Standard 5 Study Guide Saving and Investing

advertisement

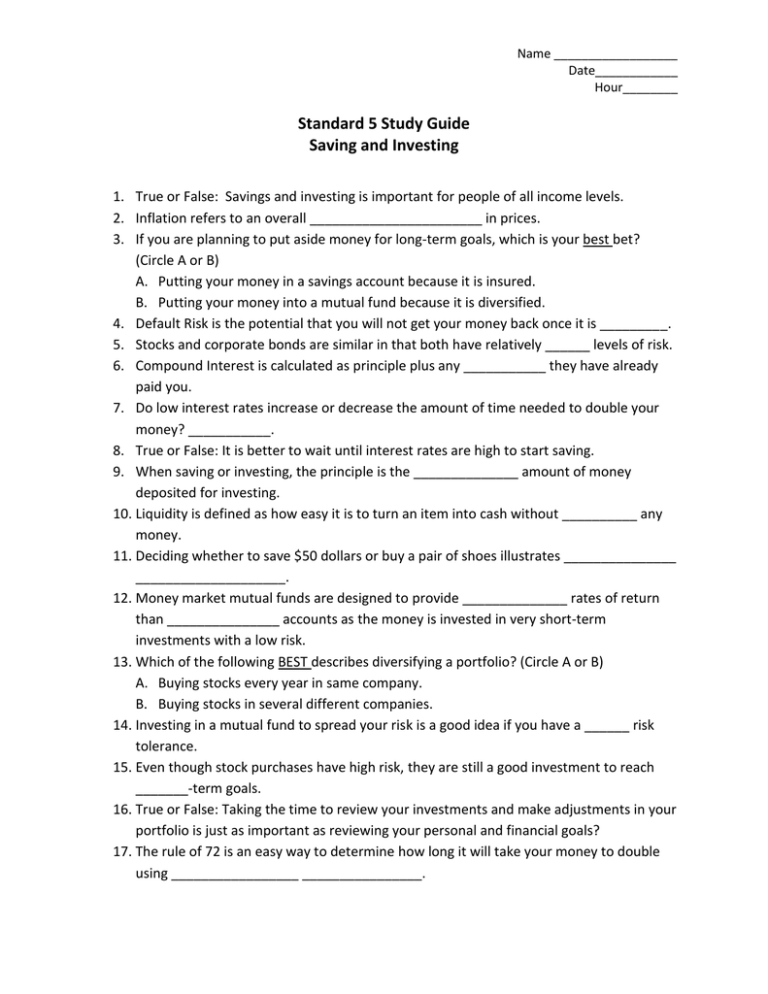

Name __________________ Date____________ Hour________ Standard 5 Study Guide Saving and Investing 1. True or False: Savings and investing is important for people of all income levels. 2. Inflation refers to an overall _______________________ in prices. 3. If you are planning to put aside money for long-term goals, which is your best bet? (Circle A or B) A. Putting your money in a savings account because it is insured. B. Putting your money into a mutual fund because it is diversified. 4. Default Risk is the potential that you will not get your money back once it is _________. 5. Stocks and corporate bonds are similar in that both have relatively ______ levels of risk. 6. Compound Interest is calculated as principle plus any ___________ they have already paid you. 7. Do low interest rates increase or decrease the amount of time needed to double your money? ___________. 8. True or False: It is better to wait until interest rates are high to start saving. 9. When saving or investing, the principle is the ______________ amount of money deposited for investing. 10. Liquidity is defined as how easy it is to turn an item into cash without __________ any money. 11. Deciding whether to save $50 dollars or buy a pair of shoes illustrates _______________ ____________________. 12. Money market mutual funds are designed to provide ______________ rates of return than _______________ accounts as the money is invested in very short-term investments with a low risk. 13. Which of the following BEST describes diversifying a portfolio? (Circle A or B) A. Buying stocks every year in same company. B. Buying stocks in several different companies. 14. Investing in a mutual fund to spread your risk is a good idea if you have a ______ risk tolerance. 15. Even though stock purchases have high risk, they are still a good investment to reach _______-term goals. 16. True or False: Taking the time to review your investments and make adjustments in your portfolio is just as important as reviewing your personal and financial goals? 17. The rule of 72 is an easy way to determine how long it will take your money to double using _________________ ________________. Name __________________ Date____________ Hour________ 18. Which form of interest gives you the greatest return? (Circle A or B) A. Simple B. Compound 19. True or False: An average rate of return on an investment shows past performance and how it might perform in the future. 20. Government savings bonds are backed by the _______________________, so there is little or no default risk. 21. If your account is earning 6% interest, it will take ________ years for your money to double. 22. Which of the following items is liquid? a. Money is in a savings account. b. A new Car. c. Money invested in a CD. d. Money invested in real estate. 23. How much money will you have at the end of 5 years if your principal is $100 and your interest rate is 10% (Simple interest)? _______________ 24. If you plan to go skiing next winter, your best choice for saving money is: ( circle A or B) A. Buying Stock. B. Putting money in a savings account. 25. How much money will you have at the end of 5 years if your principal is $100 and your annual compound interest rate is 10%? _______________