Midwestern Actuarial Forum Fall 2003 Medical Malpractice: State Of The Line

advertisement

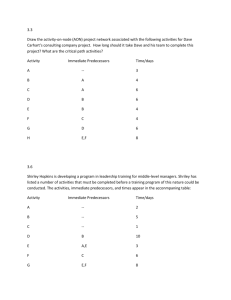

Midwestern Actuarial Forum Fall 2003 September 24, 2003 Medical Malpractice: State Of The Line Brian Alvers, ACAS, MAAA Aon Re Services Agenda Business Climate And Liability Tort Reform Section 1 Industry Analysis Section 2 Reinsurance And DFA Considerations Section 3 Section 1 Business Climate And Liability Tort Reform Medical Malpractice Crisis Insurers Increasing Loss Costs Inadequate Loss Reserves Poor Investment Results Hardened Reinsurance Market Insureds Availability Problems Affordability Problems Aon Re Inc. Copyright 2003 1 Insurer Actions Taken Base Rate Increases Reduction Of Schedule Credits Reduction Of Other Discounts (e.g., Claims-Free) Reduction In Limits Offered Increase In SIRs For Excess Business Exit States/Territories With Poor Experience Exit Line Of Business Aon Re Inc. Copyright 2003 2 Insured Actions Taken Physician Owned/Operated Insurers Self-Insurance, Captives Limit Services Retire Early Move To Other State/Territory Practice Defensive Medicine Aon Re Inc. Copyright 2003 3 Medical Malpractice Business Climate Year 2002 In Crisis Crisis Brewing No Crisis Source: AMA Member Communications - July 17, 2002 Aon Re Inc. Copyright 2003 4 Medical Malpractice Business Climate Year 2003 In Crisis Crisis Brewing No Crisis Source: AMA Member Communications - July 9, 2003 Aon Re Inc. Copyright 2003 5 States Actions Taken Florida SB 2-D Passed Still Needs Governor’s Signature Michigan HB 4980 and SB 633 Proposed Texas Proposition 12 Approved Aon Re Inc. Copyright 2003 6 Florida SB 2-D Caps On Non-Economic Damages $500K From Individual Doctors/Defendants, Not To Exceed $1M From All Doctors/Defendants Regardless Of Number Of Claimants $750K For A Single Hospital, Not To Exceed $1.5M From All Hospitals $150K Cap For Emergency Room Physicians Aon Re Inc. Copyright 2003 7 Florida SB 2-D Rates Reflecting Savings Med Mal Insurance Rates Approved On Or Before 7/1/2003 Remain In Effect Until A New Rate Filing Is Made Reflecting Savings Under The New Act New Filing No Later Than 1/1/2004 The New Rate To Apply To Policies Effective Or Renewed After Effective Date Of The Act (8/14/2003) Requires Insurers To Provide A Refund Aon Re Inc. Copyright 2003 8 Michigan HB 4980 And SB 633 Identical Bills Proposed From House And Senate Make It Easier To Recover Economic And NonEconomic Damages Based On “Loss Of Opportunity” Currently, Recovery Can Not Be Had Unless The “Loss Of Opportunity” Is Greater Than 50% Aon Re Inc. Copyright 2003 9 Texas Proposition 12 Constitutional Amendment Capping Non-Economic Damages In Jury Awards To $250K In Cases Against Doctors And Health Care Providers Approved By A 51% To 49% Margin On 9/13/2003 Only 10% Voter Turnout Aon Re Inc. Copyright 2003 10 States With “No Crisis” California, Colorado $250K Non-Economic Damages Cap Louisiana $500K Total Damages Cap Indiana $1.25M Total Damages Cap Wisconsin $410K, $500K For Minors New Mexico $600K Cap Excluding Punitive Damages Aon Re Inc. Copyright 2003 11 States “In Crisis” FL, TX Reform Passed NY, IL, PA, NJ, GA, NC, WA, CT, KY, OR, AR, WY No Caps OH, WV, NV, MS Various Caps $250K to $500K Missouri $557K Cap $250K Non-Economic Damages Cap Vetoed By Governor Aon Re Inc. Copyright 2003 12 Are Caps The Answer? Weiss Ratings, Inc. (www.WeissRatings.com) No Far More Important Factors Median Annual Payment Up More In States With Caps (48.2% Versus 35.9% From 1991 To 2002) The PIAA (www.thepiaa.org) Says Weiss Makes Numerous Errors In Assumptions Total Claim Payouts Increased 52.8% In Cap States Versus 100.1% In Non-Cap States Aon Re Inc. Copyright 2003 13 Are Caps The Answer? GAO Report (GAO-03-702) Losses Appear To Be Primary Driver Of Medical Malpractice Rate Increases No Clear Policy Recommendations Other Factors Cause Increases Lack Of Comprehensive Data Aon Re Inc. Copyright 2003 Especially Economic Versus Non-Economic 14 Are Caps The Answer? Caps May Precipitate More Doctors Being Named In Suits To Obtain Multiple Recoveries Reinsurers Not Factoring In Reduction In Claim Cost Just Too Early To Tell Little Impact On Modeling For A Couple Of Years Same True For Many Insurers Aon Re Inc. Copyright 2003 15 Section 2 Industry Data Analysis Industry Data Analysis Industry 2002 Schedule P (OneSource) Parts 1-4F Sections 1 (Claims-Made) And 2 (Occurrence) Develop Industry Losses And DCC To Ultimate Use Paid, Incurred Loss Development Methods Compare Ultimate Losses To Earned Premium Aon Re Inc. Copyright 2003 16 Industry Loss and DCC Ratio 140% Loss and DCC Ratio 130% 120% 110% 100% 90% 80% 1992 Aon Re Inc. Copyright 2003 1994 1996 1998 2000 2002 17 Industry Loss and DCC Ratio Exposure Number Of Licensed Physicians Pros: Easy To Get (Medical Marketing Services, Inc.) Reasonable Estimate Of Exposure Cons: Aon Re Inc. Copyright 2003 What About Hospitals? What About Tail And DDR? What About Trend To Self-Insurance? 18 Industry Loss and DCC Ratio 140% $ Per Physician 11,000 130% Loss and DCC Ratio 10,000 120% Loss Per Physician 9,000 110% 8,000 100% 7,000 6,000 5,000 1992 Aon Re Inc. Copyright 2003 Premium Per Physician 90% Loss and Loss Expense Ratio 12,000 80% 1994 1996 1998 2000 2002 19 Industry Loss and DCC Ratio 1994 – 1998 Loss Per Physician Increased 36% Premium Per Physician Decreased 4% Exponential Trend In Losses Per Physician Trend Rate = 6.82% 2 R = 98.4% Actual Trend Rate Higher, As Denominator Is Licensed Physicians, Not Insured Physicians Generally Assume 7.5% - 10% Aon Re Inc. Copyright 2003 20 Peer Company Analysis – Top 20 Writers Capital Adequacy Company Rating Lexington Insurance Company A++ State Volunteer Mutual Insurance Co. Continental Casualty Co Truck Insurance Exchange St. Paul Fire & Marine Ins Co. NORCAL Mutual Insurance Company Evanston Insurance Co Medical Protective Company % NPW Med Mal Surplus 12/31/2001 12/31/2002 Net Leverage NPW / Surplus (NPW + Net Liab.) / Surplus 2002 BCAR 12/31/2001 12/31/2002 12/31/2001 12/31/2002 Score 16% 1,746,113 1,763,654 0.5 1.1 1.7 3.0 179.8 A A A A A A A 100% 4% 26% 3% 100% 24% 99% 137,176 4,700,064 300,614 4,142,586 268,032 230,889 408,215 129,287 5,115,932 275,557 4,925,779 222,214 313,850 401,726 0.7 0.7 2.6 1.2 0.6 1.6 0.8 1.0 1.4 2.7 0.9 0.8 1.8 1.3 3.8 4.3 5.7 4.3 2.7 4.7 3.2 4.7 5.3 6.6 3.3 3.3 5.0 4.7 173.1 170.5 160.1 156.8 148.0 141.8 137.1 Health Care Indemnity, Inc. American Physicians Assurance Corp Medical Assurance Company Inc Pronational Insurance Co. Doctors Company Insurance Group MAG Mutual Insurance Company AAAAAA- 100% 74% 96% 96% 97% 97% 583,763 176,819 172,841 175,874 383,965 158,558 482,536 163,466 193,335 196,955 341,412 142,978 0.4 1.1 1.0 0.8 0.8 0.7 0.7 1.4 1.2 0.8 1.2 1.0 2.4 4.6 4.7 3.9 3.0 3.0 3.3 5.4 5.1 3.8 4.5 4.3 183.9 138.8 137.6 137.6 129.6 103.5 FPIC Insurance Group B++ 89% 107,914 126,610 1.4 1.1 5.2 5.5 125.4 ISMIE Mutual Insurance Company B+ 100% 241,406 170,517 0.7 1.3 4.0 6.6 87.0 Medical Liability Mutual Insurance Co. B 96% 1,428,745 933,042 0.4 0.8 2.6 4.8 71.2 Princeton Insurance Company B- 64% 141,602 107,239 1.7 1.1 7.3 9.7 73.3 MCIC VT Inc RRG Physicians Reciprocal Insurers NR-1 NR-4 96% 99% 10,114 68,559 10,352 73,110 2.0 2.0 2.4 2.1 13.1 12.2 Source: AM Best And The National Association Of Insurance Commissioners Aon Re Inc. Copyright 2003 21 Peer Company Analysis – Top 20 Writers Earnings Adequacy (5-Year Average) Company Rating % NPW Med Mal Pre-Tax ROR Return on PHS Combined Ratio 16% 24.4% 8.9% 97.1 Lexington Insurance Company A++ State Volunteer Mutual Insurance Co. Continental Casualty Co Truck Insurance Exchange St. Paul Fire & Marine Ins Co. NORCAL Mutual Insurance Company Evanston Insurance Co Medical Protective Company A A A A A A A 100% 4% 26% 3% 100% 24% 99% 0.0% -1.2% -6.4% 6.5% 2.1% 9.4% 15.9% 1.9% 1.0% -12.3% 10.5% -1.6% 11.6% 14.4% 134.7 123.1 108.6 117.8 122.7 98.8 106.0 Health Care Indemnity, Inc. American Physicians Assurance Corp Medical Assurance Company Inc Pronational Insurance Co. Doctors Company Insurance Group MAG Mutual Insurance Company AAAAAA- 100% 74% 96% 96% 97% 97% 9.4% -8.1% 10.4% -8.1% 0.2% 3.0% 5.4% -6.3% 5.9% 7.5% 0.8% -0.1% 114.1 126.2 111.0 134.2 115.3 120.9 FPIC Insurance Group B++ 89% 4.4% 3.1% 110.2 ISMIE Mutual Insurance Company B+ 100% 0.7% -0.9% 131.1 Medical Liability Mutual Insurance Co. B 96% -6.3% -0.8% 136.7 Princeton Insurance Company B- 64% -9.8% -9.6% 130.6 MCIC VT Inc RRG Physicians Reciprocal Insurers NR-1 NR-4 96% 99% -1.8% 5.7% 10.2% 111.7 120.8 Source: AM Best And The National Association Of Insurance Commissioners Aon Re Inc. Copyright 2003 22 Peer Company Analysis – Top 20 Writers Average Increase In Net Leverage = 28% 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 AM Best Rating A++ A Net Leverage = (NPW + Net Liabilities) / Surplus A- B++ Or Lower Year-End 2001 Year-End 2002 Source: AM Best And The National Association Of Insurance Commissioners Aon Re Inc. Copyright 2003 23 A.M. Best Capital Adequacy Issues Remaining Medical Malpractice Writers Are Capital Constrained Opportunity To Sell In Hard Market Hampered By Poor Capital Adequacy As Measured By A.M. Best Poor U/W Results Reduced Reported Surplus Net Capital Required To Support Rating Increasing Substantially Aon Re Inc. Copyright 2003 Rising Net Premiums Through Increased Market Share And Rising Rates “Excessive Growth” Compounding Increased Required Capital Assumed Reserve Deficiency 24 Section 3 Reinsurance And DFA Considerations Reinsurance Market Dynamics Past Results Reflect Inadequate Primary Rates Significant Increase In Severity And Frequency Severity Increases Have Greater Effect On Excess Reinsurers Reinsurance Market Response Reinsurers Require Projected U/W Profit 12% - 18% ROE Perform Extensive Actuarial Analysis Huge Concern Over Severity Trend, Reserves Restricted Capacity May Increase Rate At Renewal Despite Rate Increases And Exposure Reduction By Cedant Aon Re Inc. Copyright 2003 25 Reinsurance Market Dynamics Reinsurer Focus Points Quality Of Business Plan/Underwriting Discipline Purchasing Philosophy Of Buyer Cedants Extremely Leveraged Higher Primary Rates, Surplus Down Pressure On Rating (AM Best, S&P) Pressure On Capital Adequacy (BCAR, S&P CAR, RBC) But Reinsurers Will Not Do Quota Share Consider Non-Traditional, Structured Program, And/Or Lower Excess Of Loss Retention Aon Re Inc. Copyright 2003 26 Reinsurance Considerations In Medical Malpractice Take Into Account Effective Rate Action Not Just Base Rate Increases Change In Schedule Credits/Debits Change In Increased Limits Factors Take Into Account Changes In Exposure Limit And Attachment Profile State/Territory Mix Classification/Specialty Mix Docs: OB/GYN, Cardiac Surgeons, Neurosurgeons Hospitals: Teaching Versus Not, Size, Rural/Urban Coverage Not Just Per Claim (Per Doctor) Watch Out For Clash, ECO/XPL Aon Re Inc. Copyright 2003 27 DFA Considerations In Medical Malpractice Split ALAE Only From Indemnity And ALAE Claims Could Be 80/20 Split Lognormal Works Very Well For Severity Both Indemnity And ALAE Watch For Clustering Correlation Indemnity And Settlement Lag Indemnity And ALAE Don’t Forget Parameter Uncertainty Coefficient Of Variation Worst Of All 10-Year Schedule P Lines Aon Re Inc. Copyright 2003 28