ASSESSING FISCAL RISKS THROUGH LONG-TERM BUDGET PROJECTIONS

advertisement

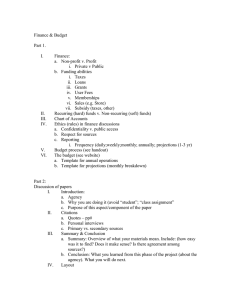

ASSESSING FISCAL RISKS THROUGH LONG-TERM BUDGET PROJECTIONS Paal Ulla Budgeting & Public Expenditures Division Public Governance & Territorial Development Directorate (GOV) Sydney, Australia, June 2006 1 Why long-term projections? Reasons for stronger emphasis on long-term projections: Macroeconomic stability; stabilization supported by monetary policy Planning on the core functions of the public sector Efficient use of public resources Transparency is needed in a globalized financial market Fiscal sustainability 2 Is there a need for worry… Income will be doubled in the next 40 years, so? Yes, there is a need for worry: It is the demographic structure not the income level, that creates the problems. Higher tax rates may reduce the incentives to work even with higher income. It will take time to adapt to the demographic changes, which give a need for lower public employment. These challenges will appear in 5-10 years. 3 Alternatives for growth in total factor productivity A. Real income per capita, 1000 NOK 1200 1000 1200 Reference High growth Low growth 1000 800 600 600 400 400 200 0 0 2010 2020 2030 2040 2050 2060 Source: Ministry of Finance, Norway 18 15 12 800 200 A. Net lending public sector 9 18 15 Ref. 1.44% High 1.90 % 12 Low 1.00 % 9 6 6 3 3 0 0 -3 -3 -6 -6 2010 2020 2030 2040 2050 2060 4 Issues Addressed How to produce long-term projections? What are the uncertainties? What to learn from long-term projections to secure sustainability and avoid fiscal risks? 5 Sustainability Debt sustainability: when a borrower is expected to be able to continue servicing debt without large changes to the revenues and/or spending However, economic theory does not indicate the maximum level of debt (or taxation) – You do not know if you are in an unsustainable position until you are there. Fiscal risks are best met by fiscal sustainability 6 Long-term revenues projections Purpose: to get a realistic view of available resources Growth in taxation based on GDP Growth adjusted for – Income tax on transfers from public sector to households such as pensions – Capital income rise at the expense of labour income, fringe benefits, tax exemptions – Wealth-based taxation, quantity-based excises 7 Long-term expenditure projections Discretionary spending Mandatory spending Reserves for new programmes One-off expenditures Interest payments 8 Projecting present expenditures Demographic forecasts Discretionary spending Mandatory spending 9 Unknown future expenditures Reserves for new programmes One-off expenditures 10 Sources of uncertainty Economic assumptions Macroeconomic long-term modelling Demographic assumptions Labour market participation Productivity Specification of programmes for public revenues and expenditures Interest rates 11 Macroeconomic long-term modelling Equilibrium in the long run When will we reach equilibrium? 12 Demographic assumptions Fertility rates Immigration Life expectancy 13 Labour market participation Labour market participation depends on: – Age and gender – Cultural factors – Future income Pension reforms as a solution? 14 Productivity Little gain in nominal spending because real wages increase in the public sector There may be some gain for the public sector: – Productivity in the public sector may reduce public employment – Productivity in the private sector may reduce the prices on goods and services 15 Main uncertainties in the projections Main Demographics, life expectancy Labour market participation rates Productivity, pension reforms Interest rates Fertility rates in the even longer run 16 Time horizon Cover the problems and the solution; baby boomers indicate at least a time horizon of 40-50 years Will there be a constant increase in expenditure? The uncertainties in the demographics increase because accumulated increased longevity and projections include fertility rates not yet observed 17 Projections in some countries United Kingdom 50-year projection included in the yearly pre-budget documents in December United States 75-year projection in the yearly budget proposal Australia Productivity Commission Research Report gives projections to 2044-45 New Zealand Will present their first report in June 2006 Norway Special report in 2004 with projections to 2060 Germany First report in June 2005 gives projections to 2050 European Union European Commission and Economic Policy Committee’s report in February 2006 gives projections up to 2050 18 What do long-term projections tell us so far? Many countries will have to raise taxes even if they reduce spending The growth in the total expenditure must be curbed: pension and health care reforms There will be a shortage of labour, capital deepening of public sector may be needed Debt has to be reduced in some countries otherwise they will need a primary surplus to avoid rising debt 19 How to avoid fiscal risks in the future Handling uncertainty Incorporating long-term considerations into the yearly budget process Specifying public expenditure programmes Shifting uncertainty to the private sector Reducing the debt (interest payments) 20 Important documents Projecting OECD Health and Long-Term Care Expenditures: What are the Main Drivers (OECD 2006, ECO/WKP(2006)5) Joaquim Oliveira Martins, Frederic Gonand, Pablo Antolin, Christine de la Maisonneuve, Kwang-Yeol Yoo: The Impact of Aging on Demand, Factor Markets and Growth (OECD Economic Working Papers No. 420, ECO/WKP(2005)7) Jean-Marc Burniaux, Romain Duval and Florence Jaumotte; Coping with Ageing : A Dynamic Approach to Quantify the Impact of Alternative Policy Options on Future Labour Supply in OECD Countries, ( OECD Economic Department Working Papers No 371, 21. June 2004) Working Party No. 1 on Macroeconomic and Structural Policy Analysis, Labour Force Participation of Groups at the Margin of the Labour Market: Past and Future Trends and Policy Challenges, (OECD ECO/CPE/WP1(2003)8, 22. September 2003) (Includes 3 annex.) Economic Policy Committee, European Commission; The impact of aging on public expenditure: projections for the EU25 Member States on pensions, health care, long-term care, education and unemployment transfers (2004-2050) (Special Report No 1/2006, DG ECFIN, Brussels, 14 February 2006) 21