IFAC

Education

June 2002

Exposure Draft

Response Due Date December 31, 2002

Committee

Continuing Professional

Education and Development

Proposed International Education

Guideline for Professional Accountants

Issued for Comment by

the International

Federation of Accountants

This Exposure Draft was approved for publication in May 2002 by the

Education Committee of IFAC.

The mission of IFAC is the worldwide development and enhancement of

an accountancy profession with harmonized standards, able to provide

services of consistently high quality in the public interest. The Education

Committee’s mission is to serve the public interest by the worldwide

advancement of education and development for professional accountants

leading to harmonized standards.

The Education Committee requests comments on this Exposure Draft.

Respondents are encouraged to comment on the specific questions

attached at the end of this document and any other issues related to this

Exposure Draft. Comments sent by email are preferred but they may also

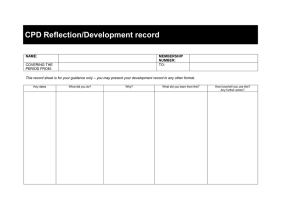

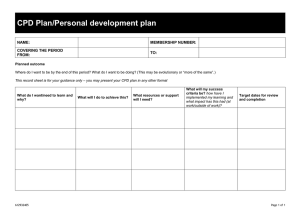

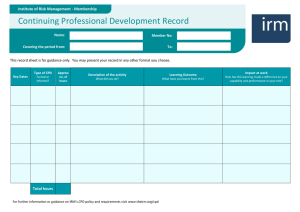

be submitted by computer disk or in hard copy.

Comments should be received by 31 December 2002.

Comments received by the due date will be reviewed by the Education

Committee and may influence the final Guideline. Comments received

before 15 October 2002 will be reviewed by the Education Committee at

its November 2002 meeting. Comments received after that date will be

reviewed by the Committee in March 2003.Notwithstanding this,

comments received after the due date and on an ongoing basis are also

welcome. Respondents should note that comments are considered a matter

of public record.

Comments on this publication should be sent to:

Technical Director

International Federation of Accountants

535 Fifth Avenue, 26th Floor

New York, NY 10017, USA

Fax + 1 212-856 9420

E-mail responses should be sent to: EDComments@ifac.org

Information about the International Federation of Accountants can be

found at its website, www.ifac.org. Copies of this publication may be

downloaded free of charge from the site.

Copyright © June 2002 by the International Federation of Accountants.

All rights reserved.

CONTENTS

PAGE

PREFACE .......................................................................................... 2

INTERNATIONAL EDUCATION GUIDELINES FOR

PROFESSIONAL ACCOUNTANTS .................................................. 2

PURPOSE OF THE GUIDELINE ...................................................... 2

SCOPE OF THE GUIDELINE ........................................................... 2

BACKGROUND .............................................................................. 3

DEFINITIONS ................................................................................... 3

FOREWORD ..................................................................................... 9

ACKNOWLEDGEMENTS............................................................... 11

AVAILABILITY OF CPD ............................................................... 12

APPROPRIATE SUBJECT AREAS ................................................. 13

MINIMUM LEVEL OF CPD........................................................... 15

INPUT- AND OUTPUT-BASED SYSTEMS..................................... 17

COMPLIANCE PROCESS AND RESPONSES TO NONCOMPLIANCE ................................................................................ 19

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

Preface

International Education Guidelines for Professional Accountants

1.

International Education Guidelines for Professional Accountants

(IEG) assist in the implementation of generally accepted good

practice in the education of professional accountants by

providing advice or guidance on how to achieve good practice or

current best practice.

2.

International Education Guidelines for Professional Accountants

may interpret, illustrate, elaborate, or expand on matters related

to International Education Standards for Professional

Accountants. In this function, the Guidelines assist member

bodies to implement and achieve ‘good practice’ as prescribed in

International Education Standards for Professional Accountants.

The Guidelines may also recommend practice that is wider or

deeper than the practice prescribed in a Standard. Alternatively,

they may outline exemplary methods or practices, including

those that are recognized as current ‘best practice’, which

member bodies may wish to adopt.

Purpose of the Guideline

3.

This Guideline is intended to assist member bodies in

establishing a requirement for an effective program of continuing

professional education and development (hereafter referred to as

continuing professional development or CPD) for members, as

prescribed in the proposed International Education Standard,

“Continuing Professional Education and Development”.

Scope of the Guideline

4.

This guideline:

2

addresses the objectives of CPD; the subject areas that

should be viewed as consistent with those objectives; and

the extent of the CPD commitment appropriate for

professional accountants in public practice, industry,

commerce, education and the public sector;

Definitions

explains the importance of mandatory CPD for all member

bodies on a worldwide basis;

explains the necessity of appropriate corrective and

disciplinary mechanisms to assure compliance with CPD

requirements;

assists in the implementation of the proposed International

Education Standard, “Continuing Professional Education

and Development”.

Background

5.

The IFAC Education Committee has for many years issued

guidelines and other papers on education issues. Previously, the

Committee released IEG 2, “Continuing Professional Education”

(February 1982, revised May 1998). The Committee considers

that it is now appropriate to issue individual Standards building

on this framework, by dealing with each major topic in a

separate Standard. In addition, Guidelines will also be developed

to support the Standards where necessary, providing advice,

guidance and examples to assist member bodies in implementing

good practice as prescribed by the Standards.

6.

This Guideline supports the proposed International Education

Standard,

“Continuing

Professional

Education

and

Development”, released as an Exposure Draft in July 2002,

providing further elaboration and interpretation of the standards.

Definitions

7.

Terms marked with an asterisk (*) indicate terms that are defined

elsewhere in this glossary.

Best practice

Refers to practices considered to be exemplary, of the

highest order, the most advanced, or leading in a

particular area in the education* of professional

accountants.

Explanation

“Best practice” refers to the best examples of

established practice in the preparation of professional

3

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

accountants. “Best practice” will often go beyond

“good practice” and, as such, is at a higher level than

the considered minimum requirements. Statements and

examples of “best practice” are essential for the

advancement of accounting education and provide

useful guidance to member bodies for the continual

improvement of their education programs.

Capabilities

Are the professional knowledge, * skills* and

professional values* required to demonstrate

competence*.

Explanation

Capabilities include content knowledge, technical and

functional skills, behavioral skills, intellectual abilities,

and professional values and attitudes.

Competence

Is being able to perform a work role to a defined

standard, with reference to real working environments.

Explanation

Competence may be assessed by a variety of means,

including work place performance, work place

simulations, written tests of various types and selfassessment.

Continuing

professional

development

(CPD)

Refers to learning* activities for developing the

capabilities* of individuals to perform competently

within their professional environments.

Explanation

Continuing professional development is aimed at the

post-qualification maintenance or enhancement of

professional competence. It involves the development

of capabilities through either formal, structured and

verifiable learning programs (sometimes referred to as

‘continuing professional education’ – CPE) or

informal, unstructured learning activity.

4

Definitions

Development

Is the acquisition of capabilities* which contribute to

competence.*

Explanation

Development refers to the growth of attributes that

contribute to competence, however achieved.

Individuals may develop their abilities through a wide

range of processes such as learning, including

education and training; experience; reflection;

observation or receipt of information; other structured

and unstructured learning activities; or through

natural growth over time.

Education

Refers to a systematic act or process aimed at

developing knowledge, skills*, character, or other

abilities and attributes within individuals. It includes

developmental activities commonly referred to as

training*.

Explanation

Education is a formal, structured learning process

whereby individuals develop attributes considered

desirable by society. Education is usually

characterized by the growth of an individual’s mental

and practical abilities, as well as maturing in attitude,

resulting in an enhanced ability of the individual to

function and contribute to society, in either specific or

non-specific contexts. While often conducted in

academic environments, education also includes

formal learning processes in other environments, such

as on-the-job and off-the-job training. Education is, by

nature, formal and therefore excludes informal,

unstructured learning and developmental processes.

Valuable learning, training, and development can also

take place in less formal environments through

processes that are not formal or structured enough to

be considered ‘education’.

Ethics

Refers to the professional values* and principles of

conduct applying to professional accountants* as well

as to students* and trainees* associated with the IFAC

5

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

member bodies.

Good Practice

Refers to those elements considered essential to the

education* and development* of professional

accountants* and performed at a standard necessary to

the achievement of competence. *

Explanation

“Good practice” relates not only to the range of

content and processes of education and development

programs, but also to the level or standard at which

they are performed (i.e. the depth and quality of the

programs). The IFAC Education Committee is

conscious of the wide diversity of culture; language;

and educational, legal, and social systems in the

countries of the member bodies and of the variety of

functions performed by accountants. Different factors

within these environments may vary the ability of

member bodies to adopt some aspects of “good

practice”. Nevertheless, member bodies should

continuously aspire to “good practice” and achieve it

wherever possible.

Information

technology

Refers to hardware and software products, information

system operations and management processes, and the

human resources and skills* required to apply those

products and processes to the task of information

production and information system development,

management and control.

Learning

Refers to a broad range of processes whereby an

individual develops capabilities,* including skills* and

attitudes in the application of knowledge.

Explanation

Learning can be achieved by formal processes such as

education (including training) or informal processes

such as day-to-day work experience, reading published

material, passive observation, and reflection

6

Definitions

Learning Plan

Refers to structured processes that help professional

accountants guide their professional development.*

Plans include a self-assessment of the gap between

current and needed knowledge, skills,* and abilities, a

set of learning objectives arising from this assessment,

and learning activities to be undertaken to fulfill the

learning plan.

Postqualification

Refers to a broad range of processes whereby an

individual develops capabilities,* including skills* and

attitudes in the application of knowledge.

Explanation

The term ‘post-qualification’ is usually associated with

activities and requirements relating to the professional

development of those who have already obtained a

professional qualification. It is often associated with

action relating to the maintenance or further

development of professional competence.

Professional

accountant

Refers to those individuals, whether they be in public

practice (including a sole practitioner, partnership or

corporate body), industry, commerce, the public sector

or education, who are members of an IFAC member

body.

Professional

knowledge

Refers to those topics that make up the subject of

accountancy as well as other business disciplines that,

together, constitute the essential body of knowledge for

professional accountants.*

Professional

values

Are the attitudes that identify professional

accountants* as members of a profession. They

comprise principles of conduct generally associated

with, and deemed essential in defining the distinctive

characteristics of, professional behavior.

Explanation

Professional values include technical competence,

ethical behavior (e.g. independence, objectivity,

confidentiality, and integrity), professional demeanor

7

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

(e.g. due care, timeliness, courteousness, respect,

responsibility, and reliability), pursuit of excellence

(e.g. commitment to continual improvement and lifelong learning), and social responsibility (e.g.

awareness and consideration of the public interest).

Skills

Refer to the various types of abilities required to apply

knowledge and values appropriately and effectively in

a professional context.

Explanation

Professional accountants are required to possess a

range of skills, including technical and functional

skills, organizational and business management skills,

personal skills, interpersonal and communication

skills, a variety of intellectual skills, and skills in

forming professional judgments.

Specialization

Is the formal recognition by a member body of a group

of its members possessing distinctive competence* in a

field, or fields, of activity related to the work of the

professional accountant.

Structured

learning

Is measurable, verifiable activity designed to impart

specific knowledge and skills.*

Explanation

Examples of structured learning include courses and

presentations; individual study programs that require

some completion by the individual; and participation

in formal conferences, briefing sessions, or discussion

groups. Structured learning is usually, in some

respects, not totally within the control of the individual

undertaking the learning. For example, a third party

may determine the scope or design of the activity, or

when or how the learning takes place.

Training

8

Refers to pre- and post-qualification* developmental

activities, within the context of the work place, aimed

at bringing a student* or professional accountant* to an

agreed level of professional competence.*

Explanation

Training includes work place-based education and

experience activities for developing an individual’s

competence to perform tasks relevant to the role of the

professional accountant. Training may be undertaken

while performing actual tasks (on-the-job training) or

indirectly through instruction or work-place simulation

(off-the-job training). Training is conducted within the

context of the work place, with reference to the specific

roles or tasks performed by professional accountants.

It can include any activity purposefully designed to

improve the ability of an individual to fulfill the

practical experience requirements for qualification as

a professional accountant.

Foreword

8.

Readers are referred to the proposed International Education

Standard

“Continuing

Professional

Education

and

Development”. Member bodies are expected to consider that

Standard in establishing CPD requirements. If CPD is a

legislated matter, member bodies are expected to advise

legislators of the international standard and strive for full

compliance.

9.

This pronouncement provides guidelines for the establishment

and enforcement by member bodies of an effective program of

CPD.

10.

The knowledge needed to function effectively as an accountant

in public practice, industry, commerce, education and the public

sector continues to expand and change at a rapid rate. This trend

is certain to continue. For example, there have been significant

changes in the environment in which accountants operate. These

include changes in accounting and auditing standards, new

legislation and regulation affecting the profession and the people

and organizations it serves, increasingly complex tax systems

and rules, and the ongoing development and greater use of

sophisticated financial instruments. These changes have been

9

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

accompanied by the widespread use of technology, Internet

services and the everyday use of quantitative methods.

11.

10

Not only are accountants facing increased knowledge

requirements, but they and their professional associations are

also facing increased public expectations about the quality of

financial statements and independent audits. Related pressures

for disclosure of more information, some assurance on interim

financial statements and greater use of forecasts have had an

impact on management accountants and independent auditors

alike. In addition, the need to be competitive in a worldwide

economy has prompted a more intense focus on the role and

responsibilities of the management accountant in entities of all

types. Finally, there is an increasing interest around the world in

achieving greater public accountability by the business and

financial communities, as well as the public sector, and

accountants in all sectors have important contributions to make

to that process. All of this places a special responsibility on

accounting educators. The effectiveness of national CPD

programs is and will continue to be a significant factor in any

discussions related to international reciprocity.

Acknowledgements

Acknowledgements

The Education Committee thanks the Task Force members who have

contributed to the development of this Guideline:

Country

Canada

China

Malaysia

United States

Transnational Auditors Committee

Name

Shirley Reilly, Steven J Glover,

Robert W Dye

Shuang Li, WeiHua Liu

Dato Abdul Halim Mohyiddin, Tan

Shook Kheng and Albert Wong

Mun Sum

Gary Holstrum Beatrice Sanders,

Charles H Calhoun III

Melvin Berg (observer to the

Education Committee)

Membership of the IFAC Education Committee

The following were members of the Education Committee when this

Guideline was approved:

Country

New Zealand

Argentina

Canada

China

Czech Republic

France

Hungary

Israel

Malaysia

Pakistan

South Africa

Thailand

Turkey

United Kingdom

United States

Name

Warren Allen (Chair)

Hector Carlos Ostengo

Shirley Reilly

Shuang Li

Bohumil Král

Alain Burlaud

József Rooz

Yoram Eden

Abdul Halim Mohyiddin

S.M. Zafarullah

Steve McGregor

Usana Patramontree

Masum Türker

David Hunt

Gary Holstrum.

11

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

Availability of CPD

12.

IFAC member bodies should help their members meet the CPD

requirement prescribed by the proposed International Education

Standard,

“Continuing

Professional

Education

and

Development”, by facilitating access to CPD activities that

maintain and improve members’ technical and professional

skills.

13.

Member bodies should either directly provide relevant CPD

programs for their members or facilitate access to programs

offered by others (e.g., commercial providers, other professional

bodies, other member bodies, universities and colleges, etc.).

Relevant CPD

14.

Relevant CPD:

a)

maintains or enhances current professional competences for

their members;

b) assists members of the profession to apply new techniques,

understand economic developments and evaluate their

impact on their clients or employers and on their own work,

and to meet changing responsibilities and expectations; and

c)

serves the public interest by providing reasonable assurance

that members of the profession are competent to perform the

services they undertake to provide.

Objective of CPD

15.

The Code of Ethics states that it is the professional duty of the

individual members not only to maintain professional

competence, but also to strive continually to improve their

competence. Thus, the objective of CPD programs should be

continual improvement, not merely maintaining some minimum

knowledge level.

16.

Although maintaining and improving technical knowledge is one

objective of CPD, CPD should go beyond technical knowledge.

Appropriate subject areas for CPD are addressed later in this

Guideline.

12

17.

Clients and employers not only expect expert technical

knowledge from professional accountants but also that

accountants should be able to advise them on the impact of

changes in the economic and business environment. Such

changes may well affect the judgments and estimates

accountants make in the process of preparing financial

statements or performing other professional tasks. They may also

affect the nature, timing and extent of an auditor’s procedures.

Therefore, the business plans and strategies of clients or

employers may need to be revised when there are changes in the

economic and business environment. A professional accountant

is expected to constantly monitor business risks, threats and

opportunities. For these reasons, a program of CPD established

and operated by a member body or other parties should give

appropriate consideration to educational needs that go beyond

basic technical knowledge.

Appropriate subject areas

18.

CPD should contribute to the professional ability of individual

members. Therefore, acceptable CPD activities should be

relevant to the professional work of each member. Some member

bodies may choose to mandate specific topics for a program of

CPD. Others may choose to rely on their individual members to

select subject areas that are appropriate for them. In some

circumstances (e.g. for licensing purposes or for specialists) a

member body may establish some minimum requirements for

specified areas of CPD.

Members’ Responsibility

19.

Continuing professional education carries a cost to members in

terms of both time and money. The majority of members, trained

in accountancy and schooled in business matters, are unlikely to

select CPD activities where the costs exceed the benefits.

20.

Moreover, given the diverse activities that members of the

accountancy profession perform, it would be difficult to define a

common CPD curriculum that all members should be required to

follow. Any attempt to do so is likely to result in too rigid an

approach and might serve as a disincentive to many members. A

13

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

preferable approach is to establish, as a general rule, that the

subjects selected by members should be relevant to their work.

21.

In considering whether a CPD course or activity is relevant to

the work of a member, member bodies are encouraged to

recognize the changing nature of the environment and not to

inhibit participation in courses simply because they do not have

an immediate application to the member’s daily work (e.g.,

programs dealing with social, economic and environmental

trends should be recognized).

22.

It is recognized that a member body may need to be more

prescriptive in some circumstances ( e.g., licensed auditors or

certified specialists). Specific competences may need to be

developed for particular specialties (e.g. transnational auditors)

and these may require particular technical knowledge and

professional skills. IFAC's Transnational Auditors Committee,

for example, provides guidance for member bodies and members

active in transnational audits.

Knowledge and Professional Skills

23.

Accounting professionals in any field of employment need to

maintain competence in all matters related to fulfilling their role

as professionals. A person performing professional services

needs to have a broad range of capabilities. Thus, the concept of

professional competence should be interpreted broadly.

Accordingly, acceptable CPD encompasses programs

contributing to the development and maintenance of both

technical and non-technical professional skills.

24.

Technical skills include CPD in financial accounting,

management accounting, public sector accounting, auditing,

governance, consulting services, information technology, social

responsibility and environmental protection, management,

taxation, and ethics. Non-technical professional skills are equally

important (e.g., communication skills, leadership, knowledge of

different cultures when performing transnational work).

25.

To help guide their professional development, individuals may

find it useful to develop a learning plan. The learning plan can be

14

Minimum level of CPD

used to evaluate learning and competency development. It

should be reviewed periodically and modified as competency

needs change.

Minimum level of CPD

26.

The proposed International Education Standard, “Continuing

Professional Education and Development”, requires member

bodies to establish minimum levels of CPD that their members

should obtain within a specified period on either an input-based

standard or an output-based standard.

Flexibility in the timing of CPD

27.

Spreading the CPD requirement over a three-year period permits

greater flexibility in the application of the guidelines and enables

members to adapt their CPD activities to their particular

circumstances.

Structured learning

28.

It is for each member body to determine what activities would

qualify for recognition as structured learning. Member bodies

should focus on the need for an activity to be measurable and

verifiable, as well as the need to meet appropriate learning

objectives.

29.

Examples of structured learning include:

courses presented by educational institutions, member

bodies or employers;

individual study programs (correspondence courses,

audiotape or videotape packages, computerized learning

programs) that require some evidence of successful

completion by the member;

participation as a speaker or attendee in conferences,

briefing sessions or discussion groups;

acting as a lecturer, instructor or discussion leader on a

structured course but repeat presentations of the course

should not be considered for this purpose;

15

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

service as a member of a technical committee of a

professional body or individual firm as long as a specific

portion of the committee meeting is formally designed to

impart specific knowledge in preparation for committee

debate or discussion;

writing technical articles, papers or books, within reasonable

limits, because the output is clearly verifiable;

“on the job” experience for a finite period of time when the

member can produce reliable, objectively verifiable

evidence that a specific new competence has been

developed.

30.

In general, however, one single, repetitive activity, for example,

teaching introductory accounting to multiple audiences, should

not constitute a member’s total CPD activity.

31.

The recommended hours of structured learning need not be taken

in one block of time. They can be made up by participation in a

number of shorter programs throughout the period.

Unstructured learning

32.

Apart from their participation in structured learning, accountants

need to keep abreast of a wide range of developments affecting

their profession, clients and employers. This is done through

unstructured learning, such as regularly reading professional

journals and the financial and business press, discussing current

developments with colleagues, accessing relevant databases on

the Internet and other activities. Some member bodies may wish

to emphasize the importance of unstructured learning activities

by establishing requirements. Unless the enhancement in

knowledge, skills, or competences related to unstructured

learning can be assessed by objectively verifiable and reliable

measurements, any requirement for unstructured learning should

be an addition to, not a substitute for, the requirement set for

structured learning from input-based requirements.

33.

There are several reasons for this, and they are all related to the

need of providing reasonable assurance to the public that the

16

objectives of the member body’s CPD program are being

achieved:

a)

Structured learning (especially the inputs in an input-based

system) can be efficiently monitored and measured, while

unstructured learning normally cannot.

b) Structured learning is usually designed to achieve specific

learning objectives, while unstructured learning is typically

general and unplanned in nature.

c)

34.

Structured learning usually depends on approved instructors

or instructional materials, while unstructured learning

depends on the individual accountant.

Member bodies will be justified in recognizing unstructured

learning for satisfying CPD requirements if their members can

substantiate that learning occurred through objectively

verifiable and reliable measurement.

Input- and Output-based Systems

35.

Input-based systems traditionally have served as a proxy for

measuring competence. Because input hours of CPD are so

easily measured, hours have been recommended as the

measurement criterion.

36.

The effectiveness of CPD is, however, ideally measured in terms

of output; i.e., the knowledge, skills or competences that have

been acquired. Output-based assessments may not be practicable

in most situations. Member bodies are encouraged to experiment

with innovative approaches for measuring knowledge, skills, and

competences. With experimentation, eventually some workable

models may evolve. Readers and member bodies are referred to

the International Education Paper, Competence-Based

Approaches to the Preparation and Work of Professional

Accountants, which discusses these issues and profiles a

competence-referenced model.

37.

Some options for output-based approaches include periodic reexamination, practice inspections or peer reviews. For certain

sectors, a member body may be able to rely on mechanisms

17

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

within employer or specialty associations, for example,

publication of articles in refereed journals for academic members

or government reviews of licensed bankruptcy trustees. For

members in remote locations, there may be organized and

monitored discussion groups (either face-to-face or through the

Internet) which discuss current topics and which the member

body could utilize to develop reliable, objectively verifiable

measurements to substantiate unstructured learning.

Members in Industry, Government and other Non-Public Accounting

Sectors

38.

The minimum requirement should apply to all active accounting

professionals, including those in public accounting, industry,

commerce, education and the public service.

39.

There are several reasons for this:

a)

The public interest arguments for minimum CPD for public

accounting are, in many cases equally valid for members in

these other sectors as they hold positions of importance

involving quality financial reporting, public accountability

and maintaining the public trust.

b) A member in industry, commerce, education or government

carries the professional designation, and any incompetence

or unethical behavior has the same consequences to the

reputation and standing of the profession as by someone in

public practice.

c)

Member bodies should not create an impression of a twotier profession by imposing lower or different standards on

those not in public accounting.

d) The arguments for CPD to cope with a rapidly changing

environment, and the consequential need to adapt the

strategic or business plans of those organizations relying on

the member's professional competence, are equally valid for

these sectors.

e)

18

Employers hiring members in these sectors rely, at least to

some extent, on the professional membership as proof of

professional competence and therefore would expect the

member body to impose equal professional standards,

including mandatory CPD, on these members.

40.

Member bodies should consider what specific or additional CPD

should be obtained by members working in areas of high risk to

the public, such as auditing, work with securities or the

preparation of financial reports of publicly-held companies.

Need for Continual Review of CPD Requirements and Arrangements

41.

The accounting profession is a dynamic one, operating in an

environment of change. Guidelines developed today are unlikely

to meet the needs of tomorrow. Every member body should

make formal arrangements to regularly review its CPD

arrangements to ensure that they continue to meet the needs of

the profession at any particular time.

Stepped (or Phased) Implementation Plan

42.

Some member bodies may find that adequate educational

resources are not yet available to meet the needs of members

wishing to comply with the proposed CPD requirements as

outlined above. For them, it may be necessary to adopt a CPD

program that is commensurate with immediately available

resources and increases gradually (in steps or phases) to the

recommended minimum requirement over a reasonable period.

Such a gradual, but firm, schedule of requirements is preferable

to one in which the requirements are contingent upon the

development of educational resources. The gradual, but firm,

schedule is likely to stimulate the development of necessary

educational resources. Making a requirement contingent on the

development of those resources is likely to delay implementation

of the plan.

Compliance Process and Responses to Non-Compliance

43.

In developing CPD programs, member bodies should implement

systems to effectively monitor the extent to which members are

complying with the CPD requirement prescribed in the proposed

International Education Standard, “Continuing Professional

Education and Development”.

19

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

44.

Member bodies should establish appropriate mechanisms for

dealing with non-compliance with CPD requirements. Such

mechanisms should focus on bringing a member into

compliance, and should explicitly provide for disciplinary action

when necessary.

System and Staffing

45.

A member body would need to set up its own system for

monitoring participation by individual members in structured

learning and for evaluating the quality of those activities. It is

suggested that a member body ensure that sufficient staff with

appropriate training administer the program or consider setting

up a board or committee under its control that would be charged

with oversight responsibilities.

Reporting

46.

Participation in structured learning can be monitored in several

ways. The following are some options, which are not mutually

exclusive:

OPTION 1

20

Require members to submit an annual report of CPD

activities.

Individual reports submitted by a representative sample of

members would be checked against the attendance or

completion documents that the CPD provider gives to a

member body.

It would be desirable to require these annual reports to

identify the specific structured learning that a member has

undertaken, rather than accept a simple representation on

compliance with the requirement.

This allows the member body to review the reports for

overall reasonableness and facilitates checking reports to

supporting information.

Compliance Process and Responses to Non-Compliance

OPTION 2

Require members to maintain documentation on their CPD

activities, which the member body “audits” on a selective

sampling basis.

OPTION 3

Build the review of learning plans or CPD documents into

practice inspection programs.

Member bodies may require that public accounting

employers impose CPD programs and effective monitoring

systems into their quality assurance programs and track

CPD activities within their time recording systems.

Practice inspection or peer review programs would include a

component that tests this element of quality assurance.

Discipline

47.

The sanctions initially applied for non-compliance should focus

on bringing the member into compliance within a reasonable

period of time. Care should be taken to strike a balance between

a sanction that in substance amounts to permitting a member to

defer or avoid compliance with the CPD requirement and one

that is excessively punitive.

48.

Member bodies should develop punitive sanctions based on the

legal and environmental conditions in their countries (in some

countries they might include expulsion from membership or

denial of the right to practice). Such sanctions should be reserved

for members who have made it clear, through a pattern of noncompliance or through their response to the member body’s

inquiries, that they are likely to continue to disregard the

importance of complying with the CPD requirements.

49.

Imposing sanctions is not an action that should be taken lightly.

A professional accountant’s willful failure to maintain and

improve his or her professional competence is, however, a

violation of a significant professional duty that justifies

disciplinary action. Moreover, it is unfair to the majority of

members who do and will continue to participate in required

CPD programs, at a cost of time and money, to allow others who

do not do so to escape any penalty.

21

Continuing Professional Education and Development

Proposed International Education Guideline for Professional Accountants

Providers

50.

The quality of structured learning offered to members of the

profession, and the CPD credit to be granted for participation,

can be evaluated by approving the providers of those programs

or by approving individual programs. Approving program

providers is often more efficient and would focus on the

procedures and controls instituted by the providers to ensure that

programs are prepared, reviewed and conducted by qualified

individuals, that the learning objectives are appropriate for the

intended participants and achievable within the time allotted for

the program, and that the instructional materials are sufficiently

comprehensive and properly designed. Whichever approach is

taken, the member body should subsequently monitor offerings

of programs on a test basis. Member bodies have a right to

expect that the providers reimburse them for any costs incurred

in making these evaluations.

51.

Member bodies are referred to the International Education Paper

"Recognition of Pre-certification Education Providers" (to be

released July 2002). That Paper does not specifically address

CPD providers, but the principles and issues may be equally

applicable.

52.

CPD from other providers not previously approved may be

acceptable. Members reporting such should be prepared to

provide the necessary support to show quality if requested by the

member body. This might include providing copies of the course

outline, copies of learning materials, credentials of the teaching

staff, etc.

53.

The quality of structured learning offered by accounting firms or

other employers should be evaluated on the same basis as that of

other external education providers. Generally, member bodies

should recognize in-house programs of employers, provided

there is reasonable assurance of quality.

Other Activities

54.

22

It should not be difficult to evaluate the CPD content of activities

such as service on technical committees and writing articles. The

journals or magazines a member writes for should be well

recognized, making it possible to rely on the quality control of

the publisher. The member body should be familiar with the

Compliance Process and Responses to Non-Compliance

work of the technical committees and thus able to recognize the

appropriate learning activity. The member body may request and

evaluate copies of outlines or other available materials from the

individual member claiming credit for participation.

55.

Member bodies may prescribe limits to the quantity of CPD that

might be allowed in each of the categories. For example, a

member body may decide that no more than 10 per cent of the

minimum CPD requirement may be allowable for work with

technical committees or no more than 20 per cent may be

allowable for technical writing.

Regulators

56.

Professional accountants must demonstrate to regulators or other

authoritative bodies that learning has occurred and that the type

and quality of learning is appropriate for their professional

responsibilities. Regulatory or other authoritative requirements

may mandate that professional accountants document their

learning activities.

Retention of Documentation

57.

Members should be required to maintain sufficient

documentation to support their annual CPD report to their

member body. CPD is an individual responsibility, and members

should be encouraged to maintain a lifetime record of CPD,

which may be useful to show to employers or potential

employers. In the absence of legal or other requirements, a

reasonable policy is to retain documentation for a minimum of

five years from the end of the year in which the learning

activities were completed.

Members in Remote Locations or Working out of the Country

58.

Member bodies should be prepared to provide extended periods

for compliance or greater flexibility in recognition of distance

learning or other unstructured learning for members in remote

locations or working out of the country. A member body may

make special provisions for out of country members who are

members of a member body with a CPD requirement in that

country.

23