Document 17780353

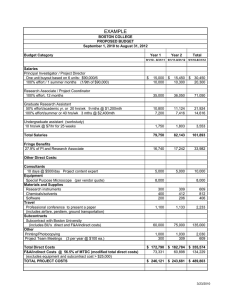

advertisement

If the funder provides specific guidelines related to format or contents of your budget… FOLLOW THEM! Otherwise, your proposal may not make it out of the screening phase. In preparing a budget, the investigator needs to be concerned with two types of costs: • Direct Costs • Indirect Costs Direct Costs + Indirect Costs = Total Budget Costs that can be identified as necessary to complete a specific sponsored project or activity. • Assignable with a high degree of accuracy and directly related to the project. • Typical direct costs include salaries and fringe benefits, materials and supplies, travel, and equipment. Costs directly charged to a project must pass four tests: • Reasonable • Allocable • Consistent • Allowable Reasonable Costs: those which a prudent person would expect to incur during completion of a similar project. • Is the expense necessary to complete the project? • Is the budgeted item appropriate for the project? • Does the cost of the budgeted item reflect market conditions? Allocable Costs: Assignable to a specific objective within the project. • Solely intended to achieve proposal objectives. • Benefit both the proposed project and the institution as a whole. OR • Necessary for operations of institution but also assignable to specific objectives of the project. *Expenses cannot be shifted between projects to cover cost overruns. Each expense must be allocable to the project to which it is charged. Consistent Costs: treated in accordance with accepted accounting practices appropriate to the project. • Institution must treat costs in a similar manner regardless of the project to which they are assigned. • If an item is treated as an indirect cost by the institution under one program, it must be treated the same under all programs. Allowable Costs: Expenses that are reasonable, allocable and consistent and which conform to the guidelines of the institution and project sponsor. • Take special note of exclusions, limits, and constraints that a sponsor lists in its Request for Proposals. Typical direct costs include: • Salaries • Fringe Benefits • Equipment • Travel • Participant Costs • Other Direct Costs Salaries • Full and part-time salaries of Cooperative Extension personnel. • Considerations: Annual salaries and wages of individuals involved in project; number of months project will take; percentage of time each individual will be involved in the project based on a 226-day year. • Total time allocated to sponsored projects cannot exceed 100% of a staff member’s paid work hours. • If project spans fiscal years, allow for salary increases. Fringe Benefits • Health insurance, unemployment insurance, worker compensation, social security, retirement contributions, and other benefits provided by employer. • Based on percentage of total salary. • For Fiscal Year 2012 fringe benefits rate are 30.4% for salaried employees (24.61% if NIFA sponsored) and 7.6% for temporary employees. Equipment • A single item with a useful life of more than one year and a cost exceeding $5,000. • Line-item each piece of equipment in budget. • Equipment requested must be necessary and justifiable for completion of project. Travel • As necessary to complete project or report findings. • Air fare, lodging, meals, mileage, registration fees, ground transportation, etc. • Based on per diem rates or actual expenses. • Budget in-state and out-of-state travel separately. • Use reasonable estimates of expenses based on current market conditions and rates. • Federally-funded air travel must be via a U.S.-owned carrier. Participant Costs • Expenses incurred by project participants who are not Cooperative Extension employees. • Study subjects, students to be trained, program attendees, etc. • Stipends, travel, supplies, education materials, etc. Other Direct Costs (list is not all-inclusive) • Materials and Supplies necessary to complete project that have a useful life of less than one year and a cost of less than $5,000. • Publications associated with reporting research findings, distributing information, or providing educational materials. • Professional/Consulting services at prevailing market rates and not to exceed the consultant’s normal compensation rate. • Freight and Postage if significant and beyond those anticipated as a cost of normal office operations. Other Direct Costs, continued • Advertising and Public Relations fulfilling obligations of sponsored agreement including recruitment of personnel, bid announcements, and educational message dissemination. Promotional items are not allowable. • Sub-awards “passed through” to another institution to complete specified components of project. *See indirect costs for limitations associated with sub-awards. Costs that contribute to a project but are difficult to allocate in exact proportions. • Includes utilities, administration, clerical assistance, depreciation, computers, office supplies, etc. • Does note include cost of equipment, capital expenditures, rental of off-site facilities, scholarships, and each sub-award amount exceeding $25,000. • Treatment of costs must be consistent; items treated as indirect under one project must also be indirect under other projects. • Costs are normally calculated based on “Modified Total Direct Costs” (MTDC) •Total Direct Costs minus equipment, capital expenditures, rental of off-site facilities, and subawards to the extent they exceed $25,000 • Indirect cost calculations are based on negotiated percentages of MTDC or limits designated by project sponsor. • Cash, property, services, volunteer labor, etc. • Not treated as direct costs. • Useful in calculation of matching funds that may be required for a project. • Must be non-federal and not used as matching for any other federally-funded project. • Value based on current market prices, appraisal, or labor rates. • Include separate budgets for each year and a summary budget for entire project. • Account for inflation, salary adjustments, and other unpredictable cost increases. • For Fiscal Year 2012, a reasonable rate of increase is 3% annually.