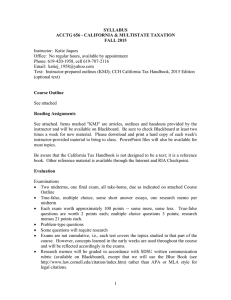

T ACCOUNTING 657: ACCOUNTING FOR INCOME TAXES

advertisement

ACCOUNTING 657: ACCOUNTING FOR INCOME TAXES Syllabus, Summer 2014 Instructor: Assistant Professor Steve Gill T ax costs can consume a significant portion of business wealth. Nearly every economic decision involves tax considerations. The study of taxation is important for any business major, but it has added importance for students interested in careers in accounting. Taxation is pervasive, complex and critical to decision-making. This course is primarily the comprehensive study of the financial accounting for income taxes. In addition, it covers accounting methods and periods for Federal income tax purposes. About one-quarter of the focus is on rules and regulations surrounding accounting methods and periods for Federal income tax purposes. The core content of the course is focused on ASC740 (primarily pre-codification FAS109 and FIN48) and applications of preparation, review and audit of a corporate tax provision. Students interested in a career in either audit or tax should find this course valuable. Course Objectives: The primary objective is that I want to help you understand the role of taxation in economic decision making and financial reporting. The knowledge and skills provided should facilitate future learning in tax even if you do not expect to become a tax professional. Students should obtain an extensive and detailed knowledge of accounting methods and periods and should understand how tax provisions are prepared and ultimately reflected in audited financial statements as tax expense, deferred taxes and the related footnote disclosures. In addition, students should gain insight into how a typical tax department functions to address the tax reporting cycle from provision to compliance. These skills are often not found as part of a core graduate curriculum in a Masters of Taxation or Accountancy degree. Detailed exposure to this topic should give a student a competitive advantage in a career in a public accounting firm. Learning Objectives: The MSA program has 6 student learning objectives. This course is intended to address the following program level objectives: Research Desired level: Analysis Students will be able to use relevant research tools and academic/professional literature to analyze or take a position in accounting and business situations. Problem Solving/Critical Thinking/Technical Competence Desired level: Synthesis Students will be able to address unstructured problems in the areas of accounting information systems, financial reporting, or taxation. Unstructured problem solving involves using discipline-specific technical 1 knowledge and skills to anticipate issues, formulate hypotheses, problem solve, develop conclusions, or recognize the strategic role of accounting in business organizations and society. This course intends to provide students with the opportunity to meet each of the following learning objectives: 1. Describe the tax accounting methods and periods and financial accounting methods and periods that apply to revenue and expense recognition. 2. Compare and contrast financial accounting and tax accounting rules to identify common book-totax differences. 3. Utilize the U.S and international guidance for proper accounting and reporting for income taxes in a realistic and complex setting. 4. Describe the risks and objectives of an audit of the tax provision and tax footnote disclosure. 5. Organize and prepare tax provision schedules and communicate the related income tax footnote to financial statements. Meeting the Objectives: To help you in meeting these objectives, I have provided an array of education elements including: Firm guidance on Accounting for Income Taxes revised 2013 by PwC. Access to the FASB Codification (http://aaahq.org/ascLogin.cfm) Username - AAA51809 Password – qCSQHJQ (case matters) Templates and guest lecturers intended to expand knowledge of topics currently active within the industry. 11 three hour and forty minute class meetings during which we will do a variety of teaching and learning activities; One midterm and one final exam; Office hours. Our Learning Community: Just like any other human relationship, successful relationships in the classroom require mutual respect and communication. I promise to do my part to foster the positive aspects of this learning community, and I expect the same in return from each student. My responsibilities: I will be prepared for every class. I will attempt to answer any questions that you have, if not immediately, then as soon as possible thereafter. I will try and create a classroom environment that feels safe – safe for you to ask questions without fear of embarrassment and safe for you to be yourself and focus on learning. I will do my best to be fair in my assessment of your performance and assignment of grades and to report these grades as quickly as possible. I will attempt to help you understand what you read in the guidance and also add value to the course by adding insights and information that is not in the text. I will try to continuously improve this class. Your responsibilities: I expect that you will come to class. Your presence in class benefits us all. I expect you to come to class prepared. I expect you will plan your schedule appropriately to allow sufficient time outside of class to be successful in this course. I expect that you will ask questions of me and your colleagues when you do not understand something you read, something I said, or something one of your colleagues said in class. It is imperative that any confusion you might have be as temporary as possible. If you are uncomfortable asking in class, I expect you to contact me in my office. I expect you to come prepared to meetings during office hours. Try and write out the question or for possibly quicker responses, try and e-mail the question first. I expect you to obtain access to e-mail and Blackboard and check both frequently. Academic Honesty: Accounting is a profession that depends on trust – individuals, companies and society as a whole place reliance on the decisions and opinions of accountants. For most of history, accountants were viewed among the most trusted members of society. In recent years, certain events have eroded this trust. Rebuilding this trust will take a long time but can be accomplished if future accountants ensure that such lapses do not recur. I take my role in this effort very seriously (and I hope you will as well). All assignments are individual assignments and less specifically instructed otherwise. As such, all homework should be your own work only. If you are unsure as to what is safe to ask of another person, then ask me first; otherwise, assume it is NOT safe to ask. The SDSU Standards for Student Conduct (http://www.sa.sdsu.edu/srr/conduct1.html) states that unacceptable student behavior includes “cheating, plagiarism, or other forms of academic dishonesty that are intended to gain unfair academic advantage.” Any student suspected of academic dishonesty will be reported to the SDSU Center for Student Rights and Responsibilities; if found responsible for academic dishonesty, the student will receive an F in ACCTG 657. Course Logistics: Scheduled class times are: Section Days 1 MW Times 18:00-21:40 Prerequisites: This course represents a hybrid between financial accounting topics and tax topics. Key to tax provision preparation is the ability to understand both the financial accounting rules and the tax rules related to complex transactions such as stock-based compensations, foreign currency translation and purchase accounting. To be successful in this course you should have either an undergraduate degree in accounting or coursework consistent with our ACCTG 620 and 624 courses. Not having those courses will make your experience in the course much more difficult. Course Material: You are not required to purchase any course materials. Computers: Once we get started using the provision worksheets, you may find it easier to have your own laptop with you in class. 3 Assessment: Your primary assessment will be through exams and in-class participation. Exams will be given on the scheduled exam dates listed in the calendar below. Assessment Midterm Exam Final Exam Participation Total for course % of grade 40 50 10 100 Exams: Your first exam is on basic income tax provisions. It is scheduled for your normally scheduled class time and will require you to complete a set of excel schedules that document and compute a basic income tax provision. I may also ask for specific disclosure items that we have covered in class up to that point. Your final exam is part in class (tax provision) and part take-home exam that will require extensive writing and the completion of a more complex provision using the provision model we have used throughout the semester. I will attempt to provide as much time as necessary so that all students can complete the take-home by the deadline. Homework and Participation: I do not expect to assign homework that is required to be turned in and graded (although I reserve the right to do so). Preparing for class should typically involve reading the assigned materials and on occasion, preparing materials for discussion. Your contribution to class discussions is an invaluable part of your learning experience, and the experiences of the other students in the class. Without your active involvement in the class meetings, the class will not be a success for any of us. You need to make a meaningful contribution to the class discussion in at least ten class sessions to earn full points in this category. Your contributions can be in the form of responses to queries posed during our discussions, questions that you ask related to our discussions, and presentations of reading summaries and/or research case conclusions. Contributions are evaluated each class session using a 3-point scale (0=no contribution, 1=satisfactory contribution, 2=exceptional contribution). Course Calendar: The course calendar is posted separately in Blackboard. It is a plan for using the available class time we have this semester. It is my best estimate of how the semester will progress, but from time to time, I may change it. About me: Instructor: Office Email: Office phone: Office mailbox: Office hours: Steve Gill, Ph.D., CPA (MA inactive), Associate Professor SS3435 sgill@mail.sdsu.edu (619) 594-6273 Located near entrance to School of Accountancy offices on 2nd floor of SS. T: 4:00-5:00pm and other times by appointment Quick Bio of Prof Gill: Education: University of Florida, B.S. Accounting 1989; Northeastern University, M.S.T. 1996 University of Massachusetts, Ph.D, February 2008 Work experience: PricewaterhouseCoopers – Audit, Miami, Fl 1990-1992 Ryder Systems, Inc – Internal Audit, Miami, Fl 1993 ThermoElectron, Inc – Internal Audit, Waltham, MA 1993-1994 Eastern Enterprises, Inc – Corporate Accounting, Weston, MA 1994-1996 PricewaterhouseCoopers – Tax Manager, Boston, MA 1996-1998 Digitas, Inc – VP Finance and Tax Director, Boston, MA 1998-2002 Research Interests: Taxation of mutual funds and investment portfolios; internal control in tax financial reporting. 5