Instant Messaging Concepts and Positioning in Mobile 3G Markets Author Matti Vesterinen

advertisement

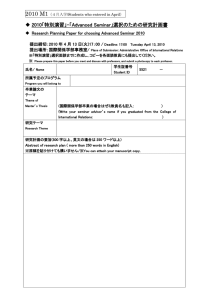

Instant Messaging Concepts and Positioning in Mobile 3G Markets Author Matti Vesterinen Supervisor Professor Heikki Hämmäinen Instructor Doctor Roland Wölker Not That Confidential 1 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Contents • Theoretical Frameworks • Foundation of the study • Industry scenarios • Conclusions 2 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Introduction • IM an extremely popular service in the Internet • Mobile IM (MIM) still a niche service • Voice services predicted to decline in the future • Need for new revenue sources • Problem: • What will the future MIM industry look like? 3 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Theoretical Frameworks •Industry scenarios: •Five forces: Identify the uncertainties that may affect industry structure Threat of new entrants Determine the causal factors driving them Make a range of plausible assumptions about each important causal factor Rivalry among existing firms Bargaining power of suppliers Bargaining power of buyers Combine assumptions about individual factors into internally consistent scenarios Analyse the industry structure that would prevail under each scenario Threat of substitute products or services •Thematic interview 4 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Determine the sources of competitive advantage under each scenario Predict competitor behaviour under each scenario Positioning of MIM • Big four IM providers Yahoo!, MSN, AOL and ICQ have proprietary services • SMS used in some cases as a bearer for IM and email • Solutions created to make services more real time: SMS chat, push email Real time (telephony) MIM t IM e Intern Near real time (file transfer) SMS Non real time (attachments) Email Any file Video clip format 5 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe MMS Image Text Voice Video Overall delay decreases Overview of Bearer Technologies Internet services Video Conferencing File transfer Video sharing Browsing PoC Email Online gaming MMS WAP browsing CSD HSCSD GPRS EDGE Bandwidth increases 6 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe WCDMA HSDPA WIMAX MIM Technologies • SMS solutions • Usage expensive, work in every phone • IP Multimedia Subsystem • 3GPP standardised, not everyone follow the standard • Wireless Village • Large device base, lack of running servers • SIP/SIMPLE • Still to come, SIP used mostly so far for VoIP • XMPP • Standard ready, Google first big supporter • Java clients • Difficult to make compelling UI, widely supported • Proprietary solutions • Big four and VoIP players emerge from the Internet 7 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Industry Scenarios – Identifying Uncertainties List of uncertain elements of structure is constructed using Michael Porter’s five forces analysis: Entry Barriers How big will the advantage be to have large volumes (savings in R&D, marketing, distribution, etc.)? … Rivalry What is the market balance between big four and / or between operators? … Substitutes How popular will other mobile messaging services be (SMS, MMS, email, VIM)? … Buyers How high will user demand be? … Suppliers Will operators create MIM services in-house? … 8 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Industry Scenarios – Scenario Variables Scenario Variables are elements that are independent and are able to affect industry structure: SCENARIO VARIABLE New proprietary solutions Operator support Terminal support Network support Interoperability Commitment Technical solutions Service expandability Provider incentives User demand Service description Pricing model Clientele 9 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe CORRESPONDING UNCERTAINTY Would new proprietary solutions be able to offer something that current solutions will not offer? How difficult will it be to offer MIM service without support from mobile operators? How difficult will it be to offer MIM service without support from terminal manufacturers? How difficult will it be to offer MIM service without support from network (P2P type of solutions)? Will there be interoperability among different communities? Will Internet IM providers / mobile operators be committed to MIM? Will there be significant differences between MIM services offered through different solutions (Wireless Village, SIP/SIMPLE, XMPP-Jabber, proprietary, etc.)? How easy will it be to scale the service (geographically, feature-wise)? What are the incentives to offer MIM (e.g. big four vs. operators)? How high will user demand be? Will there be significant differences between MIM services of different providers (pricing, features, advertisements, etc.)? What kind of pricing models will be deployed? How popular will enterprise MIM be? Industry Scenarios – Causal Factors Identifying causal factors is the way to verify that the uncertain elements are not dependent elements. Causal factors will also help in determining the range of assumptions that will be made about each scenario variable. SCENARIO VARIABLE CAUSAL FACTORS New proprietary solutions External to the industry Regulations Internet solutions (proprietary or not) Overall technology development Internal to the industry Capabilities / restrictions with available solutions Selection and success of open standards Number of available standards Operator support External to the industry Regulations Buying habits of end users Popularity of service bundles Popularity of subsidisation Development of charging and billing methods Internal to the industry Policies of players Technology development Terminal support 10 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe External to the industry Regulations Usage habits of end users Overall technology / service development … Industry Scenarios - Scenarios SCENARIO VARIABLE New proprietary solutions Operator support Terminal support Network support Interoperability Commitment Technical solutions Service expandability Provider incentives User demand Service description Pricing model Clientele KASANEN RÄISÄNEN X X LEHTI 1 2 X X OVERALL X X X X 2 1 1 Interviews were conducted in order to find the most important scenario variables 1 X Terminal support 1 No No Yes 1 2 Among mobile operators 3 Interoperability A scenario should be an internally consistent view of what future industry structure could be 11 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Among Internet communities All 4 5 6 Industry Scenarios - Analysis Each of the six scenarios were analysed in the same way: 12 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Discussion • Geographical location of the market Terminal support • Phone price categories No • Evolution paths No Yes 1 2 Among mobile operators • Sustainability 3 Interoperability • Persistent connectivity • Minimal bandwidth • Charging models 13 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Among Internet communities All 4 5 6 Conclusions • The most important scenario variables affecting the future MIM industry: • Terminal support • Interoperability • Role of big four likely to increase in relation to the amount of interoperability • However, cooperation with Internet players is a source of competitive advantage for mobile operators under certain industry structures • Service usability and competitors highlighted as well • Resulted scenarios can be used for constructing more specific strategies • More extensive research by choosing more or different scenario variables • How revenue from other mobile services, especially mobile messaging services, would be affected under each of the six scenarios 14 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Questions? Thank you! Not That Confidential 15 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Industry Scenarios – Analysis 16 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Industry Scenarios – Analysis SCENARIO 2 “Isolated islands” Future Industry Structure Terminal support creates entry barriers and consequently economies of scale needed to enter the market. New customers and more usage through cooperation - fierce market share game. Switching costs high if preinstalled services satisfactory. Big four players powerful in case terminals support their services. Structural Attractiveness Low Sources of Competitive Advantage High initial market share. National economies of scale. Choosing target segment and differentiating accordingly. Keeping cost of differentiation low. Competitors serving different segments. How aggressively will the big four players target mobile domain? Competitor Behaviour Aggressively 17 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Cautiously S 3 Industry Scenarios – Analysis“Operator communities dominate” CENARIO Future Industry Structure Offering access to Internet communities an opportunity for new entrants. Especially acquisitions by Internet players possible. Disruption through price competition and connecting to Internet players. Most users use preinstalled service. The big four players have little power over mobile operators. Structural Attractiveness Moderate Sources of Competitive Advantage Pricing. National scale economies. Usability on the level of SMS and MMS. Common user interface for all messaging services. Know-how from other mobile services. Advertising benefits all operators on the market. Will Mobile Virtual Network Operators (MVNO) start a price war? Competitor Behaviour Yes 18 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe No Industry Scenarios – Analysis SCENARIO 4 “Privilege of few” Future Industry Structure Exploitable potential in MIM. Internet communities an opportunity for new entrants. Disruption by connecting operator community to Internet communities. Substitute services offer chat service for cellular customers. Low switching costs. Structural Attractiveness High Sources of Competitive Advantage Usability. Proprietary extra features. Ability to communicate broadly also with Internet devices. Low cost structure. Operators’ can invest in substitute services or cooperate with Internet players while keeping the customer lockup. Will terminal manufacturers start large scale cooperation with the big four players? Competitor Behaviour Yes 19 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe No Industry Scenarios – Analysis SCENARIO 5 “Mobiles access Internet communities” Future Industry Structure High entry barrier. MIM closely connected to operator’s other services. User’s choice base on price and service characteristics. The big four players powerful. Structural Attractiveness Moderate Sources of Competitive Advantage Attractive pricing. Usability. Attaching MIM more closely to other services. Massive community needed to connect it to the interoperable domain. Global coverage. Will mobile operators and the big four players have a charging agreement? Competitor Behaviour Yes 20 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe No Industry Scenarios – Analysis SCENARIO 6 “All access” Future Industry Structure High entry barriers. Rivalry shifts toward price war. Active users search for the best overall offering. Internet players become more powerful over time due to service portability. Structural Attractiveness Structural attractiveness is low in the long run Sources of Competitive Advantage Low cost structure. High market share. Global scale economies. Blocking paths for new players to enter the industry. Right target segment matching capabilities and overall strategy. Innovative features – Call for skilled and motivated employees. How aggressively the big four players try to broaden their mobile service offering? Competitor Behaviour Aggressively 21 © 2006 Nokia Thesis Seminar / 2006-02-16 / MVe Cautiously