FORM VAT 126 canteens) for the month of [See Rule 44 (2)(a)]

advertisement

![FORM VAT 126 canteens) for the month of [See Rule 44 (2)(a)]](http://s2.studylib.net/store/data/016946992_1-03402c6060a7141d9dddd900f81fb970-768x994.png)

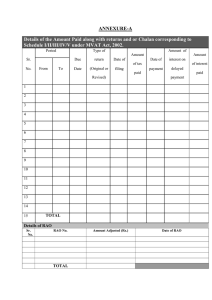

FORM VAT 126 [See Rule 44 (2)(a)] Monthly statement of tax deducted at source (in respect of industrial canteens) for the month of 1. Name and address of the person deducting tax : 2. Registration Certificate No. if registered under the Karnataka Value Added Tax Act, 2003. : 3. Amount paid by the factory / industrial concern / establishment to the dealer running canteen / cafe / restaurant run in their premises as their contribution : 4. Amount received by the dealer from the employees : 5. Total amount received by the dealer towards sale of articles of food and drinks to the employees : 6. Amount of tax deducted at source at 4% : 7. Details of remittance (a) Challan No. and date, if remitted to Government Treasury / Bank Or (b) Cheque, DD or Receipt No. and date if remitted to the Local VAT office or VAT Suboffice : DECLARATION I, .......................... do hereby solemnly declare that to the best of my knowledge and belief, the information furnished in the statement is true and complete. Place: Date: Signature of the authorized person Name and Status

![Form C-II BiharValue AddedTax Act, 2005 [See rule 29(4)(i)]](http://s2.studylib.net/store/data/016946521_1-69cdc6071f1e00f3a3d37cdb1d375ea6-300x300.png)

![PART-1 FORM 801 [see Rule 17A(2)] TRANSACTION-WISE VAT SALES TO CUSTOMERS e-ANEXURE, e-LOC](http://s2.studylib.net/store/data/016947222_1-fd898eba575f8458e01be1825021f012-300x300.png)