Economics of Information and Contracts

advertisement

Regulation

Analyzed in two contexts:

◮

Procurement: The firm supplies a good to the government

◮

Regulation: The firm supplies a good to consumers on behalf of

government

Economics of Information and Contracts

⋆

Screening: Applications

⋆

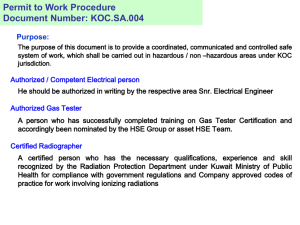

Defense contracts

Utilities (electricity, gas), telecommunications, railroads

There are many natural monopolies in utilities, telecommunication,

infrastructure, and transportation industries

Levent Koçkesen

◮

Koç University

◮

Due to large fixed costs, average cost is decreasing even at large

production levels

It may be socially efficient to have a monopoly

Government needs to regulate to prevent them acting as a monopolist

But it doesn’t know the relevant characteristics (e.g., technology)

and/or does not observe actions (e.g., cost reducing effort) of the firm

Levent Koçkesen (Koç University)

Screening: Applications

1 / 27

Regulation

◮

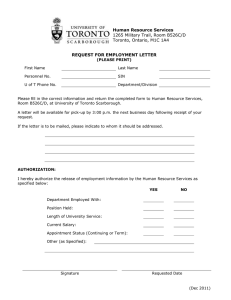

a: a fixed fee

b: fraction of costs born by the firm (measures the power of incentives)

Possible contracts

◮

⋆

fixed-price (price-cap): b = 1

◮

incentive (cost-sharing): 0 < b < 1

⋆

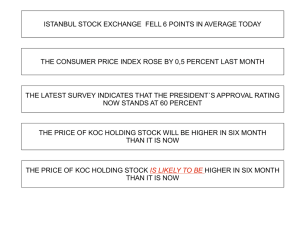

40.9%

13.6%

31.4%

cost-plus

incentive

fixed-price

Regulation:

◮

historically: cost-of-service

more recently: price-cap and incentive regulation

firm does not bear any cost

low powered: firm does not have an incentive to lower cost

◮

⋆

2 / 27

Procurement: 1960 US

◮

cost-plus (cost-of-service): b = 0

⋆

Screening: Applications

Regulation

Typically, government uses accounting (cost) data and reimburses a

fraction of firm’s monetary expenditures c

Its aim is to obtain the highest societal welfare in providing the good

We will model it as follows: government pays c and a net transfer t to

the firm

t = a − bc

◮

Levent Koçkesen (Koç University)

government does not reimburse any cost; pays only a fixed fee

high powered: firm is the residual claimant for its cost savings

Levent Koçkesen (Koç University)

Screening: Applications

3 / 27

Levent Koçkesen (Koç University)

Screening: Applications

4 / 27

Regulation

Regulation

Government: provide incentives to reduce cost and extract firm’s rent

Fixed-price

◮

Incentives: Good

◮

Rent extraction: Bad

⋆

⋆

⋆

⋆

Early models

Firm is the residual claimant

Provides efficient effort

◮

◮

Rent is non-negative when cost is high

Exogenous reduction in cost benefits the firm

The bible: Laffont, J.-J. and J. Tirole (1993), A Theory of Incentives

in Procurement and Regulation, Cambridge: MIT Press.

Cost-plus

◮

◮

Baron, D. and R. Myerson (1982), “Regulating a Monopolist with

Unknown Costs,” Econometrica, 50, 911-30.

Laffont, J.-J. and J. Tirole (1986), ”Using Cost Observation to

Regulate Firms,” Journal of Political Economy, 94, 614-41.

Incentives: Bad

Rent-extraction: Good

Optimal contract

◮

◮

Perfect information about technology: fixed-price

Imperfect information: incentive (cost-sharing) contract

Levent Koçkesen (Koç University)

Screening: Applications

5 / 27

Regulation

Levent Koçkesen (Koç University)

Screening: Applications

6 / 27

Perfect Information

Our model: a simple version of Laffont and Tirole (1986)

Regulator knows θ (therefore, can deduce e = θ − c)

The firm produces a single indivisible output

Accounting cost is c = θ − e

Its problem is:

◮

◮

◮

min{θ − e + t}

(e,t)

θ ∈ {θL , θH }, prob(θL ) = p

e is effort which costs the firm ψ(e) = e2 /2

We assume ∆θ = θH − θL ≤ 1 − p

Regulator wants to maximize S − P

◮

◮

s.t. t − e2 /2 ≥ 0,

e≥0

The constraint must bind: t = e2 /2

min{θ − e + e2 /2}

S is (constant) consumer surplus from consuming the good

P = c + t is total payment, t is net transfer to the firm

e≥0

If the solution is in the interior (e∗ > 0)

Therefore, regulator wants to minimize P

Payoff of the firm P − c − e2 /2 = t − e2 /2

−1 + e∗ = 0 ⇒ e∗ = 1

Reservation payoff of the firm is zero

Comparing with the boundary (e = 0) shows that the solution is in

the interior

c is observable but not θ or e

Levent Koçkesen (Koç University)

Screening: Applications

7 / 27

Levent Koçkesen (Koç University)

Screening: Applications

8 / 27

Perfect Information

Unobservable θ and e

Effort is efficient

What happens if regulator offers first-best?

marginal cost = ψ ′ (e∗ ) = e∗ = 1 = marginal benefit

◮

cL = θL − 1, cH = θH − 1 and tL = tH = 0.5

For the efficient type (θL )

and

∗

t = 0.5

◮

firm receives no rent

◮

Regulator pays the firm a fixed total payment P = θ − 0.5

Induces the firm to minimize c + e2 /2

This is a price-cap (fixed-fee) regulation

Effort required to obtain cost cL is 1

Effort required to obtain cost cH (e′ ) is 1 − ∆θ < 1:

c H = θH − 1 = θL − e ′

◮

Since transfers are the same, she prefers to mimic the inefficient type

Usual recipe for optimal contract:

t = a − (c − c∗ )

◮

Efficient type (θL ):

◮

Inefficient type (θH ):

⋆

where

⋆

a = ψ(e∗ ) = 0.5

⋆

c∗ = θ − e∗ = θ − 1

Levent Koçkesen (Koç University)

Screening: Applications

⋆

9 / 27

Unobservable θ and e

min

Levent Koçkesen (Koç University)

Screening: Applications

10 / 27

1. IRL does not bind:

tL − e2L /2 ≥ tH − (eH − ∆θ)2 /2 > tH − e2H /2 ≥ 0

p(tL + θL − eL ) + (1 − p)(tH + θH − eH )

2. ICL binds, otherwise

subject to

tL − e2L /2 > tH − (eH − ∆θ)2 /2 > tH − e2H /2 ≥ 0

tL − e2L /2 ≥ 0

and the regulator can decrease tL

tH − e2H /2 ≥ 0

3. IRH binds, otherwise (by (1)) can decrease tL and tH by the same

small amount

tL − e2L /2 ≥ tH − (eH − ∆θ)2 /2

tH − e2H /2 ≥ tL − (eL + ∆θ)2 /2

4. eH ≤ eL + ∆θ or cH ≥ cL : ICL and ICH imply

Note that for type θL , effort required to achieve cost cH = θH − eH is

equal to eH − (θH − θL ). Similarly, for high type’s effort to achieve

low cost.

We implicitly assume eH − ∆θ ≥ 0, which we will need to verify once

we solve the problem.

Levent Koçkesen (Koç University)

provides less than first best effort (to reduce efficient type’s rent)

obtains no rent

Solving the Problem

Regulator chooses a contract {(tL , cL ), (tH , cH )} to minimize

p(tL + cL ) + (1 − p)(tH + cH ) subject to IR and IC constraints.

Since c = θ − e, the problem can be written as

(ti ,ei )

provides first best effort

obtains positive rent

Screening: Applications

11 / 27

e2H /2 − (eL + ∆θ)2 /2 ≤ tH − tL ≤ (eH − ∆θ)2 /2 − e2L /2

Result follows from simple algebra

5. ICH can be ignored: follows from steps (2) and (4)

Levent Koçkesen (Koç University)

Screening: Applications

12 / 27

Solving the Problem

Solving the Problem

Therefore, the problem is equivalent to

min

(ti ,ei )

Substituting in the constraints, the problem is equivalent to

p(tL + θL − eL ) + (1 − p)(tH + θH − eH )

min {p(e2H /2 + e2L /2 − (eH − ∆θ)2 /2 − eL ) + (1 − p)(e2H /2 − eH )}

subject to

eL ,eH ≥0

tH − e2H /2 = 0

or

tL − e2L /2 = tH − (eH − ∆θ)2 /2

max −{p(e2H /2 + e2L /2 − (eH − ∆θ)2 /2 − eL ) + (1 − p)(e2H /2 − eH )}

eL ,eH ≥0

Note that

tL − e2L /2 = ∆θ(eH − ∆θ/2)

eH ≥ ∆θ implies that type θL obtains a rent

Levent Koçkesen (Koç University)

Screening: Applications

13 / 27

Solving the Problem

Levent Koçkesen (Koç University)

Screening: Applications

14 / 27

Solving the Problem

Critical points are given by

The objective function is strictly concave and the constraint functions

eL and eH are concave

Therefore, if a solution exists Kuhn-Tucker conditions will uniquely

identify it

−p(eL − 1) + λL = 0

−(p∆θ + (1 − p)(eH − 1)) + λH = 0

λL , λH , eL , eH ≥ 0,

λL eL = λH eH = 0

First equation and λL ≥ 0 ⇒ eL > 0 ⇒ λL = 0, which implies

The Lagrangean is given by

eL = 1

L = −{p(e2H /2 + e2L /2 − (eH − ∆θ)2 /2 − eL ) + (1 − p)(e2H /2 − eH )}

+ λL eL + λH eH

Similarly the assumption ∆θ ≤ 1 − p implies that

eH = 1 −

p

∆θ

1−p

and eH ≥ ∆θ, as required.

Levent Koçkesen (Koç University)

Screening: Applications

15 / 27

Levent Koçkesen (Koç University)

Screening: Applications

16 / 27

Properties of the Solution

Financial Contracts and Credit Rationing

Familiar “no distortion at the top” and “under-provision for inefficient

types” result

Optimal regulation: offer a menu so that

◮

Efficient firm chooses a price-cap regulation

⋆

⋆

◮

A constant payment PL = tL + θL − eL

tL = aL − bL c, aL = tL + θL − eL and bL = 1

◮

◮

tH = aH − bH c, aH = tH + eH (θH − eH ) and bH = eH = 0.5

Levent Koçkesen (Koç University)

Screening: Applications

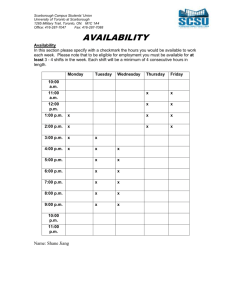

If there is excess demand of funds, the interest rate should increase to

equate demand with supply

The reason might be adverse selection

As the interest rate increases only riskier projects apply

Most popular article:

Inefficient firm chooses a cost-sharing arrangement

⋆

Why are certain worthy projects not funded?

17 / 27

A Simple Model

Stiglitz, J. and A. Weiss (1981)

Levent Koçkesen (Koç University)

Screening: Applications

18 / 27

Symmetric Information

There is a population (unit mass) of risk-neutral borrowers

Each borrower owns a project that requires an investment of 1

Two types of borrowers: risky (θr ) and safe (θs )

◮

The problem of the bank facing borrower of type i is

max

prob(θs ) = q

Di ≥0

Each project has an uncertain return X ∈ {0, Ri }, Ri with prob. pi

◮

pi (Ri − Di ) ≥ 0

Assume ps > pr and Rr > Rs

We will look into two scenarios:

For now assume pi Ri = m > 1

1. pi Ri = m > 1: Both projects worth investing

2. pr Rr < 1 < ps Rs : Only safe project worth investing

Solution is simple: lend all α and set

Single bank with total amount of funds max{q, 1 − q} < α < 1

Net expected payoff of the bank if it lends to type i and requires a

repayment of Di is given by pi Di − 1

◮

pi Di − 1

subject to

θr = (pr , Rr ) and θs = (ps , Rs )

Di = Ri

Expected payoff of the bank is α(pi Ri − 1) = α(m − 1) > 0

Assumes limited liability: if the return is zero, the borrower defaults

and bank gets zero repayment

Levent Koçkesen (Koç University)

Screening: Applications

19 / 27

Levent Koçkesen (Koç University)

Screening: Applications

20 / 27

Adverse Selection

Adverse Selection

Assume that a bank contract is simply D

D > Rs ⇒ only risky apply ⇒ best to set D = Rr

D = Rs < Rr ⇒ risky borrowers would like to pay more D to get a

loan

But as D increases borrower pool becomes riskier and the bank’s

payoff decreases

payoff = (1 − q)(pr Rr − 1) = (1 − q)(m − 1)

D ≤ Rs ⇒ both apply ⇒ lend all α at D = Rs

payoff = α[q(ps Rs − 1) + (1 − q)(pr Rs − 1)] = α[qm + (1 − q)pr Rs − 1]

◮

◮

◮

Adverse selection

D = Rs

some borrowers cannot get credit

credit rationing

Levent Koçkesen (Koç University)

Screening: Applications

21 / 27

Second Best

Levent Koçkesen (Koç University)

max

The bank’s problem is

(xi ,Di )

22 / 27

This suggests the reduced problem:

xi is probability of getting a loan

max

Screening: Applications

Solving the Problem

A contract is {(xs , Ds ), (xr , Dr )}

◮

◮

Can the bank do better by designing more sophisticated contracts?

If (1 − q)(m − 1) < α[qm + (1 − q)pr Rs − 1]

(xi ,Di )

xs ps (Rs − Ds ) ≥ 0

xr pr (Rr − Dr ) ≥ xs pr (Rr − Ds )

subject to

xi pi (Ri − Di ) ≥ 0,

0 ≤ xi ≤ 1,

xr ≥ xs

i = s, r

xi pi (Ri − Di ) ≥ xj pi (Ri − Dj ),

0 ≤ xi ≤ 1,

i, j = s, r

This should be familiar by now

◮

If bank offers the first best menu

{(xs , Ds ), (xr , Dr )} = {(α, Rs ), (α, Rr )}

◮

◮

Risky type mimics the safe type

Screening: Applications

i = s, r

qxs + (1 − q)xr ≤ α

i = s, r

qxs + (1 − q)xr ≤ α

Levent Koçkesen (Koç University)

qxs (ps Ds − 1) + (1 − q)xr (pr Dr − 1)

subject to

qxs (ps Ds − 1) + (1 − q)xr (pr Dr − 1)

IR constraint of the high type (θr ) does not bind

IC constraint of the low type (θs ) does not bind

Monotonicity in the allocation xr ≥ xs

The original problem (P) is equivalent to the reduced problem (RP)

23 / 27

Levent Koçkesen (Koç University)

Screening: Applications

24 / 27

1. Constraints of (P) imply those of (RP): From the two IC constraints:

xr Rs − xs Rs ≤ xr Dr − xs Ds ≤ xr Rr − xs Rr

max xs [q(ps Rs − 1) − (1 − q)pr (Rr − Rs )] + (1 − q)xr (pr Rr − 1)

which implies xr ≥ xs

2. At the solution to (RP) IC constraint holds as equality: otherwise can

increase Dr

◮

Here we use xr > 0. If xr = 0, then by Step (1) xs = 0, which cannot

be a solution to (RP)

IR and IC constraints of (RP) imply IR for type θr

xr = 1 > α

xs > 0 implies

Together with monotonicity and budget constraint

α − (1 − q)

xs =

<α

q

IC for risky type (Rr − Dr = xs (Rr − Ds )) and Ds = Rs imply

xr pr (Rr − Dr ) ≥ xs pr (Rr − Ds ) ≥ xs pr (Rs − Ds ) ≥ 0

◮

xs ,xr

Since we assumed pi Ri = m > 1

q(ps Rs − 1) − (1 − q)pr (Rr − Rs ) ≥ 0

3. Solution of (RP) satisfy the constraints of (P)

◮

Suppose xs > 0. Then, Ds = Rs

Substitute the IC and IR into the objective function

Step (2) and xr ≥ xs imply IC for type θs

ps [xs (Rs − Ds ) − xr (Rs − Dr )] = ps [xs Rs − xr Rs + xr Rr − xs Rr ]

= ps (xr − xs )(Rr − Rs )

≥0

Dr = xs Rs + (1 − xs )Rr > Rs = Ds

If q(ps Rs − 1) − (1 − q)pr (Rr − Rs ) < 0

xs = 0

Levent Koçkesen (Koç University)

Screening: Applications

25 / 27

Interpretation

The bank trades off the rents extracted from risky borrowers with

ability to lend all its funds

When safe borrowers are numerous enough, wants to lend to them,

which leads to rent for risky borrowers

But rather than financing everybody by setting D = Rs , the bank

gives risky borrowers preferential access by setting xr > xs in

exchange for higher repayment

Credit rationing disappears: The only ones not fully funded are safe

borrowers, but they are indifferent about being funded

Credit rationing reappears if we instead assume pr Rr < 1 < ps Rs

◮

◮

Bank wants to turn away risky borrowers (i.e., set xr = 0), but cannot

do it without also denying the safe ones (since xr ≥ xs )

Either everybody is funded (if (qps + (1 − q)pr )Rs ≥ 1) or nobody, i.e.,

there is a financial collapse

Levent Koçkesen (Koç University)

Screening: Applications

27 / 27

Levent Koçkesen (Koç University)

Screening: Applications

26 / 27

![C-SWIR Seminar Promo: 26oct2015 [DOC 143.50KB]](http://s2.studylib.net/store/data/014974093_1-9ff6fa79b7dfcfba164f1f275834567b-300x300.png)