An overview and professional opportunity in NPO Sectors Partner

advertisement

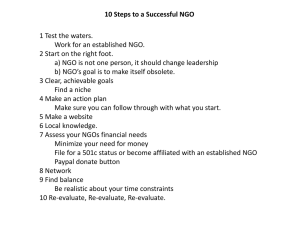

An overview and professional opportunity in NPO Sectors CA K. Reny Philip Partner Philips Cherian & Associates EVOLUTION AND GROWTH OF NPOS History of Indian NPO sector Evolution over the years and role of CAs NGO Sector Professional opportunities of Chartered Accountants in NPO sector. 1. Consultants at the Conceptualization and formation stage of NPOs 2. Statutory Auditors and Internal Auditors 3. Auditors on behalf of donors and funding agencies 4. Reviewers of Financial Management Systems 5. Advisors on Financial Management and Systems 6. Trainers / Resource Persons 7. Finance Managers and CFOs 8. Senior Management Team Members and CEOs 9. Members and / or Chairpersons of Advisory Bodies 10. Lobbying or advocating for Accounting standards, laws etc 1.Consultants at the Conceptualization and formation stage of NPOs Conceptualizing – Deciding the form of organization of the charity on the basis of need of the client and consistent with law of the land. The decision also depends on various factors including Size of the Institution Legal requirement Initial Cost Recurring cost Compliance Required Corporate Structure Number of persons required to constitute Global appearance Advantages and disadvantages of deciding the form of institution Characteristics ……….Consultants at the Conceptualization and formation stage of NPOs Contd…… ii. Formation of organization - Drafting of Trust deed, Bye Laws of Society, MOA & AOA of section 25/ section 8 company etc and registration Other services include applying for various statutory and related registration a.PAN/TAN b. 12 A Registration c. 80 G Regn d.FCRA e. 35 AC f. Service Tax g. Profession Tax 2. As Statutory Auditors & Internal Auditors of NPO In addition to the audit in respective laws of incorporation , the major laws for which Audit is applicable to NGO sector organisations are Income Tax Act 1961. Statutory Audit 44 AB Audit ( In case there is business turnover beyond limits prescribed) Foreign Contribution (Regulation) Act 2010 3. Auditors on Behalf of Donors and Funding Agencies: An auditor has to peruse the DONOR-NGO agreement to report on the compliance on the terms of the agreement to the Donor. The auditor is asked by the donors to submit a special audit report/utilization certificates to them in addition to signing the financial statements. 4. Reviewers of Financial Management System NGO sector organizations has to be of high standards to meet the demands of the various stakeholders Expert help is necessary as both the international agencies and the NGOs are interested in improving the standards of accounting, financial reporting and legal compliance aspects. 5.Advisors on Financial Management and Systems: Donor agencies have several requirements in relation to financial accounting and reporting when they provide funds to the NGO. NGOs need good advisors on various financial management and legal aspects for themselves, and other organisations dealing with them. 6.Trainers / Resource Persons in Financial The NGO sector staff, management team, board persons and officer-bearers are mostly from diverse fields and not necessarily experts on financial management. Smaller NGOs find it extremely difficult to get qualified persons for accounting and financial management. Thus NGO staff requires a lot of training in accounting and legal compliances. Even board members need orientation on financial management to play their role effectively as treasurers or members of Finance Advisory Committee. 7.Finance Managers and CFOs: In larger NGOs, there is a great need for qualified persons to occupy the positions of finance managers. 8.Senior Management Team members and CEOs: In few national and international NGOs in the recent past Chartered Accountants are selected for the top positions. It is an interesting responsibility to lead a non-profit organisation whose main goal is changing the lives of people especially the downtrodden and the underprivileged in society. 9.Member of Advisory Bodies: As the Boards and Governing Bodies of NGO sector There is a good scope for Chartered Accountants to become members of these Committees and play a useful role. This role may be honorary but for those who would like to contribute to the NGO sector, this is a sure way. There is a great need for financial experts on the Boards, Governing Bodies and Committees of NGO sector organisations. Here Chartered Accountants can play a vital role in the Governance . 10. Lobbying or advocating for Accounting Standards, Laws etc: This is an emerging new role, which is a felt need for NGO sector organisations. There is a great need to lobby with the respective authority or the Government Agency to amend the respective legislation or the regulation which is adversely affecting the NGO sector. An Untapped Area full of Professional Opportunities special opportunities especially for smaller firms, individuals and proprietorship firms of Chartered Accountants Corporate social responsibility (CSR) Chartered accountants Network is an excellent way for nation building