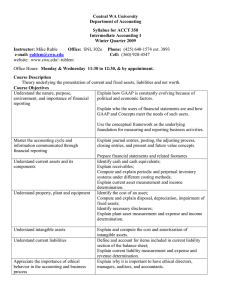

Central WA University Department of Accounting Syllabus for ACCT 350 Intermediate Accounting I

advertisement

Central WA University Department of Accounting Syllabus for ACCT 350 Intermediate Accounting I Fall Quarter 2009 Instructor: Mike Ruble Office: SNL 302e e-mail: rublem@cwu.edu website: www.cwu.edu/~rublem Phone: (425) 640-1574 ext. 3893 Cell: (360) 920-4547 Office Hours: Monday & Wednesday 9:00 to 10:00, 4:30 to 5:30 & by appointment. Course Description Theory underlying the presentation of current and fixed assets, liabilities and net worth. Course Objectives Understand the nature, purpose, Explain how GAAP is constantly evolving because of environment, and importance of financial political and economic factors. reporting Explain who the users of financial statements are and how GAAP and Concepts meet the needs of such users. Use the conceptual framework as the underlying foundation for measuring and reporting business activities. Master the accounting cycle and information communicated through financial reporting Understand current assets and its components Understand property, plant and equipment Understand intangible assets Understand current liabilities Appreciate the importance of ethical behavior in the accounting and business process Explain journal entries, posting, the adjusting process, closing entries, and present and future value concepts. Prepare financial statements and related footnotes Identify cash and cash equivalents; Explain receivables; Compute and explain periodic and perpetual inventory systems under different costing methods; Explain current asset measurement and income determination. Identify the cost of an asset; Compute and explain disposal, depreciation, impairment of fixed assets; Identify necessary disclosures; Explain plant asset measurement and expense and income determination. Explain and compute the cost and amortization of intangible assets. Define and account for items included in current liability section of the balance sheet; Explain current liability measurement and expense and revenue determination. Explain why it is important to have ethical directors, managers, auditors, and accountants. Textbooks: Kieso, Weygandt & Warfield, Intermediate Accounting, 13th ed., Wiley, 2010 Course Requirements & Grading Mid-term Exams, 125 points each Final Exam Projects – to be announced Quizzes Total Possible 250 125 75 120 570 The specific letter grade assigned will be based upon relative point standing at the end of the course. An approximate range of grades would be: Percent 93 to 100 89 to 92 87 to 88 82 to 86 79 to 81 77 to 78 Grade A AB+ B BC+ Percent 72 to 76 69 to 71 67 to 68 62 to 66 59 to 61 Below 59 Grade C CD+ D DF Examinations Examinations will be a combination of problems, short answer and objective (M/C, T or F and Matching) questions. Make-up exams will only be given in very unusual circumstances. An unexcused absence results in a grade of zero. Quizzes Quizzes will be short (20-30 minutes) problems, multiple choice or short answer questions which will be taken in class or taken home, at the end of each two chapters or so. While 7 quizzes will be taken, the lowest grade will be dropped so the high 6 quizzes will be a part of the course grade. Homework Assigned homework is for your benefit and will be discussed in class. So keep current and stay ahead of the curve. Projects Projects are still under development and will be announced soon. Caveat The above schedule and procedures in this course are subject to change in the event of circumstances beyond the instructor’s control.