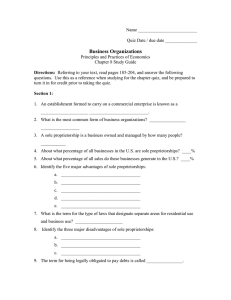

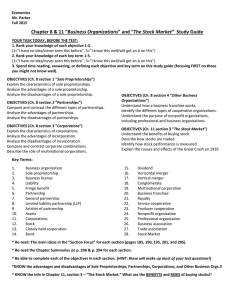

Ch. 22 Section 1 Types of Businesses

advertisement

Ch. 22 Section 1 Types of Businesses Proprietorships # of businesses in America 73% -- sole proprietorships (single owned) 20% -- corporations 7% -- partnerships Proprietorships (cont.) Sales 89% -- corporations 6% -- sole proprietorships 5% -- partnerships Sole Proprietorship most common form of business organization in U.S. Owned and operated by one person Advantages Easiest form of business to set up; anyone can start a proprietorship up whenever they want to as long as you have the money. Sole Proprietorship (cont.) Single owner fully owns the business and receive all the profits Owners can make decisions quickly Do not have to consult others Are not subject to any corporate income tax However… Sole Proprietorship (cont.) Disadvantages: Financial responsibility lies on one person (unlimited liability) Difficult to raise financial capital (money) Hard to attract qualified employees vs. large corporations (ex. benefits, wages) Partnerships Partnerships – businesses owned by two or more people. Advantages: Can raise money more easily Can always take on new partners Each partner brings specific talents to the business No corporate income tax Partnerships (cont.) Disadvantages: Legal structure is complex; added or removed members means a new agreement has to be made. Articles of partnership – legal agreement which identifies how much each partner will contribute, how profits will be shared, how to break up the business if it is closed, what role each will play, etc. Unlimited liability (each person is responsible for all business debt) Corporations Corporation – business that has many of the rights and responsibilities of individuals - can own property - can sue or be sued - must pay taxes Corporations start with a charter – government document granting permission to organize. Describes the business and specifies the amount of stock that will be issued (ownership shares) Corporations (cont.) Corporations are unique in that stockholders own the company, but elect a board of directors who will decisions on their behalf. Board of Directors do not handle the day-to-day running of the business (CEOs/COOs) Corporation owners and managers are two different groups of people Corporations (cont.) Advantages: Easier to raise financial capital by selling new shares of stock which allows expansion Easier to borrow from banks Professional managers (CEO) are hired to run the business. If they fail, they are replaced with someone who will get the job done for the shareholders. Corporations (cont.) Ownership can be easily transferred by buying or selling stock. Limited liability for stockholders Corporations (cont.) Disadvantages: Expensive and complex to set up Shareholders have little say in the running of the business Corporations are more subject to more government regulations. Must report detailed information of company finances to keep stockholders informed. Corporations (cont.) Double taxation - first corporation pays a corporate income tax on its yearly profits - stockholders then must pay income tax on the dividends distributed to them.