Handout Jan Sijbrand

advertisement

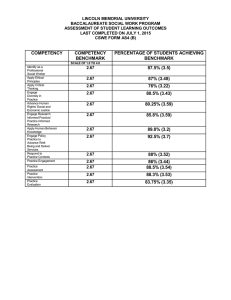

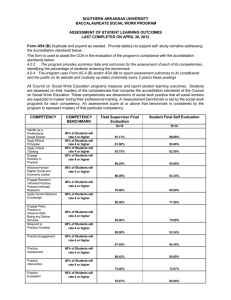

Handout to the introduction by Jan Sijbrand during the press conference announcing the Comprehensive Assessment Amsterdam, 26 October 2014 1. Results of the Asset Quality Review (AQR) Common Equity Tier 1 capital as a percentage of risk-weighted assets 23.7% 15.5% 14.9% 14.5% 14.5% 75.5% 21.8% 72.5% 12.8% 12.0% 12.2% 12.1% 10.4% 10.1% 8.0% ING Bank Rabobank ABN Amro SNS Bank Year-end 2013 RBS NV Adjusted for AQR Source: AQR, Stress Test and Join-up templates, Strategy& analysis BNG Bank NWB Bank 2. Results of the Comprehensive Assessment (CA) – baseline scenario Common Equity Tier 1 capital as a percentage of risk-weighted assets 23.7% 15.5% 12.8% 10.4% 10.4% 11.2% 15.0% 12.2% 12.5% 14.5% 13.3% 21.3% 75.5% 72.6% 8.0% ING Bank Rabobank ABN Amro SNS Bank Year-end 2013 RBS NV Results of baseline scenario Source: AQR, Stress Test and Join-up templates, Strategy& analysis BNG Bank NWB Bank 3. Results of the Comprehensive Assessment (CA) – adverse scenario Common Equity Tier 1 capital as a percentage of risk-weighted assets 23.7% 15.5% 12.8% 14.5% 12.2% 10.4% 8.7% 17.3% 8.4% 75.5% 9.1% 6.8% 54.0% 7.2% 5.5% ING Bank Rabobank ABN Amro Year-end 2013 SNS Bank RBS NV Results of adverse scenario Source: AQR, Stress Test and Join-up templates, Strategy& analysis BNG Bank NWB Bank 4. AQR results by country Total and average CET1 impact by country before taxes Total CET1 capital impact before taxes in EUR billion Average 1) CET1 ratio impact 12.0 12 4.0% 11 3.5% 10 9 8 3.0% 7.6 2.5% 6.7 7 5.6 6 5 2.0% 1.5% 3.8 4 3.0 3.0 3 2 1.6 1.1 1 0.2 0 GR CY SI 0.1 PT AT LV 0.1 IT EE 0.8 FI 1.2 0.0 0.1 MT Average CET1 ratio adjustment 1) Risk-weighted assets (RWA) of the banks Source: Disclosure templates, Strategy& analysis SK 0.0 BE NL DE LT 0.7 IE 1.0% 0.5% 0.1 LU 0.0% FR ES Impact on CET1 capital (before taxes) 5 5. CA results by country Total and average CET1 impact by country, after taxes Total CET1 capital impact after taxes, in EUR billion Average1) CET1 ratio impact 50 47.2 49.2 46.9 18% 45 16% 40 14% 35 12% 30 25 22.5 20 5 0 6% 13.0 10.9 8.0 10 0.1 8% 18.5 15.2 15 10% 22.5 3.2 1.4 4% 3.7 1.2 0.2 0.1 2% 0.1 0% -0.2 -5 MT SI GR BE PT IE CY Average CET1 ratio adjustment LU IT AT DE FI NL FR SK LV LT ES -2% EE Impact on CET1 capital (after taxes, incl. RWA increase2)) 1) Risk-weighted assets (RWA) of the banks 2) Impact based on 5.5% capital requirement Source: Disclosure templates, Strategy& analysis 6 6. Build-up of AQR capital impact Dutch banks - In EUR billion 0.5 3.8 -1.0 3.8 20% 1.4 2.8 0.6 1.2 Loan files Extrapolation Collective provisions Trading book & CVA1) Impact before taxes Tax effect Impact after taxes IFRS / non-IFRS Possible IFRS findings 1) Credit valuation adjustment is credit risk for derivatives Source: AQR templates, Strategy& analysis 7 7. AQR results by type of portfolio Before taxes - In EUR million Corporate 1,743 NL commercial real estate 858 Trading book & CVA1) 549 Mortgages Small SME ING Bank 397 226 Rabobank ABN Amro SNS Bank RBS NV BNG Bank 1) Credit valuation adjustment is credit risk for derivatives Note: NL commercial real estate contains the Dutch portfolios of ING, Rabobank and ABN Amro Source: AQR templates, Strategy& analysis NWB Bank 8 8. Comparison with commercial real estate AQR For ING, Rabobank and ABN Amro in the Netherlands after taxes – in EUR million 858 224 Tax effect 634 Capital impact ~650 Additional capital requirement1) Commercial real estate AQR 2013 Impact SSM AQR 2014 1) Capital impact for commercial real estate AQR relates to an estimate for the Dutch portfolios. Note: The methodology used was different for both examinations. Source: DNB, Strategy& analysis 9 9. Aggregated impact on the capital For the Dutch banks in adverse stress test scenario – in EUR billion 32.3 -7.6 -28.5 -3.3 -3.0 Operating profit Decrease in Credit losses on interest loans income AFS nonrealised losses 1) Impact based on 5.5% capital requirement Source: Stress test templates, Strategy& analysis Other -5.6 -15.6 Increase of RWA1) Impact after taxes 10 10. Capital strengthening 2008 - 2014 Total for all SSM banks – in EUR billion 50,0 48.8 9.5 Shortage in CA after taxes 40.5 Capital strengthening 38.8 32.1 26.3 2008 2009 2010 25.5 2011 2012 26.9 2013 As at October 2014 Note: Figures for 2018-2013 relate to capital strengthenings for the 30 largest participating banks. Source: ECB aggregate report on the Comprehensive Assessment, Strategy& analysis 11