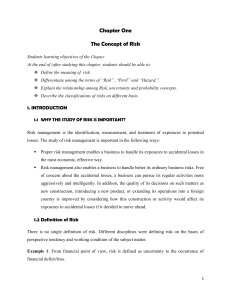

Module 10 Objectives Upon completion of this module, you will be able to: 1. describe the following terms of risk management: speculative risk, pure risk, exposures, perils, loss frequency, loss severity, policy limits, deductibles, and coinsurance 2. state the recommended action for different levels of frequency and severity for losses 3. list and explain ways to handle risk 4. define the large-loss principle and the principle of indemnity Define the following: Speculative risk Pure risk Exposures Perils Explain loss frequency and loss severity. Describe the following methods of handling risk: Risk avoidance Risk retention Loss control Risk transfer Risk reduction What is a hazard? Define the following: Large-loss principle Law of large numbers Principle of indemnity What four areas do people need to cover? What the five main insurances to address? What does renter’s insurance cover? What are the two parts of homeowner’s insurance? Explain actual cash value and replacement cost coverage. List losses that are usually not covered under a basic homeowner’s insurance policy. What is the purpose of an umbrella policy?