CENTRAL WASHINGTON UNIVERSITY College of Business Department of Finance & OSC

advertisement

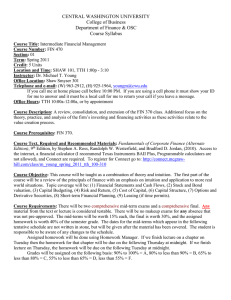

CENTRAL WASHINGTON UNIVERSITY College of Business Department of Finance & OSC Course Syllabus Course Title: Intermediate Financial Management Course Number: FIN 470 Section: 01 Term: Spring 2012 Credit: 5 Units Location and Time: SHAW 101, TTH 10:20a - 12:30 Instructor: Dr. Michael T. Young Office Location: Shaw Smyser 403 Telephone and e-mail: (W) 963-2912, (H) 925-1964, youngm@cwu.edu If you call me at home please call before 10:00 PM. If you are using a cell phone it must show your ID for me to answer and it must be a local call for me to return your call if you leave a message. Office Hours: W 12:00-3:00, or by appointment Course Description: A review, consolidation, and extension of the FIN 370 class. Additional focus on the theory, practice, and analysis of the firm’s investing and financing activities as these activities relate to the value creation process. Course Prerequisites: FIN 370. Course Text, Required and Recommended Materials: Fundamentals of Corporate Finance (Alternate Edition), 9th Edition, by Stephen A. Ross, Randolph W. Westerfield, and Bradford D. Jordan, (2010). Access to the internet, a financial calculator (I recommend Texas Instruments BAII Plus, Programmable calculators are not allowed), and Connect are required. To register for Connect go to http://connect.mcgrawhill.com/class/d_young_spring_2012_tth_1020-1230_2 Course Objective: This course will be taught as a combination of theory and intuition. The first part of the course will be a review of the principals of finance with an emphasis on intuition and application to more real world situations. Topic coverage will be: (1) Financial Statements and Cash Flows, (2) Stock and Bond valuation, (3) Capital Budgeting, (4) Risk and Return, (5) Cost of Capital, (6) Capital Structure, (7) Options and Derivative Securities, (8) Short-term Financial Planning, (9) Leasing (if time permits). Course Requirements: There will be two comprehensive mid-term exams and a comprehensive final. Any material from the text or lecture is considered testable. There will be no makeup exams for any absence that was not pre-approved. The mid-terms will be worth 15% each, the final is worth 30%, and the assigned homework is worth 40% of the semester grade. The dates for the mid-terms which appear in the following tentative schedule are not written in stone, but will be given after the material has been covered. The student is responsible to be aware of any changes to the schedule. Assigned homework will be done using Homework Manager. If we finish lecture on a chapter on Tuesday then the homework for that chapter will be due on the following Thursday at midnight. If we finish lecture on Thursday, the homework will be due on the following Tuesday at midnight. Grades will be assigned on the following basis: 90% to 100% = A, 80% to less than 90% = B, 65% to less than 80% = C, 55% to less than 65% = D, less than 55% = F. Class Attendance and Academic Honesty: Class attendance is expected and the student is responsible for all assignments announced during class periods. Any student found cheating will be assigned a failing grade for the course and may be reported to the Vice Chancellor for Student Affairs and the Dean of the College of Business for further disciplinary action. Good study habits are a must for this class! If you apply yourself you should have little or no problem passing. A rule of thumb is that you should spend 3 hours in study for every hour in lecture. Allow me to make some suggestions: 1) Read the material BEFORE lecture. 2) Try to do the homework after reading the material, but before lecture. Any problems or questions can then be asked about during lecture. 3) Every day after class review the material covered in that day's lecture as well as the previous day's lecture. 4) If you have some point that you do not understand ASK! Asking questions does not indicate that you are stupid. It does show me that you have a willingness to learn. You must understand that I have studied this material for years and at times forget what you find difficult. Help me out and ask questions. Tentative Schedule Date 3/27 3/29 4/3 4/5 Chapter 1&2 3 4 5 6 Topic Introduction and Cash Flow Review Working with Financial Statements Long-Term Financial Planning and Growth Introduction to Valuation: TVM Discounted Cash Flow Valuation 4/10 7 Interest Rates and Bond Valuation 4/12 8 9 Stock Valuation NPV and Other Investment Criteria 4/17 4/19 *** EXAM 1 (Chapters 1 – 9) *** 10 Making Capital Investment Decisions 4/24 4/26 5/1 5/3 5/8 5/10 5/15 5/17 5/22 5/24 5/29 6/6 Chapter Problems 2: 14,18-21,24,25 3: 1,2,5,8,11,12,18 4: 3,6,7,10,16-20,22,25,30 5: 14-16, 18-20 6: 45,46,48,49,51,52,53, 55,69,71 7: 3,7,12,15,16,20,23, 29,32 8: 8,9,13,14,19,22,23,24 9: 1,4,9,14,16,17,19,25, 26 10: 17,20,21,25,26,27,29, 32,33,35 11: 13,14,20-24,27 12: 14,16-18,24 13: 19,23,24,26,27 14: 15,20-24 15: 2,4,5,9,14 16: 1,4,8,12,14,17 17: 1,2,5,10,12 11 Project Analysis and Valuation 12 Capital Market History 13 Return, Risk, and the SML 14 Cost of Capital 15 Raising Capital 16 Financial Leverage and Capital Structure 17 Dividends and Dividend Policy *** EXAM 2 (Chapters 1 – 17) *** 18 Short-Term Finance and Planning 18: 2,5,6,8,10,11,14 19 Cash and Liquidity Management 19: 1-10 20 Credit and Inventory Management 20: 1-3,6,10,12,14,20 24 Options and Corporate Finance 24: 3,4,8,9,11-14,20,21 25 Option Valuation 25: 1-6,8,10,11,13,14 27 Leasing 27: 1-10 *** FINAL (Chapters 1 – 19, 22, 24, 25 and 27) *** 10:00 – 12:00