CHAPTER 3 INCOME SOURCES I. Gross Income

advertisement

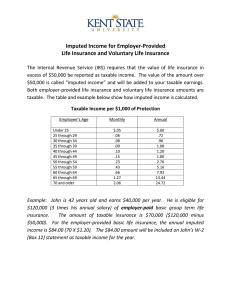

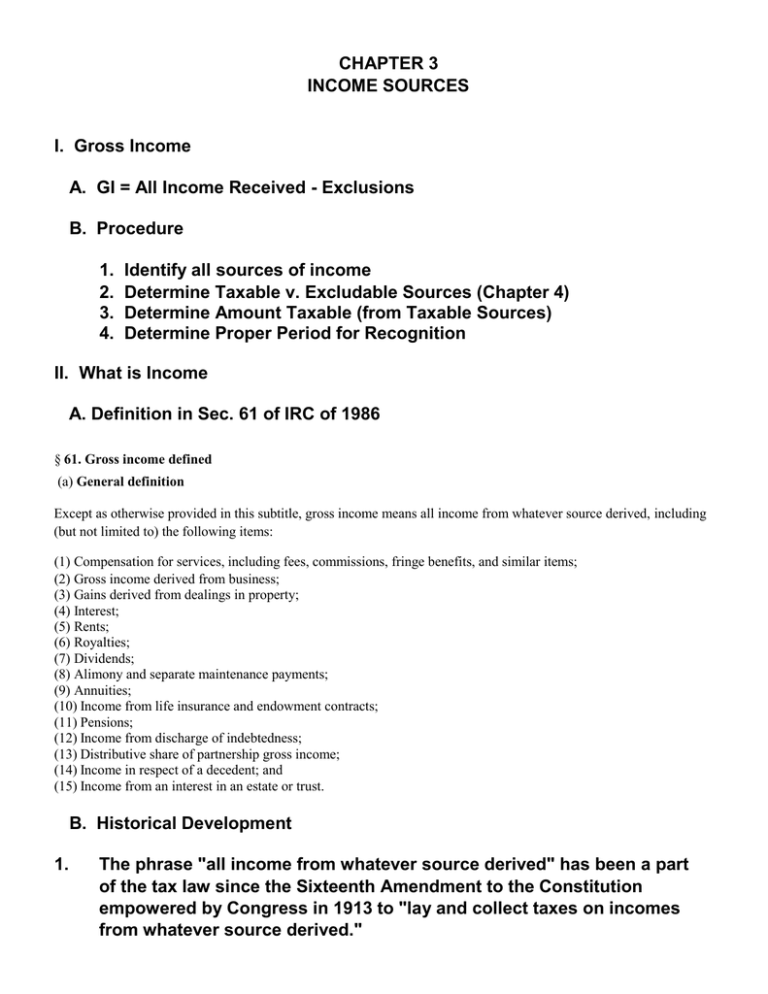

CHAPTER 3 INCOME SOURCES I. Gross Income A. GI = All Income Received - Exclusions B. Procedure 1. 2. 3. 4. Identify all sources of income Determine Taxable v. Excludable Sources (Chapter 4) Determine Amount Taxable (from Taxable Sources) Determine Proper Period for Recognition II. What is Income A. Definition in Sec. 61 of IRC of 1986 § 61. Gross income defined (a) General definition Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items: (1) Compensation for services, including fees, commissions, fringe benefits, and similar items; (2) Gross income derived from business; (3) Gains derived from dealings in property; (4) Interest; (5) Rents; (6) Royalties; (7) Dividends; (8) Alimony and separate maintenance payments; (9) Annuities; (10) Income from life insurance and endowment contracts; (11) Pensions; (12) Income from discharge of indebtedness; (13) Distributive share of partnership gross income; (14) Income in respect of a decedent; and (15) Income from an interest in an estate or trust. B. Historical Development 1. The phrase "all income from whatever source derived" has been a part of the tax law since the Sixteenth Amendment to the Constitution empowered by Congress in 1913 to "lay and collect taxes on incomes from whatever source derived." C. Current View 1. An increase in wealth 2. Realization a. A change in the form and/or substance of the taxpayer's property or property rights and b. The involvement of a second party - generally an ArmsLength Transaction Note: No definition of income exists in the Internal Revenue Code. What constitutes income evolves with changes in society. III. Income Sources A. Earned Income - Income received from the performance of labor or services. 1. Problems a. Assignment of Income -- Attempt to transfer income earned by a higher marginal rate taxpayer to a family member who is in a lower tax bracket. Foiled by the assignment of income doctrine. Entity that earns income must pay tax on it regardless of who receives the income. b. What Constitutes a Receipt 1) Cash-Equivalent approach - anything received that has a fair market value will trigger income recognition. Income can be received in cash, goods, services, lodging, stock, etc. 2) Constructive Receipt c. GI from a Trade or Business = Sales - COGS B. Unearned Income - Earnings from investments and gains from the sale, exchange, or other disposition of investment assets. Unearned income represents the return on an investment. 1. Interest and Dividend Income Chapter 3 - 3 a. Dividends taxed at long-term capital gains rates (2003 Act) 2. Rental and Royalty Income b. GI = Income received less related expenses 1) Losses may result 3. Annuities - A series of equal payments received over equal time periods for a determinable period of time. General Operation of an Annuity Current Investment ($$) Future Receipts $ $ $ $ $ a. Problem - What portion of the future receipts constitute a return of capital (original investment) and what portion of the future receipts represent a return on capital (income). b. Formula for capital investment portion Exclusion Ratio = Cost of the Contract (Investment) Number of Payments Amount Included = Payments Received - Amount Excluded 1) Problem - How many payments will be received when the annuity calls for payments for life? A) Payments received > Nov. 18, 1996 - Use “simplified method” B) Table 3-2 for more than 1 annuitant Table 3-1 Number of Monthly Annuity Payments Using the Simplified Method Age on Annuity Starting Date Number of Payments 55 and under 360 56-60 310 61-65 260 66-70 210 71 and over 160 Chapter 3 - 4 2) Problem - outliving the life expectancy - more payments are received on the annuity than were provided for in the exclusion ratio calculation. A) When the period used to calculate the exclusion ratio passes, all subsequent payments are fully taxable. 3) Problem - Early death - i.e. not all expected payments are received. A) In the year of death, a deduction is allowed for any investment in the annuity that has not yet been excluded. 4. Calculation of gain/loss on sale of investments Less: Less: Equals: Proceeds from Sale of Property Selling Expenses Amount Realized from Sale of Property Adjusted Basis of the Property Gain (Loss) on Sale 5. Income from Conduit Entities a. The owner of a conduit entity (partnership, S corporation) held as an investment includes their share of the conduit's income on their return. 1) Any payments received from the conduit (withdrawals, dividends) are not income. They are returns of the taxpayer's investment (reduce basis). C. Transfer From Others -Increases in wealth that are neither earned nor do they represent income from investment. 1. Prizes & Awards - generally taxable a. Awards received for literary, scientific, educational, and charitable achievements may be excluded from tax if they are immediately given to a governmental or qualified charitable organization. b. Awards of tangible personal property for employee achievement based on length of service or safety are allowed an exclusion of up Chapter 3 - 5 to $400 of the value of the award. 1) Exclusion goes to $1,600 if made out of a qualified plan. 2. Unemployment Compensation - always taxable a. Compared to Workers' Compensation 3. Social Security Benefits a. Rationale for taxation of 1/2 of benefits received b. Formula for determining taxable amount: Taxable amount of Social Security: The Lesser of: 1) 1/2 (Social Security Benefits) or 2) 1/2 (Modified AGI - Base Amount) Modified AGI = AGI + 1/2 (SS Benefits) + Tax Exempt Income Base Amount = $25,000 Unmarried; $32,000 Married c. Taxpayers whose modified AGI exceeds $34,000 (unmarried), $44,000 (married couple) are subject to the 2nd tier inclusion rule. Taxable portion of Social Security is the lesser of: 1) 85% (Social Security Benefits) or 2) the sum of: a. 85%(modified AGI - base amount) plus b. the smaller of: Taxable Social Security under 50% calc. (above) or $4,500 for an unmarried individual $6,000 for a married couple Base Amount = $34,000 Unmarried; $44,000 Married Chapter 3 - 6 4. Alimony Received a. Treatment of Alimony v. Child Support b. Property Settlements - Not taxable 1. Problem - Front loading alimony to disguise property settlement c. Alimony Payments reduced based on a contingency related to a child. 1. The amount of reduction is treated as a child support payment. Alimony is the amount to be paid over the entire time period. 5. Death benefits - Taxable if received after August 19,1996. D. Imputed Income 1. General nature of imputed income 2. Role of Administrative Convenience Concept 3. Below Market Rate (Interest Free) Loans a. All loans are deemed to carry interest at the applicable federal interest rate. b. This results in an imputation of interest owed from the borrower to the lender. 1) Lender Has Interest Income; Borrower has Interest Expense from this imputed interest. c. An imputed payment of cash from the lender is deemed to occur to pay the lender the interest imputed in the first step. [SEE Figure 31 on page 103] 1) The taxability of this second imputation depends on the relationship that exists between the borrower and the lender. a) Gift Loans - loans made between family members. The Chapter 3 - 7 second imputation is considered to be a gift. Gifts are not taxable to either the donor or the donee. i.e. the only tax effect for a gift loan is the initial imputation of interest on the loan in the first step. b) Employment Related Loans - Loans made between an employer and an employee. The imputed payment of cash in step 2 is deemed to be compensation paid from the employer to employee. Result: Income to the employee/deduction for the employer. c) Shareholder Loans - Loans made between a corporation and a shareholder. If the corporation makes the loan, the imputed payment of cash is considered to be a dividend paid to the shareholder. Result: Income to the shareholder/no deduction for the corporation. If the shareholder makes the loan to the corporation, the imputed payment of cash is deemed to be a contribution to the capital of the corporation. Result: No income to either the shareholder or the corporation. d. Exceptions for certain loans 1. De Minimis loans - any loan < $10,000 is exempted from the imputed interest rules. 2. Gift Loans < $100,000 a) Interest imputed on the loan cannot borrower's net investment income. exceed the 1) Net Investment Income = Investment Income Investment Expenses. b) If the borrower's Net Investment Income is < $1,000, no interest is imputed on the loan. i.e. the loan is exempted from the imputed interest rules. 4. Payment of Expenses by Others - Anytime one taxpayer pays the expenses of another taxpayer, the taxpayer whose expenses were paid has realized an increase in wealth. Chapter 3 - 8 a. The increase in wealth constitutes income, unless the payment is made as a valid gift. b. Most income recognition situations involve payments of expenses in a business setting. 5. Bargain Purchases - When one taxpayer confers a benefit on another taxpayer by allowing them to purchase property at a price below market value, the "bargain" element is taxable to the purchaser. a. Purchases made at Arms-Length are not taxable. b. Most bargain purchases occur in business settings. The Substance of the sale is an attempt to compensate. IV. Capital Gains and Losses A. Netting Procedure EXHIBIT 3-4 CAPITAL GAIN AND LOSS NETTING PROCEDURE STEP 1 Identify all capital gains and losses occurring during the year as being shortterm gains and losses, long-term gains and losses, collectibles gains and losses, gains on qualified small business stock, and unrecaptured Section 1250 gains. STEP 2 Combine all long-term gains and losses to determine a net long-term position for the year. Collectibles gains and losses, gains on qualified small business stock, and unrecaptured Section 1250 gains are treated as being held long term. Combine all short-term gains and losses to determine a net short-term position for the year. Long-Term Gains Long-Term Losses Net Long-Term Gain (Loss) $ XXX (XXX) Short-Term Gains Short-Term Losses Net Short-Term Gain (Loss) $ XXX (XXX) $ XXX $ XXX or or $ (XXX) $ (XXX) STEP 3 If the positions determined in Step 2 are opposite (i.e. one is a gain and one is a loss), net the two positions together to obtain either a gain or a loss position for the year. If the positions determined in Step 2 are the same (i.e. either both are gains or both are losses), no further netting is necessary. Chapter 3 - 9 B. Treatment of Net Capital Gains and Losses (Individuals) Table 3-4 Capital Gain/Loss Position Short-term capital gain Holding Period 12 months or less Tax Treatment Ordinary income Adjusted net capital gain More than 12 months Taxed at 15% (0% for 10% or15% marginal rate taxpayers; 20% for 39.6% marginal rate taxpayers) Unrecaptured Section 1250 gain More than 12 months Taxed at a maximum rate of 25% Net collectibles gain More than 12 months Taxed at a maximum rate of 28% Gain on qualified small business stock More than 5 years 50% of gain is excluded. Remaining gain is taxed at a maximum rate of 28% Short-term capital loss 12 months or less Deductible loss for AGI; limited to $3,000 per year with indefinite carryforward of excess loss to future year's netting Long-term capital loss More than 12 months Deductible loss for AGI; limited to $3,000 per year with indefinite carryforward of excess loss to future year's netting. Any short-term losses are applied against the $3,000 limit before long-term losses are deducted C. Adjusted Net Capital Gain (Netting results in LTCG) 1. Adjusted Net Capital Gain = Net LTCG from netting - 28% Rate Gain - Unrecaptured Section 1250 Gain + Dividend Income 2. 28% Rate Gain = Net Gains taxed at 28% - Net STCL - LTCL Carryover a. If 28% rate gain is negative, it is netted against any unrecaptured Section 1250 gain. 3. The effect of this ordering is to tax net capital gains at 15% first. Chapter 3 - 10 D. Conduit Entity Reporting of Capital Gains 1. Conduit entities must report each owner's (partner, stockholder) share of the conduit's "ordinary taxable income" separately from any income or deduction items that receive special treatment on the owner's individual return. Because capital gains and losses are netted separately on individual owners returns each owner's share must be reported separately from other income. E. Tax Treatment of Dividends -- Eligible dividends received are taxed at the long-term capital gains rates (0%, 15%, or 20%). 1. Eligible dividends are dividends from a domestic corporation or certain qualified foreign corporations. V. Effect of Accounting Method on Income Recognition A. Cash Method - In general 1. 2. 3. 4. 5. Cash-Equivalent Approach Constructive Receipt Simplicity of Method Ability to Time Income and Deductions Restrictions on Use a. If the taxpayer has inventories, sales and cost of goods sold must be accounted for on the accrual method. B. Hybrid Method - Use accrual for sales of inventories and to calculate Cost of Goods Sold. All other income and Expense items are accounted for using the Cash Method. C. Accrual Method - In general 1. Cost and Complexity of Method 2. Little leeway to Time Income and Deductions Chapter 3 - 11 D. Exceptions Applicable to Accrual Basis Taxpayers 1. Receipts of Prepaid Income (Rents, Interest, Service income) are generally taxable in the year of receipt under the Wherewithal-To-Pay Concept. 2. Deferral method – Advance receipts for services, goods for sale, use of intellectual property, use of property if use is ancillary to the provision of services (e.g., hotel rentals), guaranty or warranty contracts ancillary to any of the previous items, subscriptions, and membership prepayments may be deferred to the extent the gross income is included in financial income. Any remaining income must be recognized in the next year. a. Prepaid rents and interest are never deferred! 3. Exception for Advance Receipts for Goods - the accrual method may still be used if the advance receipt is less than the cost of the goods (i.e. it is a deposit) and the prepayment is also deferred for financial reporting purposes. E. Exceptions Applicable to Both Methods (Not covered this semester) 1. Installment Sales - A sale of property where income is received in more than one tax year. Dealers in property are not allowed to use the installment sales method. a. Income (gain on sale) is recognized as payments are received. i.e. the income recognition is based on Wherewithal-To-Pay b. Installment Sale Provisions do not apply to losses 2. Percentage of Completed Contract Method - Construction contracts that take more than one year to complete must be accounted for on the basis of work completed during the year.