BUDGETING IN NORWAY 27 Annual Meeting of Senior Budget Officials Sydney, June 5

advertisement

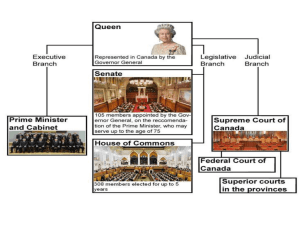

BUDGETING IN NORWAY 27th Annual Meeting of Senior Budget Officials Sydney, June 5th 2006 Teresa Curristine, Budgeting and Public Expenditures Division, Public Governance Directorate, OECD Three things to know… •Prosperous country with large oil reserves -In 2004, ranked 3rd among OECD countries in terms of GDP per capita -In 2005, UN index named Norway most liveable country in the world •Relatively large public sector -Public sector expenditure makes up 56% of mainland GDP •Wide Political Consensus – History of minority governments 2 In Brief…. •Successful management of oil assets •Medium-term deficit rule •Strong role for Cabinet in budget process •Strong formal role for Parliament •Decentralised public administration •Slow progress with government-wide system of performance 3 Successful Management of Oil Assets • Avoided mistakes of some other oil-rich nations • Established Government Pension Fund Global (previously called Petroleum Fund ) • Unique example of long-term budgetary planning 4 Fiscal rule • Medium-term deficit rule, stating that structural non-oil budget deficit should be kept at 4% (the assumed long-run real rate of return) of the assets of the Government Pension Fund • 4% rule never actually adhered to • Widespread political consensus 5 Strong Role for Cabinet • Cabinet Government • Cabinet plays central role in budget formulation • Two annual cabinet budget conferences • Relatively weak formal role of Ministry of Finance 6 Role of Parliament • Formally strong role for Parliament - Unlimited power to propose amendments to budget • Power curbed by party discipline and type of government • Ministry of Finance provides objective information to Parliament - But some members of opposition are calling for more independent information 7 Decentralised Public Administration • Decentralised - Local government plays large role in public service delivery - Central government Nordic model: Small ministries and larger number of agencies - Over 97% of central government employees work in agencies • High degree of flexibility for government agencies - Few restrictions on choice of inputs - Can carry over funds - Extensive flexibility to recruit, hire and dismiss non-senior civil servants 8 Decentralised public administration (continued) • Individual ministries responsible for monitoring and control of agencies’ spending activities • Ministry of Finance has few formal controls over ministries - limited steering capacity • Informal system works on consensus and tradition • Requires high degree of trust between actors 9 Slow Progress with GovernmentWide System of Performance • Few central requirements • Largely left to individual ministries and agencies • Sporadic implementation by ministries - Limited capacity at ministry level - Heavily dependent on agencies for information - Varying quality of information 10 Direct/Activity-based performance formula budgeting • Introduced in areas of education and health • Increased activity and reduced waiting lists • Problems due to - Increased expenditure and exceeding spending limits, especially in health - Perverse incentives - Questions about quality of service delivery 11 Conclusion • Modern budget system • Unique in terms of management of oil assets and long-term budgeting • Strong role of Cabinet • Formal versus informal roles of Parliament and Ministry of Finance • System based on wide political consensus 12