Document 17582482

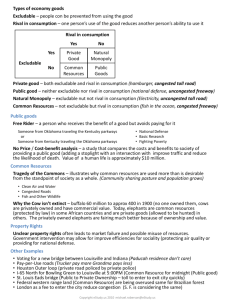

advertisement

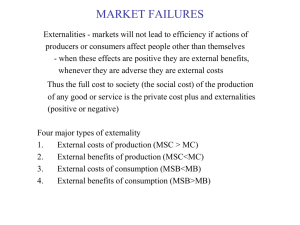

Capitalism is associated with limited government, but government is necessary for three reasons: Establish and maintain legal system to protect property rights. Promote equity in the distribution of income and wealth. Correct inefficiencies that arise from markets (externalities, public goods, and monopoly power). Public Finance/Choice is the area of economics that studies the public sector. Incentives are different in markets versus political sphere– in capitalism preference are revealed with purchases versus votes. Efficiency in competitive markets occurs where MB=MC. Where MB= private (max.) willingness to pay and MC= private (min.) willingness to sell. More correctly, society will see the outcome as efficiency where marginal social benefits = marginal social costs. Externalities drive a wedge between private and social benefits and private and social costs. Price of Aluminum Supply (private cost) Equilibrium MB=MC Demand (private value) 0 QMARKET Quantity of Aluminum Copyright © 2004 South-Western Externalities are benefits (costs) received (borne) by neither the seller or the buyer but by third parties. Private benefits + external benefits = social benefits Private costs + external costs = social costs Since external benefits and costs are not perceived by buyers and sellers they are not captured in markets. Therefore, markets may fail to allocate resources inefficiently. Marginal social costs are greater than marginal private costs. Pollution is a cost that may not be borne by sellers, but it is a cost nonetheless to society. Private markets will overproduce (devote too many resources) to the production of goods with negative externalities. External costs and the supply curve. Missing the extra costs, markets generate an outcome where MSC > MSB, signal that decreasing output will increase net social benefits. Is zero pollution efficient? Price of Aluminum Social Cost =MSC Cost of pollution Supply (private cost) =MPC MSC MSC Optimum Equilibrium MSB MSB Demand (private value) MPB=MPB 0 QOPTIMUM QMARKET Quantity of Aluminum Copyright © 2004 South-Western Marginal social benefits are greater than marginal private benefits. Education is a benefit not only to the individual but to society in general. Private markets will underproduce (devote too few resources) to the production of goods with positive externalities. External benefits and the demand curve. Missing the extra benefits, markets generate outcomes where MSB > MSC, a signal that increasing production will increase net social benefits. Price of Education Supply (private cost) MSB The market does too little MSB>MSC MSC Social value Demand (private value) 0 QMARKET QOPTIMUM Quantity of Education Copyright © 2004 South-Western Efficiency versus who ought to modify their behavior? Moral and Ethical Codes Non-governmental organizations or Charities Integrating certain activities (bee keepers and fruit growers) Contract between parties Coase Theorem – if negotiation costs are zero, private parties can resolve the problem of externalities. An optimal compensatory payment (bribe) = one that makes both parties better off. Initial distribution of rights does not affect the efficient outcome, but it does determine who will pay whom. Example of heating the apartment in Santiago Government Regulation policies Limits to pollution Specific technology requirements Government production Regulation and least cost solutions Taxes and Subsidies Who should pay the tax or receive the subsidy? Tax /subsidy incidence is the same External costs, supply (demand) and the optimal tax. External benefits, demand (supply) and the optimal subsidy. Tradeable Pollution Permits The higher costs of avoiding pollution, i.e. the higher the benefits from polluting, the more a firm is willing to pay. Criticism of Economic Solutions to Pollution To live is to pollute Natural carrying capacity Externalities are “invisible” to buyers and sellers in markets. In some cases, government action may be needed to make them visible and ensure they are included in economic decision-making. The efficient allocation of resources occurs where: MSB=MSC Certain kinds of goods or services are underproduced in markets because the market does not contain sufficient incentives to produce them in efficient amounts. Certain kinds of resources are overused because they are owned collectively or people cannot prevent them from being used. Exclusion or non-exclusion– can individuals be excluded from consuming the good or the resource. (e.g. hamburger, houses, physical examination versus fireworks, national defense, and the ocean outside of territorial waters)? Rival or non-rival – does one person’s use of the good or resource affect another persons use. (e.g. hamburger versus lighthouse, uncongested versus congested highway) Rival? Yes Yes No Private Goods Natural Monopolies • Ice-cream cones • Clothing • Congested toll roads • Fire protection • Cable TV • Uncongested toll roads Common Resources Public Goods • Fish in the ocean • The environment • Congested nontoll roads • Tornado siren • National defense • Uncongested nontoll roads Excludable? No Copyright © 2004 South-Western Private Good – excludable and rival (hamburger) Public Good – not excludable and nonrival (lighthouse, warning siren) Common Resource – rival but not excludable (ocean, old days pasture land) Natural Monopoly – excludable but nonrival (protecting another house – MC is small) Examples are fireworks, national defense, basic research, alleviating poverty) Free-rider problem – another example of revealed preference. If people cannot be excluded, they have no little incentive to pay for the good or service). Free-riders make it difficult for private providers to provide the optimal amount of a public good. Voluntary exchange does not work efficiently and efficiency may be provided by government coercion. The government must perform costbenefit analysis to decide if it is worthwhile to provide the good and determine how much should be produced (valuing a life). Stoplights Highways – public or private, uncongested or congested Taxes are then imposed to provide for the good. Boston Commons – overuse of a rival resource where individuals were not purposively not excluded. Ocean Fishing Bison versus Cattle – the importance of property rights Pricing in national parks Efficiency and the market system Market failures Government failures