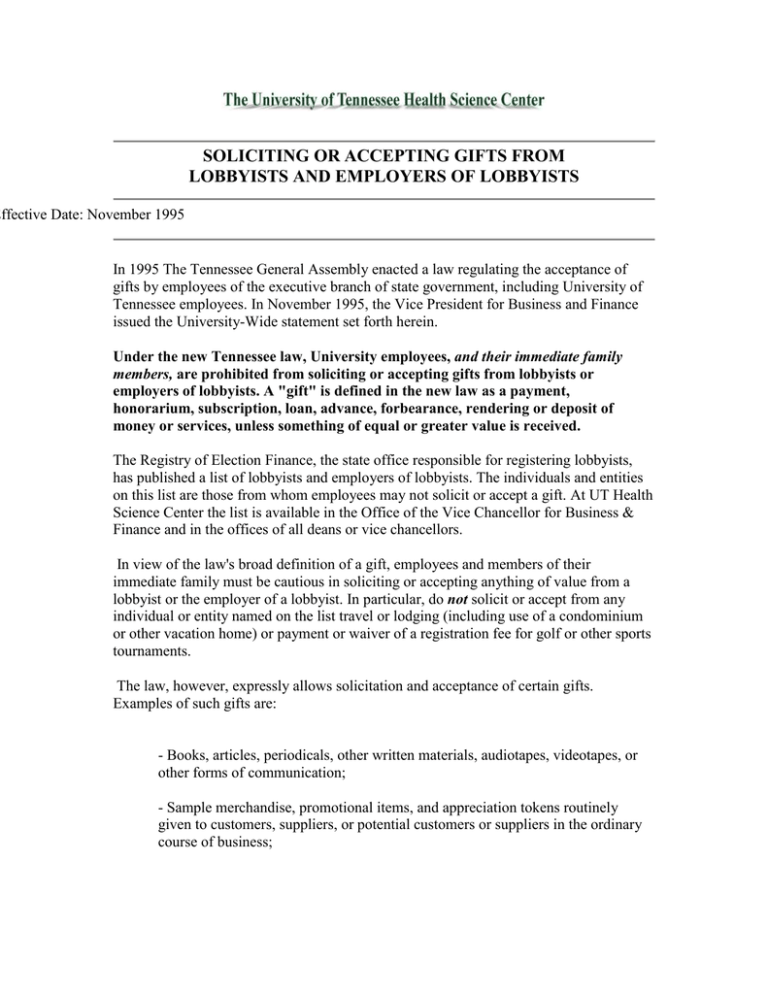

SOLICITING OR ACCEPTING GIFTS FROM LOBBYISTS AND EMPLOYERS OF LOBBYISTS

advertisement

SOLICITING OR ACCEPTING GIFTS FROM LOBBYISTS AND EMPLOYERS OF LOBBYISTS Effective Date: November 1995 In 1995 The Tennessee General Assembly enacted a law regulating the acceptance of gifts by employees of the executive branch of state government, including University of Tennessee employees. In November 1995, the Vice President for Business and Finance issued the University-Wide statement set forth herein. Under the new Tennessee law, University employees, and their immediate family members, are prohibited from soliciting or accepting gifts from lobbyists or employers of lobbyists. A "gift" is defined in the new law as a payment, honorarium, subscription, loan, advance, forbearance, rendering or deposit of money or services, unless something of equal or greater value is received. The Registry of Election Finance, the state office responsible for registering lobbyists, has published a list of lobbyists and employers of lobbyists. The individuals and entities on this list are those from whom employees may not solicit or accept a gift. At UT Health Science Center the list is available in the Office of the Vice Chancellor for Business & Finance and in the offices of all deans or vice chancellors. In view of the law's broad definition of a gift, employees and members of their immediate family must be cautious in soliciting or accepting anything of value from a lobbyist or the employer of a lobbyist. In particular, do not solicit or accept from any individual or entity named on the list travel or lodging (including use of a condominium or other vacation home) or payment or waiver of a registration fee for golf or other sports tournaments. The law, however, expressly allows solicitation and acceptance of certain gifts. Examples of such gifts are: - Books, articles, periodicals, other written materials, audiotapes, videotapes, or other forms of communication; - Sample merchandise, promotional items, and appreciation tokens routinely given to customers, suppliers, or potential customers or suppliers in the ordinary course of business; - Unsolicited tokens or awards of appreciation or bona fide awards in recognition of public service in the form of a plaque, trophy, desk item, wall memento, and similar items; - Discounts afforded to the general public or specified groups or occupations under normal business conditions (as long as the discount is not based on your status as a University employee); and - Prizes and awards given in public contests. The law includes the following penalty provisions: - For the first violation, the Registry of Election Finance may assess a civil penalty or 200% of the value of the gift or $25.00, whichever is greater. - For any subsequent violation, the Registry may assess the same penalty as for a first violation or, in the alternative, a civil penalty up to $10,000 and referral to the district attorney general for prosecution as a Class C misdemeanor. A Class C misdemeanor carries a criminal penalty of imprisonment for not greater than 30 days or a fine not to exceed $50.00, or both. - In the case of any willful or fraudulent violation, the Registry may refer the violation to the district attorney general for prosecution as a Class C misdemeanor. It is the opinion of the University's General Counsel that the University could not pay these penalties for an employee without express authorization by the Board of Trustees, and it is doubtful the Board has the power to authorize such payment. It should be noted that the statute also includes the following "safe harbor" provision: A gift made contrary to this section shall not be a violation of the section if the ... official or immediate family member does not use the gift and returns it to the donor within the latter of ten (10) days of receipt or ten (10) days of having knowledge that the gift was a violation or pays consideration of equal or greater value within the latter of ten (10) days of receipt or ten (10) days of having knowledge that the gift was a violation. This information should be shared with all director-level employees and all other employees who are in positions where they may influence decisions regarding companies that are chosen to provide goods or services to the University. Those individuals should be particularly mindful of this law and should share this information with their staffs. A copy of these provisions will be provided to all faculty and staff hired after January 1, 1996. If there is any doubt about whether an offered gift is acceptable under the new law, it will be best not to accept it.