Ch. 24 Section 2 The Federal Reserve System

advertisement

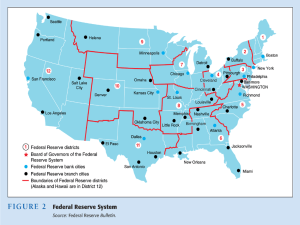

Ch. 24 Section 2 The Federal Reserve System Structure and Organization The Federal Reserve System (FED) is the central bank of the U.S. It is the bank for banks; when banks need money, they borrow from the FED Established in 1913, the government did not have the money to set up the central bank, larger banks had to help by buying stock into it. Structure and Organization (cont.) The U.S. is divided into 12 Federal Reserve Districts Each has one main Federal Reserve Bank and most have branch banks Boston Philadelphia NY Cleveland Richmond Atlanta Chicago St. Louis Minneapolis K.C. Dallas San Francisco Structure and Organization (cont.) Federally chartered commercial banks must be members of the FED; state chartered banks may join Member banks buy stock in the FED and earn dividends from it. Structure and Organization (cont.) A Board of Governors (7) is appointed by the President and he selects one to chair the board for a 4 year term. The Board of Governors is supposed to be independent of the President and Congress Without political pressure, economic decisions can be made freely in the countries best interest. Structure and Organization (cont.) Officials of the district banks serve on the FEDs advisory councils which keep the FED informed of: - economic conditions within each district - financial institutions - issues related to consumer loans Federal Open Market Committee (FOMC) is the FEDs major policy making group. FOMC Federal Open Market Committee (FOMC) makes decisions that affect the economy as a whole by manipulating/controlling the money supply Functions of the FED The FED oversees most large commercial banks. It can block a merger between banks if the merger would lessen competition. Oversees the international business of American banks and foreign banks that operate in this country. Enforces laws that deal with consumer borrowing; creates laws that require lenders to spell out the details of a loan before a consumer borrows Functions of the FED (cont.) Acts as the government’s bank. Government deposits revenues in the FED and withdraws it to buy goods. Sells U.S. government bonds and Treasury bills, which the government uses to borrow money. Issues the nation’s currency. Government agencies produce the money, but the FED controls its circulation. Conducting Monetary Policy Monetary Policy – controlling the supply of money and the cost of borrowing money (interest rates) according to the needs of the economy. The FED can change interest rates by changing the money supply Conducting Monetary Policy (cont.) If the FED wants a lower interest rate, it expands the money supply, which moves the supply curve to the right. If the FED wants a higher interest rate, it contracts the money supply, which moves the supply curve to the left. The FED manipulates the money supply by 3 means: - discount rate - reserve requirement - open market operations Discount Rate Discount Rate – the rate the FED charges member banks for loans. If the FED wants to stimulate the economy, it lowers the discount rate. Lower rates encourage banks to borrow from the FED and that means more loans to their customers (lower interest rates) If the FED wants to slow down the economy, discount rates are raised to discourage borrowing. This contracts the money supply and raises interest rates Reserve Requirement Member banks must keep a certain % of their money in the Federal Reserve Banks as a reserve. The FED can raise the reserve requirement to reduce the money banks have available to lend. It can lower the reserve requirement to increase the money banks have to lend. Open Market Operations Open Market Operations – the purchase or sale of U.S. government bonds and Treasury bills. Buying bonds from investors puts more cash into investors hands thus increasing the money supply; this shifts the supply curve of money to the right lowering interest rates Selling bonds to investors takes cash out of investors hands thus decreasing the money supply; this shifts the supply curve of money to the left raising interest rates Implementation of Monetary Policy Can be done more quickly this way than by allowing politicians to argue their views on Capitol Hill. FED can always adjust its actions when needed Manipulation of interest rates is key when trying to influence business investments and consumer spending Loose Money Policy Loose Money Policy: – Can lead to inflation. 1. Easy to borrow 2. Consumers buy more 3. Business expansion 4. Employment increases 5. Spending increases Tight Money Policy Tight Money Policy: – Can lead to recession 1. Difficult to borrow 2. Consumers buy less 3. No business expansion 4. Unemployment increases 5. Production decreases