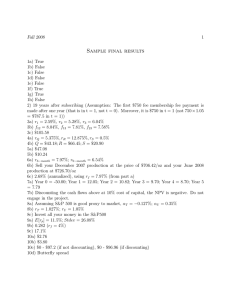

– P/C Liabilities Discounting & Risk Margins Implementation issues – pros/cons

advertisement

Discounting & Risk Margins – P/C Liabilities • Implementation issues • Discounting alternatives – pros/cons CAS Presentation to the IASB – February 15, 2005 Slide 1 Discounting & Risk Margins – P/C Liabilities Implementation issues Background Statements 1. “One size does not fit all” Tremendous variation across products • • • • • Short tail versus long tail High volume versus low volume Long history versus no history Homogeneous vs. Heterogeneous High frequency/low severity vs. Low frequency/High severity Hence, the same model(s) will not work for all lines, accident years. CAS Presentation to the IASB – February 15, 2005 Slide 2 Discounting & Risk Margins – P/C Liabilities Implementation issues Background Statements 2. Aggregate analysis, not transactions 3. Booked liability made up of many pieces • • • 4. Two major U.S. insurers – about 175 different review lines each Two U.K. reinsurers – 50 to 100 different lines each U.S. single state personal lines insurer – 5 to 10 diff. lines Recognition lags unavoidable (Not enough time to understand the quarter before booking the quarter ) 5. Initial transition is not trivial (analysis, systems, procedures) CAS Presentation to the IASB – February 15, 2005 Slide 3 Discounting & Risk Margins – P/C Liabilities Implementation issues – “Day 2” Too many pieces to update the analysis each quarter. Must rely on pre-set tables of factors to meet booking deadlines Review, update of tables would be done periodically Tendency to not change prior assumption until reasonable likely that change is warranted • Assumptions are “sticky” (they tend not to change until change is material) • Result is “step” changes, not gradual changes. This is the situation currently, and various proposals (such as fair value) will not change it. CAS Presentation to the IASB – February 15, 2005 Slide 4 Discounting & Risk Margins – P/C Liabilities Discounting Alternatives 1. Don’t discount, no explicit margins (When policy written, up front earnings hit from nominal claim liability, over time earnings help from investment income.) PRO • • • • • • • • • Easier to accomplish Requires fewer assumptions than other alternatives Understood by current analysts, users Provides for implicit risk margin, generally thought to be a function of payout tail. Easy to calculate surrogate for economic value if discount/risk margin offset Avoids forcing companies to discount liabilities that some view as deficient in aggregate. Minimizes noise from capital markets as to time value of money Avoids choice of discount rate in markets/countries without robust bond market In many markets, due to lower level of litigiousness, liabilities are predominately short tailed and time value is not an issue CAS Presentation to the IASB – February 15, 2005 Slide 5 Discounting & Risk Margins – P/C Liabilities Discounting Alternatives 1. Don’t discount, no explicit margins CON • • • • • • • • Creates incentives for non-economic transactions Arbitrage potential, as markets seek out alternative structures where time value more readily recognized Non-comparable across product lines Non-comparable across industries, if accounting rules differ. Can be a poor surrogate for economic value, as some long tail lines are actually low risk – e.g., annuity claims Overstates uncertainty & cost of some long tail lines – e.g., must provide nominal estimate of amts. payable in distant future with small present value but high (and highly uncertain) nominal value Doesn’t reflect economics, as seen by ability to purchase reinsurance products to get around the accounting. Penalizes growth, overstates income during times of shrinking volume. CAS Presentation to the IASB – February 15, 2005 Slide 6 Discounting & Risk Margins – P/C Liabilities Discounting Alternatives 2. Discount, no risk margin (Maximizes up front earnings) PRO • Relative easy to accomplish (for most products) • Avoids the biggest judgment calls (relative to risk margin) • Should reduce use of some of the products bought principally for accounting reasons • Improves comparability across products • Improves comparability across industries • Relatively easy to understand • Could reduce estimation uncertainty, in situations where uncertainty comes mostly from the tail with large nominal value but small present value. CAS Presentation to the IASB – February 15, 2005 Slide 7 Discounting & Risk Margins – P/C Liabilities Discounting Alternatives 2. Discount, no risk margin CON • • • • • Overstates income at initial writing of business Implementation would acerbate any existing problem with deficient booked claim liabilities. Creates short-term noise that may distort true economics, especially if short-term fluctuations are not realizable when in company’s favor (nor capable of being forced on the company when not in their favor – LIQUIDITY, REALISABILITY CONCEPTS) Ignores product risk profiles – hence can result in even worse comparability than not discounting (especially if risk is function of payout tail). May be difficult to accomplish in countries without a robust bond market. (a con for nearly all discounting approaches) CAS Presentation to the IASB – February 15, 2005 Slide 8 Discounting & Risk Margins – P/C Liabilities Discounting Alternatives 3. Discount, benchmark or “rule of thumb” margin (simplified, standardized approach to obtain most of “economic value” advantages) PRO • • • • • Easier to understand than “mark to model” economic value approaches Less expensive to implement Less training required to implement Economic value surrogate with best comparability across the insurance industry Should eliminate most products designed solely for accounting reasons Overall ,achieves most of the benefits of “economic value” at minimum costs CAS Presentation to the IASB – February 15, 2005 Slide 9 Discounting & Risk Margins – P/C Liabilities Discounting Alternatives 3. Discount, benchmark or “rule of thumb” margin CON • Uncertain who would pick the benchmark • More work than earlier alternatives, for imperfect economic value surrogate • Uncertain how benchmarks would be maintained/updated, especially as economy changes or new products are developed. • Risk that the benchmark does not result in comparability across product lines, industries CAS Presentation to the IASB – February 15, 2005 Slide 10 Discounting & Risk Margins – P/C Liabilities Discounting Alternatives 4. Discount, theoretical margin (Time value of money, with risk margin probably “mark to model”. Could be higher or lower than undiscounted.) PRO • Should reflect economic value, for best comparability across products, companies, industries • Eliminate products designed to circumvent accounting rules • Theoretically, can adapt to new products, environments CAS Presentation to the IASB – February 15, 2005 Slide 11 Discounting & Risk Margins – P/C Liabilities Discounting Alternatives 4. Discount, theoretical margin CON • Calibration not possible where no market exists • Can be very expensive to maintain, • Questionable reliability due to calibration problems • Given calibration problems, comparability may be worsened across products, companies, industries • Questionable relevancy if no secondary market exists for the liabilities, such that any “gains” cannot be realised nor “losses” forced upon a company. • Results may be difficult to understand, even for management and others in the business. • Final result may not be materially different from undiscounted approach, despite significant work. CAS Presentation to the IASB – February 15, 2005 Slide 12 Discounting & Risk Margins – P/C Liabilities Concluding remarks CAS Presentation to the IASB – February 15, 2005 Slide 13