H&R BLOCK BUDGET CHALLENGE Retirement Review Answer Key

advertisement

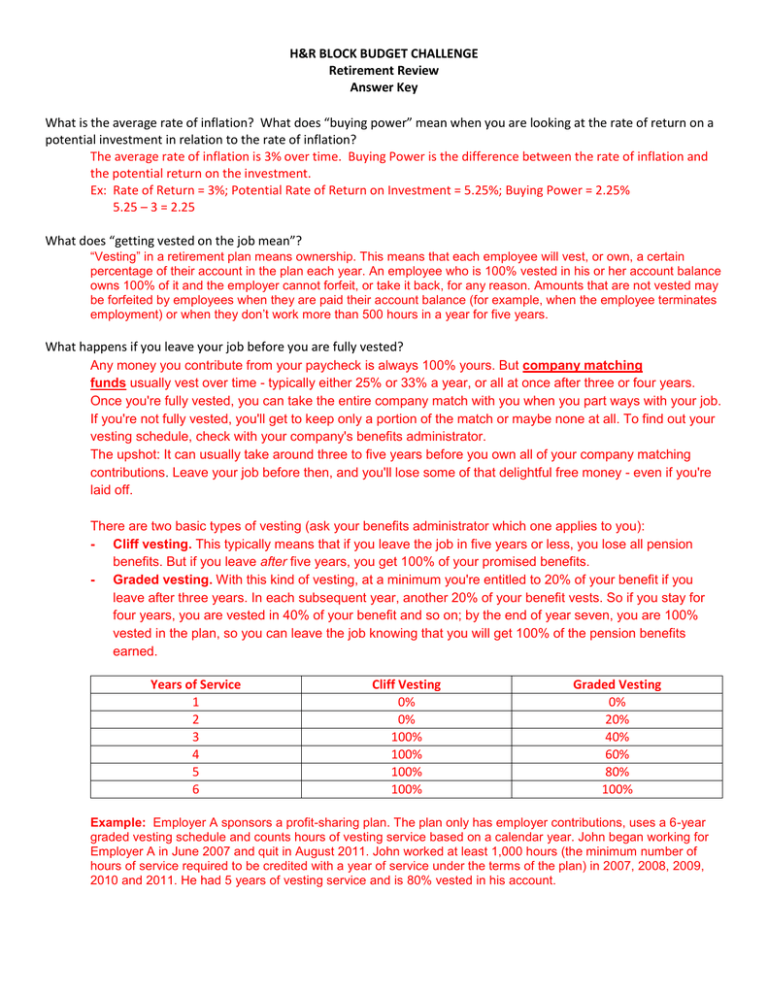

H&R BLOCK BUDGET CHALLENGE Retirement Review Answer Key What is the average rate of inflation? What does “buying power” mean when you are looking at the rate of return on a potential investment in relation to the rate of inflation? The average rate of inflation is 3% over time. Buying Power is the difference between the rate of inflation and the potential return on the investment. Ex: Rate of Return = 3%; Potential Rate of Return on Investment = 5.25%; Buying Power = 2.25% 5.25 – 3 = 2.25 What does “getting vested on the job mean”? “Vesting” in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. An employee who is 100% vested in his or her account balance owns 100% of it and the employer cannot forfeit, or take it back, for any reason. Amounts that are not vested may be forfeited by employees when they are paid their account balance (for example, when the employee terminates employment) or when they don’t work more than 500 hours in a year for five years. What happens if you leave your job before you are fully vested? Any money you contribute from your paycheck is always 100% yours. But company matching funds usually vest over time - typically either 25% or 33% a year, or all at once after three or four years. Once you're fully vested, you can take the entire company match with you when you part ways with your job. If you're not fully vested, you'll get to keep only a portion of the match or maybe none at all. To find out your vesting schedule, check with your company's benefits administrator. The upshot: It can usually take around three to five years before you own all of your company matching contributions. Leave your job before then, and you'll lose some of that delightful free money - even if you're laid off. There are two basic types of vesting (ask your benefits administrator which one applies to you): - Cliff vesting. This typically means that if you leave the job in five years or less, you lose all pension benefits. But if you leave after five years, you get 100% of your promised benefits. - Graded vesting. With this kind of vesting, at a minimum you're entitled to 20% of your benefit if you leave after three years. In each subsequent year, another 20% of your benefit vests. So if you stay for four years, you are vested in 40% of your benefit and so on; by the end of year seven, you are 100% vested in the plan, so you can leave the job knowing that you will get 100% of the pension benefits earned. Years of Service 1 2 3 4 5 6 Cliff Vesting 0% 0% 100% 100% 100% 100% Graded Vesting 0% 20% 40% 60% 80% 100% Example: Employer A sponsors a profit-sharing plan. The plan only has employer contributions, uses a 6-year graded vesting schedule and counts hours of vesting service based on a calendar year. John began working for Employer A in June 2007 and quit in August 2011. John worked at least 1,000 hours (the minimum number of hours of service required to be credited with a year of service under the terms of the plan) in 2007, 2008, 2009, 2010 and 2011. He had 5 years of vesting service and is 80% vested in his account. What is a 401(k)? What is a 403(b)? A 401(k) is a retirement savings plan sponsored by an employer. It lets workers save and invest a piece of their paycheck before taxes are taken out. Taxes aren't paid until the money is withdrawn from the account. A 403(b) plan, also known as a tax-sheltered annuity (TSA) plan, is a retirement plan for certain employees of public schools, employees of certain tax-exempt organizations, and certain ministers. Which type of investment typically charges the investor the lowest fees? Index fund - passively managed Mutual fund - actively managed Bond fund - actively managed International funds If you had $5,000 to invest into the following funds, which one would have the highest value (not including any fees) at the end of the second year? Fund with Year 1 return of 0% & Year 2 return of 0% Fund with Year 1 return of +30% and a year 2 return of -25% Fund with Year 1 return of -9.5% and Year 2 return of +10% Fund with Year 1 return of +10% and Year 2 return of -9.5% If you had a fund with a Year 1 return of 0% and a year 2 return of 0%, what is this fund's a) average annual return for the two years 0% ((0+0)/2) = 0 b) actual return for the two year period? 0% ((1+.0) * (1-.0) - 1) = 0 c) are you gaining or losing money? Neither If you had a fund with a Year 1 return of +30% and a year 2 return of -25%, what is this fund's a) average annual return for the two years +2.5% ((30+(-25))/2 = 2.5 b) actual return for the two year period? -2.5% ((1+.30) * (1-.25) - 1) = -.025 c) are you gaining or losing money? Losing If you had a fund with a Year 1 return of -9.5% and a year 2 return of +10%, what is this fund's a) average annual return for the two years +2.5% (-9.5+10)/2 = 2.5 b) actual return for the two year period? -.45% ((1-.095) * (1+.10) - 1) = -.0045 c) are you gaining or losing money? Losing If you had a fund with a Year 1 return of +10% and a year 2 return of -9.5%, what is this fund's a) average annual return for the two years +2.5% (10+(-9.5))/2 = 2.5 b) actual return for the two year period? -.45% ((1+.10) * (1-.095) - 1) = -.0045 c) are you gaining or losing money? Losing