Eurostat financial database and what we can learn from it.

advertisement

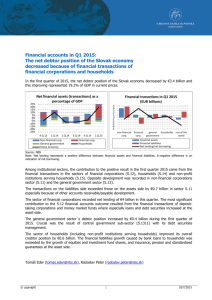

Eurostat financial database and what we can learn from it. OECD - FS Working Party 2-4 November 2009 Eurostat / Ismael Ahamdanech Zarco Financial Accounts in Eurostat Legal Framework Data collection Integrated annual accounts Some interesting figures Future developments Legal Framework ESA95 Transmission Programme Both documents are binding for the Member States. Moreover, other documents explain and give guidance on compilation, such as the Manual on Sources and Methods for the Compilation of ESA95 Financial Accounts Data collection Compulsory data Voluntary data Integrated Annual Accounts To understand interrelations in an economy it is necessary to analyze both real and financial aspects. For this reason, increasing attention is paid to integrated national accounts. Eurostat publishes Annual accounts by institutional sector where data above and below the line are presented together in an integrated manner. Similar approach to the Eurostat/ECB joint project on Euro area accounts (see presentation tomorrow) Related to flow of funds approach ANNUAL ACCOUNTS BY INSTITUTIONAL SECTOR 2008 (million euros, current prices) date of transmission of non financial account: 27/08/2009 Saving and capital transfers receivable Capital transfers payable and changes in non-financial assets Households General Financial Non-financial including government corporations corporations NPISH (S.13) (S.12) (S.11) (S.14+S.15) Total economy (S.1) Capital accounts Rest of the Sum over World sectors (S.2) (S.1+S.2) Sum over sectors (S.1+S.2) Rest of the world (S.2) Total economy (S.1) Non-financial corporations (S.11) Financial corporations (S.12) General government (S.13) Households including NPISH (S.14+S.15) CHANGE IN NET WORTH DUE TO SAVING AND CAPITAL TRANSFERS ACCOUNT B.8n / B.12 21663 -1801 2047 9397 31306 -10304 21002 Net saving / current external balance 21002 -10237 31239 5147 2003 3759 20330 -10304 31306 9397 2047 -1801 21663 Changes in net worth due to saving and capital transfers B.10.1 ACQUISITION OF NON-FINANCIAL ASSETS ACCOUNT Changes in net worth due to saving and capital transfers B.10.1 15651 -1301 2087 -6277 10159 -10159 0 B.9 21002 Net lending (+) / net borrowing (-) (Changes in ) Financial assets Households General Financial Non-financial including government corporations corporations NPISH (S.13) (S.12) (S.11) (S.14+S.15) Total economy (S.1) (Changes in ) Liabilities and net financial assets Financial accounts Rest of the Sum over World sectors (S.2) (S.1+S.2) Sum over sectors (S.1+S.2) Rest of the World (S.2) Total economy (S.1) Non-financial corporations (S.11) Financial corporations (S.12) General government (S.13) Households including NPISH (S.14+S.15) 5273 29862 -24589 -255535 5825 -83095 308216 0 -10159 10159 -6277 2087 -1301 15651 0 -2024 2024 1141 478 458 -54 -8135 8135 -7419 1609 -1760 15705 OPENING FINANCIAL BALANCE SHEET BF.90 Net financial assets (+) / liabilities (-) FINANCIAL TRANSACTIONS ACCOUNT B.9 Net lending (+) / net borrowing (-) (from capital accounts) B.9 - B.9F Statistical discrepancy B.9F 0 Net lending (+) / net borrowing (+) from financial accounts OTHER CHANGES IN FINANCIAL ASSETS AND LIABILITIES ACCOUNT B.10.2+B.10.3 Other changes in net worth 524 3446 -2922 43002 -15172 -7373 -23378 5814 25189 -19375 -219952 -7739 -92227 300543 CLOSING FINANCIAL BALANCE SHEET BF.90 Net financial assets (+) / liabilities (-) Some interesting figures (i) Households’ Net Financial Assets (BF90) (2005 = 100). NC 140 120 100 80 60 40 20 0 BE DK DE IE GR ES 2005 FR HU 2006 NL 2007 AT 2008 PT SK FI SE NO Some interesting figures (ii) Households’ net Financial Transactions. Liabilities of F4 (loans). (2005 = 100). NC 550 500 450 150 100 50 0 BE DK DE IE GR ES 2005 FR 2006 HU 2007 NL AT 2008 PT SK FI SE NO Some interesting figures (iii) Households’ Other Economic Flows in financial assets (2005 = 100). NC For the sake of clarity, data for BE, DE, IE, GR, ES, FR, HU, NL, PT, SK, SE and NO have been censured Some interesting figures (iv) General Governments’ Stocks of total Liabilities (2005 = 100). NC 180 160 140 120 100 80 60 40 20 0 BE DK DE IE GR ES 2005 FR HU 2006 NL 2007 AT 2008 PT SK FI SE NO Some interesting figures (v) Non Financial Corporations’ transactions in F7 Liabilities (EUR m). NC 70000 60000 50000 20000 10000 0 -10000 -20000 BE DK DE IE GR ES 2005 FR 2006 HU NL 2007 AT 2008 PT SK FI SE NO Some interesting figures (vi) Financial Corporations’ Stocks of Liabilities in F5 (2005=100). CO 180 160 140 120 100 80 60 40 20 0 BE DK DE GR ES FR 2005 HU 2006 NL 2007 AT PT 2008 SK FI SE NO Some interesting figures (vii) Financial Corporations’ transactions in Assets of F4 (2005 = 100). CO 1400 1300 1200 1100 300 200 100 0 BE DK DE GR ES 2005 FR HU 2006 NL 2007 AT PT 2008 SK FI SE NO Some interesting figures (viii) Financial Corporations’ Other Economic Flows in assets (2005 = 100). CO 350 250 150 50 -50 BE DK DE GR ES FR HU NL AT PT -150 -250 -350 -450 2005 2006 For the sake of clarity, data for FR, HU, PT, SK, SE and NO have been censured 2007 2008 SK FI SE NO Future Developments Reliable and timely data for policymakers: lessons from financial crisis New ESA is being drafted – proposal made in 2010; to come into force in 2014 New Transmission Program (to came into force in 2014) is being discussed: – Importance of split of OEF into Nominal Holdings Gains and Losses and Other Changes in Volume – Importance of counterpart data Integration of financial and non financial accounts For more information: =>http://epp.eurostat.ec.europa.eu/portal/page/portal/euros tat/home (Eurostat Web Page) =>http://epp.eurostat.ec.europa.eu/portal/page/portal/statist ics/search_database (Eurostat DataBase)