SONOMA COUNTY OFFICE OF EDUCATION SCOE BIZ __________________________________________________________________________________________

advertisement

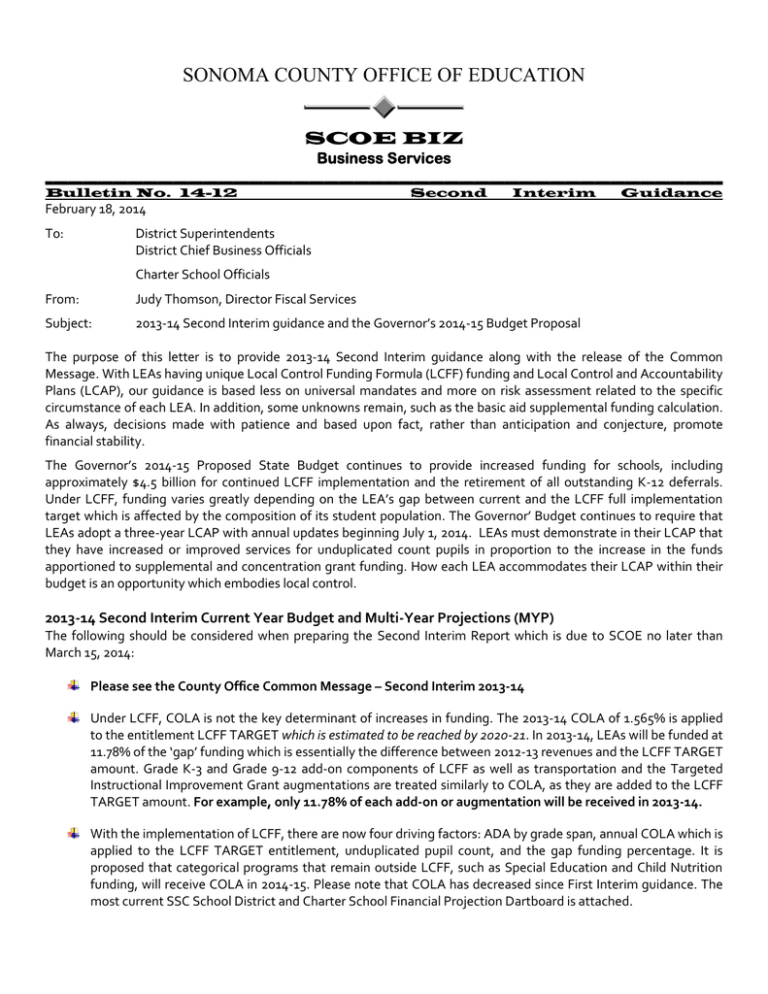

SONOMA COUNTY OFFICE OF EDUCATION SCOE BIZ Business Services __________________________________________________________________________________________ Bulletin No. 14-12 Second Interim Guidance February 18, 2014 To: District Superintendents District Chief Business Officials Charter School Officials From: Judy Thomson, Director Fiscal Services Subject: 2013-14 Second Interim guidance and the Governor’s 2014-15 Budget Proposal The purpose of this letter is to provide 2013-14 Second Interim guidance along with the release of the Common Message. With LEAs having unique Local Control Funding Formula (LCFF) funding and Local Control and Accountability Plans (LCAP), our guidance is based less on universal mandates and more on risk assessment related to the specific circumstance of each LEA. In addition, some unknowns remain, such as the basic aid supplemental funding calculation. As always, decisions made with patience and based upon fact, rather than anticipation and conjecture, promote financial stability. The Governor’s 2014-15 Proposed State Budget continues to provide increased funding for schools, including approximately $4.5 billion for continued LCFF implementation and the retirement of all outstanding K-12 deferrals. Under LCFF, funding varies greatly depending on the LEA’s gap between current and the LCFF full implementation target which is affected by the composition of its student population. The Governor’ Budget continues to require that LEAs adopt a three-year LCAP with annual updates beginning July 1, 2014. LEAs must demonstrate in their LCAP that they have increased or improved services for unduplicated count pupils in proportion to the increase in the funds apportioned to supplemental and concentration grant funding. How each LEA accommodates their LCAP within their budget is an opportunity which embodies local control. 2013-14 Second Interim Current Year Budget and Multi-Year Projections (MYP) The following should be considered when preparing the Second Interim Report which is due to SCOE no later than March 15, 2014: Please see the County Office Common Message – Second Interim 2013-14 Under LCFF, COLA is not the key determinant of increases in funding. The 2013-14 COLA of 1.565% is applied to the entitlement LCFF TARGET which is estimated to be reached by 2020-21. In 2013-14, LEAs will be funded at 11.78% of the ‘gap’ funding which is essentially the difference between 2012-13 revenues and the LCFF TARGET amount. Grade K-3 and Grade 9-12 add-on components of LCFF as well as transportation and the Targeted Instructional Improvement Grant augmentations are treated similarly to COLA, as they are added to the LCFF TARGET amount. For example, only 11.78% of each add-on or augmentation will be received in 2013-14. With the implementation of LCFF, there are now four driving factors: ADA by grade span, annual COLA which is applied to the LCFF TARGET entitlement, unduplicated pupil count, and the gap funding percentage. It is proposed that categorical programs that remain outside LCFF, such as Special Education and Child Nutrition funding, will receive COLA in 2014-15. Please note that COLA has decreased since First Interim guidance. The most current SSC School District and Charter School Financial Projection Dartboard is attached. The annual gap funding percentages to be used in the LCFF calculation are 11.78% for 2013-14 and 28.05% for 2014-15. Gap funding in the out-years can vary dramatically based on a LEA’s risk tolerance. The more uncertain a LEA is of the variables used in calculating LCFF, such as the stability of its unduplicated pupil count or grade span ADA estimations, the lower the risk tolerance. LEAs with low risk tolerance, minimal reserves, or significant gap funding amounts should use more conservative gap funding percentages in the outyears. Those LEAs with small gap funding amounts may use gap funding percentages up to the Department of Finance (DOF) estimates for 2014-15 and 2015-16. LEAs that do not have reserves which exceed the minimum reserve level by at least one year of growth in LCFF funding should not use gap percentages in 15-16 and 16-17 that exceed the SSC Simulator gap percentages. However, in 2016-17 it is recommended that all LEAs use no greater than the 8.4% gap funding percentage without providing for contingencies in expenditure plans or a corresponding increase in reserves. LEAs should be cognizant that Proposition 30 revenues are temporary. The additional ¼ cent sales tax (estimated to generate approximately 20% of Proposition 30’s temporary taxes) will expire in 2016 and the increase in personal income tax on high wage earners (estimated to generate approximately 80% of Proposition 30’s temporary taxes) will expire in 2018. The gap funding percentage included in the LCFF calculators/simulators are as follows: 2013-14 2014-15 2015-16 2016-17 11.78% 28.05% 7.8% 8.4% GAP funding percentage LCFF Simulator on School Service of California website ~ Percentages in 2015-16 and 2016-17 reflect the amount of funding necessary to simply provide an LCFF adjustment equal to COLA and its impact on closing the LCFF funding gap. LCFF Calculator on FCMAT website ~ default %s are based 11.78% 28.05% 33.95% 21.67% on DOF estimates ** ** Please note that the gap funding % of the LCFF Calculator is easily modified on the Assumptions tab. Also note that each fiscal year’s gap funding percentages cannot be added together to calculate a total percentage of LCFF gap that has been funded. The percentage of gap that is funded in a given year must be calculated as a percentage of that specific year’s revised and remaining LCFF gap. Expenditures that are should be considered in the MYP: o Routine Restricted Maintenance expenditure requirements return to the 3% minimum level in 2015-16. o PERS contribution rate ~ The PERS employer contribution rate is 11.442% for 2013-14 as approved on June 18, 2013 and are expected to increase. PERS has estimated a contribution rate of 13.3% in 2015-16. Additional employer contributions should be anticipated in creating the MYP. o STRS contribution rate ~ The Governor has called for action to address the STRS unfunded liability in 2015-16. It is recommended to increase STRS contribution rate in 2015-16. o Costs associated with meeting adequate progress towards class size requirements for LCFF k-3 grade span adjustment. Under the LCFF, basic aid districts will receive minimum state funding of no less than the amount received in 2012-13. The hold harmless amount will be calculated based on the categorical allocation net of 8.92% fair share reduction. One-time redevelopment agency (RDA) asset liquidation revenue will removed from the fair share calculation in 2014-15. Basic aid districts will be subject to the Local Control and Accountability Plan (LCAP) and Supplemental and Concentration Grant regulations under LCFF. See attached 2013-14 County Program Reporting Matrix for ADA and CALPADS reporting of district served students in County programs. The LCAP public hearing must be on the same day as the budget public hearing and requires the agenda to be posted at least 72 hours prior to public hearing. The public meeting for the LCAP adoption and budget adoption may be no sooner that than the subsequent day. LCAPs must be adopted by June 30 prior to the fiscal year for which it is created, starting with 2014-15. Charter school funding under the LCFF will be largely identical to district funding, except that in certain circumstances charter funding will be constrained by factors related to the district in which the charter is physically located. A charter school’s concentration grant percentage will be limited to the percentage associated with the school district where the charter school resides. If the charter school is physically located in more than one school district, then the charter’s percentage cannot exceed that of the school district with the highest percentage. Charter schools do not have declining enrollment protection. All charter schools are required to prepare an LCAP. The Education Protection Account (EPA) amount is an offset to state aid. All districts are guaranteed a minimum of $200 per ADA beginning in 2012-13 and each year thereafter through 2018-19. The five day reduction of instructional days in the school year will end in 2014-15. Districts who received district of choice and basic aid supplemental funding in 2012-13 should be conservative with 2013-14 and out-year estimates as State exhibits clarifying the specific calculation are not yet available. By the end of fiscal year 2013-14, school districts must meet compliance and fully restore the Reserve for Economic Uncertainties to the reserve percentages established in the Criteria and Standards. Summary Statement It is recommended that LEAs proactively involve stakeholders in a transparent and inclusive LCAP and budgeting process to obtain the consensus needed in creating programs which meet educational goals and maintain fiscal solvency. Greater detail regarding LCFF funding will be found in the state-wide County Office Common Message – Second Interim 2013-14 located at dp.scoe.org website under the Workshops tab. Please call if you have questions, need assistance or advice. We are here to assist districts however possible.