Document 17756389

advertisement

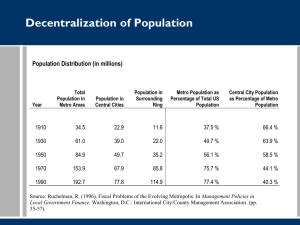

1960 2000 2010 1930 Overview of Welfare Economics • • • • • • • • Pareto Efficiency Supply & Demand Market Equilibrium Marginal Costs & Marginal Benefits Market Failure Externalities Public Goods Common Resources “A planner’s primary obligation is to serve the public interest.” - AICP Code of Ethics and Professional Conduct Welfare Economics: The study of how different forms of economic activity and different methods of allocating scarce resources affect the well-being of individuals or communities Pareto Efficiency: An allocation of resources is considered Pareto efficient if no alternative allocation can make at least one person better off without making someone else worse off Supply & Demand Marginal Cost & Marginal Benefit Demand (Benefit to Consumers or Society) The relationship between the price of a good/service and the quantity purchased by consumers Law of Demand: All else being equal, quantity demanded decreases as price increases. (The number of people whose benefit exceeds the price decreases as price increases) (Negative relationship between price and quantity = downward slope) Demand $2.25 Price $ - Quantity Demanded $2.00 $1.75 100 89 $1.50 $ 0.50 75 $1.25 $ 0.75 62 $ 1.00 50 $ 1.25 37 $ 1.50 25 Price $ 0.25 $1.00 $0.75 $0.50 $0.25 $ 1.75 12 $ 2.00 0 $0 10 20 30 40 50 60 Quantity 70 80 90 100 110 Supply (Cost to Producers or Society) The relationship between the price of a good/service and the quantity that producers are willing to supply Law of Supply: All else being equal, quantity produced increases as price increases. (The number of producers whose cost is lower than the price increases as price increases) (Positive relationship between price and quantity = upward slope) Supply $2.25 $2.00 Price $1.75 $ - Quantity Supplied 0 $0.25 12 $0.50 25 $0.75 37 $1.00 50 $0.75 $1.25 62 $0.50 $1.50 75 $0.25 $1.75 89 $2.00 100 $1.50 Price $1.25 $1.00 $- 0 10 20 30 40 50 60 Quantity 70 80 90 100 110 Supply and Demand $2.25 $2.00 $1.75 Price $1.50 $1.25 $1.00 $0.75 $0.50 $0.25 $0 10 20 30 40 50 60 Quantity 70 80 90 100 110 Price $ $ $ $ $ $ $ $ $ 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 Quantity Demanded 100 89 75 62 50 37 25 12 0 Quantity Supplied 0 12 25 37 50 62 75 89 100 Outcome Price Will: Shortage Rise Shortage Rise Shortage Rise Shortage Rise EQUILIBRIUM Surplus Fall Surplus Fall Surplus Fall Surplus Fall Nicholas' Demand $3.50 $3.50 $3.00 $3.00 $2.50 $2.50 $2.00 $2.00 Price Price Catherine's Demand $1.50 $1.50 $1.00 $1.00 $0.50 $0.50 $- $0 2 4 6 8 Quantity 10 12 14 0 2 4 6 8 Quantity 10 12 14 Price Catherine's Demand Nicholas' Demand $ - 12 $ 0.50 10 6 16 $ 1.00 8 5 13 $ 1.50 6 4 10 $ 2.00 4 3 7 $ 2.50 2 2 4 $ 3.00 0 1 1 + 7 Market Demand = 19 Market Demand $3.50 $3.00 Price $2.50 $2.00 $1.50 $1.00 MB $0.50 $0 5 10 Quantity 15 20 Social Surplus Consumer Surplus: The difference between what consumers are willing-to-pay and what they have to pay Graphically, the area under the demand curve and above the price Producer Surplus: The difference between producers’ total revenue and marginal cost Graphically, the are above the supply curve (MC) and below the price Consumer Surplus $2.25 $2.00 $1.75 Price $1.50 $1.25 $1.00 $0.75 $0.50 $0.25 $0 10 20 30 40 50 60 Quantity 70 80 90 100 110 Producer Surplus $2.25 $2.00 $1.75 Price $1.50 $1.25 $1.00 $0.75 $0.50 $0.25 $0 10 20 30 40 50 60 Quantity 70 80 90 100 110 Social Surplus Consumer Surplus: The difference between what consumers are willing-to-pay and what they have to pay Graphically, the area under the demand curve and above the price Producer Surplus: The difference between producers’ total revenue and marginal cost Graphically, the are above the supply curve (MC) and below the price Social Surplus $2.25 $2.00 $1.75 Price $1.50 $1.25 $1.00 $0.75 $0.50 $0.25 $0 10 20 30 40 50 60 Quantity 70 80 90 100 110 Realities of the Market The private market only ensures efficiency under strict conditions, including: Many buyers and sellers (no monopolies) Identical goods and services Perfect information No barriers to entry No externalities (side effects) … Even a “perfectly competitive” private market: cannot effectively allocate public goods or common resources Does not address issues of distribution or equity… “Four Vital Functions of Planning” (Klosterman, 1985) Argument for and Against Planning 1. Improves information for public and private decision making 2. Considers external effects of individual and group action 3. Promotes collective interest, esp. w/ respect to public goods 4. Considers distributional effects of market actions (equity) Zero Economic Profit? A firm that earns zero economic profit is said to earn “normal profits” Two ways to measure profit: 1. Economic Profit = Total Rev. – (Explicit Costs + Implicit Costs) 2. Accounting Profit = Total Rev. – (Explicit Costs) Explicit Costs include: capital, labor, etc. (actual $ payments) Implicit Costs include: the value of resources used in production for which no monetary payments are made (opportunity costs) e.g., implicit cost to the farmer is salary he could have made had he chosen another pursuit) A firm that just covers its operating costs and its implicit costs makes ZERO economic profit, but still makes an accounting profit 4 bushels @ $10 => TR 40k cap. costs -3k taxes -1k explicit costs labor -1k rent -10k acct. prof. = 25 k forgone income - 20k implicit costs savings invested - 5k Economic Profit = 0 Monopolist’s Marginal Revenue Price Total Revenue Quanity - $ Marginal Revenue $ 22 - $ 20 1 $ 20 $ 20 $ 18 2 $ 36 $ 16 $ 16 3 $ 48 $ 12 $ 14 4 $ 56 $ 8 $ 12 5 $ 60 $ 4 $ 10 6 $ 60 $ $ 8 7 $ 56 $ (4) $ 6 8 $ 48 $ (8) $ 4 9 $ 36 $ (12) $ 2 10 $ 20 $ (16) - Price Total Revenue Quanity Marginal Revenue Monopolist’s Marginal $ 20 1 $ 20 $ 20 Revenue $ 22 - $ - $ 18 2 $ 36 $ 16 $ 16 3 $ 48 $ 12 $ 14 4 $ 56 $ 8 $ 12 5 $ 60 $ 4 $ 10 6 $ 60 $ $ 8 7 $ 56 $ (4) $ 6 8 $ 48 $ (8) $ 4 9 $ 36 $ (12) $ 2 10 $ 20 $ (16) - $25 $20 $15 D $10 $5 $- 2 4 6 8 10 12 Market Failure Externalities: Economic side effects or “spillovers.” costs or benefits that stem from an economic activity, but that affect people other than those directly involved in a market transaction. Can be POSITIVE or NEGATIVE Market Failure Example of negative externality Driving involves direct cost: gas, driver’s time …and creates indirect, or external, costs: pollution, congestion, road maintenance, etc. The individual driver does not bear the indirect costs, and does not consider them in his/her decision-making process Market Failure Example of positive externality: A beekeeper’s bees create benefits that can be captured: honey, sold to customers … and external benefits that cannot be captured: bees pollinate nearby orchards The orchard farmers do not pay the beekeeper for this benefit, so the beekeeper does not consider it in his decision-making process Figure 2 Pollution and the Social Optimum Price of Aluminum Social cost Cost of pollution Supply (private cost) Optimum Equilibrium Demand (private value) 0 QOPTIMUM QMARKET Quantity of Aluminum Copyright © 2004 South-Western Figure 3 Education and the Social Optimum Price of Education Supply (private cost) Social value Demand (private value) 0 QMARKET QOPTIMUM Quantity of Education Copyright © 2004 South-Western Market Failure Public Goods: Defined by non-rivalrous consumption and non-excludability Non-rivalrous consumption: Good or service can be used by one person without detracting from the ability of other to use it Non-excludability: Impossible or impractical to exclude some people from enjoying the benefits of a good service, even if they are unwilling to pay for it Topics Budgets especially revenue sources, – Especially taxes Guidelines for Evaluating Taxes Equity: Progressive / Regressive Taxes The Tax Wedge, Elasticity, and Incidence Guidelines for Evaluating Taxes Ease of Administration Equity 1. Ability to pay (progressivity vs. regressivity) 2. Benefit principle of taxation Efficiency 1. Effect on social surplus (welfare) 2. Ability to raise revenue Tax Equity Progressive: Burden of tax increases w/ income. Higher inc households spend a greater percentage of their income on the tax than lower income households. Regressive: Burden of tax decreases w/ income . Higher inc households spend a smaller percentage of their income on the tax than lower income households Proportionate: Burden of the tax remains the same over all levels of income Major State and Local Taxes as Percent of Income for Family of Four $ Income Property Sales Auto/Gas 25,000 $ 1.28% 3.46% 1.84% 0.89% 50,000 3.10% 3.60% 1.75% 0.50% Income Level $ 75,000 $ 3.75% 3.67% 1.75% 0.61% 100,000 $ 4.17% 3.53% 1.66% 0.60% 150,000 4.61% 3.40% 1.57% 0.43% Source: District of Columbia Office of Revenue Analysis. (2004). Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison. The Efficiency Effects of a Tax Price Supply Price buyers pay Size of tax Price without tax Price sellers receive Demand 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western The Effects of a Tax Levied on Sellers Price P* + t Size of tax Supply (MC) P* Demand 0 Q* Quantity Copyright © 2004 South-Western The Effects of a Tax Levied on Sellers Price Supply (MC) Price buyers pay Size of tax Price without tax Price sellers receive Demand (MB) 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western The Effects of a Tax Levied on Buyers Price Supply (MC) P* Size of tax P* - t Demand 0 Q* Quantity Copyright © 2004 South-Western The Effects of a Tax Levied on Buyers Price Supply (MC) Price buyers pay Size of tax Price without tax Price sellers receive Demand Demand (MB) 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western The Efficiency Effects of a Tax Price Supply (MC) Price buyers pay Size of tax Price without tax Price sellers receive Demand 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western Tax Incidence The party that actually pays the tax to the government (whether that is the seller or buyer) can pass part of that tax forward to consumer, or backward to the producer. The party that the tax is shifted to bears the tax incidence The incidence depends on price elasticity of supply and demand Elasticity The incidence of taxation, the amount of deadweight loss caused by a tax, and the amount of revenue raised by a tax all depend on how responsive the quantity supplied and quantity demanded are to changes in price The Efficiency Effects of a Tax Price Supply (MC) Price buyers pay Size of tax Price without tax Price sellers receive Demand 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western The Efficiency Effects of a Tax Price MC Size of tax 2.50 Supply (MC) Size of tax 2.00 1.50 Demand 0 Quantity Copyright © 2004 South-Western Tax Incidence and Elasticities Inelastic Demand Price Supply 2.75 Size of tax Size of tax 2.00 1.75 Demand 0 Quantity Copyright © 2004 South-Western Tax Incidence and Elasticities Elastic Demand Price Supply 2.25 2.00 Size of tax Size of tax Demand 1.25 0 Quantity Copyright © 2004 South-Western Tax Incidence and Elasticities Inelastic Supply Price Supply Size of tax Demand 0 Quantity Copyright © 2004 South-Western Tax Incidence and Elasticities Elastic Supply Price Size of tax Supply Demand 0 Quantity Copyright © 2004 South-Western Tax Distortions and Elasticities (c) Inelastic Demand Price Supply Size of tax When demand is relatively inelastic, the deadweight loss of a tax is small. Demand 0 Quantity Copyright © 2004 South-Western Tax Distortions and Elasticities (d) Elastic Demand Price Supply Size of tax Demand When demand is relatively elastic, the deadweight loss of a tax is large. 0 Quantity Copyright © 2004 South-Western Tax Distortions and Elasticities (a) Inelastic Supply Price Supply When supply is relatively inelastic, the deadweight loss of a tax is small. Size of tax Demand 0 Quantity Copyright © 2004 South-Western Tax Distortions and Elasticities (b) Elastic Supply Price When supply is relatively elastic, the deadweight loss of a tax is large. Size of tax Supply Demand 0 Quantity Copyright © 2004 South-Western Corrective Tax (negative externalities) (Social MC) Price Size of tax Supply (Pvt MC) P* P Demand (MB) 0 Q* Q Quantity Copyright © 2004 South-Western The Effects of a Tax on Social Surplus Price Supply Price without tax Demand 0 Quantity without tax Quantity Copyright © 2004 South-Western The Effects of a Tax on Social Surplus Price Supply Price buyers pay Size of tax (T) Tax revenue (T × Q) Price sellers receive Demand 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western Deadweight Loss and Tax Revenue from Three Taxes of Different Sizes (a) Small Tax Price Deadweight loss Supply PB Tax revenue PS Demand 0 Q2 Q1 Quantity Copyright © 2004 South-Western Deadweight Loss and Tax Revenue from Three Taxes of Different Sizes (b) Medium Tax Price Deadweight loss PB Supply Tax revenue PS 0 Demand Q2 Q1 Quantity Copyright © 2004 South-Western Deadweight Loss and Tax Revenue from Three Taxes of Different Sizes (c) Large Tax Price PB Tax revenue Deadweight loss Supply Demand PS 0 Q2 Q1 Quantity Copyright © 2004 South-Western Sprawl Traits 1. 2. 3. 4. 5. 6. 7. Unlimited outward extension of development Low-density residential/comm. development Widespread strip commercial Leapfrog development Auto dependence (private auto) Segregation of land uses by zones Reliance on trickle down or filtering process to provide housing to low income HH 8. Lack of centralized control of land uses 9. Fragmentation of power over land use (many localities) 10. Great fiscal disparity among localities Burchell, Robert. (1998) The Costs of Sprawl – Revisited. Transportation Cooperative Research Program Report 39. Washington, DC: National Academy Press.