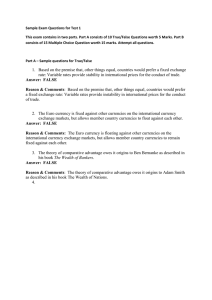

International Business Dealing with Currencies (Foreign Exchange)

advertisement

International Business Dealing with Currencies (Foreign Exchange) with summary of international organizations and basic introduction to the International Monetary System 9-1 The international economy so far… Huge cultural differences between countries Big differences in political economic systems Getting narrower Reduction in restrictions accelerates growth in trade Technology ties world together WTO addresses disputes Enormous increase in wealth Effects for businesses not in international trade: huge increase in competition Not everyone benefits Median incomes in developed world not increasing Benefits in poorer countries are unevenly spread Today’s tasks… Understand the use of currencies in international trade Get a basic sense of the international monetary system Summarize international organizations Discuss the midterm Maybe … watch a video that captures what this is doing in the fastest changing countries Foreign Exchange Terms Foreign exchange: money denominated in the currency of another nation or group of nations Cash Credit Bank deposits Other short-term claims (e.g., bonds) Exchange rate: the price of a particular currency relative to another Basic questions … What is money? How should you convert money from one currency into another? How are the values of currencies set? How can you limit foreign exchange risk (the possibility that unpredicted changes in exchange rates will have adverse consequences for the firm)? Can you predict when currency values will change? If so, how? What is money? The “medium of exchange” that is, something widely accepted as means of payment Usually, governments declare certain pieces of paper to be money But people must accept them Alternatives are inconvenient, but possible Tobacco in early American colonies U.S. dollar in Russia when ruble collapsed Sell abroad, and you may receive payment in foreign currency Buy abroad, and you may have to pay in foreign currency Travel abroad, you must spend foreign currency A foreign direct investment will have to pay expenses in foreign currency How should you convert money from one currency into another? Current values of major foreign currencies are available on the Web Most businesspeople normally buy from or sell to a bank The bank takes a bigger ‘spread’ than the rates offered on the Web, but handles all details Banks may vary a lot in how good a deal they give A business with significant foreign activity creates a stable relationship with one or a few banks Nowadays, you can do your own currency trading How are the values of currencies set? There are two basic ways “Fixed” or “Pegged” exchange rates Governments decide the value of currency Example: Hong Kong’s government keeps the value of its dollar at roughly US$0.129 (US$1=HK$7.75) With a ‘fixed rate’, there is absolutely no variability. A ‘pegged’ rate implies small variability Most key world currencies float against each other Supply and demand sets values This is how exchange rates are set for the US dollar vs. Euro, Japanese yen, British pound, Swiss franc, etc. Insuring Against Foreign Exchange Risk Businesses use the foreign exchange market to provide insurance against foreign exchange risk Protecting yourself against foreign exchange risk is called hedging You can buy or sell using 1. spot exchange rates 2. forward exchange rates 3. currency swaps Insuring Against Foreign Exchange Risk 1. Spot Exchange Rates The spot exchange rate is the rate at which a foreign exchange dealer converts one currency into another currency on a particular day Spot rates are determined by the interaction between supply and demand, and so change continually Insuring Against Foreign Exchange Risk 2. Forward Exchange Rates A forward exchange occurs when two parties agree to exchange currency at some specific future date Forward rates are typically quoted for 30, 90, or 180 days into the future Forward rates are typically the same as the spot rate plus or minus an adjustment for the interest the parties will pay/receive Insuring Against Foreign Exchange Risk 3. Currency Swaps A currency swap is the simultaneous purchase and sale of an amount of foreign exchange on two different dates Swaps are used when it is desirable to move out of one currency into another for a limited period without incurring foreign exchange rate risk Fixed exchange rates have important benefits They make business predictable In some very prosperous periods, most major exchange rates have been fixed The late 19th century 1945-1971 The gold standard made the benefits of fixed rates clear Before WW I, all major currencies were convertible into gold UK £1=113 grains gold (.2354 oz) US $1= 23.22 grains (.0484 oz) So £1=4.87 Everyone knew what everything was and would be worth The gold standard system had broken down after WW I The Bretton Woods conference in 1944 created a new system of fixed rates The International Monetary Fund (IMF) managed the system It can lend to countries in fiscal crisis But it usually demands dramatic cuts in government spending, etc., in return However, fixed exchange rates require discipline in the government – and a willingness to create pain Example: Suppose your nation’s economy is very prosperous Your people will have money to buy imports Their demand for foreign currencies will put upward pressure on their exchange rates Government has to slow the domestic economy to prevent change in exchange rate Higher taxes, higher interest rates, lower spending Many economists say if a country is having difficulty maintaining a fixed exchange rate, the economy is ‘overheated’ They say higher interest rates or higher taxes might be better for the economy in the long run in those circumstances But politicians don’t like to take pain U.S. abandoned fixed exchange rates when the Vietnam War created strong inflation It seems that the more complicated an economy, the more difficult it is to maintain fixed/pegged rates Many small countries succeed Hong Kong, Bangladesh, Fiji Few propose them for the largest developed countries today But China maintains a pegged exchange rate Its government buys all surplus dollars in the country In June 2012 China had $3,240 billion US dollars Most international business involves currencies with floating rates Buyers and sellers establish prices in markets like those for tea and wheat $5,000,000,000,000 in foreign exchange is traded every day US dollar is most widely traded involved in 90% of all transactions London is the main foreign-exchange market Key Foreign-Exchange Terms Bid: the rate at which a trader will buy foreign currency from you Offer: the rate at which a trader will sell foreign currency to you Spread: the difference between bid and offer rates; The spread is the profit margin for the trader 9-6 Market Rhythms 9-13 How can you predict when currency values will change? Business decisions demand you look far ahead If exchange rates will change and you don’t hedge adequately, your whole calculation will be off Some foreign currencies have lost 90% or more of their value in a year Argentine peso went from $1=1 peso to $1=3.5 pesos in one jump ‘Fundamental analysis’ involves examining basic economic data These forces can drive changes in exchange rates: How fast are prices rising in the country? If prices are rising the currency may fall Is there a trade surplus or deficit? Is the government running budget deficits? How much? If the government or its people are borrowing too much the currency may fall How do interest rates in the countries compare? If a country’s interest rates are high, its currency may rise How has the government been managing the currency? Is it buying or selling foreign currency? Is it running out of resources for pursuit of a strategy it has been following? Technical analysis involves examining trends in exchange rates One principle: Trends once established often tend to continue ‘The trend is your friend’ But if “everyone” agrees something will happen, it may not happen When ‘everyone’ thinks the dollar will go down, ‘everyone’ has already sold dollars If the news changes, many may quickly change their minds and want to buy Foreign exchange can be the difference between profit and loss HSBC Bank in Argentina They entered Argentina at a time when it appeared the government was starting to manage the economy effectively But they continued investing as government became more irresponsible They lost big International organizations: a summary Biggest driver of free trade has been the treaty created from the 1944 Bretton Woods conference: the General Agreement on Tariffs and Trade To strengthen it, countries created the World Trade Organization in 1995 WTO judges trade disputes International Monetary Fund was also created at Bretton Woods to keep the world’s currency system reasonably stable These won’t be on the test, but are good to know… World Bank – founded at Bretton Woods to lend to needy countries United Nations – a basically political organization founded just after WW II principally as a forum for discussions to prevent war Organization for Economic Cooperation and Development – set up by North American and European nations after WW II, it is now a cooperation group of almost all the rich countries Material below here is not required Foreign-Exchange Convertibility Fully convertible currencies are those that the government allows both residents and nonresidents to purchase in unlimited amounts “Hard currencies” are fully convertible “Soft currencies” (or weak currencies) are not fully convertible Typically from developing countries Known as “exotic currencies” 9-10