BA 3303 – Financial Statement Analysis Project

BA 3303 – Moore Financial Statement Analysis Project

BA 3303 – Financial Statement Analysis Project

Due in class on Tuesday, 14 November 2006

Use Excel to complete this assignment.

You must have your group formed no later than Thursday, November 2. I must have your group form submitted in class that day. The deadline to “fire” a group member is

Thursday, November 7. I must be notified of this action in class so that I can try to allocate such individuals to other groups.

Your assignment solution must be typed with all your members’ names at the top of the first page of the assignment. NO COVER PAGES. Show your work/problem inputs for full and partial credit. Using a spreadsheet to help with the calculations and submission of your work is required.

Introductory accounting and finance textbooks give the impression that analyzing financial statements and performing financial ratio analysis is a straightforward process.

Standard textbooks and class examples almost lead one to believe that the financial statements of all companies are laid out and presented in an identical manner. This assignment will dispel that notion. Your group will be responsible for analyzing the financial statements of Black & Decker (ticker BDK) and Hewlett-Packard (ticker HPQ).

Black and Decker has fairly standard financial statements that are representative of a company that manufactures and distributes small tools and accessories. Hewlett

Packard, on the other hand, manufactures and distributes diversified computer systems and other electronic peripherals.

Your mission will be to provide a comprehensive financial ratio analysis for both HP and

Black & Decker using all of the ratios presented in on the requirements spreadsheet.

You will also need to provide a brief write-up that discusses the differences in the presentation of financial information by the two companies.

- 1 -

BA 3303 – Moore Financial Statement Analysis Project

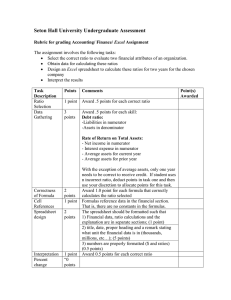

Requirements:

1. Go the Price-Waterhouse-Coopers website below and download the 10-K’s for both

Google and Walmart. You will need to get the most recent 5 years of income statements, balance sheets, and statements of cash flows. http://edgarscan.pwcglobal.com/recruit/other.html

- You can also go to the company’s website and link into the investor relations information. Most companies post their 10-k reports on their websites. Make sure you download excel files on the financial statements.

2. On an Excel spreadsheet and for each company, prepare an income statement, statement of cash flows and balance sheet for each of the five years (i.e. one worksheet per financial statement per company with five years of data)

3.

Evaluate, over the three year period: a.

Liquidity and Operating Efficiency (compute the ratios and discuss performance and trends observed) b. Profitability (prepare a common sized income statement and show appropriate margins. Then assess both ROA and ROE). As before, compute the ratios and discuss performance and trends observed. c. Long-Term Solvency and Capital Structure: Compute the ratios and discuss performance and trends observed. d. Market Value Measures and the Sustainable Growth Rate: compute the ratios and discuss performance and trends observed.

4. Provide a brief write-up and discussion of your findings for each company

5. Identify and discuss the ratios that are not relevant to the analysis of Google.

6. Submit both your write-up and the file with your work (on CD)

7. Your Group Grade Allocation Component must be turned in with the project writeup.

- 2 -