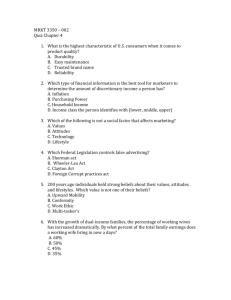

SOMETIMES YOU’VE GOT TO PROTECT SOCIAL SECURITY FROM ITS “FRIENDS”

advertisement

SOMETIMES YOU’VE GOT TO PROTECT SOCIAL SECURITY FROM ITS “FRIENDS” L. RANDALL WRAY The Center for American Progress’s Matt Miller has argued that liberals can learn a valuable lesson from NY Governor Andrew Cuomo’s proposed budget. With his state facing a fiscal crisis, the Governor has proposed to cap growth of state spending on the Medicaid program. Miller has argued that we should follow his example and apply a similar cap to Social Security spending. Briefly, New York’s Medicaid spending was slated to grow by 13%, much faster than the overall inflation rate. Governor Cuomo has proposed to ignore funding formulas and to limit growth to 6%. Miller wants liberals to follow that example by changing Social Security’s formula used to adjust benefits. Miller rightly notices that Social Security expenditures are also projected to grow faster than inflation. Of course, some of that is due to our aging society, with more retirees to support. But funding formulas for Social Security also contribute to growth of individual benefits beyond cost of living adjustments. In other words, Social Security expenditures in real terms (after inflation) increase faster than growth of the retired population, meaning that the benefits received in the future by a retiree will be higher in real terms than they are today. Here’s why. In the 1970s it was recognized that if real living standards rise over time (due to growing productivity of workers), then Social Security retirement benefits would fall behind even if they are adjusted for inflation. Suppose you retired today at age 65 and were fortunate enough to live another 25 years to the ripe old age of 90. Let us say you retire at the typical benefit of $18,000 paid to one who has earned a medium wage preretirement. If that benefit is adjusted every year to account for inflation, when you die in 2036 you will still be able to buy the same consumer basket in your last year of life (assuming the COLA adjustments accurately reflect inflation—something that is not really true). But over that 25 year period you will watch as the average American living standard rises relative to your own. You will become relatively impoverished. Over a period that long, it is likely that living standards will have increased substantially; over the course of US history they have typically doubled each generation. You will have fallen far behind in relative terms—from a not-so-comfortable living standard ($18,000 is by no means extravagant today) to a living standard that is half as good in relative terms. For comparison purposes, based on current formulas, your Social Security retirement is projected to grow in real terms from that $18,000 now to $24,000 in 2030 and to $29,000 in 2050 (should you be so lucky to live to the age of 104!) Your living standard will grow by 60% as it keeps pace with the growth of American workers’ living standards. In relative terms, you do not fall behind. If everyone else is driving flying saucers to Venetian vacations, you’ll be able to do the same. There are of course two objections. First we do not know how much living standards will rise. It will depend on growth of labor productivity. But by linking growth of Social Security benefits to real wage growth we are ensuring that no matter how much productivity grows (whether it is zero or 400 percent), seniors will get their share. Second, one could argue that in absolute terms, seniors are no worse off if we limit benefit growth to cover inflation. They’ll probably still live better in America than they would in India, after all. But one thing we do know is that well-being depends more on relative comparisons than on absolute terms. Relative poverty is more detrimental to one’s physical, psychological, and emotional health than is absolute poverty. At first that might sound counterintuitive, but researchers from many disciplines have consistently found this to be true. It is relative poverty that isolates an individual, that reduces her ability to participate fully in society. So while it is commonplace to note that America’s poor are rich by Indian standards, that comparison is entirely irrelevant. Miller’s justification for elimination of the real living standard adjustment is based on two fallacies. First, he argues that financing growth of Social Security benefits will “crowd out” all the other liberal priorities. The federal government simply will not be able to “afford” the costs of “guaranteeing great teachers for poor children, universal preschool, repairs for America's crumbling roads and sewer” if we let living standards of seniors rise. Second, he refers to growing numbers of retired baby boomers as the cause of the problem. It is a little publicized fact that when the intergenerational warriors trot out their “unfunded entitlements” that supposedly total tens of trillions of dollars, the shortfall is entirely due to the projected deficits in the long distant future after all baby boomers are dead and buried. The projected date of Armageddon, when Social Security first starts to run deficits (that is, when its total revenues fall short of its benefit payments) changes from year-to-year as assumptions change based on recent economic performance. But typically that date is sometime in the 2040s. Think about it. The babyboomers will be closing in on the century mark by then. Yes a few of them might make it. But most of us partied way too hard in the 1960s and 1970s. Heck, we were surprised to make it to the 1980s. I do not have the space to go through all the reasons why the very long term (75 years and beyond) projections of Social Security’s finances show growing budget deficits—but it mostly comes down to implausibly pessimistic and inconsistent assumptions about economic variables. See here (http://www.levyinstitute.org/pubs/ppb55.pdf and http://www.levyinstitute.org/pubs/pn_5_06.pdf) for details. In any case, it turns out that the projected financial shortfall amounts to about 2% of GDP per year after 2040 or so. In other words, if we find a way to shift 2% more of GDP annually toward Social Security’s funding over the next 30 years, the “looming financial crisis” disappears. By the way, we achieved a greater shift than that between 1960 and the 1990s. Only an ideologue could trump that up to a crisis. But forget the finances. What really matters is growth of our nation’s ability to take care of the young, the workers, and the aged. Will we be able to produce enough goods and services to provide a rising living standard to all (supplemented by imports—if the rest of the world continues to prefer to “consume” green paper money over their own output, a topic for another day)? On all plausible projections the answer is a resounding “yes”. Indeed, even the pessimistic projections made by the Social Security Trustees shows rising living standards for all even as we age as a society. That makes sense. The average worker in 1965 supported more dependents (young plus old) than workers are ever projected to support again. Why is that? Elementary: the parents of baby boomers supported 3.7 kids; the flip side of an aging society is that workers today and into the future are supporting more old people but fewer kids. It’s a tradeoff. We may not like it, but the alternatives are unpleasant: euthanasia for the elderly or very much higher birthrates. Far better to accept the aging society and to continue to ramp up productivity so that we can provide for them. Indeed, it is precisely that productivity growth that drives the growth of real benefits that Miller wants to cut! If we don’t get rising productivity, we don’t get rising real benefits. Miller is focused on something that is not an issue, and has created a “solution” for something that is not a problem.