September 3, 2002 Dear Sir:

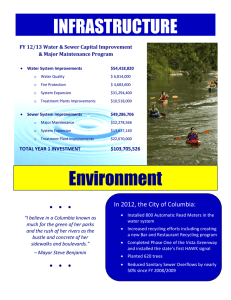

advertisement

September 3, 2002 Dear Sir: It appears to me that you have the following question: Under former ' 13-201 of your Municipal Code, can developers be required to pay the city’s sewer connection charge, in cases where the development’s sewer lines have been accepted by the city? This question was generated by a lawsuit brought against the city by developers of a subdivision who claim that under former ' 13-202, they are exempt from the connection charge because the city accepted the sewer system in the development. In my opinion, the answer is no, for at least two reasons: First, it has been held that a statute that creates a new right, takes away a vested right, or impairs contractual obligations violates Article I, Section 20, of the Tennessee Constitution, and is, therefore, invalid. [Collier v. Memphis Gas Light & Gas Water Div., 657 S.W.2d 771 (Tenn. Ct. App. 1983); Anderson v. Memphis Housing Authority, 534 S.W.2d 125 (Tenn. Ct. App. 1975)] I suspect that the retrospective application of Ordinance No. 3223 in this case would constitute the taking away of a vested right and/or the impairment of a contractual obligation. A municipality operates its utilities in its proprietary, rather than its governmental, capacity. The significance of that fact is that a municipality provides its utility services under contracts. In the case of your City, it provides sewer service under Title 13, Chapter 2, as amended, of the Municipal Code, which is part of the contract. It is said in Bybees Branch Water Association v. Town of McMinnville, 333 S.W.2d 815 (Tenn. 1960), that: A municipal corporation engaged in the business of supplying public utilities and facilities is regarded as a public corporation transacting private business for hire, and, in that respect and to that extent, as a public or private corporation. 62 C.J.S. Municipal Corporations, ' 3, p. 73....The city in its operation of utilities does so in its proprietary or individual capacity rather than in its legislative or governmental capacity. It is thus governed, for the most part, by the same rules that control a private, individual or business corporation. [206 Tenn. 375.] City of Knoxville v. Heth, 186 Tenn. 321, 210 S.W.2d 326, 329. [Also see City of Shelbyville v. State ex rel. Bedford County, 220 Tenn. 197, 415 S.W.2d 139 (Tenn. 1967); Batson v. Pleasant View Utility District, 592 S.W.2d 578 (Tenn. App. 1980); Maury County Board of Public Utilities v. City of Columbia, 854 S.W.2d 890 (Tenn. App. September 3, 2002 Page 2 1993).] Batson is particularly instructive on your question. In that case a developer and the utility district entered into a contract in which the developer would entirely at his cost extend water lines from the utility district’s mains to his new subdivision. The contract provided that the city would be entitled to charge a meter deposit for each meter it installed, and that after the lines had been installed and inspected, their ownership would vest in the utility district. After a majority of the lines had been installed and inspected, the utility district charged a $500 tap fee per residence. The developer argued that its contract with the utility district prohibited the latter from charging a tap fee, and the utility district argued that under Tennessee Code Annotated, '' 6-2610(f) [now 7-82-304(6)] and 6-2625 [now 7-82-4030], the utility district had not only the authority, but the duty, to fix and revise rates to insure that the utility was self-supporting. In holding for the developer, the Court declared that the statutes cited by the utility district did not dispose of the case in favor of the utility district, because the utility was operated in its proprietary capacity, and: By acting in its proprietary capacity, the defendant has obligated itself by contract to provide “tapping on” without charge. This is not in abrogation of its statutory authority to fix or revise rates or charges in its legislative capacity....The addition of “tapping on” charges constitutes a unilateral modification of the contracts. Modification requires the mutual assent and meeting of the minds required by contract. [At 582] Ordinarily, most cities separately charge sewer and water connection charges (tap-on fees) in addition to the cost of main extensions. Apparently, with respect to sewers, under ' 13302 of the Municipal Code (until it was amended by Ordinance No. 3223), developers paid a package sewer charge that reflected both sewer extension and connection charges, presumably as a condition to the city’s acceptance of the sewer lines. Indeed both your letter of August 26, and Para. 5 of the developer’s complaint indicate that the city did accept the sewer system in question. Former '13-202 of the Municipal Code was a part of the contract between the city and the developer. Second, generally, under the rules of statutory construction (which also apply to ordinances) statutes operate only prospectively, unless a clear, unequivocal contrary intent is evidenced in their provisions, and when a statute is capable of being read to apply either retrospectively or prospectively, it will be read to apply prospectively. [Hannum v. Bank of Tennessee, 41 Tenn. 398 (1860); Woods v. TRW, Inc., 557 S.W.2d 274 (Tenn. 1977); Kee v. Shelter Ins., 852 S.W.2d 226 (Tenn. 1993); James Cable Partners v. City of Jamestown, 43 F.3d September 3, 2002 Page 3 277 (6th Cir. 1995); Westland Drive Serv. Co. v. Citizens & S. Realty Investors, 558 S.W.2d 439 (Tenn. Ct. App. 1977); Menefee Crushed Stone Co. v. Taylor, 760 S.W.2d 223 (Tenn. Ct. App. 1988), and many other cases] Even if it could be successfully argued that Ordinance No. 3223 could be written to apply to the developer in question, it does not unequivocally say that it applies retrospectively; therefore, under the rules of statutory construction, it should be read to apply only to future developers. With regard to both reasons, the city has an argument that former ' 13-302 of the Municipal Code is a condition in the contract between the city and the developer and not a condition of the contract between the city and the purchasers of individual lots in a development. Unfortunately, that is probably not a good argument. Section 13-202 appears to generally exempt applicants for sewer service from the connection charge where the sewer system was accepted by the city. It says that: There is hereby imposed a charge for each connection made to the sanitary sewer system. Property which has been previously assessed by the city for construction and installation of the sanitary sewer, or property within a subdivision where the developer’s sanitary sewer was accepted by the city by resolution, shall not be subject to this connection charge. [Emphasis is mine.] Batson, above, probably intervenes to stop the city from charging individual lot purchasers the connection fee under former ' 13-202. Sincerely, Sidney D. Hemsley Senior Law Consultant SDH/