Great Depression & New Deal

advertisement

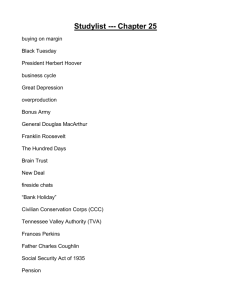

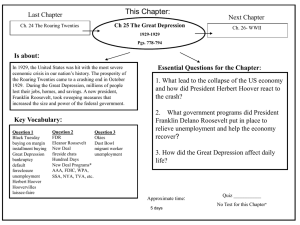

Great Depression & New Deal The economic boom of the 1920s contained the ingredients of its own collapse. A "buy-now-pay-later" mentality fueled the prosperity of the Roaring Twenties. The sudden popularity of installment buying caused an increased demand in autos, radios, and other popular items of the time. This resulted in booming production and profits for most of America's industries. The willingness to borrow also fed the rising stock market. Investors bought stocks on margin. "On margin" meant that they paid a percentage of the purchase price, say 10%, as a down payment and borrowed the rest. They were gambling that they would be able to sell at a profit when other eager buyers drove stock prices even higher. Agriculture had not done well since at least 1919 and in 1929 consumers were reaching the limit of their buying power. Stock prices did not reflect the real value of companies. Around the spring of 1929, the economy started to slow down. The stock market peaked in August 1929 then started to fall. As prices fell, other stockholders, especially those who had bought on margin, began to panic and rushed to sell. On October 18th, the stock market fell substantially. The first day of real panic, however, was October 24th, known as "Black Thursday." As more and more sold their shares, stock prices fell to record lows. The panic continued the following week and on Tuesday, October 29th ("Black Tuesday"), the market collapsed completely. This sudden fall of stock prices became known as the Stock Market Crash, or "The Great Crash." The crash caused a psychological reaction around the country. Banks that held stock as investments were seriously affected and some declared bankruptcy. Some businesses cut production and laid off workers. The unemployed were forced to cut back their spending. As consumer demand dropped, businesses laid off even more workers. This cycle continually repeated itself, and the country plunged into a depression. Meanwhile, the stock market crash and rising unemployment caused many to fear that people and businesses would be unable to repay bank loans. People began going to their banks and demanding to withdraw their money. When a large number of people do it, it's called a "run" on the banks. The money withdrawn was then out of circulation. Therefore, this further restricted the possibilities for economic growth and the depression grew more severe. It became known as "The Great Depression" because it was the worst one that the U.S. had ever experienced. Herbert Hoover was President during the first years of the Great Depression. Although he for the most part strongly believed in a laissez-faire policy of noninterference by government in any private business activity, he made some attempts to stimulate the economy. He urged businesses not to lay off workers or cut wages. At his request, Congress passed a tax cut designed to leave people with more money to spend. Hoover also asked Congress to authorize more public construction projects to increase government employment. In 1931 he supported efforts to create the Reconstruction Finance Corporation (RFC) to loan money to banks and corporations. This was implemented in 1932. These efforts, however, did not halt the slide into an everdeepening depression. People blamed Hoover for not doing more to restore the economy. Some people also criticized Hoover for opposing direct federal relief (welfare) to the needy. In the elections of 1932, American voters rejected Hoover and elected the Democratic candidate, Franklin D. Roosevelt. In his nomination acceptance speech, Roosevelt had said "I pledge you, I pledge myself, to a new deal for the American people." Once in office, Roosevelt and a heavily Democratic Congress acted on this promise by implementing a program designed to spur the economy and end the depression. This program was known as the New Deal. Massive federal work projects gave jobs to the unemployed. The Federal Deposit Insurance Corporation (FDIC) program (established in 1933) made the banking system more secure. Congress also passed the Social Security Act in 1935 to establish a permanent old-age pension. The Fair Labor Standards Act (1938) helped workers by establishing a minimum wage. These and other New Deal laws did much to bring relief to the poor and recovery and reform to America's economy. Not everyone was happy with the New Deal. Conservative Republicans accused some New Deal programs (like the FDIC and the Fair Labor Standards Act) of destroying the American free enterprise system and the spirit of individualism. They also said that New Deal work projects weakened people's self-reliance. But there were other critics that claimed that Roosevelt and the government were not doing enough. People like Senator Huey Long advocated a radical "Share the Wealth" programs that called for taking wealth from the rich and giving it to the poor. The Supreme Court also proved to be initially uncooperative and declared some New Deal legislation unconstitutional. Later, it began taking a more favorable stance regarding New Deal legislation. The Social Security Act and the National Labor Relations Act were both ruled constitutional in 1937. However, despite this opposition to the New Deal, most Americans supported it.