Your Employee Manual - Capitol Region Education Council

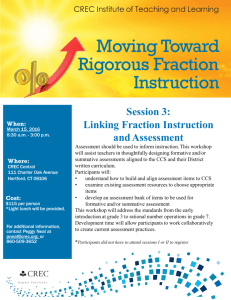

advertisement