Appendix F: Performance and Reporting Under Fiscal Responsibility Act

advertisement

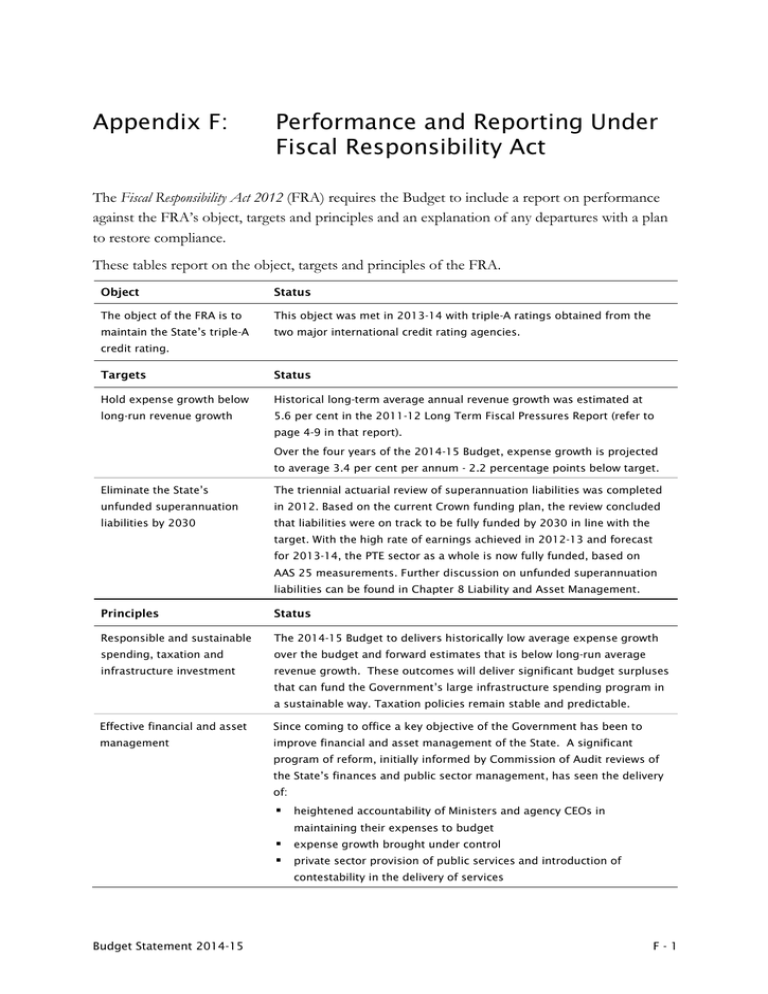

Appendix F: Performance and Reporting Under Fiscal Responsibility Act The Fiscal Responsibility Act 2012 (FRA) requires the Budget to include a report on performance against the FRA’s object, targets and principles and an explanation of any departures with a plan to restore compliance. These tables report on the object, targets and principles of the FRA. Object Status The object of the FRA is to This object was met in 2013-14 with triple-A ratings obtained from the maintain the State’s triple-A two major international credit rating agencies. credit rating. Targets Status Hold expense growth below Historical long-term average annual revenue growth was estimated at long-run revenue growth 5.6 per cent in the 2011-12 Long Term Fiscal Pressures Report (refer to page 4-9 in that report). Over the four years of the 2014-15 Budget, expense growth is projected to average 3.4 per cent per annum - 2.2 percentage points below target. Eliminate the State’s The triennial actuarial review of superannuation liabilities was completed unfunded superannuation in 2012. Based on the current Crown funding plan, the review concluded liabilities by 2030 that liabilities were on track to be fully funded by 2030 in line with the target. With the high rate of earnings achieved in 2012-13 and forecast for 2013-14, the PTE sector as a whole is now fully funded, based on AAS 25 measurements. Further discussion on unfunded superannuation liabilities can be found in Chapter 8 Liability and Asset Management. Principles Status Responsible and sustainable The 2014-15 Budget to delivers historically low average expense growth spending, taxation and over the budget and forward estimates that is below long-run average infrastructure investment revenue growth. These outcomes will deliver significant budget surpluses that can fund the Government’s large infrastructure spending program in a sustainable way. Taxation policies remain stable and predictable. Effective financial and asset Since coming to office a key objective of the Government has been to management improve financial and asset management of the State. A significant program of reform, initially informed by Commission of Audit reviews of the State’s finances and public sector management, has seen the delivery of: heightened accountability of Ministers and agency CEOs in maintaining their expenses to budget expense growth brought under control private sector provision of public services and introduction of contestability in the delivery of services Budget Statement 2014-15 F-1 Principles Status Effective financial and asset infrastructure priorities being determined on the basis of the best management (cont) economic and social outcomes through Infrastructure NSW better use of existing infrastructure divestment of assets that are not core to the delivery of public services and the sale of surplus property assets. Achieving intergenerational Keeping total state net debt low, as in this budget, ensures future equity generations bear less of the burden of today’s expenditure decisions. The effect of Government policies on intergenerational equity is also measured by the change in the long term fiscal gap from one budget to the next. Against all these measures, performance in 2013-14 and the strategy and measures in this budget comply with the requirements of the FRA. There are no departures from the object, target and principles in this budget. F-2 Budget Statement 2014-15