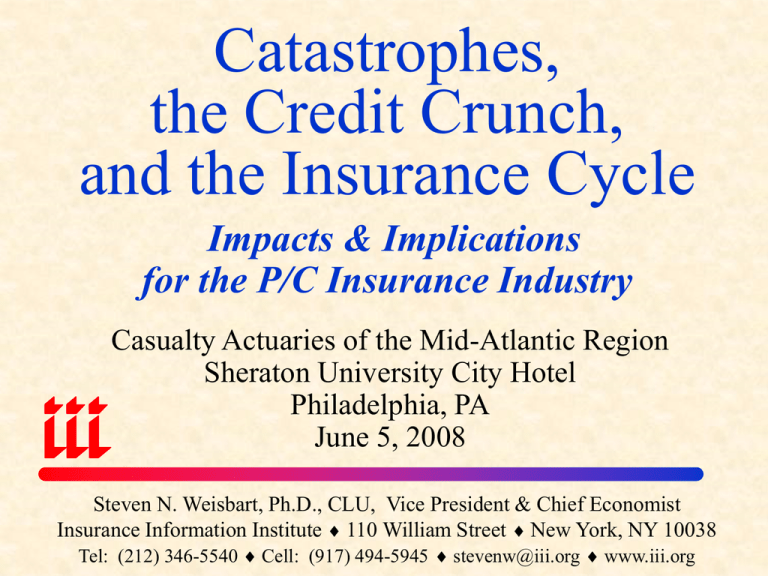

Catastrophes, the Credit Crunch, and the Insurance Cycle Impacts & Implications

advertisement

Catastrophes, the Credit Crunch, and the Insurance Cycle Impacts & Implications for the P/C Insurance Industry Casualty Actuaries of the Mid-Atlantic Region Sheraton University City Hotel Philadelphia, PA June 5, 2008 Steven N. Weisbart, Ph.D., CLU, Vice President & Chief Economist Insurance Information Institute 110 William Street New York, NY 10038 Tel: (212) 346-5540 Cell: (917) 494-5945 stevenw@iii.org www.iii.org The Weakening Economy and the Credit Crunch Real Annual GDP Growth, 2000-2009F Blue bars are actual; Yellow bars are forecasts 4.0% 3.7% 3.5% March 2001November 2001 recession Recession? 3.6% 3.1% 2.9% 3.0% 2.5% 2.5% 2.2% 2.2% 2.0% 1.6% 1.4% 1.5% 1.0% 0.8% 0.5% 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 0.0% Sources: US Department of Commerce, Blue Economic Indicators 4/08; Insurance Information Institute. Real Quarterly GDP Growth, 2005-2009F Red bars are actual, seasonally adjusted; Yellow bars are forecasts 5.5% 3 Major hurricanes 5.0% 4.8% Recession? 4.9% 4.5% 4.5% 4.0% 3.8% 3.5%3.6% 3.5% 3.1% 2.8% 2.5% 3.0% 2.8%2.9% 2.6% 2.4% 2.5% 2.1% 2.1% 1.9%2.0% 2.0% 1.5% 1.2% 1.1% 1.0% 0.9% 0.6% 0.6% 0.5% 0.1% Sources: US Department of Commerce; Blue Economic Indicators 4/08; Insurance Information Institute. 09:4Q 09:3Q 09:2Q 09:1Q 08:4Q 08:3Q 08:2Q 08:1Q 07:4Q 07:3Q 07:2Q 07:1Q 06:4Q 06:3Q 06:2Q 06:1Q 05:4Q 05:3Q 05:2Q 05:1Q 04:4Q 04:3Q 04:2Q 0.0% Case-Schiller Home Price Index Monthly: 20 City Composite (Jan 2000=100) 210 200 190 180 170 160 150 140 130 120 110 100 Peak in July 2006 at 206.52. Home prices more than doubled between January 2000 and July 2006 Home prices are now about where they were in Oct 2004 Source: http://www2.standardandpoors.com/spf/pdf/index/CSHomePrice_History_052703.xls Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 March 2008 index value was 172.16: home prices were 16.6% below their July 2006 peak 1.0 1.56 1.54 1.71 1.60 1.51 1.45 1.38 1.10 1.47 1.36 0.98 1.1 1.01 1.2 1.19 1.3 1.20 1.4 1.29 1.5 1.35 1.46 1.6 1.48 1.7 1.57 1.62 1.8 1.64 1.9 1.80 1.85 2.0 2008 vs. 2005 net premium loss is $954 million (I.I.I. est). 2.07 2.1 I.I.I. estimate: 100,000 housing starts = $87.5 million in gross premium. 1.96 New Private Housing Starts, 1990-2014F (Millions of Units) 0.9 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08F 09F 10F 11F 12F 13F 14F Source: US Department of Commerce; Blue Chip Economic Indicators (10/07), except 2008/09 figures from 4/08 edition of BCEI; Insurance Info. Institute Housing Starts, Annual Data The slump is in single-family housing. Starts of multi-family buildings have held at 310,000 to 350,000 units each year. Thousands of Units units in multi-family buildings single family units 2,100 1,800 1716 1611 1499 1465 1046 900 1273 1,200 1359 1,500 346 349 343 332 336 309 161 67 300 329 600 2001 2002 2003 2004 2005 2006 2007 2008:Q1 0 Source: US Census Bureau Quarterly Housing Starts The slump is in single-family housing. Starts of multi-family buildings have held at 70,000 to 90,000 units each quarter. 265 161 188 260 278 333 372 67 84 85 77 62 80 85 88 82 433 382 97 85 471 91 79 485.00 369.00 90 92 370.00 440.00 84 71 84 99 95 80 456 345 377 412 406 304 84 98 2008:Q1 2007:Q4 2007:Q3 2007:Q2 2007:Q1 2006:Q4 2006:Q3 2006:Q2 2006:Q1 2005:Q4 2005:Q3 2005:Q2 2005:Q1 2004:Q4 2004:Q3 2004:Q2 2004:Q1 2003:Q4 2003:Q3 2003:Q2 2003:Q1 2002:Q4 2002:Q3 2002:Q2 2002:Q1 2001:Q4 2001:Q3 2001:Q2 2001:Q1 Source: US Census Bureau 319 361 89 76 386 293 81 88 87 74 0 392 100 285 341 274 200 374 300 single family units units in multi-family buildings Thousands of Units 600 500 400 Homeowner Vacancy Rates, Quarterly, 1990-2008:Q1 July 1990March 1991 recession 3.0% March 2001November 2001 recession 2.5% 2.0% 1.5% Vacancy rates began rising in 2005:Q3 Source: U.S. Census Bureau, http://www.census.gov/hhes/www/housing/hvs/qtr108/q108tab1.html 2008:Q1 2007:Q2 2006:Q3 2005:Q4 2005:Q1 2004:Q2 2003:Q3 2002:Q4 2002:Q1 2001:Q2 2000:Q3 1999:Q4 1999:Q1 1998:Q2 1997:Q3 1996:Q4 1996:Q1 1995:Q2 1994:Q3 1993:Q4 1993:Q1 1992:Q2 1991:Q3 1990:Q4 1990:Q1 1.0% Rental Vacancy Rates, Quarterly, 1990-2008:Q1 March 2001November 2001 recession July 1990March 1991 recession 10.5% 10.0% 9.5% 9.0% 8.5% 8.0% 7.5% Source: U.S. Census Bureau, http://www.census.gov/hhes/www/housing/hvs/qtr108/q108tab1.html 2008:Q1 2007:Q2 2006:Q3 2005:Q4 2005:Q1 2004:Q2 2002:Q4 2002:Q1 2001:Q2 2000:Q3 1999:Q4 1999:Q1 1998:Q2 1997:Q3 1996:Q4 1996:Q1 1995:Q2 1994:Q3 1993:Q4 1993:Q1 1992:Q2 1991:Q3 1990:Q4 6.5% 1990:Q1 7.0% 2003:Q3 Vacancy rates began falling in 2004:Q2 Auto/Light Truck Sales, 1999-2014F (Millions of Units) 18.0 17.5 Weakening economy, credit crunch, high gas prices hurt auto sales 2008 vs. 2005: -8.3% 17.8 17.5 17.4 17.1 16.9 16.9 17.0 16.6 16.9 16.8 16.6 16.7 16.5 16.5 16.4 16.1 16.0 15.7 15.5 15.3 Falling auto sales will have a smaller effect on auto insurance exposure growth than problems in the housing market will on home insurers 15.0 14.5 14.0 99 00 01 02 03 04 05 06 07 08F 09F 10F 11F 12F 13F 14F Source: US Department of Commerce; Blue Chip Economic Indicators (10/07), except 2008/09 figures from 3/08 edition of BCEI; Insurance Info. Institute Do Increases in Gas Prices Affect Auto Collision Claim Frequency? Paid Claim Frequency = (No. of paid claims)/(Earned Car Years) x 100 Collision Claim Frequency Gas Prices $3.00 $2.50 6.5 $2.00 $1.50 6.0 $1.00 5.5 $0.50 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Sources: Energy Information Administration (http://tonto.eia.doe.gov/dnav/pet/hist/mg_tt_usA.htm); ISO Fast Track Monitoring System, Private Passenger Automobile Fast Track Data: Fourth Quarter 2007, published March 31, 2008 and earlier reports. Avg Gas Price/Gal Paid Claim Freq 7.0 Do Changes in Miles Driven Affect Auto Collision Claim Frequency? Paid Claim Frequency = (No. of paid claims)/(Earned Car Years) x 100 Collision Claim Frequency Billions of Vehicle Miles 7.0 3100 2900 6.5 2800 2700 6.0 2600 Billions of Miles Driven Paid Claim Freq 3000 2500 5.5 2400 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Sources: Federal Highway Administration (http://www.fhwa.dot.gov/ohim/tvtw/08martvt/08martvt.pdf; ISO Fast Track Monitoring System, Private Passenger Automobile Fast Track Data: Fourth Quarter 2007, published March 31, 2008 and earlier reports. Miles Driven vs. Gas Prices in Recent Months Miles Driven Miles Driven Gas Price/ Gallon Gas Prices 280,000 $3.40 270,000 $3.20 260,000 $3.00 250,000 $2.80 240,000 $2.60 230,000 $2.40 220,000 210,000 $2.20 200,000 $2.00 Jan Feb 2007 Mar April May June July Aug Sept Oct Nov Dec Jan Feb March 2008 Sources: Energy Information Administration (http://tonto.eia.doe.gov/dnav/pet/hist/mg_tt_usA.htm); Federal Highway Administration (http://www.fhwa.dot.gov/ohim/tvtw/08martvt/08martvt.pdf; . Inflation Rate (CPI-U), % Change from Prior Quarter, Annualized 6% Inflation is up again. Medical cost inflation, important in WC, auto 5.1% liability and other casualty 4.1% covers is running far ahead of overall inflation. 5.5% 5.1% 4.6% 5% 3.8% 4% 3% 3.8% 3.3% 2.3% 3.0% 2.7% 2.6% 2.5%2.6% 2.3%2.3%2.3% 2.2% 1.8% 2% 1% -2.0% 0% 09:Q4 09:Q3 09:Q2 09:Q1 08:Q4 08:Q3 08:Q2 08:Q1 07:Q4 07:Q3 07:Q2 07:Q1 06:Q4 06:Q3 06:Q2 06:Q1 05:Q4 05:Q3 05:Q2 05:Q1 -1% -2% -3% Source: US Bureau of Labor Statistics; Blue Chip Economic Indicators, Apr. 10, 2008; Ins. Info. Institute. US Unemployment Rate, (2007:Q1 to 2009:Q4F) 6.0% Higher unemployment rate reduces workers comp exposure; could signal a temporary claim frequency surge 5.5% Blue bars are actual; Yellow bars are forecasts 5.4% 4.6% 4.8% 4.7% 4.5% 4.5% 4.5% 5.6% 5.5% 5.5% 5.2% 5.0% 4.7% 5.5% 5.5% 4.9% 4.6% 4.5% 4.0% 3.5% 3.0% 06:Q1 06:Q2 06:Q3 06:Q4 07:Q1 07:Q2 07:Q3 07:Q4 08:Q1 08:Q2 08:Q3 08:Q4 09:Q1 09:Q2 09:Q3 09:Q4 Sources: US Bureau of Labor Statistics; Blue Chip Economic Indicators (4/08); Insurance Info. Inst. Implications for the P/C Insurance Industry 5% 0% -5% -10% 6% 4% 5.2% 78 -0.9% 79 80-7.4% 81 -6.5% -1.5% 82 1.8% 83 4.3% 84 85 86 5.8% 87 0.3% 88 -1.6% 89 -1.0% 90 -1.8% 91 -1.0% 92 3.1% 93 1.1% 94 0.8% 95 0.4% 96 0.6% 97 -0.4% 98 -0.3% 99 1.6% 00 5.6% 01 02 7.7% 03 1.2% 04 -2.9% 05 -0.5% 06 -2.9% 07 -2.7% 08F Real NWP Growth 15% 10% 8% Real NWP Growth Real GDP 2% 0% -2% -4% Sources: A.M. Best, US Bureau of Economic Analysis, Blue Chip Economic Indicators, 4/08; I.I.I. Real GDP Growth 20% P/C insurance industry’s growth is influenced modestly by growth in the overall economy 13.7% 25% 18.6% 20.3% Real GDP Growth vs. Real P/C Premium Growth: Modest Association Wage & Salary Disbursements (Payroll Base) vs. Workers Comp Net Written Premiums Wage & Salary Disbursement (Private Employment) vs. WC NWP $ Billions $ Billions 7/90-3/91 $7,000 $6,000 3/01-11/01 Wage & Salary Disbursements WC NPW $45 $40 $35 $5,000 $30 $4,000 $3,000 $2,000 Shaded areas indicate recessions $1,000 Weakening wage and salary growth is expected to cause a deceleration in workers comp exposure growth $25 $20 $15 $10 $5 $0 $0 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07* *As of 7/1/07 (latest available). Source: US Bureau of Economic Analysis; Federal Reserve Bank of St. Louis at http://research.stlouisfed.org/fred2/series/WASCUR; I.I.I. Fact Books What’s Being Done to “Fix” the Economy? “Fix” Fed Rate Cuts $168 Billion Stimulus Package Bear Stearns Bailout Effect on Insurers Might reduce yields on new bond investments, but Might also raise asset value of existing bonds (6580% of portfolio) In the longer run, might contribute to inflation Hope is that plan boosts overall economic activity and employment (by 500,000 jobs) and therefore might support p/c personal and commercial exposures But plan contributes to already-large federal budget deficits; Washington might hike taxes No direct effect, but tighter regulation of banks and hedge funds seems likely. Will it be the stimulus for a financial regulatory structure that includes insurers, too? Summary of Economic Risks and Implications for (Re) Insurers Economic Concern Subprime Meltdown/ Credit Crunch Housing Slump Lower Interest Rates Stock Market Slump General Economic Slowdown/Recession Risks to Insurers •Some insurers have some asset risk •D&O/E&O exposure for some insurers •Client asset management liability for some •Bond insurer problems; Muni credit quality •Reduced exposure growth •Deteriorating loss performance on neglected, abandoned and foreclosed properties •Lower investment income •Decreased capital gains (often relied upon more heavily as a source of earnings as underwriting results deteriorate) •Reduced commercial lines exposure growth •Surety slump •Increased workers comp frequency Post-Crunch: Four Fundamental Issues To Be Examined Globally Post-Crunch: Fundamental Issues To Be Examined Globally • Effectiveness and Nature of Regulation What sort of oversight is optimal given recent experience? Credit problems arose under both US and European (Basel II) regulatory regimes Will new regulations be globally consistent? Can overreactions be avoided? Capital adequacy & liquidity • Ratings on Financial Instruments New approaches to reflect type of asset, nature of risk Source: Insurance Information Institute 2 More Fundamental Issues To Be Examined Globally • Adequacy of Risk Management at Financial Institutions Worldwide Colossal failure of risk management (and regulation) Implications for ERM? Includes review of incentives • Accounting Rules Problems arose under FAS, IAS Asset Valuation, including Mark-to-Market Structured Finance & Complex Derivatives Source: Insurance Information Institute Legal Aspects of the Credit Crunch Turbulent Markets Give Rise to Lawsuits Shareholder Class Action Lawsuits* Count is current as of May 30. Suits filed/year 300 266 242 231 210 215 202 188 200 164 226 185 173 163 237 182 177 118 111 87 100 Defendants include banks, investment banks, builders, lenders, bond and mortgage insurers 0 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08* *Securities fraud suits filed in U.S. federal courts. Not included above are 313 suits (all but 1 filed in 2001) relating to IPO allocations. Source: Stanford University School of Law (http://securities.stanford.edu Origin of D&O Claims for Public Companies, 2006 40% of D&O suits originate with shareholders Competitors, 6% Customers & Clients, 4% Shareholders, 40% Employees, 25% Government, 2% Other 3rd Party, 22% Source: Tillinghast Towers-Perrin, 2006 Directors and Officers Liability Survey. Catastrophic Losses On Average, the U.S. has a $35B+ (Direct Economic Losses, 2005 $) Catastrophic Year Every 8 Years Chart shows effects of hurricanes but not other causes of catastrophic levels of property loss. $160 $160 $140 $117 $ Billions $120 $100 $84 $80 $66 $70 $66 $62 $60 $68 $52 $48 $40 $39 $40 $49 $36 $20 27 Years Sources: Source: Roger Pielke et al, “Normalized Hurricane Damage in the United States: 1900-2005,” Natural Hazards Review, Vol. 9, No. 1 (February 1, 2008), pp. 29-41; Bonnie Cavanaugh, “A Century of Aftershocks,” Best’s Review, April 2006, pp. 24-31. 2007 2003 1999 1995 1991 1987 1983 1979 1975 1971 1967 1963 1959 1955 1951 1947 1943 1939 1935 1931 1927 1923 1919 1915 1911 1907 1903 1899 $0 Largest Insured Losses (Adjusted to 2005 Exposure Levels) from 10 Hurricanes With continued coastal development, $35B+ storms will be more common. $80 $41 $33 $34 $35 $26 ur au r( de 19 rd 45 ale ,F L) Hu rr (1 94 7, D FL o O nn ) ke a( ec 19 ho 60 be , eH FL ur ) r( 19 G 28 alv , FL es to ) n (1 90 0, Be TX sts ) y (1 LI 96 5, Ex LA pr es ) s( 19 38 K ,N atr Y in ) a( 20 05 , A LA nd re )* w (1 99 M 2, ia m FL iH )* ur r( 19 26 ,F L) $20 $24 $33 $42 Ft .L H om es te ad H $ Billions $90 $80 $70 $60 $50 $40 $30 $20 $10 $0 Source: AIR Worldwide **ISO/PCS estimate as of June 8, 2006 32 Insured Losses (adjusted to 2005 exposure levels) from 10 Most Damaging US Earthquakes $120 $100 With development along major fault lines, the threat of $30B+ quakes looms large 3 of the Top 10 are not West Coast events $108 $88 $ Billions $80 $60 $38 $40 $20 $25 $9 $11 $11 $12 $27 $16 Sa n Jo se ,C A Po (7 rtl -1 an -1 d, 91 O 1; R 6. ( Sa 6) 8n 1 2Fr 18 an 77 c isc M ;6 ar o .3 ke (6 ) -1 d -1 Tr 83 ee 8; , A N 7. R or 2) (1 th rid -5 -1 ge 84 ,C 3; A H 6. ay (1 5) wa -1 7rd 19 ,C 94 A ;6 ( 10 Ft .7 .T ) -2 1ej 18 on 68 ,C ;6 Ch A .8 ar (1 ) le 9 sto -1 85 n, N 7; SC ew 7. (8 9) M 3ad 18 rid 86 ,M ;7 O Sa .3 (2 )* n -7 Fr -1 an 81 ci 2; sc o 7. (4 7) -1 * 819 06 ;7 .9 ) $0 Source: AIR Worldwide Number of Tornadoes, 1985 – 2007 2,000 1819 There are usually more than 1,000 confirmed tornadoes each year in the US. They accounted for about 25% of catastrophe losses since 1985. 1106 1093 06 07 1264 941 1216 1345 1071 1148 97 1424 1173 96 1234 1082 1132 91 856 702 656 765 800 684 1,000 1133 1,200 1990 1,400 1173 1297 1,600 1376 1,800 Sources: US Dept. of Commerce, Storm Prediction Center, National Weather Service, at http://www.spc.noaa.gov/climo/torn/monthlytornstats.pdf 2005 04 03 02 01 2000 99 98 1995 94 93 92 89 88 87 86 1985 600 Top Five Catastrophic Wildland Fires In California, 1970-2007* Insured Losses (Billions 2006 $) Oct. 20-21, 1991: Oakland, Alameda Cos., CA $2.5 Oct. 2007: Southern CA Fires* $1.6 Oct. 25-Nov. 4, 2003: San Diego Co., CA, "Cedar" $1.2 Oct. 25-Nov. 3, 2003 San Bernardino County, CA, "Old" $1.1 Nov. 2-3, 1993: Los Angeles Co., CA $0.5 Oct. 27-28, 1993: Orange Co., CA $0.5 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 *Estimated insured losses. Adjusted to 2006 dollars by the Insurance Information Institute. 2007 fire losses are stated in 2007 dollars. Source: ISO's Property Claim Services Unit; Insurance Information Institute. Global Insured Catastrophe Losses by Region, Excluding U.S.,2001-2007 $20 $18 $16 $14 Seas/Space Africa Oceania/Australia South America Asia Europe $12 $10 $8 $6 $4 $2 $0 2001 2002 2003 2004 2005 2006 Sources: Insurance Information Institute compiled from Swiss Re sigma issues. 2007 Don’t Overlook the Catastrophes that Didn’t Happen (or Haven’t Yet) • In 2007 two Category 5 storms struck the Gulf of Mexico Luckily for the U.S., neither made landfall here Unluckily for Mexico, both made landfall there. • Stephen Flynn’s The Edge of Disaster • Nassim Taleb’s Fooled by Randomness and The Black Swan U.S. Insured Catastrophe Losses* 2004 and 2005 remind us that it’s possible to suffer damage from more than one hurricane and/or other catastrophe in a year. 2007 (in Mexico) reminds us that it’s possible to have two CAT-5 storms in one year. $80 $100.0 $100 Is a $100 Billion CAT year coming soon? $61.9 $ Billions $120 $6.5 $27.5 $9.2 $5.9 01 02 $12.9 $26.5 $4.6 $8.3 99 00 $10.1 $2.6 $7.4 $5.5 92 93 $8.3 $4.7 $2.7 90 91 $20 $7.5 $40 $16.9 $22.9 $60 20?? 06 07 04 05 03 97 98 95 96 94 89 $0 *Excludes $4B-$6b offshore energy losses from Hurricanes Katrina & Rita. Note: 2001 figure includes $20.3B for 9/11 losses reported through 12/31/01. Includes only business and personal property claims, business interruption and auto claims. Non-prop/BI losses = $12.2B. Source: Property Claims Service/ISO; Insurance Information Institute Inflation-Adjusted U.S. Insured Catastrophe Losses By Cause of Loss, 1987-2006¹ Fire, $6.6 , 2.2% Civil Disorders, $1.1 , 0.4% Wind/Hail/Flood, $9.3 , 3.1% Earthquakes, $19.1 , 6.4% Winter Storms, $23.1 , 7.8% Terrorism, $22.3 , 7.5% Water Damage, $0.4 , 0.1% Utility Disruption, $0.2 , 0.1% Tornadoes, $77.3 , 26.0% Insured disaster losses totaled $297.3 billion from 1987-2006 (in 2006 dollars). Wildfires accounted for approximately $6.6 billion of these—2.2% of the total. All Tropical Cyclones, $137.7 , 46.3% 1 Catastrophes are all events causing direct insured losses to property of $25 million or more in 2006 dollars. Catastrophe threshold changed from $5 million to $25 million beginning in 1997. Adjusted for inflation by the III. 2 Excludes snow. 3 Includes hurricanes and tropical storms. 4 Includes other geologic events such as volcanic eruptions and other earth movement. 5 Does not include flood damage covered by the federally administered National Flood Insurance Program. 6 Includes wildland fires. Source: Insurance Services Office (ISO).. The 2008 Hurricane Season: Is a Bad Year in the Forecast? Number of Major (Category 3, 4, 5) Hurricanes Striking the US by Decade Mid 1920s – mid-1960s: AMO Warm Phase Mid-1990s – 2030s? AMO Warm Phase 9 8 8 6 8 4 6 6 5 5 4 6 10 10 Already as many major storms in 2000-2007 as in all of the 1990s 1900s 1910s 1920s 1930s 1940s 1950s 1960s 1970s 1980s 1990s 2000s 2010s 2020s *Figure for 2000s is extrapolated based on data for 2000-2007 (6 major storms: Charley, Ivan, Jeanne (2004) & Katrina, Rita, Wilma (2005)). Source: Tillinghast from National Hurricane Center: http://www.nhc.noaa.gov/pastint.shtm. Atlantic Sea Surface Temperatures, 1948-2007 Source: AIR web site, http://www.air-worldwide.com/_public/html/air_currentsitem.asp?ID=1364 Outlook for 2008 Hurricane Season: 60% Worse Than Average Average* 2005 2008F 9.6 49.1 5.9 24.5 2.3 28 115.5 14 47.5 7 15 80 8 40 4 5 7 9 Accumulated Cyclone Energy 96.2 248 150 Net Tropical Cyclone Activity 100% 275% 160% Named Storms Named Storm Days Hurricanes Hurricane Days Intense Hurricanes Intense Hurricane Days *Average over the period 1950-2000. Source: Philip Klotzbach and Dr. William Gray, Colorado State University, April 9, 2008. Major Hurricanes Might Form But Not Make Landfall • From Hurricane Irene in 1999 to Hurricane Lili in 2002, 21 consecutive hurricanes developed in the Atlantic basin without a single U.S. landfall. • “This is how nature sometimes works.” From 1966 to 2003, of 79 major (3-4-5) hurricanes, 19 (24%) made landfall. During 2004-5, 7 of 13 (54%) major hurricanes made landfall During 2006-7, 0 of 4 (0%) major hurricanes made landfall Source: Philip Klotzbach and William Gray, “Extended Range Forecast of Atlantic Seasonal Hurricane Activity and U.S. Landfall Strike Probability for 2008,” Department of Atmospheric Science, Colorado State University, April 9, 2008, p. 27. Catastrophe Litigation P/C Insurers Have Won Virtually Every Major Post-Katrina Case • Most cases centered on validity of flood exclusion and various wind vs. water theories • The victories in court came at a high public relations cost Post-Katrina litigation was dragged out over a 2+-year period accounting for the vast majority of negative press in the first 16 months after the storm While the industry was successful at explaining the rationale for pursuing most cases, it struggled with the classic David vs. Goliath story • The hostile stories feed “Insurance Hoax” genre of stories View that insurers systematically deny, delay and lowball Bad Faith litigation might be wave of future (e.g., LA AG suit) • FL significantly added to negative press in 2007 • Exacerbated by hundreds of thousands of nonrenewals Flood Insurance People Buy It After a Flood… but Just for a Year or Two Number of New NFIP Flood Policies in the Gulf States Since Katrina* 300,000 272,338 250,000 200,000 150,000 The number of flood insurance policies sold in the Gulf states in the 2 years following Katrina increased by 618,335 or 21.6% 187,799 111,984 100,000 50,000 34,683 11,531 0 Alabama Florida *Change from July 2005 through August 2007. Sources: NFIP ; Insurance Information Institute. Louisiana Mississippi Texas Percent Growth of NFIP Flood Policies in Gulf States Since Katrina* 90% 80% 70% 60% The number of flood insurance policies sold in the Gulf states in the 2 years following Katrina increased by 21.6% 80.24% 50% 40.54% 40% 30% 29.04% 26.69% 21.62% 14.15% 20% 10% 0% Alabama Florida Louisiana Mississippi *Change from July 2005 through August 2007. Sources: NFIP ; Insurance Information Institute. Texas Total Gulf States Percentage of NFIP Flood Policies Issued Since Katrina That Are Not Renewed* 35% 32% 30% 25% Flood policy nonrenewal rates in Gulf states are surprisingly high 25% 23% 20% 17% 19% 15% 8.6% 10% 5% 0% Alabama Florida Louisiana Mississippi Texas US** *Policies issued since July 2005 as of August 2007. **US figure is nonrenewal rate for all policies in force, average over 12 month period ending August 2007. Sources: NFIP ; Insurance Information Institute. What Could Happen in the Mid-Atlantic States? Nightmare Scenario: Insured Property Losses for NJ/NY CAT 3/4 Storm Insured Losses: $110B Economic Losses: $200B+ Distribution of Insured Property Losses, by State, ($ Billions) $80 $70 $60 $40 $30 $20 Total Insured Property Losses = $110B, nearly 3 times that of Hurricane Katrina $5 $4 $1 PA CT Other $0 NY Source: AIR Worldwide NJ How Much Damage Can a Mid-Atlantic Hurricane Do? Once Upon a Time … “There is a detailed record of major destruction by landfalling hurricanes [in the NJ-NY-NE region] in 1635, 1815, 1821, and 1938.” “A hurricane hitting the North does the same damage as a hit by the next higher Safir-Simpson category hurricane in the South. • The nature of northern hurricanes, and the changes they undergo as they move northward, also amplify damage. • Their radius of maximum winds increase 2-3 times over southern hurricanes. This changes increases storm surge damage along the coasts as well as the areal extent of wind damage inland.” Source: Nicholas Coch, “The Unique Damage Potential of Northern Hurricanes,” at http://gsa.confex.com/gsa/2006AM/finalprogram/abstract_108209.htm The Flood Risk in the Mid-Atlantic States: Few who live along the New Jersey Coast Have Flood Insurance Flood Insurance Penetration Rates: Top 25 Counties/Parishes in the US* JEFFERSON/LA WALTON/FL BROWARD/FL COLLIER/FL LEE/FL GALVESTON/TX GLYNN/GA ST. BERNARD/LA MIAMI-DADE/FL ORLEANS/LA CARTERET/NC ST. CHARLES/LA ST. JOHNS/FL CHARLOTTE/FL ST. TAMMANY/LA HORRY/SC INDIAN RIVER/FL BAY/FL BRUNSWICK/NC NASSAU/FL BERKELEY/SC PINELLAS/FL BRAZORIA/TX CHATHAM/GA TERREBONNE/LA 0% 84.0% 81.5% 80.0% 78.7% 77.1% 74.1% 69.6% 68.4% 68.1% 66.7% 65.9% 65.5% FL: 11 counties 62.4% LA: 6 parishes 59.0% 56.2% TX: 2 counties 51.6% GA: 2 counties 49.6% NC: 2 counties 48.0% 46.3% SC: 2 counties 44.4% MS: 0 counties 42.8% 42.8% AL: 0 counties 42.0% 41.9% 40.1% 10% 20% 30% 40% 50% 60% 70% 80% *As of 12/31/05. Source: New Orleans Times-Picayune, 3/19/06, from NFIP and US Census Bureau data. 90% 100% Flood Insurance Penetration Rates: Counties/Parishes Ranked 26-50* BALDWIN/AL SARASOTA/FL PALM BEACH/FL CHARLESTON/SC MANATEE/FL MARTIN/FL ATLANTIC/NJ LAFOURCHE/LA OKALOOSA/FL GEORGETOWN/SC FLAGLER/FL MAUI/HI LIVINGSTON/LA BREVARD/FL SUSSEX/DE VOLUSIA/FL ST. LUCIE/FL JEFFERSON/TX HAMPTON CITY/VA OCEAN/NJ HARRIS/TX PASCO/FL BOSSIER/LA NEW HANOVER/NC BRONX/NY 0% 39.8% 39.7% 39.2% 39.1% 38.7% 37.2% 36.5% 36.2% 34.2% 33.0% 32.1% 30.6% 28.3% 27.6% 27.0% 26.8% 26.4% 26.1% 25.4% 25.3% 25.2% 23.4% 23.3% 22.1% 21.7% 10% 20% 30% 40% 50% FL: 10 counties LA: 3 parishes TX: 2 counties SC: 2 counties NJ: 2 counties AL: 1 county MS: 0 counties CT: 0 counties Where is Cape May county? 60% 70% 80% *As of 12/31/05. Source: New Orleans Times-Picayune, 3/19/06, from NFIP and US Census Bureau data. 90% 100% Flood Insurance Penetration Rates: Counties/Parishes Ranked 51-75* CAMERON/TX FORT BEND/TX SANTA ROSA/MS HARRISON/MS JACKSON/MS NORFOLK CITY/VA HILLSBOROUGH/FL LAFAYETTE/LA EAST BATON ROUGE/LA VIRGINIA BEACH ESCAMBIA/FL HONOLULU/HI SACRAMENTO/CA CALCASIEU/LA MONTGOMERY/TX CITRUS/FL MERCED/CA CHESAPEAKE, OSCEOLA/FL HUDSON/NJ DUVAL/FL BARNSTABLE/MA MARIN/CA TULARE/CA MONMOUTH/NJ 0% 21.6% 20.9% 20.1% 19.1% 18.3% 17.8% 17.7% 17.5% 16.7% 16.3% 15.8% 15.6% 15.4% 14.5% 14.0% 13.3% 12.9% 12.6% 11.7% 11.6% 11.3% 10.2% 9.3% 9.1% 8.5% Where are Cape May and Middlesex counties? 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% *As of 12/31/05. Source: New Orleans Times-Picayune, 3/19/06, from NFIP and US Census Bureau data. Total $ NFIP Claim Payments by State (Top 10) 1/1/1978 – 3/31/2008 $ Millions $16,000 Until 2005 Texas ranked 1st in terms of total flood claims payments. $15,454 $14,000 $12,000 $10,000 $8,000 $6,000 $3,453 $4,000 $2,971 $2,795 $921 $2,000 $846 $752 $736 $791 $478 $445 PA NY CA VA $0 LA FL TX MS AL NJ NC Source: http://bsa.nfipstat.com/reports/1040.htm, visited 5/30/2008 Total Number of NFIP Claims by State (Top 10) 1/1/1978 – 3/31/2008 Closed Open Closed W/O Payment 400,000 350,000 300,000 NC PA NY Source: http://bsa.nfipstat.com/reports/1040.htm, visited 5/30/2008 24,297 NJ 29,465 AL 61,053 MS 44,288 TX 44,125 LA 64,445 FL 0 28,405 50,000 44,435 100,000 146,309 150,000 142,895 200,000 301,297 250,000 CA VA Who Should Pay for the Risk of Hurricane/Flood Damage? 63% of Non-coastal Policyowners Say Premium Subsidies for Coastal Property Owners are Unfair 70% 63% 63% 60% 50% 50% 40% 22% 30% 31% 33% 32% Interior Counties Noncoastal States 30% 20% 10% 28% 0% Coastal Counties Very unfair Coastal States Source: Insurance Research Council Somewhat Unfair Most Non-coastal Policyowners Say Taxpayer Subsidies for Coastal Property Owners are Unfair Somewhat Unfair 70% 60% Very unfair 59% 51% 50% 40% 61% 25% 30% 34% 31% Interior Counties Noncoastal States 29% 30% 20% 10% 22% 0% Coastal Counties Coastal States Source: Insurance Research Council My Financial My Financial House software House helps you Personal organize and assess your Finance current is Software financial popular as well situation The Insurance Cycle: Will the Cycle Be Unbroken? Profitability: Did Profits Reach a Cyclical Peak in 2006/07? By No Reasonable Standard Can Profits Be Deemed Excessive Profitability Peaks & Troughs in the P/C Insurance Industry,1975 – 2008F* 25% 1977:19.0% 1987:17.3% 2006:12.2% 20% 1997:11.6% 15% 10% 5% 0% 1975: 2.4% 1984: 1.8% 1992: 4.5% 2001: -1.2% 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07E 08F -5% *GAAP ROE for all years except 2007 which is actual 9-month ROAS of 13.1%. 2008 P/C insurer ROE is I.I.I. estimate. Source: Insurance Information Institute; Fortune ROE: U.S. P/C Insurance Industry vs. Fortune 500 1987:17.3% 21% 2007:14.0% 1997:11.6% 18% 15% 12% 9% Sept. 11 6% 3% Katrina, Rita, Wilma Hugo 0% Northridge 4 Hurricanes Andrew -3% 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 US P/C Insurers All US Industries Sources: Insurance Information Institute; Fortune Top Industries by ROE: P/C Insurers Underperformed Again in 2007 56.0% ousehold and Personal Products Petroleum Refining Hotels, Casinos Oil & Gas Equipment Food Services Metals Food Consumer Products etwork, Communications Equip Aerospace/Defense Medical Products Electronics Pharmaceuticals Industrial Equip Health Care Insurance P/C Insurers (Stock) L/H Insurers (Stock) Commercial Banks Div. Financials -10% Source: Fortune magazine 0% 26.3% 26.1% 24.9% 23.9% 23.0% 22.0% 21.8% 20.6% 20.4% 20.4% 20.3% 20.0% ROE of publicly-held P/C insurers in 2007 ranked 31st out of 50 industry groups despite near-peak profitability … but the P/C industry outperformed most other financial industries in 2007 19.0% 13.5% 11.0% 10.7% -1.2% 10% 20% 30% 40% 50% 60% Personal/Commercial Lines & Reinsurance ROEs, 2006-2008F* 18% 2006 2007E 16% 14.0% 2008F 10% 8% 16.8% 13.2% 14% 12% ROEs are declining as underwriting results deteriorate 9.8% 9.4% 12.3% 10.7% 9.8% 6.3% 6% 4% 2% 0% Personal Commercial Sources: A.M. Best Review & Preview (historical and forecast). Reinsurance Can Anything Change the Profit Cycle? 4 Factors That Could Affect the Length and Depth of the Cycle Factors that Could Affect the Length and Depth of the Cycle Capacity: Rapid surplus growth in recent years has left the industry with between $85 billion and $100 billion in excess capital, according to analysts All else equal, rising capital leads to greater price competition and a liberalization of terms and conditions Investment Gains: 2007 was the 5th consecutive up year on Wall Street. With declines in stock prices and falling interest rates, portfolio yields are certain to fall Smaller realized capital gains A sustained equity market decline (and potentially a drop in bond values) could reduce policyholder surplus Factors that Could Affect the Length and Depth of the Cycle Reserves: Reserves are in the best shape (in terms of adequacy) in decades, which could extend the depth and length of the cycle Many companies have been releasing “redundant” reserves, which allows them to boost net income even as underwriting results deteriorate But reserve releases will diminish in 2008; Even more so in 2009 Information Systems: Management has more and better tools that allow faster adjustments to price, underwriting and changing market conditions than it had during previous soft markets Source: Insurance Information Institute. Underwriting Trends U.S. P/C Insurance Industry Combined Ratio, 1970-2007 Combined Ratios 120 1970s: 100.3 1980s: 109.2 115 1990s: 107.8 2000s: 102.6* 110 105 100 95 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 90 *2000-2007 Sources: A.M. Best; ISO, III P/C Insurance Combined Ratio, 2001-2007 120 115.8 110 2007 deterioration due mainly to falling rates, “normal” CAT activity As recently as 2001, insurers paid out nearly $1.16 for every $1 in earned premiums The best combined ratio since 1949 107.4 100.7 100.1 100 98.3 95.6 90 92.5 2005 figure benefited from heavy use of reinsurance which lowered net losses 2001 Sources: A.M. Best; ISO, III. 02 03 04 05 06 2007 Impact of Reserve Changes on Combined Ratio $10 $5 $0 ($5) 0.1 $0.4 $18.9 $15 $22.8 3.5 $36.9 $25 $20 $33.4 6.5 $10.8 Reserve Development ($B) $35 $30 ($10) 00 01 02 03 10 9 8 Reserve 7 adequacy has 6 4.5 improved 5 substantially 4 3 2 1 -1.2 -1.6 -1.3 -1.1 0 (1) (2) ($5.0) ($5.3) ($7.0)($6.0) (3) 04 05 06 Source: A.M. Best, Lehman Brothers estimates for years 2007-2009 07F 08F 09F Combined Ratio Points 8.6 8.9 $40 PY Reserve Development Combined Ratio Points Premium Growth At a Virtual Standstill in 2007/08 Three “Hard Markets” in the Last 40 Years 25% 1975-78 1984-87 2001-04 Post-Katrina period resembles 1993-97 (post-Andrew) 20% 15% 10% 5% 0% -5% 2007: -0.6% premium growth is the first decline since 1943 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 -10% Note: Shaded areas denote hard market periods. Source: A.M. Best, Insurance Information Institute Growth in Net Written Premium, 2000-2007E 15.3% 10.0% 8.4% 5.0% P/C insurers are experiencing their slowest growth rates since 1943…but underwriting results are expected to remain relatively healthy 3.9% 2.7% 0.5% 2000 2001 2002 2003 2004 *2007 figure based on actual 9-month results. Source: A.M. Best; Forecasts from the Insurance Information Institute. 2005 0.0% 2006 2007* Personal/Commercial Lines & Reinsurance NPW Growth, 2006-2008F 30% 25% 20% Net written premium growth is expected to be slower for commercial insurers and reinsurers 28.1% 15% 10% 5% 2.0%-0.1%1.4% 3.5% 0% -5% -10% -15% -1.5%-2.3% 2006 2007E Personal 2008F Commercial Sources: A.M. Best Review & Preview (historical and forecast). -5.0% -8.5% Reinsurance Rates Under Pressure in 2007/08, Especially Commercial Lines 00 $847 99 04 05 06 07 $724 98 $690 $703 97 $685 $705 $650 $668 $700 $651 $750 $691 $800 $851 $780 $850 $847 $900 Across the U.S., auto insurance expenditures are expected to fall 0.5% in 2007, the first drop since 1999 $823 $950 $838 Lower Underlying Frequency, Modest Severity, Check Auto Insurance Costs $600 94 95 96 Sources: NAIC, Insurance Information Institute 01 02 03 Across the U.S., Home Insurance Costs* Rose 4% in 2007 $900 Homeowners in non-CAT zones $868 $835 have seen smaller increases than $850 $787 those in CAT zones $800 $729 $750 $700 $668 $650 $593 $600 $536 $550 $508 $488 $481 $500 $455 $440 $450 $418 $400 95 96 97 98 99 00 01 02 03 04 05 06 07 *Excludes cost of flood and earthquake coverage. Source: NAIC, Insurance Information Institute Average Quarterly Commercial Rate Change, All Lines, (1Q:2004 – 1Q:2008) Source: Council of Insurance Agents & Brokers; Insurance Information Institute 1Q08 -13.5% -12.0% 4Q07 2Q07 1Q07 4Q06 3Q06 2Q06 1Q06 4Q05 3Q05 2Q05 1Q05 4Q04 3Q04 2Q04 1Q04 -16% 3Q07 -13.3% -5.3% -3.0% -2.7% KRW Effect -11.8% -14% -11.3% -12% -9.6% -10% Commercial account pricing is now on par with prices in late 2001, early 2002 -8.2% -9.4% -8% -9.7% -5.9% -6% -7.0% -4% -4.6% -3.2% -2% -0.1% 0% Rising Epenses Expense Ratios Will Rise as Premium Growth Slows 32% Personal 31.1% Commercial 31% 30% 29% 30.8% 29.4% 29.9% 30.0% 29.1% 28% 27.0% 26.6% 27% 26% 25.0% 25.6% 25.6% 24.8% 24.3% 25% 24.5% 24% 23.4% 25.6% 26.4% 26.3% 27.5% 27.1% 26.6% 26.1% 25.0% 24.7% 24.4% 24.6% 23% 22% 96 97 98 99 00 01 02 *Ratio of expenses incurred to net premiums written. Source: A.M. Best; Insurance Information Institute 03 04 05 06 07E 08F Advertising Expenditures by P/C Insurance Industry, 1999-2007E $ Billions $4.5 $4.0 $4.3 Ad spending by P/C insurers is at a record high, signaling increased competition $3.7 $3.5 $3.0 $3.0 $2.5 $2.0 $1.7 $1.7 $1.8 99 00 01 $1.9 $1.7 02 $2.1 $1.5 03 04 05 06 Source: Insurance Information Institute from consolidated P/C Annual Statement data. 07E PP Auto Insurance 2005 Market Concentration, by HHI, by State Green bars = Unconcentrated markets Gray bars = Moderately concentrated markets 15 13 Number of States 11 10 Concentrated markets 10 5 4 3 3 2 2 1 1 0 0 0 0 601700 701800 801900 9011000 1001- 1101- 1201- 1301- 1401- 1501- 1601- 1701- 1801+ 1100 1200 1300 1400 1500 1600 1700 1800 HHI Sources: J. Robert Hunter, State Automobile Insurance Regulation, Consumer Federation of America, April 2008, pp. 19-20; I.I.I. calculations. The P/C Industry’s Financial Strength and Capacity U.S. P-C Insurers’ Policyholder Surplus: 1975-2007 $550 $500 Surplus exceeded a half trillion dollars for the first time during the 2nd quarter of 2007. $450 $400 $ Billions $350 $300 $250 At year end 2007, P/C insurers held $1.17 in surplus for every $1 of NWP. $200 “Surplus” is a measure of underwriting capacity. It is analogous to “Owners Equity” or “Net Worth” in non-insurance organizations $150 $100 $50 $0 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 Sources: A.M. Best, ISO, Insurance Information Institute. $1.17 $1.10 $1.01 $0.93 $0.86 $0.78 $1.17 $1.18 $1.06 $0.90 $0.77 $0.75 $0.72 $0.71 $0.64 $0.64 $0.54 $0.53 $0.6 $0.52 $0.8 $0.58 $1.0 $0.95 $1.2 Capacity: “Surplus” dollars per NWP dollar $0.89 $1.4 $1.12 In General, the Industry Has Grown Its Capacity to Accept Risk (but that capacity can also shrink) Premiums measure risk accepted; surplus is funds beyond reserves to pay unexpected losses. The higher the ratio of surplus to premiums, the greater the industry’s capacity to handle the risk it has accepted. $0.4 $0.2 Sources: NAIC Annual Statement data, via HighlineData; Ins. Info. Inst. 07 06 2005 04 03 02 01 2000 99 98 97 96 1995 94 93 92 91 1990 89 88 87 86 1985 $0.0 Annual Catastrophe Bond Transactions Volume, 1997-2007 Risk Capital Issues ($ Mill) $8,000 Number of Issuances Catastrophe bond issuance has soared in the wake of Hurricanes Katrina and the hurricane seasons of 2004/2005, despite two quiet CAT years $7,000 $6,000 $5,000 $7,329.6 35 30 25 $4,693.4 20 $4,000 15 $3,000 $1,000 $633.0 $846.1$984.8 $1,139.0 $1,219.5 $966.9 10 $1,991.1 $1,729.8 $2,000 $1,142.8 5 $0 0 97 98 99 00 01 02 03 04 Source: MMC Securities Guy Carpenter, A.M. Best; Insurance Information Institute. 05 06 07 Number of Issuances Risk Capital Issued P/C Insurer Impairment Frequency vs. Combined Ratio, 1969-2007E Combined Ratio 115 Combined Ratio after Div P/C Impairment Frequency 2 1.8 1.6 110 1.4 1.2 105 1 100 0.8 0.6 95 0.4 0.2 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07E 90 2006 impairment rate was 0.43%, or 1-in-233 companies, half the 0.86% average since 1969; 2007 will be lower; Record is 0.24% in 1972 Source: A.M. Best; Insurance Information Institute 0 Impairment Rate 120 Impairment rates are highly correlated with underwriting performance and could reach nearrecord low in 2007 Reasons for US P/C Insurer Impairments, 1969-2005 2003-2005 Affiliate Problems 8.6% Catastrophe Losses 8.6% 1969-2005 Deficient Loss Reserves/Inadequate Pricing 62.8% Deficient Loss Reserves/Inadequate Pricing 38.2% Investment Problems* 7.3% Alleged Fraud 11.4% Rapid Growth 8.6% Reinsurance Sig. Change Failure in Business 3.5% 4.6% Misc. 9.2% Deficient reserves, CAT losses are more important factors in recent years Affiliate Problems 5.6% Catastrophe Losses 6.5% Alleged Fraud 8.6% Rapid Growth 16.5% *Includes overstatement of assets. Source: A.M. Best: P/C Impairments Hit Near-Term Lows Despite Surging Hurricane Activity, Special Report, Nov. 2005; Investment Overview Not Much to Look Forward To P/C Investment Income as a % of Invested Assets Follows 10-Year US T-Note P-C Inv Income/Inv Assets 10-Year Treasury Note 9% Investment yield historically tracks 10-year Treasury note quite closely 8% 7% 6% 5% 4% 3% *As of May 30, 2008. Sources: Board of Governors, Federal Reserve System; A.M.Best; Insurance Information Institute. 08* 07 06 05 04 03 02 01 00 99 98 97 96 95 94 93 92 91 90 2% Property/Casualty Industry Investment Income*, 1994-2007 $60 02 03 04 $54.6 $52.3 $49.5 $39.6 $36.7 01 $38.7 $37.1 98 $40.8 97 $38.6 96 $39.9 95 $41.5 $38.0 $30 $36.8 $40 $33.7 Billions $50 $20 1994 99 2000 *Primarily interest and stock dividends. 2005 figure includes special one-time dividend of $3.2B. 05 06 2007 Sources: ISO; Insurance Information Institute. US P/C Industry Net Realized Capital Gains, 1990-2007 Realized capital gains exceeded $9 billion in 2004/5 but fell sharply in 2006 despite a strong stock market. Nearly $9 billion again in 2007. $ Millions $20,000 $18,019 $18,000 $16,205 $16,000 $13,016 $14,000 $12,000 $10,808 $9,244 $9,893 $9,818 $10,000 $8,000 $9,125 $6,631 $5,997 $6,000 $9,701 $8,971 $6,610 $4,806 $3,524 $4,000 $2,880 $1,664 $2,000 $0 -$2,000 90 91 92 93 94 95 96 97 98 99 Sources: A.M. Best, ISO, Insurance Information Institute. 00 -$1,214 01 02 03 04 05 06 07 Bonus: Presidential Politics and P/C Insurance Industry Profitability Political Quiz • Does the P/C insurance industry perform better (as measured by ROE) under Republican or Democratic administrations? • Under which President did the P/C insurance industry realize its highest ROE (average over 4 years)? • Under which President did the P/C insurance industry realize its lowest ROE (average over 4 years)? P/C Insurance Industry ROE by Presidential Administration,1950-2008* 16.43% 15.10% Carter Reagan II 10.45% 8.93% OVERALL RECORD: 8.65% 1950-2008* 8.35% 7.98% Republicans 8.92% 7.68% 6.98% Democrats 8.00% 6.97% 5.43% 5.03% Party of President has marginal 4.83% bearing on profitability of P/C 4.43% insurance industry 3.55% G.W. Bush II Nixon Clinton I G.H.W. Bush Clinton II Reagan I Nixon/Ford Truman Eisenhower I Eisenhower II G.W. Bush I Johnson Kennedy/Johnson 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% *ROE for 2007/8 estimated by III. Truman administration ROE of 6.97% based on 3 years only, 1950-52. Source: Insurance Information Institute P/C Insurance Industry ROE by Presidential Party Affiliation, 1950–2008E 20% Truman 25% BLUE = Democratic President Eisenhower Kennedy/ Johnson Nixon/Ford Carter RED = Republican President Reagan/Bush Clinton Bush 15% 10% 5% 0% 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08E -5% Source: Insurance Information Institute Summary • Results were excellent in 2006/07; Overall profitability reached its highest level (est. 13-14%) since 1988 • Underwriting results were aided by lack of CATs & favorable underlying loss trends, including tort system improvements But forecast for 2008 is for worse-than-average hurricane season • Premium growth rates are slowing to their levels since WW II; Commercial lines lead decreases • Investment returns insufficient to support deep soft market in terms of price, terms & conditions as in 1990s Insurance Information Institute On-Line If you would like a copy of this presentation, please give me your business card with e-mail address