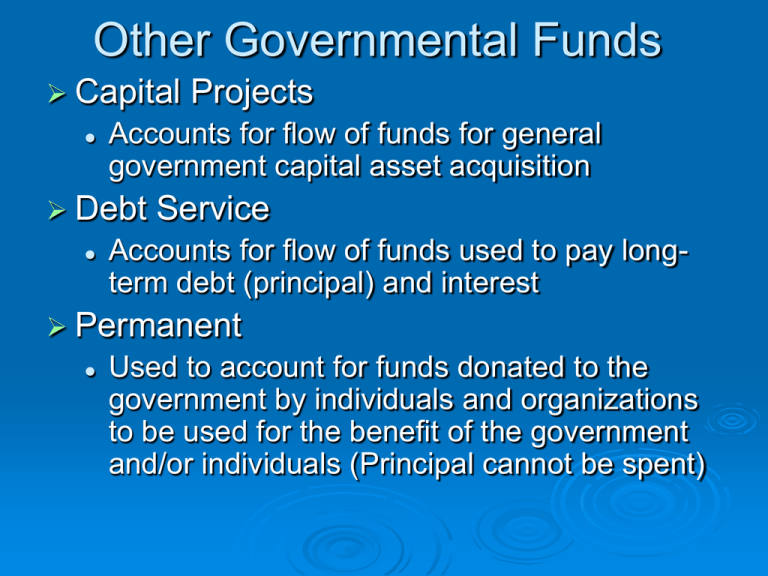

Other Governmental Funds Capital Projects Debt Service

advertisement

Other Governmental Funds Capital Accounts for flow of funds for general government capital asset acquisition Debt Projects Service Accounts for flow of funds used to pay longterm debt (principal) and interest Permanent Used to account for funds donated to the government by individuals and organizations to be used for the benefit of the government and/or individuals (Principal cannot be spent) Capital Projects Fund Exists for duration of the project Modified Accrual basis of accounting Flow of current financial resources Revenues (Few, maybe grants, miscellaneous) Bond and note proceeds are Other Financing Sources Also, transfers-in (i.e., general fund) are OFS Expenditures are for the capital project Budget not used but encumbrances are *Acquisition of general fixed assets by lease agreements is treated similar to businesses. Expenditures are debited for the present value of future lease payments and other financing sources credited. *Subsequent rental payments are recorded as expenditures for principal and interest *Special Assessments accounting depends on whether or not the government is primarily or secondarily liable for repayment of the debt. If so, reported on G-W financial statements; If not, reported as an Agency (Fiduciary) Fund event. Debt Service Fund Used to accumulate funds for repayment of general long-term debt and interest Adjusted modified accrual basis of accounting (Interest expenditures as interest comes due, unless within 30 days and balance in DS Fund to pay) Budgets are used but not encumbrances Premiums or discounts on issuance of bonds are entered as OFS or OFU in debt service fund Debt Service, Continued Revenues Taxes imposed for repayment of debt Grants and restricted donations Other Financing Sources Transfers-in from other funds Expenditures Bond Interest in period due (except, 30 day rule) Bond Principal in period due Permanent Funds Accounts for funds that are legally restricted (principal cannot be expended) Earnings are to be used for benefit of government and citizens at-large Modified Accrual basis of accounting and current flow of financial resources measurement focus Revenues are contributions, investment income, and grants Expenditures are disbursements on basis of restriction Financial Statements Balance Sheet Disaggregated (Column for each major fund and summary of all non-major funds) Current Financial Resources and Liabilities Fund Balances (Reserved and Unreserved) Statement of Revenues, Expenditures, and Changes in Fund Balances Disaggregated Modified Accrual Basis of Accounting Expenditures are current, debt service and capital outlay Bottom line is Ending Fund Balances