IFAC

Education

June 2002

Exposure Draft

Response Due Date December 31, 2002

Committee

Continuing Professional

Education and Development

Proposed International Education

Standard for Professional Accountants

Issued for Comment by

the International

Federation of Accountants

This Exposure Draft was approved for publication in May 2002 by the

Education Committee of IFAC.

The mission of IFAC is the worldwide development and enhancement of

an accountancy profession with harmonized standards, able to provide

services of consistently high quality in the public interest. The Education

Committee’s mission is to serve the public interest by the worldwide

advancement of education and development for professional accountants

leading to harmonized standards.

The Education Committee requests comments on this Exposure Draft.

Respondents are encouraged to comment on the specific questions

attached at the end of this document and any other issues related to this

Exposure Draft. Comments sent by e-mail are preferred but they may also

be submitted by computer disk or in hard copy.

Comments should be received by 31 December 2002.

Comments received by the due date will be reviewed by the Education

Committee and may influence the final Standard. Comments received by

15 October 2002 will be reviewed by the Education Committee at its

meeting in November 2002. Comments received after that date will be

reviewed by the Committee in March 2003. Notwithstanding this,

comments received after the due date and on an ongoing basis are also

welcome. Respondents should note that comments are considered a matter

of public record.

Comments on this publication should be sent to:

Technical Director

International Federation of Accountants

535 Fifth Avenue, 26th Floor

New York, NY 10017, USA

Fax + 1 212-856 9420

E-mail responses should be sent to: EDComments@ifac.org

Information about the International Federation of Accountants can be

found at its web site, www.ifac.org. Copies of this publication may be

downloaded free of charge from the site.

Copyright © June 2002 by the International Federation of Accountants.

All rights reserved.

CONTENTS

PAGE

PREFACE .............................................................................................. 2

INTERNATIONAL EDUCATION STANDARDS FOR

PROFESSIONAL ACCOUNTANTS .................................................. 2

PURPOSE OF THE STANDARD ...................................................... 2

SCOPE OF THE STANDARD ........................................................... 3

BACKGROUND .............................................................................. 3

DEFINITIONS ....................................................................................... 4

EFFECTIVE DATE ............................................................................. 10

FOREWORD ....................................................................................... 10

ACKNOWLEDGEMENTS................................................................... 13

MEMBERSHIP OF THE IFAC EDUCATION COMMITTEE ........... 13

AVAILABILITY OF CPD ................................................................... 14

MINIMUM LEVEL OF CPD .............................................................. 14

COMPLIANCE PROCESS .................................................................. 16

DISCUSSION QUESTIONS ................................................................. 17

Continuing Professional Education and Development

Proposed International Education Standard for Professional Accountants

Preface

International Education Standards for Professional Accountants

1.

International Education Standards for Professional Accountants

(IES) prescribe standards of generally accepted “good practice”’

in the education and development of professional accountants.

International Education Standards express the benchmarks that

member bodies are expected to meet in the preparation and

continual development of professional accountants. They

establish the essential elements of the education process at a

level that is aimed at gaining international recognition,

acceptance and application of the education process. Hence,

member bodies must consider these prescriptions.

2.

International Education Standards for Professional Accountants

cannot legally override local laws and regulations but will

provide an authoritative reference for informing and influencing

local regulators regarding generally accepted “good practice”.

3.

International education standards are the paragraphs in bold

typeface in this Standard. Commentary paragraphs, which may

elaborate on and assist in the interpretation of the standard

paragraphs, appear in plain typeface.

4.

The individual standards need to be read in conjunction with the

Guiding Principles for International Education Statements, and

the related commentary and implementation material contained

in the Introduction to International Education Standards for

Professional Accountants.

Purpose of the Standard

5.

2

This Standard requires member bodies to implement a

mandatory continuing professional education and development

(hereafter referred to as continuing professional development or

CPD) program. CPD is an important aspect of serving the public

interest and fosters values of continuous learning and greater

professional competence among professional accountants to

better meet client and employer needs.

Preface

6.

This Standard should be read in conjunction with proposed

International Education Guideline, “Continuing Professional

Education and Development”, which aims to assist member

bodies in implementing and achieving good practice by

providing advice and guidance on how to achieve the Standards

prescribed in this document.

Scope of the Standard

7.

This Standard prescribes continuing professional development

requirements for IFAC member bodies. The Standard addresses

access to CPD activities, minimum levels of mandatory CPD for

professional accountants and the establishment of processes to

monitor compliance with CPD requirements.

Background

8.

The IFAC Education Committee has for many years issued

guidelines and other papers on education issues. Previously, the

Committee released IEG 2, “Continuing Professional Education”

(February 1982 revised in May 1998). The Committee considers

that it is now appropriate to issue individual Standards building

on this framework, by dealing with each major topic in a

separate Standard.

9.

This Standard prescribes certain requirements set out in IEG 2

that member bodies are expected to meet and introduces a

minimum level of mandatory CPD.

10.

This Standard is supported by the proposed International

Education Guideline, “Continuing Professional Education and

Development,” which assists member bodies in establishing a

requirement for an effective program of continuing professional

development.

3

Continuing Professional Education and Development

Proposed International Education Standard for Professional Accountants

Definitions

11.

Terms marked with an asterisk (*) indicate terms that are defined

elsewhere in this section.

Best practice

Refers to practices considered to be exemplary,

of the highest order, the most advanced, or

leading in a particular area in the education* of

professional accountants.

Explanation

“Best practice” refers to the best examples of

established practice in the preparation of

professional accountants. “Best practice” will

often go beyond “good practice” and, as such,

is at a higher level than the considered

minimum requirements. Statements and

examples of “best practice” are essential for

the advancement of accounting education and

provide useful guidance to member bodies for

the continual improvement of their education

programs.

Capabilities

Are the professional knowledge*, skills* and

professional values* required to demonstrate

competence*.

Explanation

Capabilities include content knowledge,

technical and functional skills, behavioral

skills, intellectual abilities, and professional

values and attitudes.

Competence

Is being able to perform a work role to a

defined standard, with reference to real

working environments.

Explanation

Competence may be assessed by a variety of

means, including work place performance,

4

Definitions

work place simulations, written tests of various

types and self-assessment.

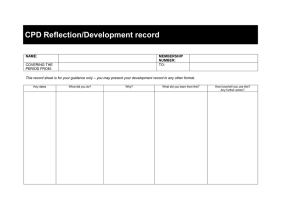

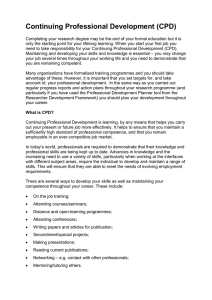

Continuing

professional

development (CPD)

Refers to learning* activities for developing the

capabilities* of individuals to perform

competently within their professional

environments.

Explanation

Continuing professional development is aimed

at the post-qualification maintenance or

enhancement of professional competence. It

involves the development of capabilities

through either formal, structured and verifiable

learning programs (sometimes referred to as

“continuing professional education” or CPE)

or informal, unstructured learning activities.

Development

Is the acquisition of capabilities* which

contribute to competence*.

Explanation

Development refers to the growth of attributes

that contribute to competence, however

achieved. Individuals may develop their

abilities through a wide range of processes

such as learning, including education and

training; experience; reflection; observation or

receipt of information; other structured and

unstructured learning activities; or through

natural growth over time.

Education

Refers to a systematic act or process aimed at

developing knowledge, skills*, character, or

other abilities and attributes within individuals.

It includes developmental activities commonly

referred to as training*

Explanation

Education is a formal, structured learning

process whereby individuals develop attributes

considered desirable by society. Education is

5

Continuing Professional Education and Development

Proposed International Education Standard for Professional Accountants

usually characterized by the growth of an

individual’s mental and practical abilities, as

well as maturing in attitude, resulting in an

enhanced ability of the individual to function

and contribute to society, in either specific or

non-specific contexts. While often conducted in

academic environments, education also

includes formal learning processes in other

environments, such as on-the-job and off-thejob training. Education is, by nature, formal

and therefore excludes informal, unstructured

learning and developmental processes.

Valuable learning, training, and development

can also take place in less formal environments

through processes that are not formal or

structured enough to be considered

“education”.

Ethics

Refers to the professional values* and

principles of conduct applying to professional

accountants* as well as to students and trainees

associated with IFAC member bodies.

Good practice

Refers to those elements considered essential to

the education* and development* of

professional accountants* and performed at a

standard necessary to the achievement of

competence*.

Explanation

“Good practice” relates not only to the range

of content and processes of education and

development programs, but also to the level or

standard at which they are performed (i.e. the

depth and quality of the programs). The IFAC

Education Committee is conscious of the wide

diversity of culture; language; and educational,

legal, and social systems in the countries of the

member bodies and of the variety of functions

performed by accountants. Different factors

6

Definitions

within these environments may vary the ability

of member bodies to adopt some aspects of

“good practice”. Nevertheless, member bodies

should continuously aspire to “good practice”

and achieve it wherever possible.

Information

Technology

Refers to hardware and software products,

information

system

operations

and

management processes, and the human

resources and skills* required to apply those

products and processes to the task of

information production and information system

development, management and control.

Learning

Refers to a broad range of processes whereby

an individual develops capabilities*, including

skills* and attitudes in the application of

knowledge.

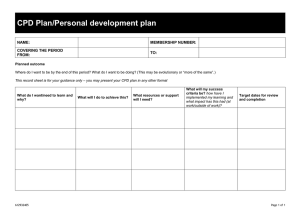

Learning plan

Structured processes that help professional

accountants

guide

their

professional

development*. Plans include a self-assessment

of the gap between current and needed

knowledge, skills*, and abilities, a set of

learning objectives arising from this

assessment, and learning activities to be

undertaken to fulfill the learning plan.

Post-qualification

Refers to the period after qualification* as an

individual member of an IFAC member body.

Explanation

The term “post-qualification” is usually

associated with activities and requirements

relating to the professional development of

those who have already obtained a professional

qualification. It is often associated with action

relating to the maintenance or further

development of professional competence.

Professional

accountant

Refers to those individuals, whether they be in

public practice (including a sole practitioner,

7

Continuing Professional Education and Development

Proposed International Education Standard for Professional Accountants

partnership or corporate body), industry,

commerce, the public sector or education, who

are members of an IFAC member body.

Professional

knowledge

Refers to those topics that make up the subject

of accountancy as well as other business

disciplines that, together, constitute the

essential body of knowledge for professional

accountants*.

Professional values

Are the attitudes that identify professional

accountants* as members of a profession. They

comprise principles of conduct generally

associated with, and deemed essential in

defining the distinctive characteristics of,

professional behavior.

Explanation

Professional values include technical

competence,

ethical

behavior

(e.g.,

independence, objectivity, confidentiality, and

integrity), professional demeanor (e.g., due

care, timeliness, courteousness, respect,

responsibility, and reliability), pursuit of

excellence (e.g., commitment to continual

improvement and life-long learning) and social

responsibility

(e.g.,

awareness

and

consideration of the public interest).

Skills

Refer to the various types of abilities required

to apply knowledge and values appropriately

and effectively in a professional context.

Specialization

Is the formal recognition by a member body of

a group of its members possessing distinctive

competence* in a field, or fields, of activity

related to the work of the professional

accountant.

Explanation

8

Definitions

Professional accountants are required to

possess a range of skills, including technical

and functional skills, organizational and

business management skills, personal skills,

interpersonal and communication skills, a

variety of intellectual skills, and skills in

forming professional judgments.

Structured Learning

Is measurable, verifiable activity designed to

impart specific knowledge and skills.*

Explanation

Examples of structured learning include

courses and presentations; individual study

programs that require some

completion

by the individual; and participation in formal

conferences, briefing sessions, or discussion

groups. Structured learning is usually, in some

respects, not totally within the control of the

individual undertaking the learning. For

example, a third party may determine the scope

or design of the activity, or when or how the

learning takes place.

Training

Refers to pre-qualification and postqualification* developmental activities, within

the context of the work place, aimed at bringing

a student* or professional accountant* to an

agreed level of professional competence.*

Explanation

Training includes work place-based education

and experience activities for developing an

individual’s competence to perform tasks

relevant to the role of the professional

accountant. Training may be undertaken while

performing actual tasks (on-the-job training) or

indirectly through instruction or work-place

simulation (off-the-job training). Training is

conducted within the context of the work place,

with reference to the specific roles or tasks

performed by professional accountants. It can

9

Continuing Professional Education and Development

Proposed International Education Standard for Professional Accountants

include any activity purposefully designed to

improve the ability of an individual to fulfill the

practical experience requirements for

qualification as a professional accountant.

Effective Date

12.

Member bodies should aim to comply with this standard by 1

January 2005. Earlier application is encouraged.

Foreword

13.

IFAC’s mission is the worldwide development and enhancement

of an accountancy profession with harmonized standards, able to

provide services of consistently high quality in the public

interest. A fundamental principle of the IFAC Code of Ethics for

Professional Accountants (November 2001) states, “A

professional accountant should perform professional services

with due care, competence and diligence and has a continuing

duty to maintain professional knowledge and skill at a level

required to ensure that a client or employer receives advantage of

competent professional service based on up-to-date

developments in practice, legislation and techniques.” (paragraph

16)

14.

This Standard prescribes a continuing professional development

requirement that member bodies should implement. Such a

requirement contributes to the profession’s objective of

providing high-quality services to meet the needs of the public

(including clients and employers).

15.

The knowledge needed to function effectively as an accountant

in public practice, industry, commerce, education and the public

sector continues to expand and change at a rapid rate. This trend

is certain to continue. Not only are accountants facing increased

knowledge requirements, but they and their professional

associations are also facing increased public expectations about

the quality of financial statements and independent audits.

Related pressures for disclosure of more information, some

assurance on interim financial statements and greater use of

forecasts have had an impact on management accountants and

10

Foreword

independent auditors alike. In addition, the need to be

competitive in a worldwide economy has prompted a more

intense focus on the role and responsibilities of the management

accountant in entities of all types. Finally, there is an increasing

interest around the world in achieving greater public

accountability by the business and financial communities, as

well as the public sector, and accountants in all sectors have

important contributions to make to that process. All of this

places a special responsibility on accounting educators.

16.

The case for mandatory CPD is as follows:

The profession must be seen to be taking practical steps to

ensure that its members maintain their technical knowledge

and professional skills.

In many countries, the profession is granted the privilege of

self-regulation and, in some cases, of reserved functions.

These privileges assume that a member body is best able to

maintain and improve the professional competence of its

members and the quality of the services provided to clients

and employers. Even in countries where such privileges are

not granted to the accounting profession, member bodies

should accept that responsibility.

In today’s changing and increasingly complex environment,

accountants cannot possibly possess all the knowledge

required to render high-quality professional services if they

do not participate in appropriate CPD. Thus, to fulfill their

responsibilities to their members and the public alike,

member bodies should implement and enforce a CPD

requirement to provide reasonable assurance that their

members can and will perform their work with professional

competence.

Reliance on competition and market forces is inadequate

and unacceptable since it is likely that incompetence or

inadequate service will be detected only after damage has

already been suffered.

Members would have guidance, added motivation and an

agreed norm under which to plan and measure their

participation in CPD.

11

Continuing Professional Education and Development

Proposed International Education Standard for Professional Accountants

17.

12

This is an effective way to ensure participation in CPD by

accountants whose knowledge is out of date and who are

unlikely to respond to a voluntary program.

On its own, CPD does not provide absolute assurance that all

members will provide every professional service with high

quality. Doing so involves more than maintaining professional

competence; it involves applying that knowledge with

professional judgment and an objective attitude in the real-life

situations found in today’s environment of social and economic

change Also, there cannot be complete assurance that every

person who participates in a CPD program will obtain the full

benefits of that program, because of variances in individual

commitment and capability. Nevertheless, it is certain that

members who are not up-to-date on current technical and general

knowledge pertinent to their work will not be able to provide

professional services competently. Therefore, despite the

inherent limitations of any CPD program, a CPD requirement

should be an important element in preserving the standards of the

profession and maintaining public confidence.

Acknowledgements

Acknowledgements

The Education Committee thanks the Task Force members who have

contributed to the development of this standard:

Country

Canada

China

Malaysia

United States

Transnational Auditors Committee

Name

Shirley Reilly, Steven J Glover,

Robert W Dye

Shuang Li, WeiHua Liu

Dato Abdul Halim Mohyiddin, Tan

Shook Kheng and Albert Wong

Mun Sum

Gary Holstrum Beatrice Sanders,

Charles H Calhoun III

Melvin Berg (observer to the

Education Committee)

Membership of the IFAC Education Committee

The following were members of the Education Committee when this

Exposure Draft was approved:

Country

New Zealand

Argentina

Canada

China

Czech Republic

France

Hungary

Israel

Malaysia

Pakistan

South Africa

Thailand

Turkey

United Kingdom

United States

Name

Warren Allen (Chair)

Hector Carlos Ostengo

Shirley Reilly

Shuang Li

Bohumil Král

Alain Burlaud

József Rooz

Yoram Eden

Abdul Halim Mohyiddin

S.M. Zafarullah

Steve McGregor

Usana Patramontree

Masum Türker

David Hunt

Gary Holstrum.

13

Continuing Professional Education and Development

Proposed International Education Standard for Professional Accountants

Availability of CPD

18.

IFAC member bodies should help their members meet their

CPD requirement by facilitating access to CPD activities that

maintain and improve members’ technical and professional

skills.

19.

Member bodies should either directly provide relevant CPD

programs for their members or facilitate access to programs

offered by others (e.g., commercial providers, other professional

bodies, other member bodies, universities and colleges, Internet

courses, etc.).

20.

CPD should contribute to the professional ability of individual

members. Therefore, acceptable CPD courses or activities should

be relevant to the professional work of each member concerned.

Though not required by this Standard, some member bodies may

choose to mandate specific topics for their CPD program. Others

may choose to rely on their members to select subject areas that

are appropriate for them.

21.

In some circumstances (e.g., for licensed members or specialist

members), a member body may establish higher minimum

requirements or minimum requirements in specified topic areas.

22.

Specialist members (e.g. transnational auditors) may need

particular assistance in accessing courses in their specialist area

to maintain their unique technical knowledge and professional

skills.

Minimum Level of CPD

23.

14

Member bodies should establish minimum levels of CPD that

their members should obtain within a specified period of

time. These levels may be input based (e.g., prescribed

number of hours per year) or output based (e.g.

demonstrable competences at an appropriate level).

Minimum Level of CPD

24.

The minimum requirement should apply to all active accounting

professionals, including those in industry, commerce, education,

government and public accounting.

25.

Member bodies with an input-based system should establish

the following minimum number of hours of structured CPD

for every active member:

a) 20 hours of structured learning per year, and

b) 120 hours of structured learning in every three-year

period.

26.

Member bodies with an output-based system should establish

minimum levels of competence based on objectively

verifiable and reliable measurements of skills, knowledge or

competences resulting from CPD activities.

27.

The effectiveness of CPD is ideally measured in terms of the

knowledge, skills or competences that have been acquired.

Output-based assessments may not be practicable in many

situations. Member bodies are encouraged to experiment with

innovative approaches for measuring knowledge, skills, and

competences.

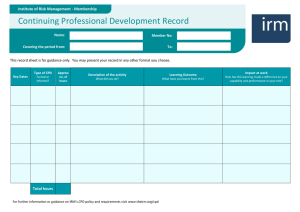

28.

It is for each member body to determine which activities would

qualify for recognition as structured learning. Member bodies

should focus on the need for an activity to be measurable and

verifiable, as well as the need to meet appropriate learning

objectives.

29.

Member bodies should consider what specific or additional CPD

should be obtained by members working in areas of high risk to

the public, such as auditing, work with securities or the

preparation of financial reports of publicly held companies.

There may also be a need to establish higher or more specific

requirements for members operating in specialist areas, (e.g.,

transnational auditors).

15

Continuing Professional Education and Development

Proposed International Education Standard for Professional Accountants

Compliance Process

30.

Member bodies should establish a compliance process to

determine whether members meet the minimum requirement

and to provide for disciplinary action when they do not.

31.

Regardless of whether a member body opts for an in-put based

or output-based CPD program, it should establish a system for

monitoring individual member participation in CPD activities

and for evaluating the quality and appropriateness of those

activities.

32.

A system of mandatory CPD will operate effectively and in the

public interest only if members who willfully fail to comply with

the requirement are brought into compliance on a timely basis or,

if they persist in willful non-compliance, are appropriately

sanctioned. Member bodies should determine punitive sanctions

after considering the legal and environmental conditions in their

countries. Some member bodies may have the legal authority to

expel non-compliant members or deny the right to practice.

33.

Evaluating the quality of structured learning may include

approving the providers of certain programs or approving a

specific program. The quality of structured learning offered by

accounting firms or other employers should be evaluated on the

same basis as that of other external education providers.

34.

Individual members should be required to maintain sufficient

documentation to support an annual report of compliance to their

member body. CPD is an individual responsibility and members

should be encouraged to maintain a lifetime record of CPD,

which may be useful to show employers or potential employers.

16

Discussion Questions

Discussion Questions

Please reference comments to the relevant paragraph numbers and provide

alternative proposals where applicable.

1.

Do you agree with the requirement for 120 hours of CPD activity

over three years (or an average of one week per year) (refer

paragraph 25)? Please comment on implementation issues

separately from the appropriateness of this level of CPD

providing your preferred alternative and reasons why.

2.

Do you agree that CPD standards should apply to all members,

not just those in public practice?

3.

Do you agree that IFAC member bodies should implement a

compliance system with appropriate disciplinary sanctions to

monitor individual members’ compliance with mandatory CPD

(refer paragraph 30)?

4.

Comment on the proposed effective date of January 1, 2005.

5.

Please comment on any other issues.

17