Exam 1 – Spring 2007 Finance 3321 – Moore

advertisement

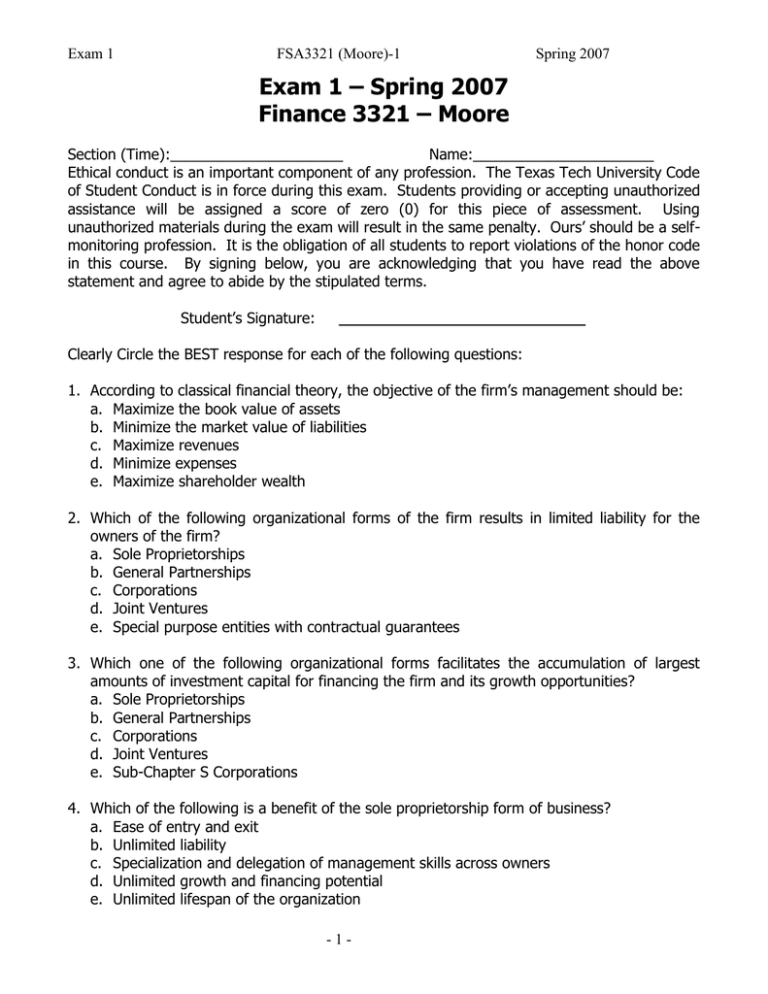

Exam 1 FSA3321 (Moore)-1 Spring 2007 Exam 1 – Spring 2007 Finance 3321 – Moore Section (Time):_____________________ Name:______________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. According to classical financial theory, the objective of the firm’s management should be: a. Maximize the book value of assets b. Minimize the market value of liabilities c. Maximize revenues d. Minimize expenses e. Maximize shareholder wealth 2. Which of the following organizational forms of the firm results in limited liability for the owners of the firm? a. Sole Proprietorships b. General Partnerships c. Corporations d. Joint Ventures e. Special purpose entities with contractual guarantees 3. Which one of the following organizational forms facilitates the accumulation of largest amounts of investment capital for financing the firm and its growth opportunities? a. Sole Proprietorships b. General Partnerships c. Corporations d. Joint Ventures e. Sub-Chapter S Corporations 4. Which of the following is a benefit of the sole proprietorship form of business? a. Ease of entry and exit b. Unlimited liability c. Specialization and delegation of management skills across owners d. Unlimited growth and financing potential e. Unlimited lifespan of the organization -1- Exam 1 FSA3321 (Moore)-1 Spring 2007 5. Which of the following IS NOT a basic business activity that should link business strategies to the business environment the firm faces? (Figure 1-2) a. Accounting Activities b. Operating Activities c. Investment Activities d. Financing Activities 6. Accounting strategies include all of the following, except: a. Choice of accounting policies b. Choice of third-party (independent) auditor c. Choice of accounting estimates d. Choice of reporting format e. Choice of supplementary disclosures 7. Which one of the following business analysis tools involves the evaluation of performance using ratios and cash flow analysis? a. Business strategy analysis b. Prospective analysis c. Accounting analysis d. Financial analysis e. Valuing the firm 8. The items in question 7 represent the steps to a structured valuation analysis. Put these steps in sequential order below: a) a, b, c, d, e b) c, a, b, e, d c) a, c, d, b, e d) a, c, b, e, d e) e, d, a, b, c 9. Which of the following is correct? a. Conservative accounting choices are mandated by republicans b. Aggressive accounting policies (choices) lead to lower earnings and higher assets c. The independent auditor’s opinion and statement on the 10-K guarantee the information contained in the financial reports are correct. d. The information contained in financial reports reflect “people-made” numbers and choices that may contain material errors and biases. e. The information contained in audited financial reports are unquestioned facts because GAAP and the SEC required perfect information to be contained in 10-K’s. 10. Which of the following is correct regarding accrual accounting? a. Accrual accounting is the information basis of inputs for most classical finance models b. Accrual accounting attempts to measure the period in which cash flows occur c. Accrual accounting attempts to measure economic activities in the period exchange transactions take place, regardless of when cash flows transpire. d. Accrual accounting forces land acquisitions to be recorded at historical cost. -2- Exam 1 11. a. b. c. d. e. FSA3321 (Moore)-1 Spring 2007 Which of the following is not an element of the 5-forces model Bargaining Power of Suppliers Threat of Substitute Products Threat of New Entrants Threat of Industry Profitability Rivalry among Existing Firms 12. What is the first step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies 13. What is the last step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies 14. Which of the following would lead to the highest degree of price competition? a. Low Product differentiation b. High Customer Switching Costs c. Few barriers to exit industry d. Low customer bargaining power 15. An industry displaying a mixture of price competition and product differentiation would be characterized by: a. Low Industry Concentration, High Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, High First mover advantage, High Product Differentiation c. Low Industry Concentration, Low Investment in R&D, Low Customer Switching Costs d. High Concentration, Low Fixed-Variable Cost Ratio, High Customer Switching Costs e. Supply < Demand, High Investment in R&D, Steep Industry Learning Curves 16. Which of the following would lead to the lowest degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, Low First mover advantage, High Product Differentiation c. Low Industry Concentration, Low Distribution Access, Low Customer Switching Costs d. High Industry Concentration, Low Fixed-Variable Cost Ratio, Low Customer Switching Costs e. Supply < Demand, High Legal Barriers to Entry, Steep Industry Learning Curves -3- Exam 1 FSA3321 (Moore)-1 Spring 2007 17. Which of the following strategies would lead to pure cost leadership or pure product differentiation strategies? a. Economies of scale and scope, high R&D investment, tight cost control b. Superior product variety, lower input costs, High investment in R&D c. Lower input costs, flexible distribution, low investment in R&D d. Low investment in brand image, Low investment in R&D, Focus on Cost Control e. Simpler product designs, Tight cost control, superior product quality 18. Which of the following strategies would lead to a mixture of cost leadership and product differentiation? a. Economies of scale and scope, simpler product design, tight cost control b. Superior product variety, more flexible delivery, High investment in R&D c. Lower input costs, low-cost distribution, high investment in R&D d. High investment in brand image, High investment in R&D, Focus on Creativity e. Simpler product designs, Tight cost control, Lower Input Cost Use the following information for questions 19-20 Net Sales/Cash from sales Changes in CFFO/OI Total Accruals/Change in Sales Net Sales/Net Accounts Receivable Net Sales/Warranty Liabilities Total Accruals/Change in Sales 2001 0.99 0.88 0.50 12.0 104 0.50 2002 0.98 0.81 .049 10.0 106 .049 2003 1.01 0.82 0.62 11.0 107 0.62 2004 1.00 0.65 0.58 16.0 108 0.58 19. Which of the expense diagnostic ratios would provide a “red flag” raising concerns that expenses may have been understated for the purpose of overstating net income in 2004? a. Net Sales/Cash from sales b. Net Sales/Warranty Liabilities c. Changes in CFFO/OI (Cash Flow from Operating Activities)/(Operating Income) d. Changes in CFFO/NOA (Cash Flow from Operating Activities)/(Net Operating Assets) e. Total Accruals/Change in Sales 20. Which of the revenue diagnostic ratios would provide a “red flag” raising concerns that revenues may have been overstated for the purpose of overstating net income? a. Net Sales/Cash from sales b. Net Sales/Net Accounts Receivable c. Net Sales/Warranty Liabilities d. Changes in CFFO/OI (Cash Flow from Operating Activities)/(Operating Income) e. Changes in CFFO/NOA (Cash Flow from Operating Activities)/(Net Operating Assets) -4- Exam 1 FSA3321 (Moore)-1 Spring 2007 21. Determining whether the firm currently has the resources and capabilities to deal with the identified key success factors is an example of which? a. Competitive Strategy Analysis b. Differentiation Analysis c. Analysis of the Degree of Actual and Potential Competition d. Analysis of the Threat of Substitute Products e. Analysis of the Bargaining Power in Input and Output Markets 22. WalMart’s ability to dictate price & delivery terms to manufacturers is an example of: a. Buyer bargaining power b. Supplier bargaining power c. Product differentiation d. Fixed-Variable Cost ratios e. Exit Barriers 23. Which of the following does not necessarily create corporate value? a. Managing the value chain b. Maintaining a good fit between the company’s specialized resources and the portfolio of businesses in which the company is operating. c. Good allocation of decision rights between the headquarters office and the business units to realize all the potential economies of scope. d. Having internal measurement, information, and incentive systems to reduce agency costs. e. Investing significant resources to product advertising and marketing activities. 24. The main purpose of a firm’s financial reports is to: a. Present Assets, Liabilities and Equity b. Present Revenues and Expenses c. Present Operating, Investing and Financing Cash Flows d. Provide equity investors a means of determining the market value of the firm e. Credibly communicate economic consequences of business activities. 25. Which of the following components of the annual financial report is not audited: a. Balance Sheet b. Income Statement c. Management discussion and Analysis d. Statement of Cash Flows e. Statement of Owners Equity -5- Exam 1 FSA3321 (Moore)-1 Spring 2007 Problem 1 (20 Points) Use the following information for Problems 1 ABC Company was established in 2003 and sells product warranty contracts on household appliances. These product service contracts last for 4 years. In the first year (2003), all $16,000,000 of contract sales were credited to revenue. In 2004, the auditor caught the error in accounting and forced ABC to adjust its accounts to reflect service contract liabilities. Assume a tax rate of 30%. Given ABC’s incorrect treatment of the service contract revenues, provide the proper adjustments to the income statement and balance sheet account balances. Make sure to show the adjustments on an after-tax basis. -6- Exam 1 FSA3321 (Moore)-1 Spring 2007 Problem 2 – Overs and Unders (10 Points) Analyze the following transactions (omissions or incorrect accounting treatments) and assess whether the accounts are Overstated, Understated, or No Effect. Fill in the appropriate boxes as (O), (U), (N) Assets 1 The company failed to write down a 50% impairment of goodwill 2 The company used too large a discount rate to estimate the present value of future service costs on a defined benefit pension plan 3 The impact of capitalizing advetising costs as deferred software development charges 4 The initial impact of using an operating lease when a capital lease recognition is appropriate -7- Liabilities Equity Revenues Expenses Net Income