Third Examination – Finance 470 - Conflict Fall 2005 (Moore)

advertisement

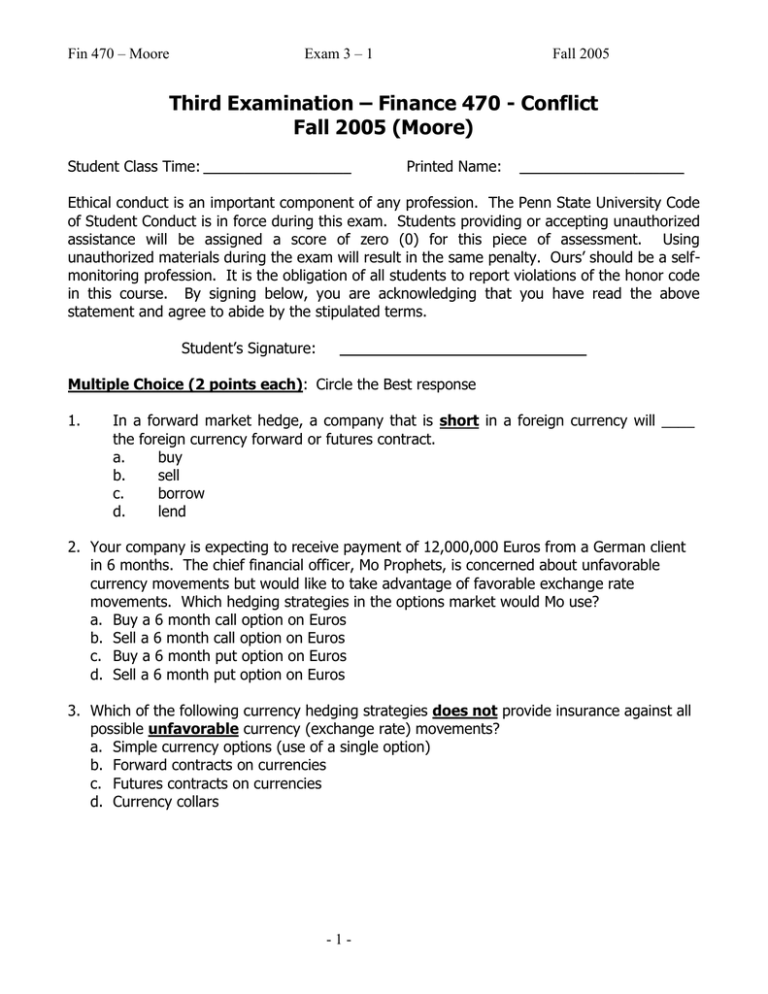

Fin 470 – Moore Exam 3 – 1 Fall 2005 Third Examination – Finance 470 - Conflict Fall 2005 (Moore) Student Class Time: __________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Penn State University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Multiple Choice (2 points each): Circle the Best response 1. In a forward market hedge, a company that is short in a foreign currency will ____ the foreign currency forward or futures contract. a. buy b. sell c. borrow d. lend 2. Your company is expecting to receive payment of 12,000,000 Euros from a German client in 6 months. The chief financial officer, Mo Prophets, is concerned about unfavorable currency movements but would like to take advantage of favorable exchange rate movements. Which hedging strategies in the options market would Mo use? a. Buy a 6 month call option on Euros b. Sell a 6 month call option on Euros c. Buy a 6 month put option on Euros d. Sell a 6 month put option on Euros 3. Which of the following currency hedging strategies does not provide insurance against all possible unfavorable currency (exchange rate) movements? a. Simple currency options (use of a single option) b. Forward contracts on currencies c. Futures contracts on currencies d. Currency collars -1- Fin 470 – Moore Exam 3 – 1 Fall 2005 The following information is to be used in answering questions 4-6. Ajax Manufacturing's Australian subsidiary has the following balance sheet (stated in Australian Dollars): Cash, marketable securities Accounts receivable Inventory (at market. Fixed Assets 250,000 1,000,000 2,700,000 5,100,000 ----------------$AU 9,050,000 Current liabilities Long-term debt Equity Total liabilities plus equity 750,000 3,400,000 4,900,000 --------------$AU 9,050,000 Total assets Assume the business was shut down for the entire year of 2005 due to a government investigation. As a result, the above balance sheet reflects both the beginning of the year and end of the year position for the company since no business activities took place. 4. Suppose the Australian dollar appreciated from 0.6500 ($US/$AU) to 0.7100 ($US/$AU) during the year. Which of the following statements best reflects the economic gain or loss one would expect to see when the financial statements are translated back to $US. a. Ajax had an economic gain on the assets b. Ajax had an economic loss on the assets c. Ajax had an economic gain on the liabilities d. Ajax had an economic loss on the equity 5. Suppose the Australian dollar depreciated from 0.7950 ($US/$AU) to 0.7781 ($US/$AU) during the year. Which of the following statements best reflects the economic gain or loss one would expect to see when the financial statements are translated back to $US. a. Ajax had an economic gain on the assets b. Ajax had an economic loss on the assets c. Ajax had an economic gain on the liabilities d. Ajax had an economic loss on the equity 6. Suppose the Australian dollar depreciated from 0.7950 ($US/$AU) to 0.7781 ($US/$AU) during the year. Which of the following results from the accounting translation would be consistent with the underlying economic gains or losses when the financial statements are translated back to $US. a. Translation loss under the Monetary/Non-Monetary method b. Translation gain under the temporal method c. Translation gain under the current rate method d. Translation gain under the current/non-current method -2- Fin 470 – Moore Exam 3 – 1 Fall 2005 7. Ford simultaneously borrows 10,000,000 Mexican pesos at 13%, converts the pesos to $US and invests dollars at 10%, both for one year. At the time Ford enters into these transactions, the spot rate for the peso is $0.095. If the spot rate is Peso. 1 = $0.087 in one year, what is the cost to Ford of this money market hedge? a. $113,100 Cost (loss) b. $95,000 Gain c. $61,900 Gain d. $10,400 Cost (loss) 8. During a home currency appreciation, exporters may pull out of markets that foreign competition makes ________. a. unprofitable b. more competitive c. profitable d. more liquid 9. ___________ exposure is based on the extent to which the value of the entire firm will change when exchange rates change. a. b. c. d. Translation Transaction Economic Operating 10. With respect to production management of exchange risk, ________ and plant location are the principal variables that companies may change to manage the risk. a. product innovation b. product retirement c. market selection d. product sourcing 11. A strong (appreciating) dollar will a. force American exporters to raise their foreign currency prices b. result in higher dollar costs for American importers c. enable American exporters to improve their profit margins d. cost American exporters market share abroad 12. Which one of the following would be the best response for a U.S. exporter to depreciation of the dollar? a. raise the foreign currency price if the dollar depreciation was expected to be temporary and the cost of regaining market share was minimal b. reduce production offshore if the depreciation were expected to persist for an extended period c. reduce product innovation d. reduce product mix (eliminate product lines) -3- Fin 470 – Moore Exam 3 – 1 Fall 2005 13. Suppose Apple is selling Macintosh computers in Germany for DM 5,500 when the exchange rate is DM 1 = $0.68. If the DM rises to $0.71, what price must Apple charge to maintain its dollar unit revenue? a. DM 5,147 b. DM 6,361 c. DM 5,743 d. DM 5,268 14. One function of the cost of capital is to ________ for the firm. a. determine the debt to equity ratio b. value future cash flows c. determine the current ratio d. determine the current lending rate 15. One of the key issues in estimating foreign project betas is to find firms that are publicly traded that share _____ risk characteristics when compared to the project. a. different b. somewhat different c. uncorrelated d. similar 16. Suppose that a foreign project has a beta of 1.25, the risk-free return is 4.5% and the market risk premium estimated at 8%. Then the cost of equity capital for the project is a. 14.500% b. 8.875% c. 10.000% d. 3.500% 17. Assume an average dividend payout rate of 100% for both U.S. and German companies. Suppose the average P/E ratio for German firms is 16 and 20 for U.S. firms. Based on the dividend growth model, in order for German and U.S. companies to have the same average cost of equity capital, what is the difference between the German and US annual earnings growth rate have to be? Recall, P0 a. b. c. d. 1.25% higher in Germany 5% higher in the US 7.5% higher in the US 7.5% higher in Germany -4- D1 ke g Fin 470 – Moore Exam 3 – 1 Fall 2005 18. In computing a company’s after-tax weighted average cost of capital, which of the following is not used as an input? a. Market value of Equity b. Book Value of Equity c. The average tax rate d. Market value of the firm’s assets 19. Your are given the following information: Cost of Equity = 24%; Cost of Debt = 9%; Tax Rate = 30%. The firm’s target D/E = 2 (based on market values). Compute after-tax WACC. Recall: WACC AT a. b. c. d. 20. VE V k e D k D (1 T ) VF VF 10.45% 12.20% 14.00% 23.00% Suppose the Euro franc is expected to appreciate against the dollar by 3% annually and the 10year Euro interest rate is 7%. What is the after-tax expected dollar cost of issuing a 10-year Euro bond if the appropriate Euro corporate tax rate is 40%? a. 10.21% b. 7.326% c. 3.8835% d. 1.165% -5- Fin 470 – Moore Exam 3 – 1 Fall 2005 Problem 1 (20 Points) Show all Work You are due to receive payment of 12,500,000 Euros in June 2006 from a French customer. The current spot exchange rate is $1.1716 per Euro. You are concerned about currency fluctuations over the next 7 months and want to hedge this future cash inflow using a currency collar. You are long Euros and are most concerned about the Euro depreciating against the dollar over this time period. Hence, you want to have insurance against price exchange rate movements outside the $1.170 per Euro and $1.260 per Euro range Each Euro option contract on the CME covers 125,000 Euros. The following bid-ask quotes have been provided by the CME: Call Options: Exercise Price 1.170 1.260 Bid $6,275 $1,250 Ask $6,750 $1,875 Ex. Price 1.170 1.260 Put Options: Bid $2,787.50 $9,587.50 Ask $3,100 $10,025 The appropriate currency collar involves a long put and a short call option. Required: 1. Graph the currency collar. Be sure to label the appropriate exercise points. Identify the Call and put option components and the profit/loss regions. 2. Ignoring transaction costs, compute the initial cost of implementing the collar. -6- Fin 470 – Moore Exam 3 – 1 Fall 2005 Problem 2 (20 Points) Show all Work Consider a project that costs $2 million today but yields no returns for several years. Once the project becomes productive, it yields $350,000 annually forever. Suppose two firms are examining this project, an Irish firm with a cost of capital of 8% and a U.S. firm with a cost of capital of 12%. 1. What is the maximum number of years the Irish firm can wait before the project begins generating the cash flows and still make it a positive NPV project? (use continuous compounding) 2. What is the maximum number of years the US firm can wait before the project begins generating the cash flows and still make it a positive NPV project? (use continuous compounding) 3. Which of the two firms can be more patient in waiting for the cash flows to begin? By how many years? -7- Fin 470 – Moore Exam 3 – 1 Fall 2005 Problem 3 (20 Points) Essay Discuss and differentiate transaction hedging strategies with Futures, single options, and collars that use a combination of puts and calls. Identify how much risk is being insured (both up and downside vs. only all downside vs. part of upside and part of downside). Discuss the relative costs associated with the three types of strategies. Make sure you distinguish how the strategies differ when you are long or short in the underlying currency. -8-