Mount Inc. was a hardware store that operated in Boise,... acquisitions that loaded the store with unsalable merchandise. Due to...

advertisement

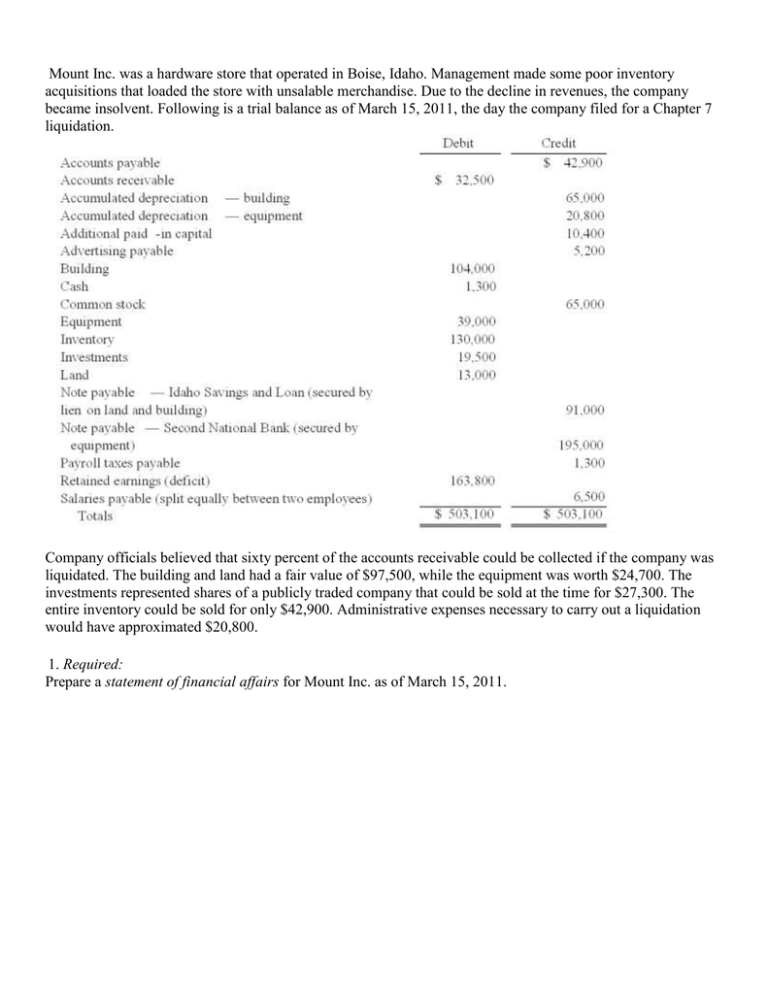

Mount Inc. was a hardware store that operated in Boise, Idaho. Management made some poor inventory acquisitions that loaded the store with unsalable merchandise. Due to the decline in revenues, the company became insolvent. Following is a trial balance as of March 15, 2011, the day the company filed for a Chapter 7 liquidation. Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation would have approximated $20,800. 1. Required: Prepare a statement of financial affairs for Mount Inc. as of March 15, 2011. 2. Assume that the company was being liquidated and that the following transactions occurred: Accounts receivable of $23,400 were collected. All of the company's inventory was sold for $52,000. Additional accounts payable of $13,000 incurred for various expenses such as utilities and maintenance were discovered. The land and building were sold for $92,300. The note payable due to the Idaho Savings and Loan was paid. The equipment was sold at auction for only $14,300 with the proceeds applied to the note owed to the Second National Bank. The investments were sold for $27,300. Administrative expenses totaled $26,000 as of July 26, 2011, but no payment had yet been made. Required: Prepare a statement of realization and liquidation for the period from March 15 through July 26, 2011. 3. How much cash would have been paid to an unsecured nonpriority creditor who was owed a total of $1,300 by Mount Inc.? (Round the payout percentage to a whole number.) Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet: Additional information is as follows: - The investments are currently worth $13,000. - It is estimated that $32,000 of the accounts receivable are collectible. - The inventory can be sold for $74,000. - The prepaid expenses and the intangible assets have no net realizable value. - The land and building are currently valued at $250,000. - The equipment can be sold for $60,000. - Administrative expenses (not yet recorded) are estimated to be $12,500. - Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees). - Accrued expenses include $7,000 of unpaid payroll taxes. 4. Compute the amount of total assets available to pay liabilities with priority and unsecured creditors. 5. Compute the amount of total liabilities with priority. 6. Compute the amount of assets available for unsecured creditors after payment of liabilities with priority. 7. Compute the amount of unsecured liabilities without priority. 8. What is the payout percentage to unsecured creditors? (Round the percentage to a whole number and two decimal places.) 9. How much will be paid to the holder of the note payable secured by the land and building? (Round your payout percentage to the nearest whole number.) 10. How much will Hampton's creditor of an unsecured accounts payable of $4,000 receive? 11. Prepare a Statement of Financial Affairs. Coyote Corp. (a U.S. company in Texas) had the following series of transactions in a foreign country during 2011: The appropriate exchange rates during 2011 were as follows: 12. Prepare all journal entries in U.S. dollars along with any December 31, 2011 adjusting entries. Coyote uses a perpetual inventory system. 13. What amount will Coyote Corp. report in its 2011 balance sheet for Inventory? 14. What amount will Coyote Corp. report in its 2011 income statement for Cost of goods sold? 15. What amount will Coyote Corp. report in its 2011 income statement for Sales? 16. What amount will Coyote Corp. report in its 2011 balance sheet for Accounts receivable? 17. What amount will Coyote Corp. report in its 2011 balance sheet for Accounts payable? 18. The beginning balance of cash was 50,000 pesos on January 1, 2011, translated at 1 peso = $.18. What amount will Coyote Corp. report in its 2011 balance sheet for Cash? On November 10, 2011, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2012. On December 1, 2011, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two month forward exchange rate on that date was 1 LCU = $.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows: The company's borrowing rate is 12%. The present value factor for one month is .9901. 19. (A.) Assume this hedge is designated as a cash flow hedge. Prepare the journal entries relating to the transaction and the forward contract. (B.) Compute the effect on 2011 net income. (C.) Compute the effect on 2012 net income. 20. (A.) Assume this hedge is designated as a fair value hedge. Prepare the journal entries relating to the transaction and the forward contract. (B.) Compute the effect on 2011 net income. (C.) Compute the effect on 2012 net income. 21. On January 1, 2011, Veldon Co., a U.S. corporation with the U.S. dollar as its functional currency, established Malont Co. as a subsidiary. Malont is located in the country of Sorania, and its functional currency is the stickle. Malont engaged in the following transactions during 2011: Required: Calculate the translation adjustment for Malont. (Round your answers to the nearest whole dollar.) Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the stickle. Currency exchange rates were as follows: 22. Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars. 23. Prepare a statement of retained earnings for this subsidiary in stickles and then translate the amounts into U.S. dollars. 24. Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars. Boerkian Co. started 2011 with two assets: cash of §26,000 (stickles) and land that originally cost §72,000 when acquired on April 4, 2008. On May 1, 2011, the company rendered services to a customer for §36,000, an amount immediately paid in cash. On October 1, 2011, the company incurred an operating expense of §22,000 that was immediately paid. No other transactions occurred during the year so an average exchange rate is not necessary. Currency exchange rates were as follows: 25. Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the stickle was the functional currency of the subsidiary. Calculate the translation adjustment for this subsidiary for 2011 and state whether this is a positive or a negative adjustment. 26. Assume Boerkian was a foreign subsidiary of a U.S. multinational company and the U.S. dollar was the functional currency of the subsidiary. Prepare a schedule of changes in the net monetary assets of Boerkian for the year 2011 and properly label the resulting gain or loss.