Alpha, Beta, and Now…Gamma

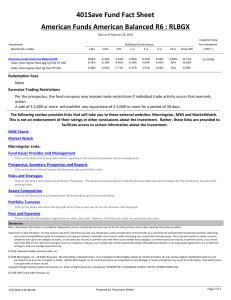

advertisement